This form provides boilerplate contract clauses that outline the scope of any indemnity under the contract agreement. Different language options are included to suit individual needs and circumstances.

Hillsborough Florida Indemnity Provisions - Scope of the Indemnity

Description

How to fill out Hillsborough Florida Indemnity Provisions - Scope Of The Indemnity?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Hillsborough Indemnity Provisions - Scope of the Indemnity, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any tasks associated with document completion straightforward.

Here's how to find and download Hillsborough Indemnity Provisions - Scope of the Indemnity.

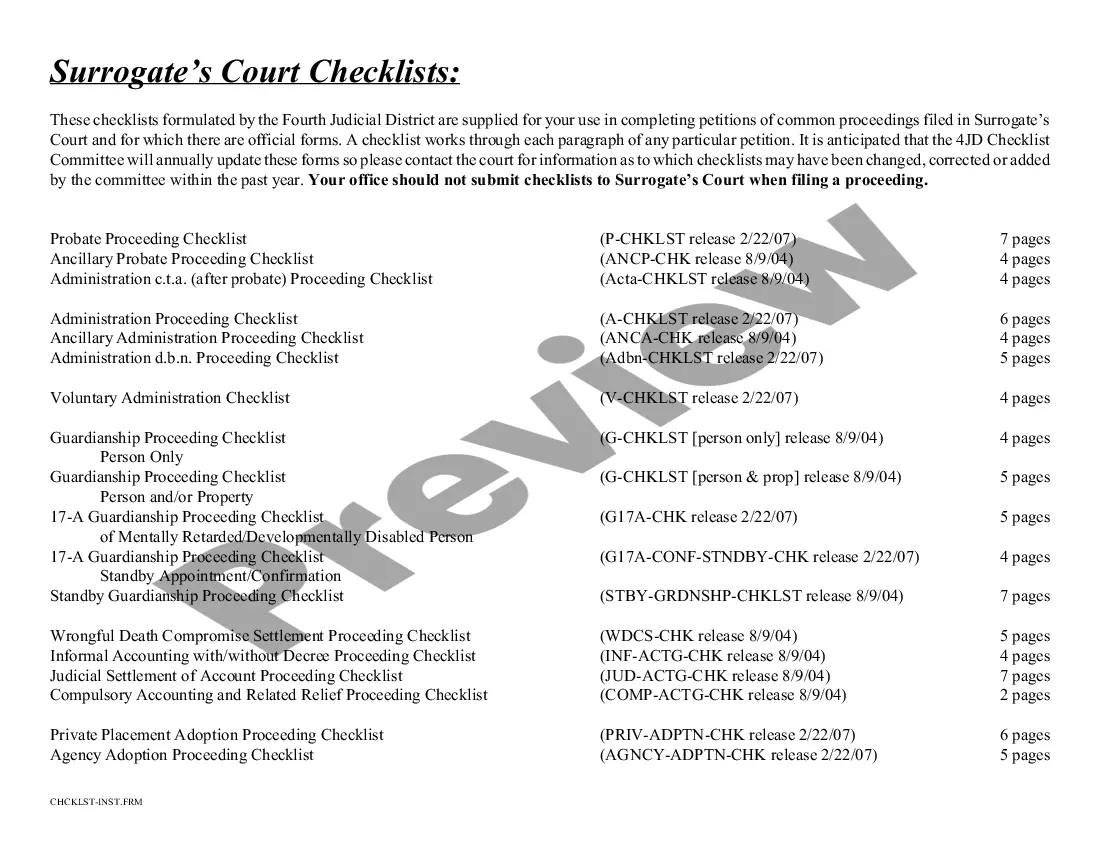

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Check the related forms or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and buy Hillsborough Indemnity Provisions - Scope of the Indemnity.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Hillsborough Indemnity Provisions - Scope of the Indemnity, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer completely. If you have to deal with an exceptionally challenging situation, we recommend using the services of an attorney to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and get your state-specific paperwork effortlessly!

Form popularity

FAQ

Life insurance does not relate to a contract of indemnity because the insurer does not promise to indemnify the insured for any loss on maturity or death of the insured but agrees to pay a sum assured in that case.

India Code: Section Details. A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity.

An indemnification provision allocates the risk and expense in the event of a breach, default, or misconduct by one of the parties. An indemnification provision, also known as a hold harmless provision, is a clause used in contracts to shift potential costs from one party to the other.

Contractual Liability Coverage The indemnity provision is the key to affording liability coverage to persons other than the insured. Absent an indemnity provision, coverage is available only to those named as insureds under the liability policy.

A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity.

Most states hold that indemnity provisions are enforceable as written. These clauses will likely be construed in accordance with the rules of construction that apply to contracts generally. However, the freedom to contract will be limited by Courts who will disallow contracts in contravention of public policy.

Why do I need an indemnity clause? Indemnity clauses are used to manage the risks associated with a contract, because they enable one party to be protected against the liability arising from the actions of another party.

Indemnity benefits are monetary payments you may be entitled to receive as compensation for lost wages or damages related to your workers' compensation claim.

A contract of indemnity has two parties. The promisor or indemnifier. The promisee or the indemnified or indemnity-holder.