Miami-Dade Florida Special Military Power of Attorney for Banking is a legal document that grants authority to an appointed agent to handle banking and financial matters on behalf of a military service member who is unable to do so. This power of attorney is specifically tailored for individuals who have ties to the Miami-Dade area in Florida and serve in the military. This special power of attorney is a crucial tool for military personnel who are actively serving and may be deployed or stationed away from their home base. It allows them to designate a trusted individual to handle important financial transactions, ensuring their affairs are managed efficiently and effectively. The Miami-Dade Florida Special Military Power of Attorney for Banking is comprehensive and covers various aspects related to banking. Some key transactions or activities it may cover include: 1. Access to Bank Accounts: This power of attorney authorizes the agent to access and manage the service member's bank accounts on their behalf. This includes making deposits, withdrawals, and transfers, as well as gathering account information and reconciling statements. 2. Paying Bills: The agent can be authorized to pay bills, loans, mortgages, credit card payments, and other financial obligations on behalf of the military service member. 3. Investment Management: If the service member has investments or securities, the agent can be granted authority to manage and make decisions regarding these investments, such as buying or selling stocks, bonds, or mutual funds. 4. Tax Matters: The power of attorney can extend to tax-related matters, allowing the agent to file tax returns, sign documents, and communicate with relevant tax authorities. 5. Loan and Credit Activities: The agent can be empowered to apply for loans, lines of credit, or mortgage refinancing on behalf of the service member. 6. Access to Safe Deposit Boxes: If the service member has a safe deposit box, the power of attorney may grant the agent the ability to access it and manage its contents. It is important to note that there may be different variations or types of Miami-Dade Florida Special Military Power of Attorney for Banking, depending on the specific requirements and preferences of the service member. Some variations may include limited powers of attorney, allowing the agent to perform only a specific set of tasks or handle transactions within certain limits. In conclusion, the Miami-Dade Florida Special Military Power of Attorney for Banking is a crucial legal document that provides military service members with peace of mind when it comes to handling their financial affairs. By granting a trusted agent the authority to make important financial decisions and transactions, service members can ensure their banking matters are effectively managed, even when they are unable to do so personally.

Miami-Dade Florida Special Military Power of Attorney for Banking

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-MIL-POA4

Format:

Word;

PDF;

Rich Text

Instant download

Description

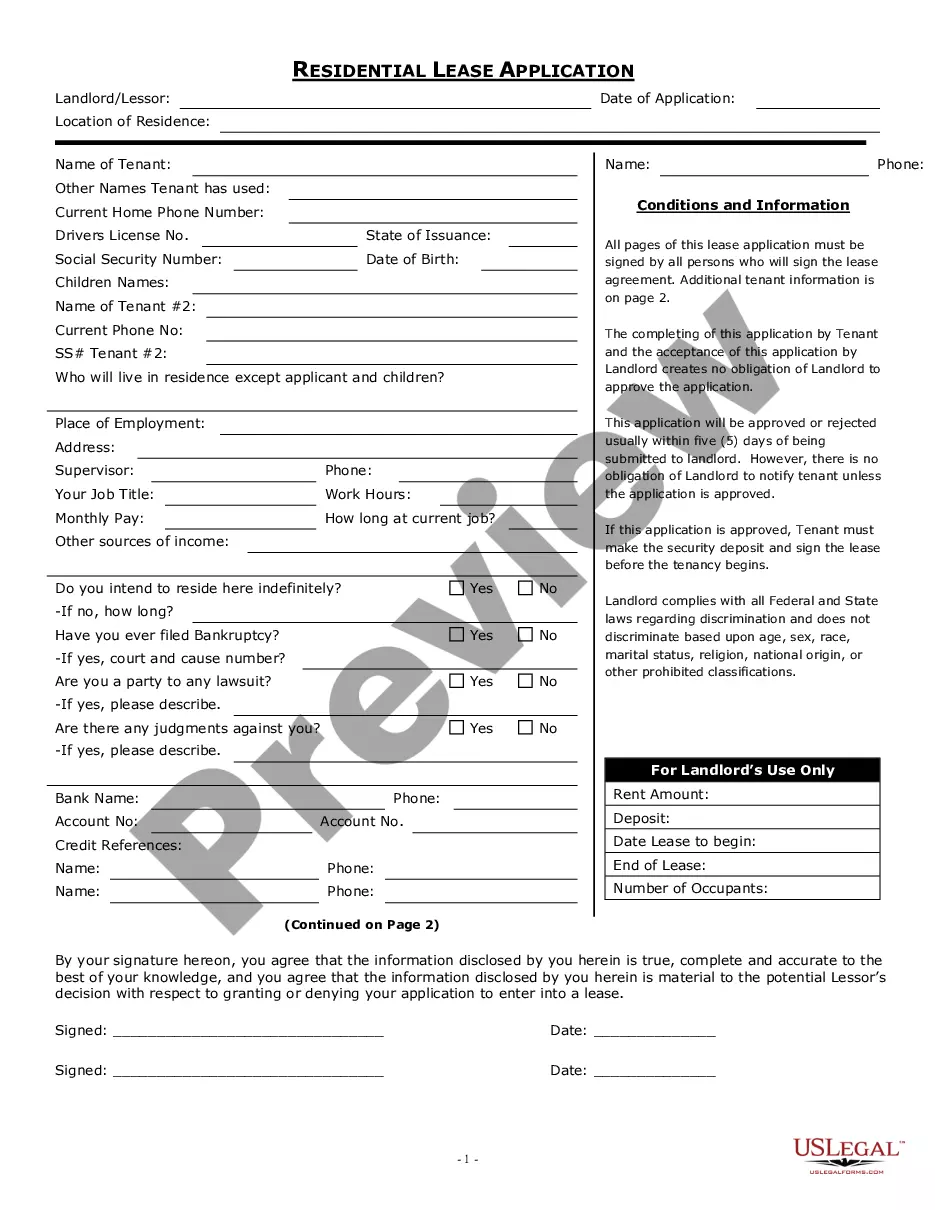

This is a power of attorney for a Military person to appoint a third party to manage property the Military person owns, such as a residence, as rental property.

Miami-Dade Florida Special Military Power of Attorney for Banking is a legal document that grants authority to an appointed agent to handle banking and financial matters on behalf of a military service member who is unable to do so. This power of attorney is specifically tailored for individuals who have ties to the Miami-Dade area in Florida and serve in the military. This special power of attorney is a crucial tool for military personnel who are actively serving and may be deployed or stationed away from their home base. It allows them to designate a trusted individual to handle important financial transactions, ensuring their affairs are managed efficiently and effectively. The Miami-Dade Florida Special Military Power of Attorney for Banking is comprehensive and covers various aspects related to banking. Some key transactions or activities it may cover include: 1. Access to Bank Accounts: This power of attorney authorizes the agent to access and manage the service member's bank accounts on their behalf. This includes making deposits, withdrawals, and transfers, as well as gathering account information and reconciling statements. 2. Paying Bills: The agent can be authorized to pay bills, loans, mortgages, credit card payments, and other financial obligations on behalf of the military service member. 3. Investment Management: If the service member has investments or securities, the agent can be granted authority to manage and make decisions regarding these investments, such as buying or selling stocks, bonds, or mutual funds. 4. Tax Matters: The power of attorney can extend to tax-related matters, allowing the agent to file tax returns, sign documents, and communicate with relevant tax authorities. 5. Loan and Credit Activities: The agent can be empowered to apply for loans, lines of credit, or mortgage refinancing on behalf of the service member. 6. Access to Safe Deposit Boxes: If the service member has a safe deposit box, the power of attorney may grant the agent the ability to access it and manage its contents. It is important to note that there may be different variations or types of Miami-Dade Florida Special Military Power of Attorney for Banking, depending on the specific requirements and preferences of the service member. Some variations may include limited powers of attorney, allowing the agent to perform only a specific set of tasks or handle transactions within certain limits. In conclusion, the Miami-Dade Florida Special Military Power of Attorney for Banking is a crucial legal document that provides military service members with peace of mind when it comes to handling their financial affairs. By granting a trusted agent the authority to make important financial decisions and transactions, service members can ensure their banking matters are effectively managed, even when they are unable to do so personally.