Orange California Cease and Desist for Debt Collectors

Description

How to fill out Orange California Cease And Desist For Debt Collectors?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Orange Cease and Desist for Debt Collectors, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Orange Cease and Desist for Debt Collectors from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Orange Cease and Desist for Debt Collectors:

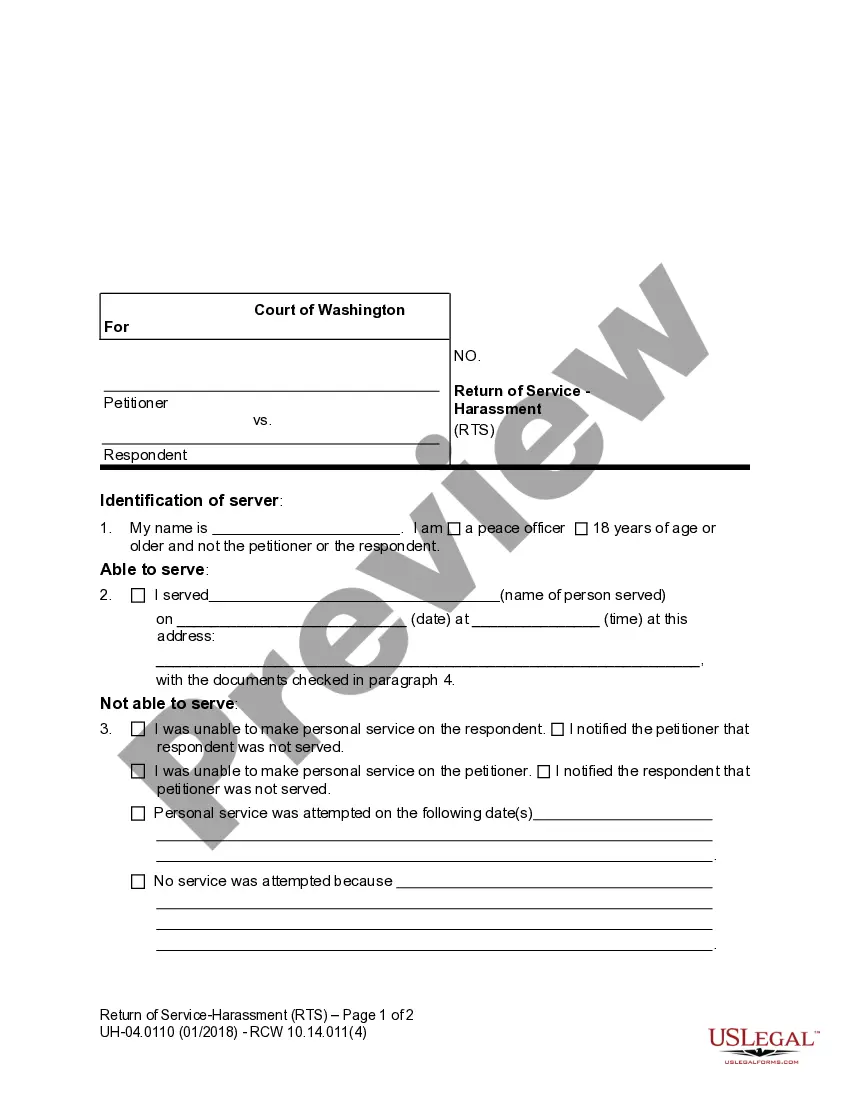

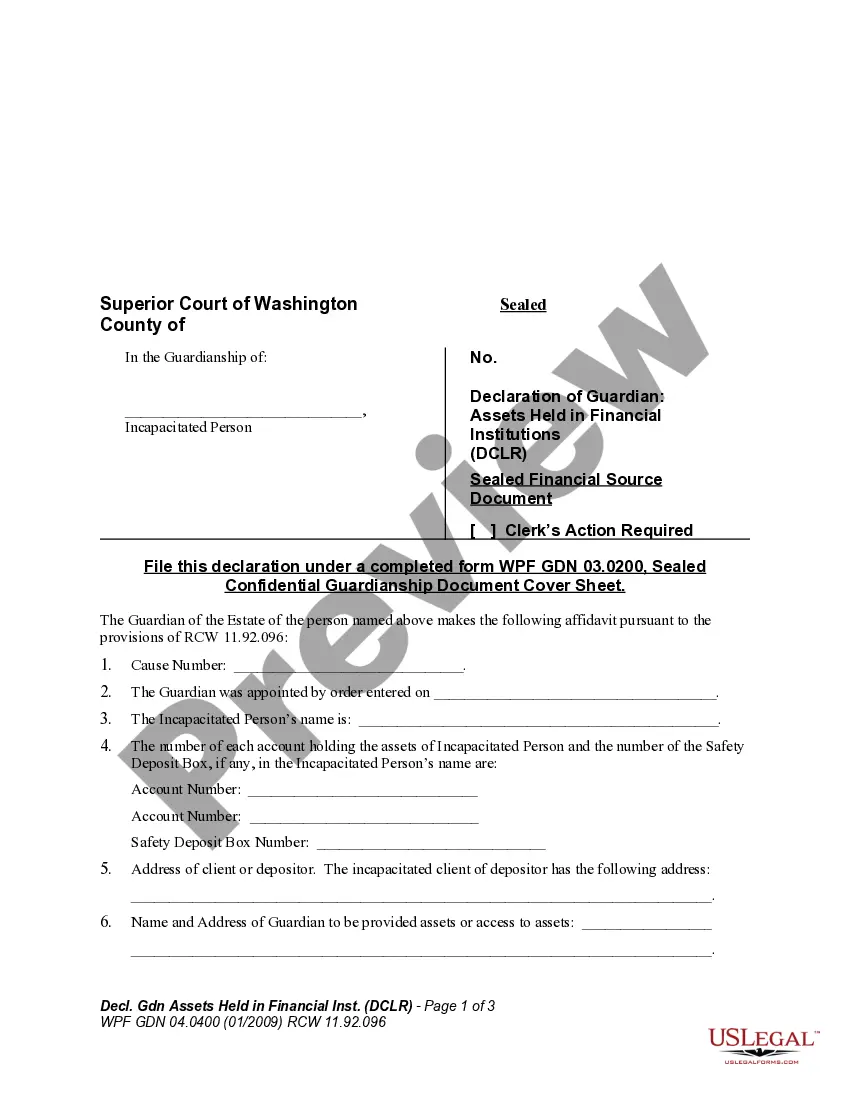

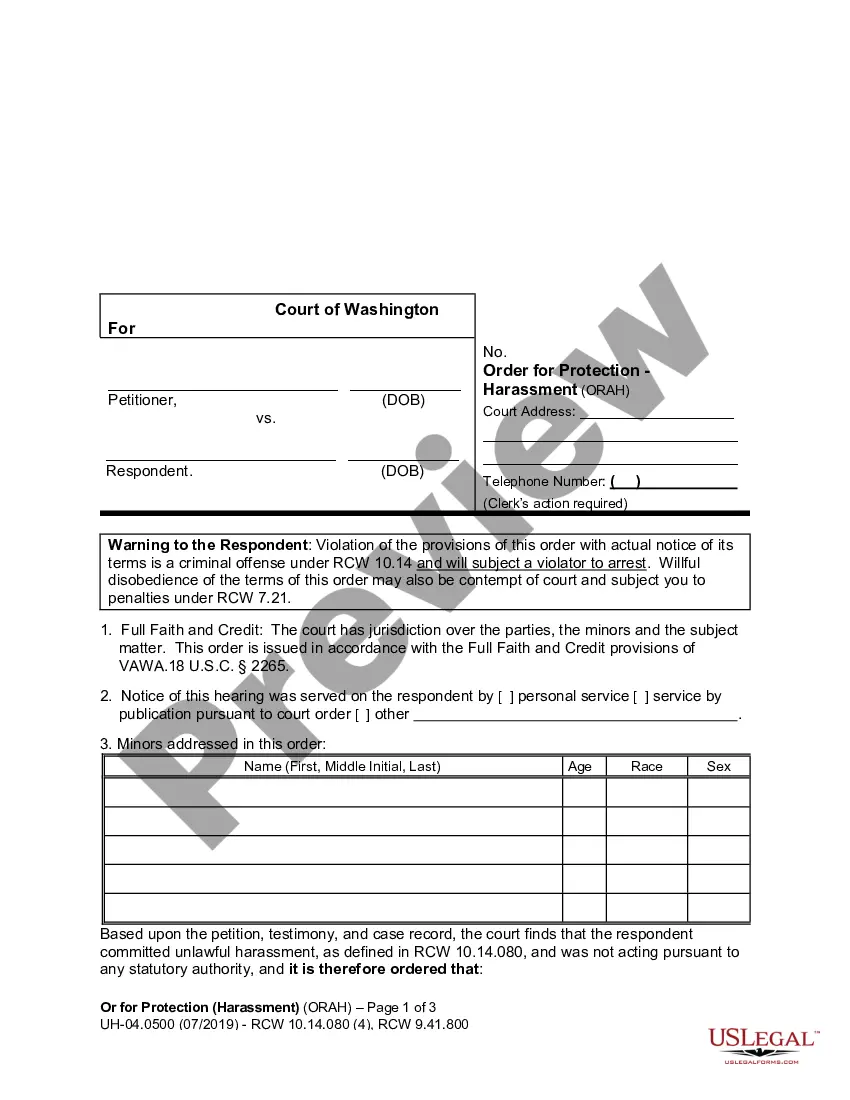

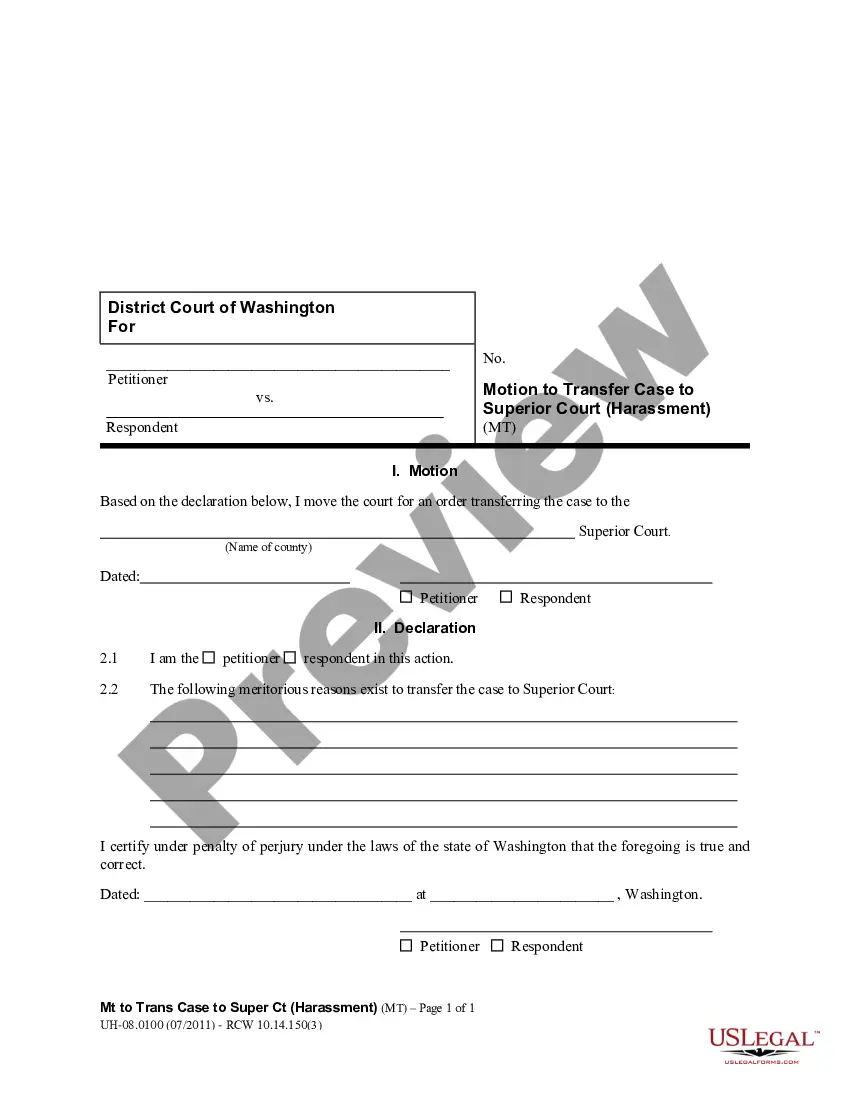

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Repeated phone calls or texts, meant to annoy or abuse you. Threats of violence or other kind of harm. Obscene, abusive, or vulgar language. Sharing your information publicly, to shame you into paying your debts.

A debt collector's No. 1 goal is to collect their missing funds. They can't curse at you or make empty threats, but they can say other things to try and scare you into paying up. Staying calm, keeping the call short and keeping your comments to a minimum are the best ways to deal with persistent bill collectors.

This variation of a Cease and Desist Letter is a formal letter sent to debt collectors to formally request they stop contacting a debtor (the person or enterprise who owes money).

Fortunately, there are legal actions you can take to stop this harassment: Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

Fortunately, there are legal actions you can take to stop this harassment: Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

Making Threats. Debt collectors sometimes use threats to pressure people into paying a debt.Calling Neighbors and Family Members.Pretending to Be a Debt Collector.Making Harassing Phone Calls.Calling When You're Represented by an Attorney.

Here's how you stop debt collection calls for someone else's debt: Answer the phone and explain you're not the person they're looking for. Tell them that they are calling the wrong number. Send a cease and desist letter to them. If they continue to call, file a complaint with the FTC.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.