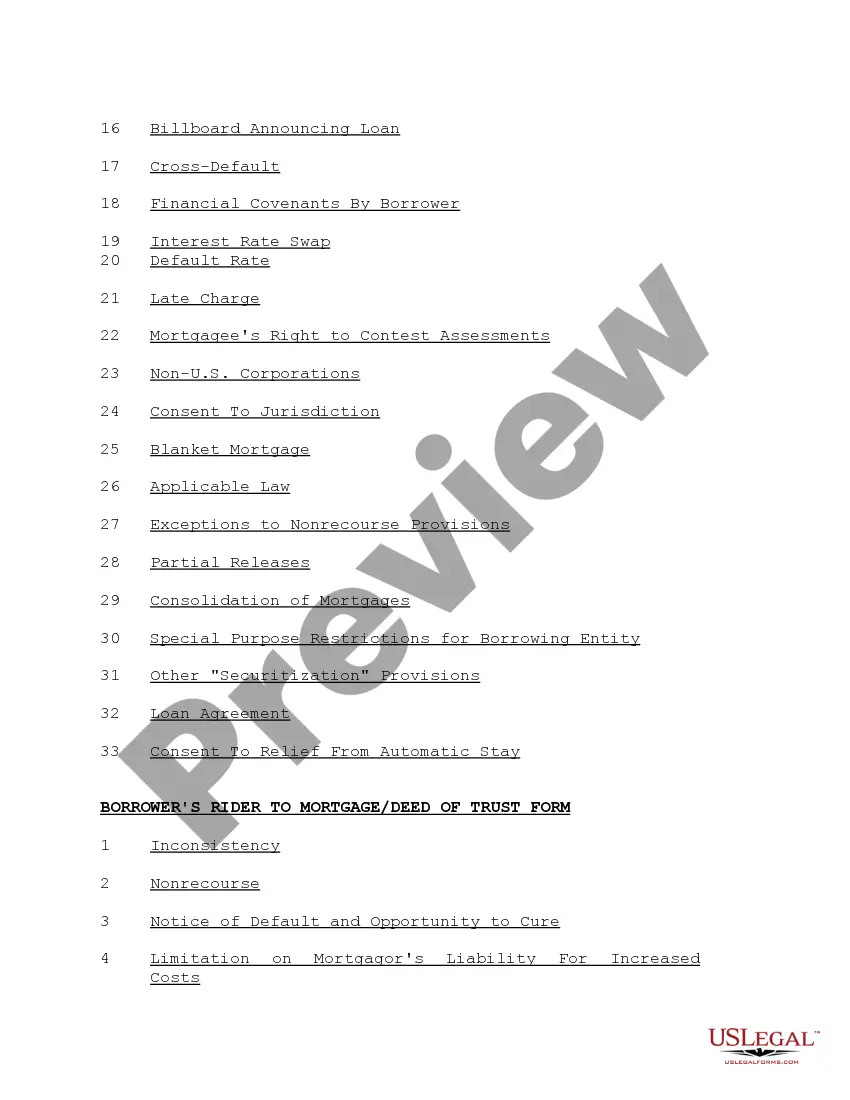

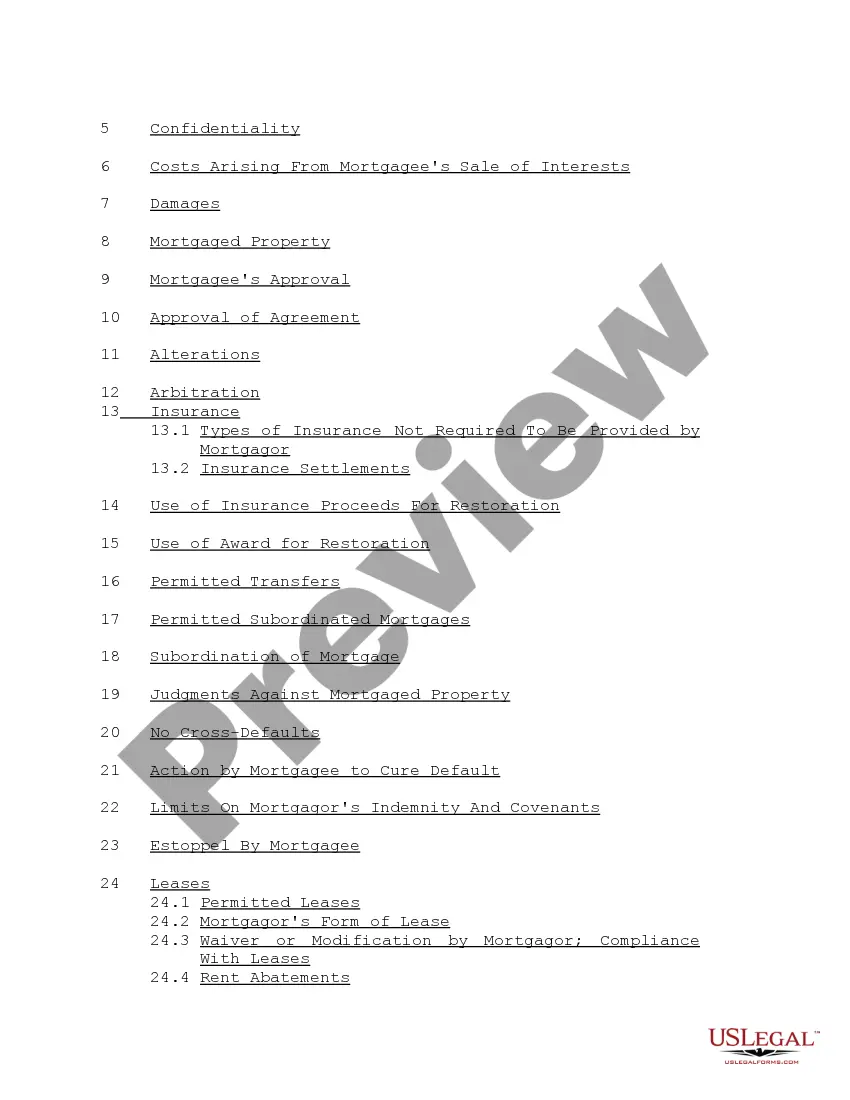

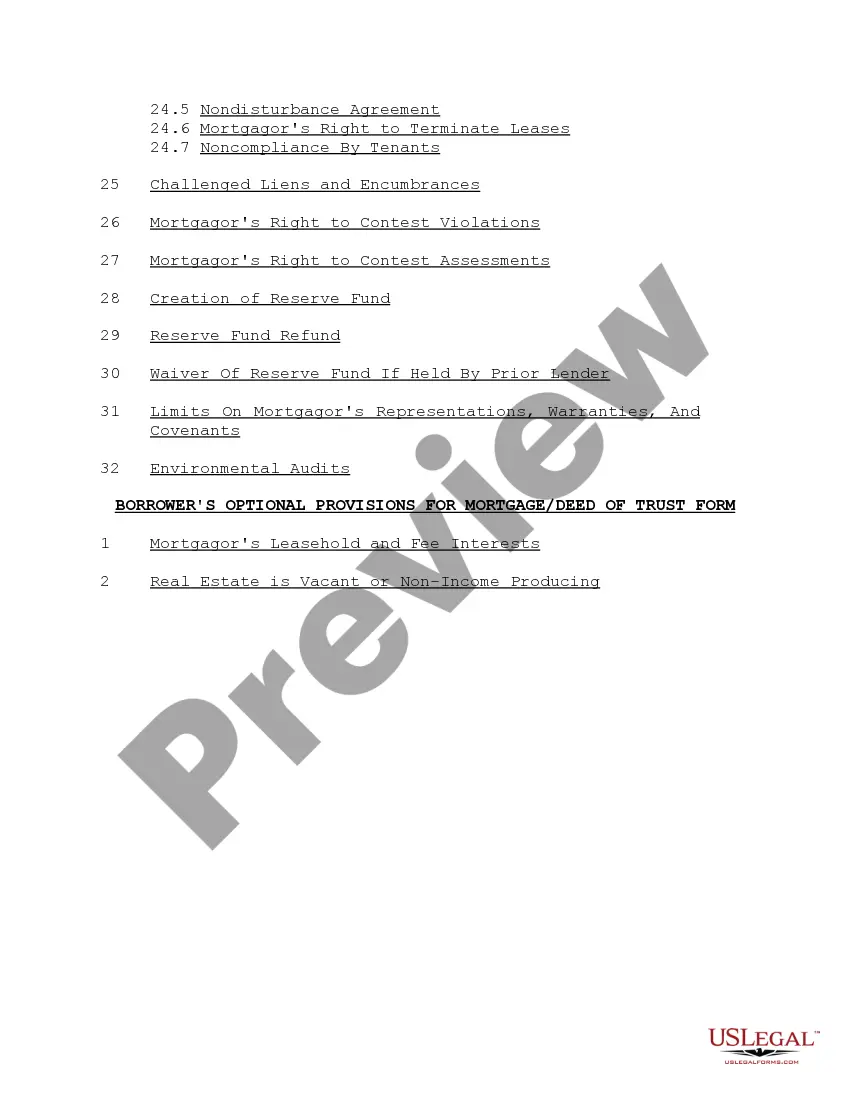

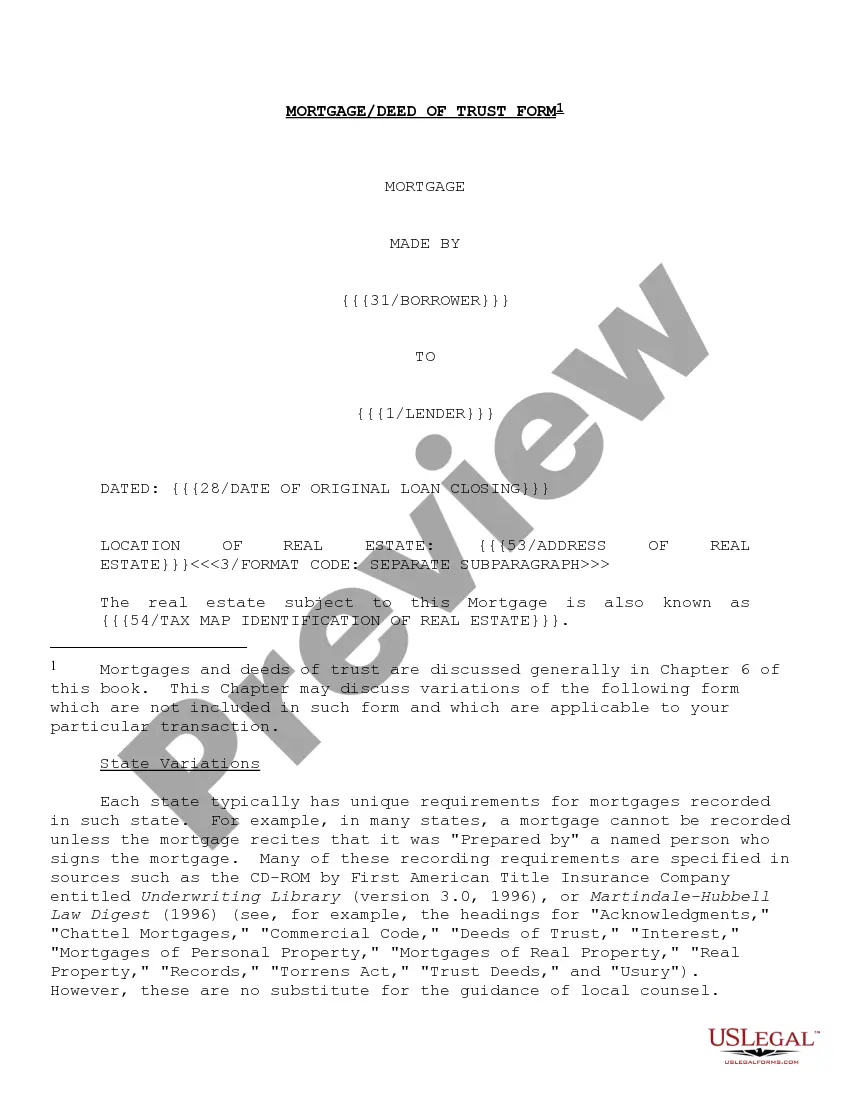

"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

Hillsborough County, Florida, offers a variety of forms and variations for the mortgage deed of trust, providing flexibility and options for property owners and lenders. Here, we will discuss the details of Hillsborough Florida Form of Mortgage Deed of Trust and its variations. 1. Hillsborough Florida Form of Mortgage Deed of Trust: The Hillsborough County mortgage deed of trust is a legally binding document used in real estate transactions. It serves as security for a loan and establishes the lender's rights in case of default. This form outlines the obligations of the borrower, the rights of the lender, and the terms and conditions of the mortgage. 2. Hillsborough Florida Adjustable-Rate Mortgage (ARM) Deed of Trust: An ARM mortgage deed of trust in Hillsborough County allows the interest rate to vary over time. This type of mortgage offers an initial fixed interest rate for a specific period, after which it adjusts periodically according to certain market indicators. Borrowers opting for an ARM mortgage should carefully review the terms and understand potential fluctuations in interest rates. 3. Hillsborough Florida Fixed-Rate Mortgage Deed of Trust: A fixed-rate mortgage deed of trust is ideal for borrowers seeking predictability and stable payments. This variation features an interest rate that remains constant throughout the loan term. It provides borrowers with a clear understanding of their repayment obligations, making budgeting and financial planning easier. 4. Hillsborough Florida Balloon Mortgage Deed of Trust: A balloon mortgage deed of trust offers lower monthly payments initially but requires a lump sum payment at the end of the loan term. Borrowers in Hillsborough County may select this option if they plan to sell or refinance the property before the balloon payment becomes due. 5. Hillsborough Florida Reverse Mortgage Deed of Trust: A reverse mortgage deed of trust is designed for homeowners aged 62 or older. This variation allows homeowners to convert their home equity into cash while still retaining ownership of the property. Unlike traditional mortgages, borrowers do not make monthly payments. Instead, the loan balance increases over time. Repayment is usually triggered when the borrower sells the home, moves out, or passes away. In conclusion, Hillsborough County offers various forms and variations of the mortgage deed of trust to cater to different financial needs and circumstances. Whether you prefer an adjustable or fixed interest rate, aspire for lower initial payments, or need to tap into your home equity, there is a Hillsborough Florida Form of Mortgage Deed of Trust to suit your requirements. It is crucial to consult with legal and financial professionals to fully understand the implications and responsibilities associated with each variation before making a decision.