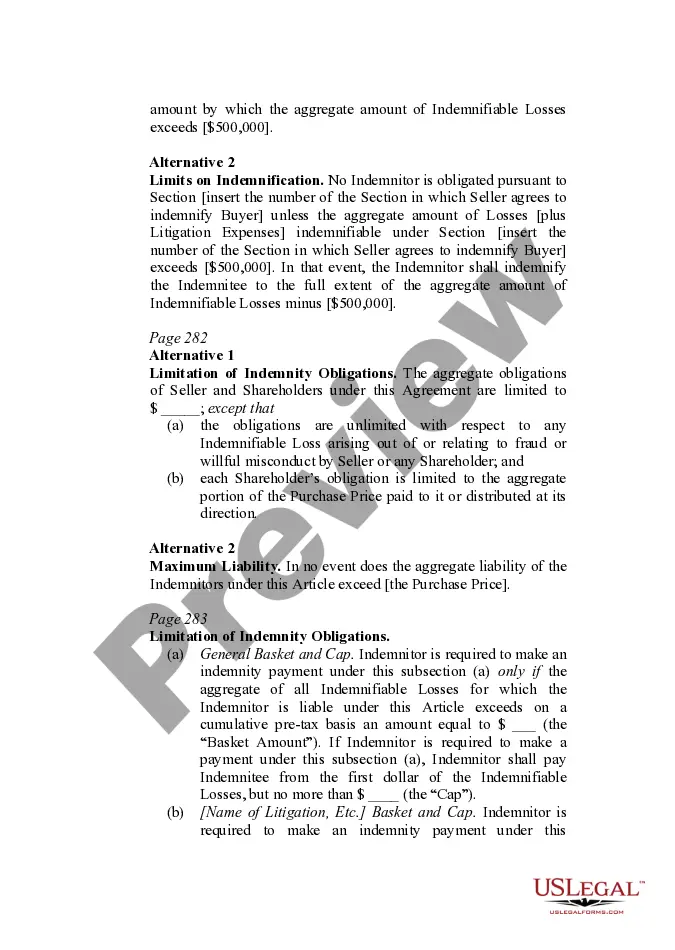

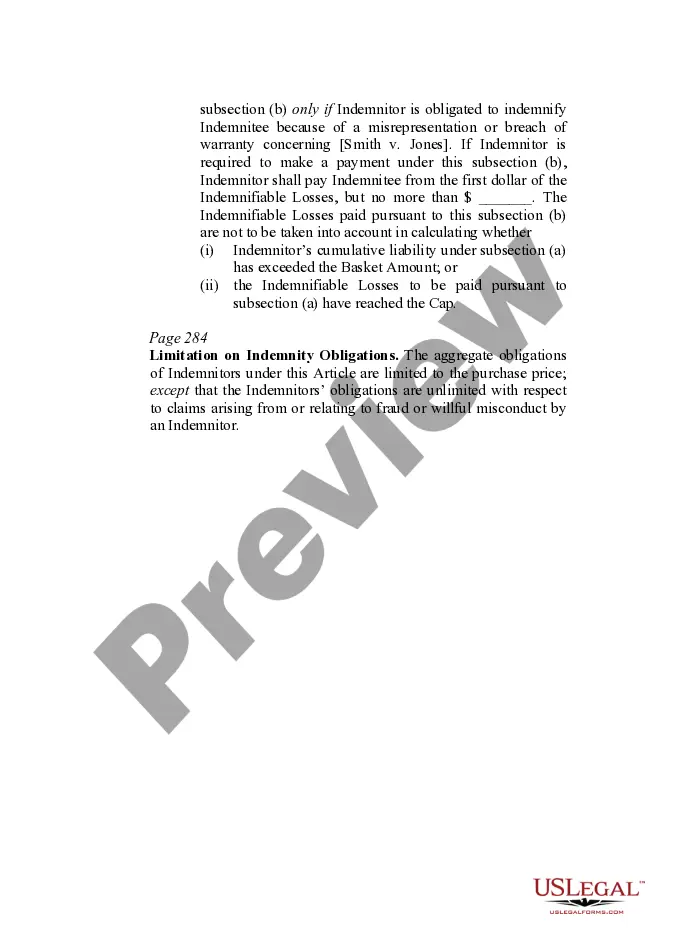

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement. Several different language options are included to suit individual needs and circumstances.

Orange California Indemnity Provisions refer to the specific terms and conditions outlined in legal contracts or agreements that dictate the extent of financial liability between parties involved in a transaction or business relationship in the city of Orange, California. These provisions serve to protect one party (the indemnity) from potential losses, damages, or legal claims caused by the actions or negligence of the other party (the indemnity). Dollar Exposure of the Indemnity is a crucial aspect of these provisions as it determines the maximum value for which the indemnity can be held responsible. It sets a limit on the amount that the indemnity will be liable to pay in case of any identifiable losses incurred by the indemnity. Baskets, Caps, and Ceilings are different types of conditions that further refine the indemnity provisions and affect the scope and extent of the indemnity's liability. These conditions provide additional protection and establish thresholds for the indemnity's claims. 1. Baskets: Baskets are thresholds that need to be crossed before the indemnity becomes liable for any identifiable losses. They can be set at a specific dollar amount or a percentage of the total transaction value. For example, a basket of $10,000 means that the indemnity will be indemnified only when the losses exceed this amount. 2. Caps: Caps establish a maximum limit on the indemnity's liability. It ensures that the indemnity is not held accountable for losses beyond a certain amount, regardless of the actual damages incurred by the indemnity. Caps are usually set at a fixed dollar value or as a percentage of the transaction's total value. 3. Ceilings: Ceilings define the uppermost limit that can be claimed under the indemnity provisions. This limit is typically set to protect the indemnity from excessive financial exposure, especially in high-value transactions. When the claimed losses reach or exceed the ceiling, the indemnity is not obligated to indemnify the indemnity any further. Understanding and carefully defining these Orange California Indemnity Provisions — Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings is crucial for businesses, individuals, or organizations involved in contractual agreements. It ensures both parties are aware of the financial risks and protection associated with their responsibilities, ultimately leading to fair and balanced indemnification practices.Orange California Indemnity Provisions refer to the specific terms and conditions outlined in legal contracts or agreements that dictate the extent of financial liability between parties involved in a transaction or business relationship in the city of Orange, California. These provisions serve to protect one party (the indemnity) from potential losses, damages, or legal claims caused by the actions or negligence of the other party (the indemnity). Dollar Exposure of the Indemnity is a crucial aspect of these provisions as it determines the maximum value for which the indemnity can be held responsible. It sets a limit on the amount that the indemnity will be liable to pay in case of any identifiable losses incurred by the indemnity. Baskets, Caps, and Ceilings are different types of conditions that further refine the indemnity provisions and affect the scope and extent of the indemnity's liability. These conditions provide additional protection and establish thresholds for the indemnity's claims. 1. Baskets: Baskets are thresholds that need to be crossed before the indemnity becomes liable for any identifiable losses. They can be set at a specific dollar amount or a percentage of the total transaction value. For example, a basket of $10,000 means that the indemnity will be indemnified only when the losses exceed this amount. 2. Caps: Caps establish a maximum limit on the indemnity's liability. It ensures that the indemnity is not held accountable for losses beyond a certain amount, regardless of the actual damages incurred by the indemnity. Caps are usually set at a fixed dollar value or as a percentage of the transaction's total value. 3. Ceilings: Ceilings define the uppermost limit that can be claimed under the indemnity provisions. This limit is typically set to protect the indemnity from excessive financial exposure, especially in high-value transactions. When the claimed losses reach or exceed the ceiling, the indemnity is not obligated to indemnify the indemnity any further. Understanding and carefully defining these Orange California Indemnity Provisions — Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings is crucial for businesses, individuals, or organizations involved in contractual agreements. It ensures both parties are aware of the financial risks and protection associated with their responsibilities, ultimately leading to fair and balanced indemnification practices.