"Instructions for Completing Mortgage Deed of Trust Form" is a American Lawyer Media form. The following form is for instructions for completing mortgage deed of trust.

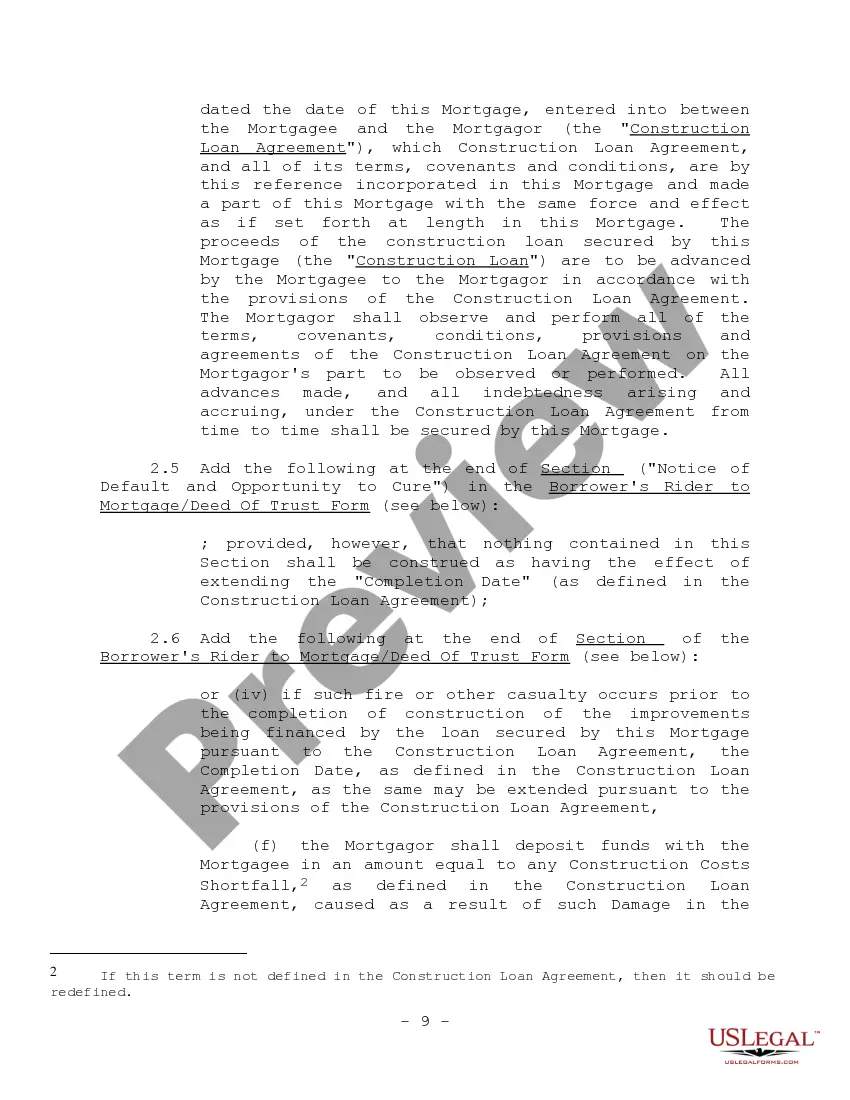

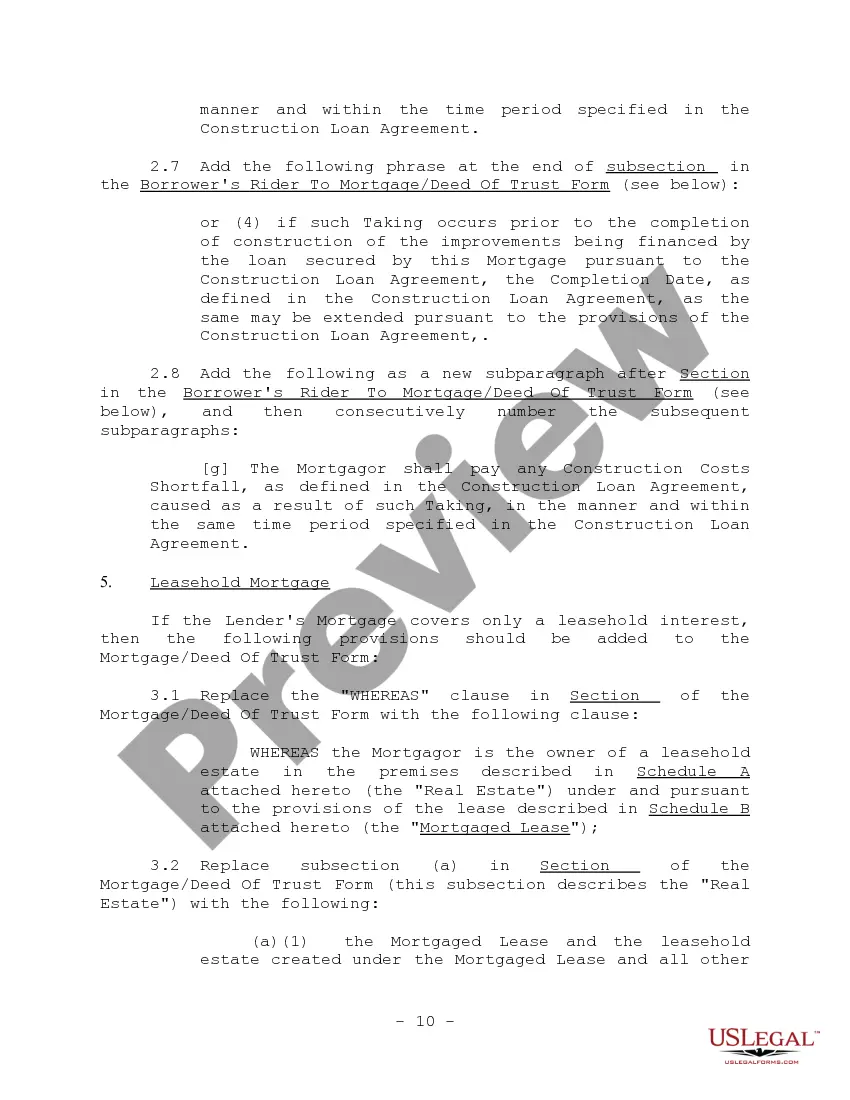

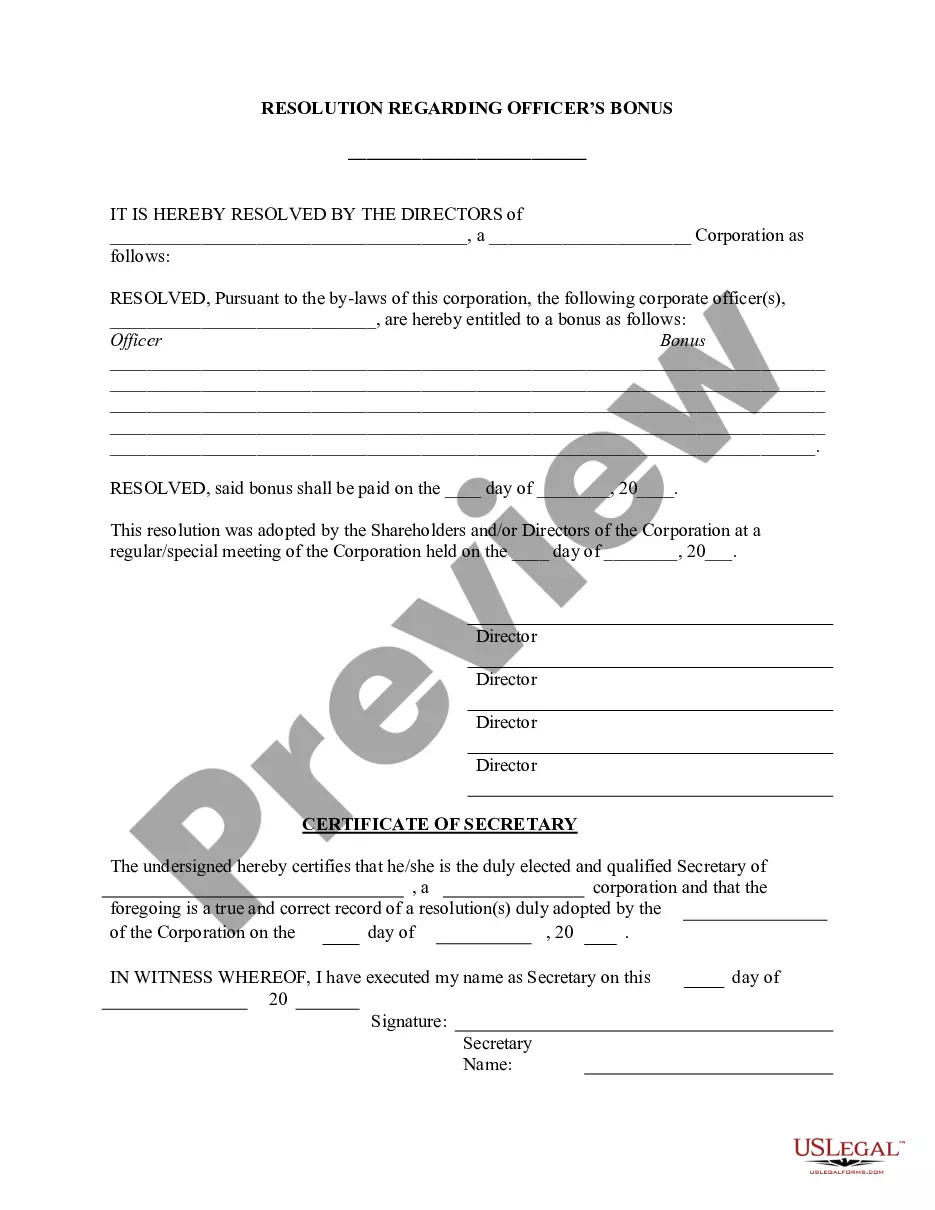

Phoenix, Arizona is the capital city of the state of Arizona and holds a significant position in the Southwestern region of the United States. Known for its warm climate and beautiful desert landscapes, Phoenix is a bustling city that attracts a diverse population of residents and visitors alike. When it comes to real estate transactions in Phoenix, one crucial document that arises is the Mortgage Deed of Trust Form. This legal document acts as security for a lender, protecting their interest in a property by creating a lien against it. Here, we will provide detailed instructions on completing the Mortgage Deed of Trust Form in Phoenix, Arizona, ensuring a smooth and legally compliant process for all parties involved. 1. Identification Section: Begin by carefully entering the names and contact information of all relevant parties involved in the mortgage transaction. This includes the borrower, lender, and trustee if applicable. It is essential to provide accurate and up-to-date contact details to ensure the smooth progress of the transaction. 2. Property Information: Clearly identify the property that is being pledged as security for the loan. Include the complete legal description of the property, such as lot number, block information, subdivision name, and any other relevant details required by the form. Ensure accuracy when providing this information to prevent any potential legal disputes. 3. Loan Information: Enter the loan amount, interest rate, and other relevant terms regarding the loan being secured by the Mortgage Deed of Trust form. This includes the repayment schedule, due dates, and any prepayment penalties or special conditions that apply to the loan. Accurate representation of the loan details is vital for both lender and borrower. 4. Notary Acknowledgment: Most Mortgage Deed of Trust forms require notarization to validate the document. Ensure to leave ample space for the notary's seal and signature where indicated on the form. Plan ahead and arrange for a certified notary public to witness the signing of the form promptly. Types of Phoenix Arizona Instructions for Completing Mortgage Deed of Trust Form: 1. Residential Mortgage Deed of Trust Form: This form applies to residential properties used for single-family homes, condominiums, townhouses, or other similar dwellings. It outlines the specific details related to the mortgage transaction involving residential properties. 2. Commercial Mortgage Deed of Trust Form: This form is tailored for commercial properties, such as office buildings, retail spaces, or industrial complexes. It takes into account the unique considerations associated with commercial real estate transactions. 3. Refinance Mortgage Deed of Trust Form: In situations where a property owner refinances their existing mortgage, this form is used to secure the new loan against the property. It includes necessary details related to the refinancing process and ensures the lender's legal interest in the property. Completing a Mortgage Deed of Trust Form in Phoenix, Arizona demands attention to detail and adherence to legal requirements. By carefully following the instructions and choosing the appropriate form type for your specific situation — whether it's a residential, commercial, or refinance transaction — you can ensure a successful and legally sound mortgage process. Seek professional advice or legal counsel if needed to ensure compliance with all relevant laws and regulations surrounding real estate transactions in Phoenix, Arizona.Phoenix, Arizona is the capital city of the state of Arizona and holds a significant position in the Southwestern region of the United States. Known for its warm climate and beautiful desert landscapes, Phoenix is a bustling city that attracts a diverse population of residents and visitors alike. When it comes to real estate transactions in Phoenix, one crucial document that arises is the Mortgage Deed of Trust Form. This legal document acts as security for a lender, protecting their interest in a property by creating a lien against it. Here, we will provide detailed instructions on completing the Mortgage Deed of Trust Form in Phoenix, Arizona, ensuring a smooth and legally compliant process for all parties involved. 1. Identification Section: Begin by carefully entering the names and contact information of all relevant parties involved in the mortgage transaction. This includes the borrower, lender, and trustee if applicable. It is essential to provide accurate and up-to-date contact details to ensure the smooth progress of the transaction. 2. Property Information: Clearly identify the property that is being pledged as security for the loan. Include the complete legal description of the property, such as lot number, block information, subdivision name, and any other relevant details required by the form. Ensure accuracy when providing this information to prevent any potential legal disputes. 3. Loan Information: Enter the loan amount, interest rate, and other relevant terms regarding the loan being secured by the Mortgage Deed of Trust form. This includes the repayment schedule, due dates, and any prepayment penalties or special conditions that apply to the loan. Accurate representation of the loan details is vital for both lender and borrower. 4. Notary Acknowledgment: Most Mortgage Deed of Trust forms require notarization to validate the document. Ensure to leave ample space for the notary's seal and signature where indicated on the form. Plan ahead and arrange for a certified notary public to witness the signing of the form promptly. Types of Phoenix Arizona Instructions for Completing Mortgage Deed of Trust Form: 1. Residential Mortgage Deed of Trust Form: This form applies to residential properties used for single-family homes, condominiums, townhouses, or other similar dwellings. It outlines the specific details related to the mortgage transaction involving residential properties. 2. Commercial Mortgage Deed of Trust Form: This form is tailored for commercial properties, such as office buildings, retail spaces, or industrial complexes. It takes into account the unique considerations associated with commercial real estate transactions. 3. Refinance Mortgage Deed of Trust Form: In situations where a property owner refinances their existing mortgage, this form is used to secure the new loan against the property. It includes necessary details related to the refinancing process and ensures the lender's legal interest in the property. Completing a Mortgage Deed of Trust Form in Phoenix, Arizona demands attention to detail and adherence to legal requirements. By carefully following the instructions and choosing the appropriate form type for your specific situation — whether it's a residential, commercial, or refinance transaction — you can ensure a successful and legally sound mortgage process. Seek professional advice or legal counsel if needed to ensure compliance with all relevant laws and regulations surrounding real estate transactions in Phoenix, Arizona.