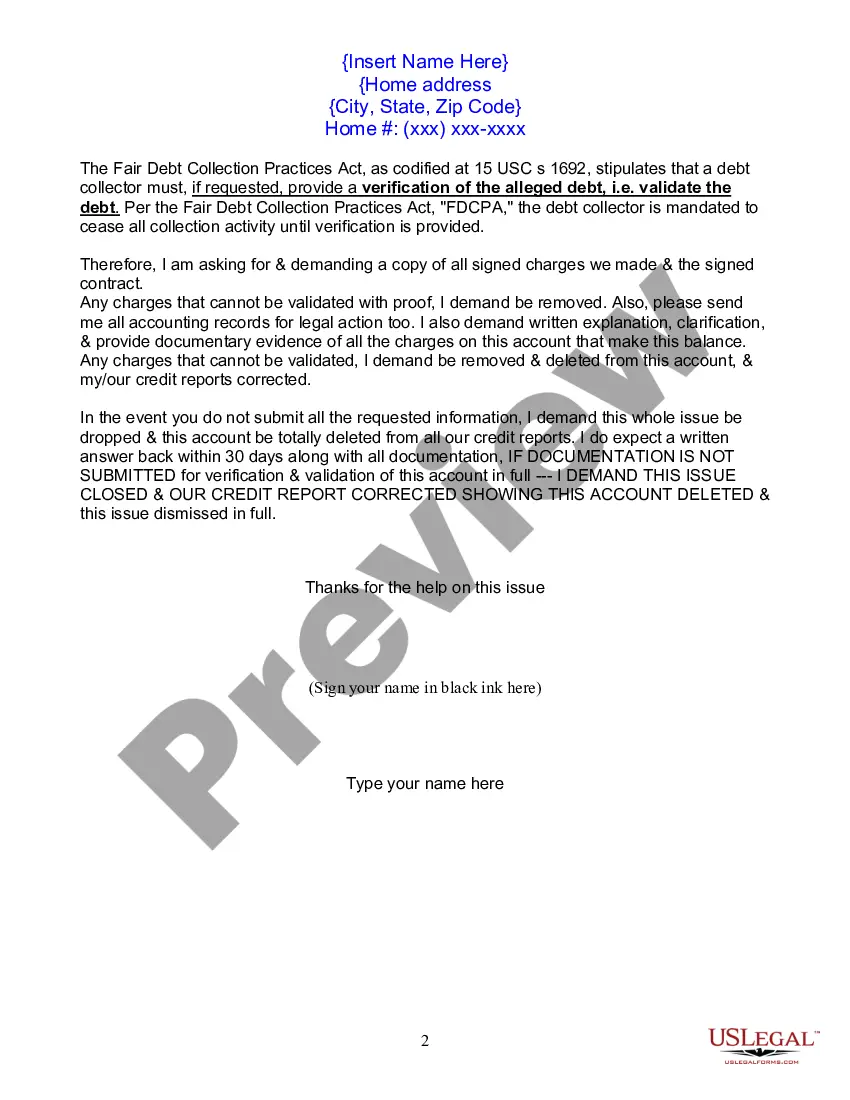

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Orange California Letter of Dispute — Complete Balance is a legal document used in the state of California to contest and resolve credit disputes concerning unpaid balances. This official letter is often sent to creditors, collection agencies, or credit reporting agencies with the aim of rectifying errors or disputing inaccurate information regarding outstanding debts. The Orange California Letter of Dispute — Complete Balance serves as a method to protect consumer rights and ensure fair credit reporting practices. In the letter, the sender provides a comprehensive explanation of the dispute, supporting evidence, and a requested resolution. It is essential to include specific details, such as account numbers, dates, and amounts owed, to facilitate an accurate investigation and resolution of the dispute. There are different types of Orange California Letters of Dispute — Complete Balance that individuals may need to use based on their unique situations. These variations include: 1. Orange California Letter of Dispute — Inaccurate Balance: This type of letter is used when disputing an incorrect balance shown on an account statement. It may arise due to errors in calculations, applied fees, or misapplied payments. 2. Orange California Letter of Dispute — Unauthorized Charges: This variation is used when disputing charges that were not authorized by the consumer. It may involve situations such as identity theft or fraudulent activity on an account. 3. Orange California Letter of Dispute — Outdated Information: This type of letter is employed to challenge outdated or obsolete information on a credit report. It aims to ensure that inaccurate or incorrect data, such as past delinquencies or accounts that have been settled, are removed from the credit history. 4. Orange California Letter of Dispute — Identity Mix-Up: This variation is used when disputing a case of mistaken identity. It involves situations where a person's credit report contains information related to someone else with a similar name or identity. Regardless of the specific type of Orange California Letter of Dispute — Complete Balance, it is crucial to provide clear and concise information, outline the issue at hand, and explain the desired resolution. This will increase the likelihood of a successful investigation and a favorable outcome that rectifies any discrepancies in credit reporting information.Orange California Letter of Dispute — Complete Balance is a legal document used in the state of California to contest and resolve credit disputes concerning unpaid balances. This official letter is often sent to creditors, collection agencies, or credit reporting agencies with the aim of rectifying errors or disputing inaccurate information regarding outstanding debts. The Orange California Letter of Dispute — Complete Balance serves as a method to protect consumer rights and ensure fair credit reporting practices. In the letter, the sender provides a comprehensive explanation of the dispute, supporting evidence, and a requested resolution. It is essential to include specific details, such as account numbers, dates, and amounts owed, to facilitate an accurate investigation and resolution of the dispute. There are different types of Orange California Letters of Dispute — Complete Balance that individuals may need to use based on their unique situations. These variations include: 1. Orange California Letter of Dispute — Inaccurate Balance: This type of letter is used when disputing an incorrect balance shown on an account statement. It may arise due to errors in calculations, applied fees, or misapplied payments. 2. Orange California Letter of Dispute — Unauthorized Charges: This variation is used when disputing charges that were not authorized by the consumer. It may involve situations such as identity theft or fraudulent activity on an account. 3. Orange California Letter of Dispute — Outdated Information: This type of letter is employed to challenge outdated or obsolete information on a credit report. It aims to ensure that inaccurate or incorrect data, such as past delinquencies or accounts that have been settled, are removed from the credit history. 4. Orange California Letter of Dispute — Identity Mix-Up: This variation is used when disputing a case of mistaken identity. It involves situations where a person's credit report contains information related to someone else with a similar name or identity. Regardless of the specific type of Orange California Letter of Dispute — Complete Balance, it is crucial to provide clear and concise information, outline the issue at hand, and explain the desired resolution. This will increase the likelihood of a successful investigation and a favorable outcome that rectifies any discrepancies in credit reporting information.