Fairfax Virginia is a vibrant city located in the northern region of the Commonwealth of Virginia in the United States. As the county seat of Fairfax County, it is known for its rich history, strong economy, and diverse community. A Fairfax Virginia Letter for Account Paid in Full is a legal document issued to confirm that a financial obligation has been fully settled. This letter serves as a proof of payment and states that the recipient no longer owes any outstanding balance on their account. It is typically sent by creditors, debt collectors, or financial institutions to borrowers or debtors once payment has been received. Keywords: Fairfax Virginia, letter, account, paid in full, legal document, financial obligation, settled, proof of payment, outstanding balance, creditor, debt collector, financial institution, borrowers, debtors. Different types of Fairfax Virginia Letter for Account Paid in Full may include: 1. Mortgage Loan Paid in Full Letter: This type of letter is issued by a mortgage lender to a borrower once the entire loan amount, including principal and interest, has been fully repaid. It confirms that the mortgage has been satisfied, and no further payments are required. 2. Credit Card Account Paid in Full Letter: Credit card companies often send this letter to credit card holders who have paid off their outstanding balance entirely, including any accrued interest. The letter serves as a formal acknowledgment that the credit card account has been closed due to full payment. 3. Auto Loan Paid in Full Letter: When an individual pays off their auto loan in its entirety, the lending institution (such as a bank or credit union) sends a letter confirming that all outstanding principal, interest, and fees have been settled. This document is crucial for title transfer, removing any liens, and proving ownership. 4. Medical Bill Paid in Full Letter: Healthcare providers may issue this letter to patients who have fully paid their medical bills. It states that the patient's account is now closed and no further payment is required. 5. Personal Loan Paid in Full Letter: Personal loans, whether from banks, online lenders, or friends, can also be accompanied by a Paid in Full Letter once the complete loan amount is repaid. It outlines that the borrower has met their financial obligations and no longer owes any outstanding balance. In conclusion, Fairfax Virginia is home to a variety of letters for an account paid in full, catering to specific financial obligations such as mortgages, credit cards, auto loans, medical bills, and personal loans. These letters serve as important documentation confirming the settlement of debts and provide peace of mind to both creditors and borrowers.

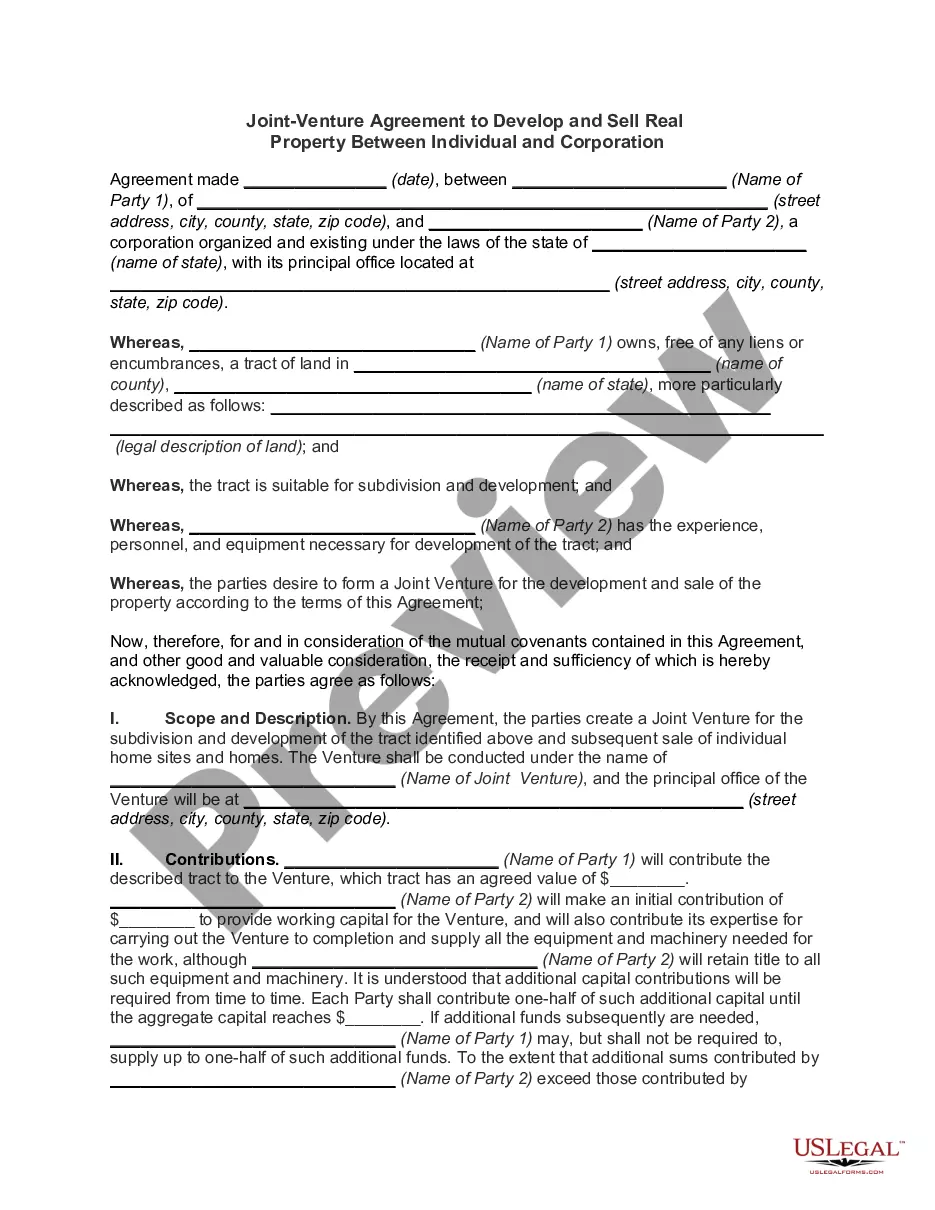

Fairfax Virginia Letter for Account Paid in Full

Description

How to fill out Fairfax Virginia Letter For Account Paid In Full?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business objective utilized in your region, including the Fairfax Letter for Account Paid in Full.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Fairfax Letter for Account Paid in Full will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Fairfax Letter for Account Paid in Full:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Fairfax Letter for Account Paid in Full on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

If you know the instrument number or deed book and page number, you may request a copy of your deed either by mail or over the telephone by calling 703-691-7320, option 3 and then option 3 again. Send your written request to: Fairfax Circuit Court 4110 Chain Bridge Road, Suite 317 Fairfax, VA 22030.

Real Estate tax bills are due in two installments on July 28 and December 5 of each calendar year.

Property taxes are generally due twice a year; around June/July, depending on the jurisdiction and again in December. It is also worth noting that property taxes are paid in arrears. So, the June/July payment that one makes covers the period January 1 of that year until the end of June.

Property taxes in the State of Illinois are collected a year in arrears. For example, taxes for the 2020 tax year are billed and payable in 2021.

Please email us at dtappdbusiness@fairfaxcounty.gov or call us at 703-222-8234, option 4, with any questions.

The Office of the Circuit Court Clerk.

Stub Number - The Stub Number is a unique number assigned to your Real Estate account.

The public is able to access documents, such as deeds, birth and death certificates, military discharge records, and others through the register of deeds. There may be a fee to access or copy public records through the register of deeds.

Payment Options Directly from your bank account (direct debit) ACH credit initiated from your bank account. Credit or debit card. Check or money order.

Fairfax prorates the personal property tax bill for vehicles to recognize the number of months it has resided in Fairfax County.

More info

In order to qualify for your bonus, you must have contributed toward your 401(k). See “How to Get Roth 401(k) with NOVEL” to learn how to get it without having to qualify. — Paying off a debt usually improves your credit score. Now paying your healthcare bill simple, clear and convenient. View your bills for your entire household, make a one-time payment, or set up a finance plan. The reports of iron mining are not to be relied upon because the cost of transporting the ore is very high. Contractual bonuses are different in that they are typically not paid out until the first quarter of the following year. In order to qualify for your bonus, you must have contributed toward your 401(k). See “How to Get Roth 401(k) with NOVEL” to learn how to get it without having to qualify. How to Pay off Credit Card Debt — No problem. The first step in doing this is finding a credit card companies credit card with unlimited credit limits.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.