Travis Texas Statement to Add to Credit Report: Explained and Types When it comes to managing your credit report, one crucial element is the addition of a proper statement that accurately represents your financial situation. In Texas, the Travis County Clerk's office offers a specific type of statement known as the Travis Texas Statement to Add to Credit Report. This statement serves to provide important information related to financial matters and can be helpful when you need to explain certain circumstances affecting your credit history. The Travis Texas Statement to Add to Credit Report can be categorized into two primary types: 1. Personal Identifying Information (PIN) Statement: This type of statement focuses on protecting your personal data and preventing identity theft. By providing detailed information, such as your full name, social security number, addresses, and associated telephone numbers, you can add an extra layer of security to your credit report. This can be especially useful after instances of identity theft or any suspicious activity related to your personal information. 2. Financial Hardship Statement: This statement is designed to explain any financial difficulties you may have faced that led to negative entries on your credit report. By adding a financial hardship statement, you can provide context and demonstrate that your credit issues were a result of extenuating circumstances, such as job loss, medical emergencies, or the sudden occurrence of major life events. This type of statement may be helpful when applying for loans or credit cards in the future. When submitting a Travis Texas Statement to Add to Credit Report, it is essential to include relevant keywords to ensure a full and accurate representation. These keywords might include: 1. Identity theft 2. Personal information protection 3. Address change 4. Contact number update 5. Fraudulent activity alert 6. Financial difficulties 7. Job loss 8. Medical emergency 9. Sudden life events 10. Contextual explanation 11. Loan application 12. Credit card application. By including these keywords in your statement, you can help credit agencies and potential lenders better understand your credit history and make informed decisions. Keep in mind that it is crucial to provide factual and honest information while avoiding unnecessary details that may not be relevant to the financial context. In conclusion, the Travis Texas Statement to Add to Credit Report is an effective tool to enhance your credit history and explain any pertinent circumstances. The two primary types, Personal Identifying Information (PIN) Statement and Financial Hardship Statement, provide different focuses but serve the common goal of providing context and clarity to your credit report.

Travis Texas Statement to Add to Credit Report

Description

How to fill out Travis Texas Statement To Add To Credit Report?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Travis Statement to Add to Credit Report, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Travis Statement to Add to Credit Report from the My Forms tab.

For new users, it's necessary to make several more steps to get the Travis Statement to Add to Credit Report:

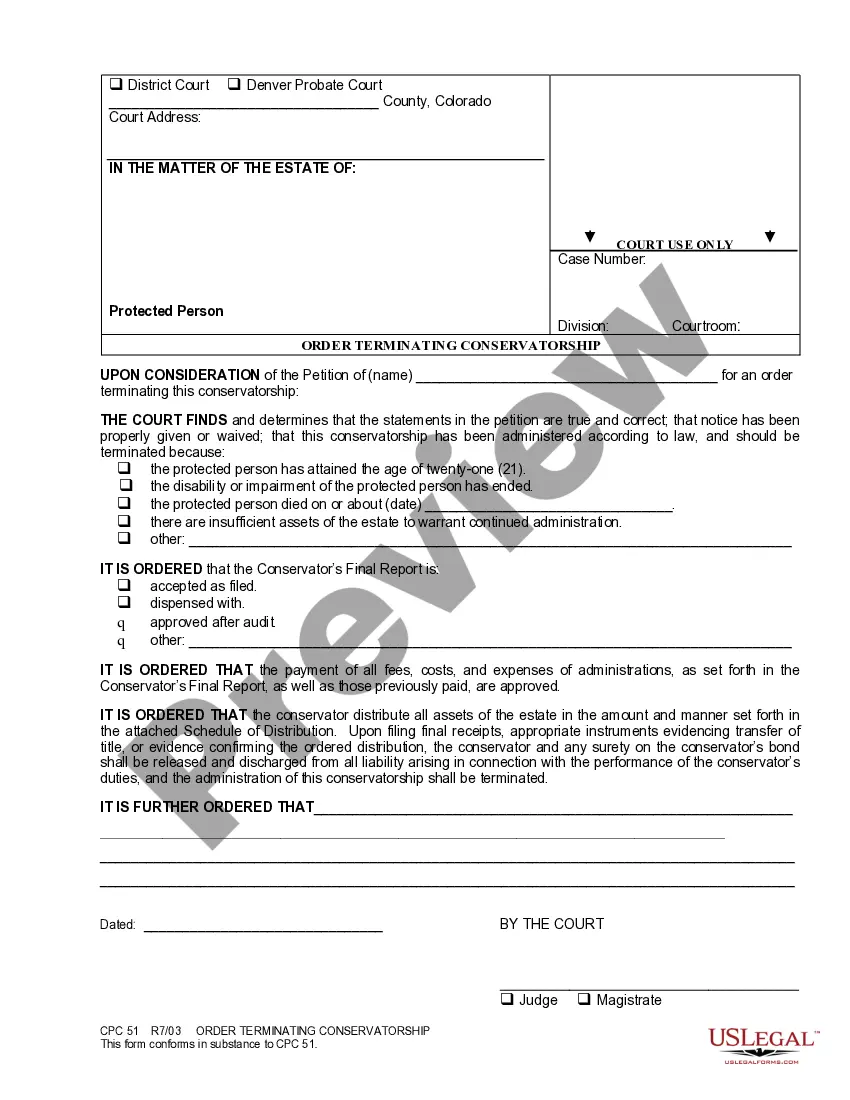

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!