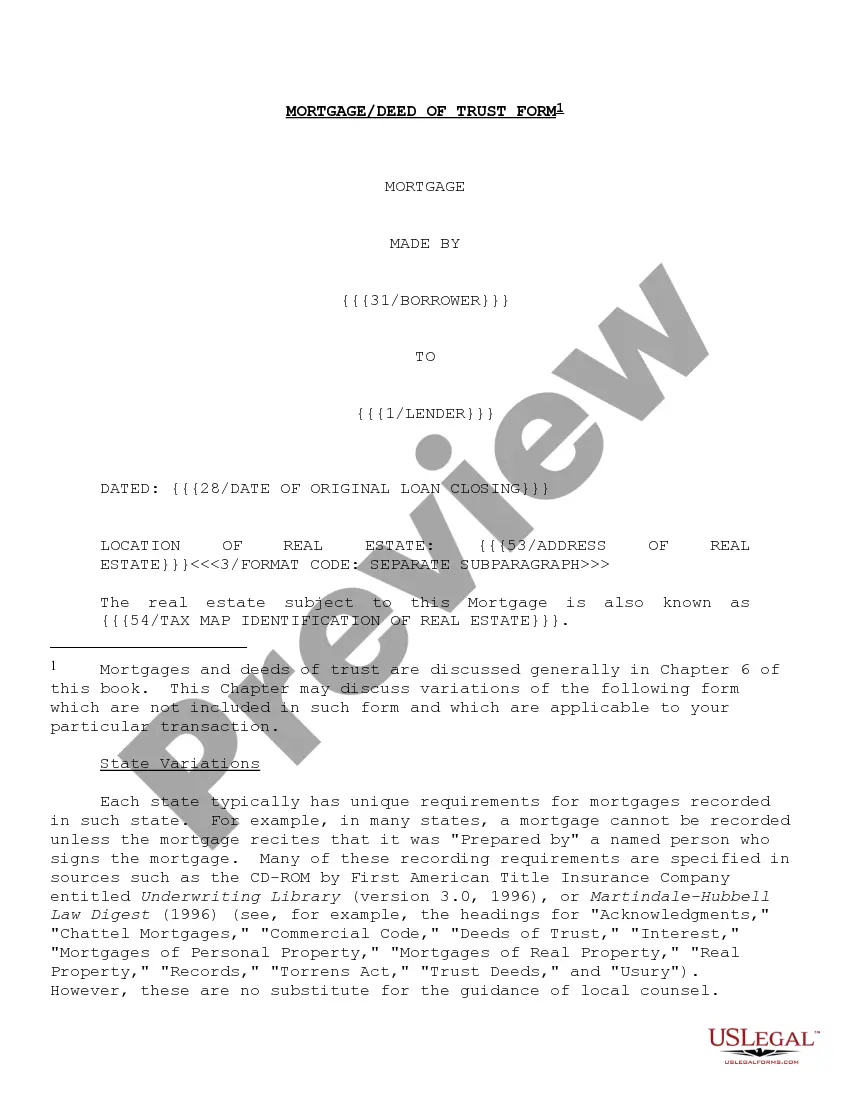

"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

Salt Lake City, Utah is the capital and largest city of the state of Utah, located in the western United States. Known for its stunning natural landscapes and a thriving urban center, Salt Lake City offers a unique combination of outdoor recreational activities and a bustling, cosmopolitan city life. When it comes to real estate transactions in Salt Lake City, one commonly used legal document is the Form of Mortgage Deed of Trust. This document is a legally binding agreement between a borrower (the trust or) and a lender (the beneficiary) that establishes a mortgage on a property. The form outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any specific provisions agreed upon by both parties. The Salt Lake Utah Form of Mortgage Deed of Trust serves as a security instrument, ensuring that the lender has a legal claim on the property in case the borrower defaults on the loan. It provides a mechanism for the lender to initiate foreclosure proceedings in the event of non-payment, enabling them to recoup their investment. While there are variations of the Form of Mortgage Deed of Trust in Salt Lake City, they generally follow a similar structure and purpose. Some common variations include: 1. Fixed-Rate Mortgage Deed of Trust: This variation establishes a fixed interest rate for the duration of the loan, providing consistency and predictability in the borrower's monthly payments. 2. Adjustable-Rate Mortgage Deed of Trust: Unlike the fixed-rate variation, this type of mortgage allows for periodic adjustments to the interest rate, usually after an initial fixed-rate period. These adjustments are typically based on market conditions, potentially resulting in fluctuating monthly payments for the borrower. 3. Balloon Mortgage Deed of Trust: This variation involves making smaller monthly payments over an agreed-upon period, with a large final payment due at the end of the loan term. It can be an attractive option for borrowers who expect a significant increase in income or plan to sell the property before the final payment becomes due. 4. Government-Backed Mortgage Deed of Trust: These variations include loans insured or guaranteed by government entities like the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). They often provide more favorable terms and lower down payment requirements to eligible borrowers. The precise terms and conditions of the Salt Lake Utah Form of Mortgage Deed of Trust and its variations may vary depending on individual agreements and market conditions. It is essential for both borrowers and lenders to carefully review and understand the specifics of the document before entering into a mortgage agreement in Salt Lake City, Utah. Consulting with legal professionals or real estate experts can help ensure compliance with local laws and protect the parties' interests.Salt Lake City, Utah is the capital and largest city of the state of Utah, located in the western United States. Known for its stunning natural landscapes and a thriving urban center, Salt Lake City offers a unique combination of outdoor recreational activities and a bustling, cosmopolitan city life. When it comes to real estate transactions in Salt Lake City, one commonly used legal document is the Form of Mortgage Deed of Trust. This document is a legally binding agreement between a borrower (the trust or) and a lender (the beneficiary) that establishes a mortgage on a property. The form outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any specific provisions agreed upon by both parties. The Salt Lake Utah Form of Mortgage Deed of Trust serves as a security instrument, ensuring that the lender has a legal claim on the property in case the borrower defaults on the loan. It provides a mechanism for the lender to initiate foreclosure proceedings in the event of non-payment, enabling them to recoup their investment. While there are variations of the Form of Mortgage Deed of Trust in Salt Lake City, they generally follow a similar structure and purpose. Some common variations include: 1. Fixed-Rate Mortgage Deed of Trust: This variation establishes a fixed interest rate for the duration of the loan, providing consistency and predictability in the borrower's monthly payments. 2. Adjustable-Rate Mortgage Deed of Trust: Unlike the fixed-rate variation, this type of mortgage allows for periodic adjustments to the interest rate, usually after an initial fixed-rate period. These adjustments are typically based on market conditions, potentially resulting in fluctuating monthly payments for the borrower. 3. Balloon Mortgage Deed of Trust: This variation involves making smaller monthly payments over an agreed-upon period, with a large final payment due at the end of the loan term. It can be an attractive option for borrowers who expect a significant increase in income or plan to sell the property before the final payment becomes due. 4. Government-Backed Mortgage Deed of Trust: These variations include loans insured or guaranteed by government entities like the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). They often provide more favorable terms and lower down payment requirements to eligible borrowers. The precise terms and conditions of the Salt Lake Utah Form of Mortgage Deed of Trust and its variations may vary depending on individual agreements and market conditions. It is essential for both borrowers and lenders to carefully review and understand the specifics of the document before entering into a mortgage agreement in Salt Lake City, Utah. Consulting with legal professionals or real estate experts can help ensure compliance with local laws and protect the parties' interests.