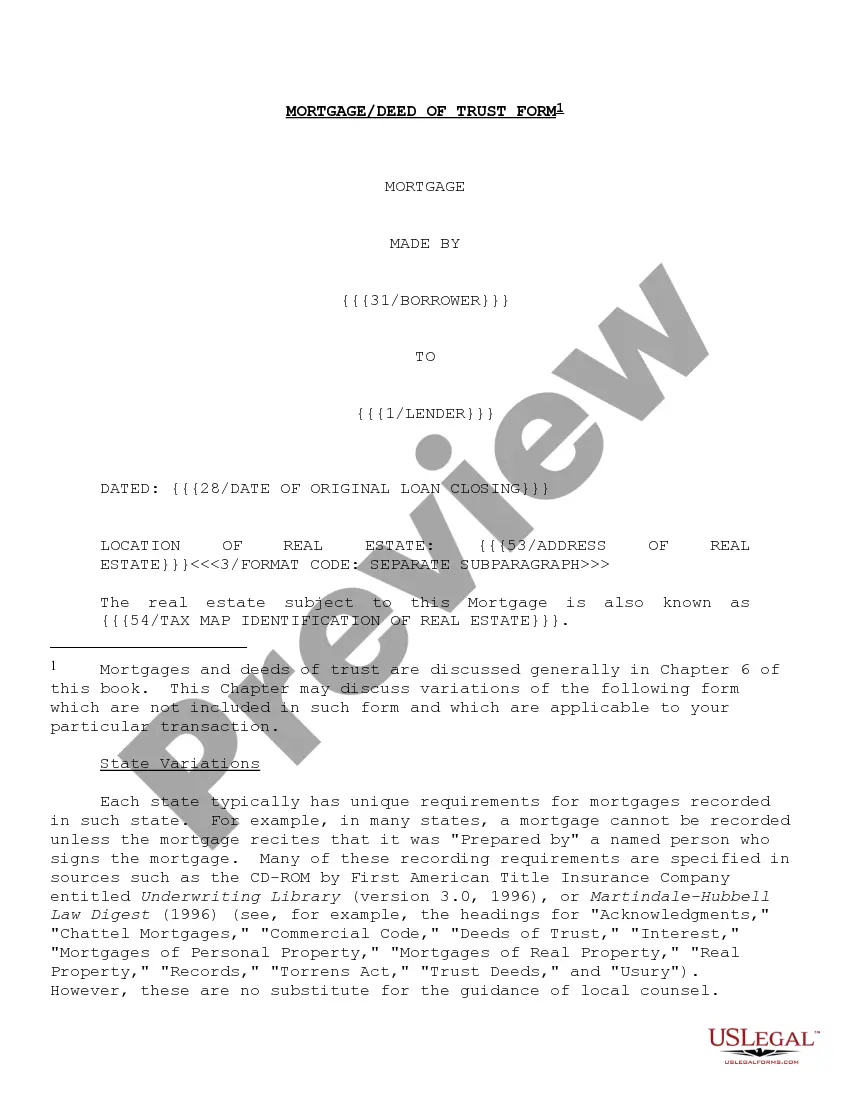

"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

Los Angeles, California, offers various forms of Mortgage Deeds of Trust and their variations to facilitate the home-buying and lending process. These legal documents play a crucial role in protecting the rights of borrowers and lenders during mortgage transactions. Below, we will explore these forms and their variations in more detail, highlighting relevant keywords. 1. Los Angeles California Form of Mortgage Deed of Trust: The Los Angeles California Form of Mortgage Deed of Trust is a standardized document used in the region for mortgage transactions. It establishes a legal agreement between the borrower (mortgagor), the lender (mortgagee), and a neutral third party known as the trustee. The trustee holds the property title as collateral on behalf of the lender until the loan is repaid. Keywords: Los Angeles California, Form of Mortgage Deed of Trust, mortgage transactions, borrower, lender, mortgagor, mortgagee, trustee, property title, collateral, loan repayment. 2. Standard Mortgage Deed of Trust: This variation of the Los Angeles California Form of Mortgage Deed of Trust follows a standardized format typically used across the state. It outlines the terms and conditions of a mortgage loan, including repayment terms, interest rates, and conditions for default. Additionally, it establishes the trustee's role and outlines foreclosure procedures, should the borrower fail to repay the loan. Keywords: Standard Mortgage Deed of Trust, standardized format, terms and conditions, mortgage loan, repayment terms, interest rates, default conditions, trustee's role, foreclosure procedures. 3. Adjustable-Rate Mortgage Deed of Trust: An Adjustable-Rate Mortgage (ARM) Deed of Trust is a variation of the Los Angeles California Form of Mortgage Deed of Trust that caters to borrowers seeking adjustable interest rates. Unlike a fixed-rate mortgage, the interest rate of an ARM loan may fluctuate over time, typically based on the current market conditions. This type of mortgage requires specific provisions within the Deed of Trust to accommodate changing interest rates and payment adjustments. Keywords: Adjustable-Rate Mortgage Deed of Trust, ARM, adjustable interest rates, fixed-rate mortgage, fluctuating interest rate, market conditions, specific provisions, payment adjustments. 4. FHA-Insured Mortgage Deed of Trust: The Federal Housing Administration (FHA) insures certain mortgage loans to minimize risk for lenders and provide access to affordable housing. The Los Angeles California Form of Mortgage Deed of Trust includes specific provisions to comply with FHA requirements when financing a home purchase within the FHA program. These provisions aim to protect both the borrower and the lender, ensuring a smooth and secure transaction. Keywords: FHA-Insured Mortgage Deed of Trust, Federal Housing Administration, mortgage loans, risk minimization, affordable housing, FHA program, provisions compliance, smooth transaction. In conclusion, Los Angeles, California, offers different forms and variations of the Mortgage Deed of Trust, each tailored to meet specific borrower needs or comply with certain loan programs. By utilizing these legal documents, borrowers and lenders can establish a secure and legally binding relationship that protects the rights and interests of all parties involved in the mortgage transaction.Los Angeles, California, offers various forms of Mortgage Deeds of Trust and their variations to facilitate the home-buying and lending process. These legal documents play a crucial role in protecting the rights of borrowers and lenders during mortgage transactions. Below, we will explore these forms and their variations in more detail, highlighting relevant keywords. 1. Los Angeles California Form of Mortgage Deed of Trust: The Los Angeles California Form of Mortgage Deed of Trust is a standardized document used in the region for mortgage transactions. It establishes a legal agreement between the borrower (mortgagor), the lender (mortgagee), and a neutral third party known as the trustee. The trustee holds the property title as collateral on behalf of the lender until the loan is repaid. Keywords: Los Angeles California, Form of Mortgage Deed of Trust, mortgage transactions, borrower, lender, mortgagor, mortgagee, trustee, property title, collateral, loan repayment. 2. Standard Mortgage Deed of Trust: This variation of the Los Angeles California Form of Mortgage Deed of Trust follows a standardized format typically used across the state. It outlines the terms and conditions of a mortgage loan, including repayment terms, interest rates, and conditions for default. Additionally, it establishes the trustee's role and outlines foreclosure procedures, should the borrower fail to repay the loan. Keywords: Standard Mortgage Deed of Trust, standardized format, terms and conditions, mortgage loan, repayment terms, interest rates, default conditions, trustee's role, foreclosure procedures. 3. Adjustable-Rate Mortgage Deed of Trust: An Adjustable-Rate Mortgage (ARM) Deed of Trust is a variation of the Los Angeles California Form of Mortgage Deed of Trust that caters to borrowers seeking adjustable interest rates. Unlike a fixed-rate mortgage, the interest rate of an ARM loan may fluctuate over time, typically based on the current market conditions. This type of mortgage requires specific provisions within the Deed of Trust to accommodate changing interest rates and payment adjustments. Keywords: Adjustable-Rate Mortgage Deed of Trust, ARM, adjustable interest rates, fixed-rate mortgage, fluctuating interest rate, market conditions, specific provisions, payment adjustments. 4. FHA-Insured Mortgage Deed of Trust: The Federal Housing Administration (FHA) insures certain mortgage loans to minimize risk for lenders and provide access to affordable housing. The Los Angeles California Form of Mortgage Deed of Trust includes specific provisions to comply with FHA requirements when financing a home purchase within the FHA program. These provisions aim to protect both the borrower and the lender, ensuring a smooth and secure transaction. Keywords: FHA-Insured Mortgage Deed of Trust, Federal Housing Administration, mortgage loans, risk minimization, affordable housing, FHA program, provisions compliance, smooth transaction. In conclusion, Los Angeles, California, offers different forms and variations of the Mortgage Deed of Trust, each tailored to meet specific borrower needs or comply with certain loan programs. By utilizing these legal documents, borrowers and lenders can establish a secure and legally binding relationship that protects the rights and interests of all parties involved in the mortgage transaction.