This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

Nassau New York Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations

Description

How to fill out Nassau New York Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Tax And Insurance Considerations?

Whether you intend to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Nassau Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to obtain the Nassau Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

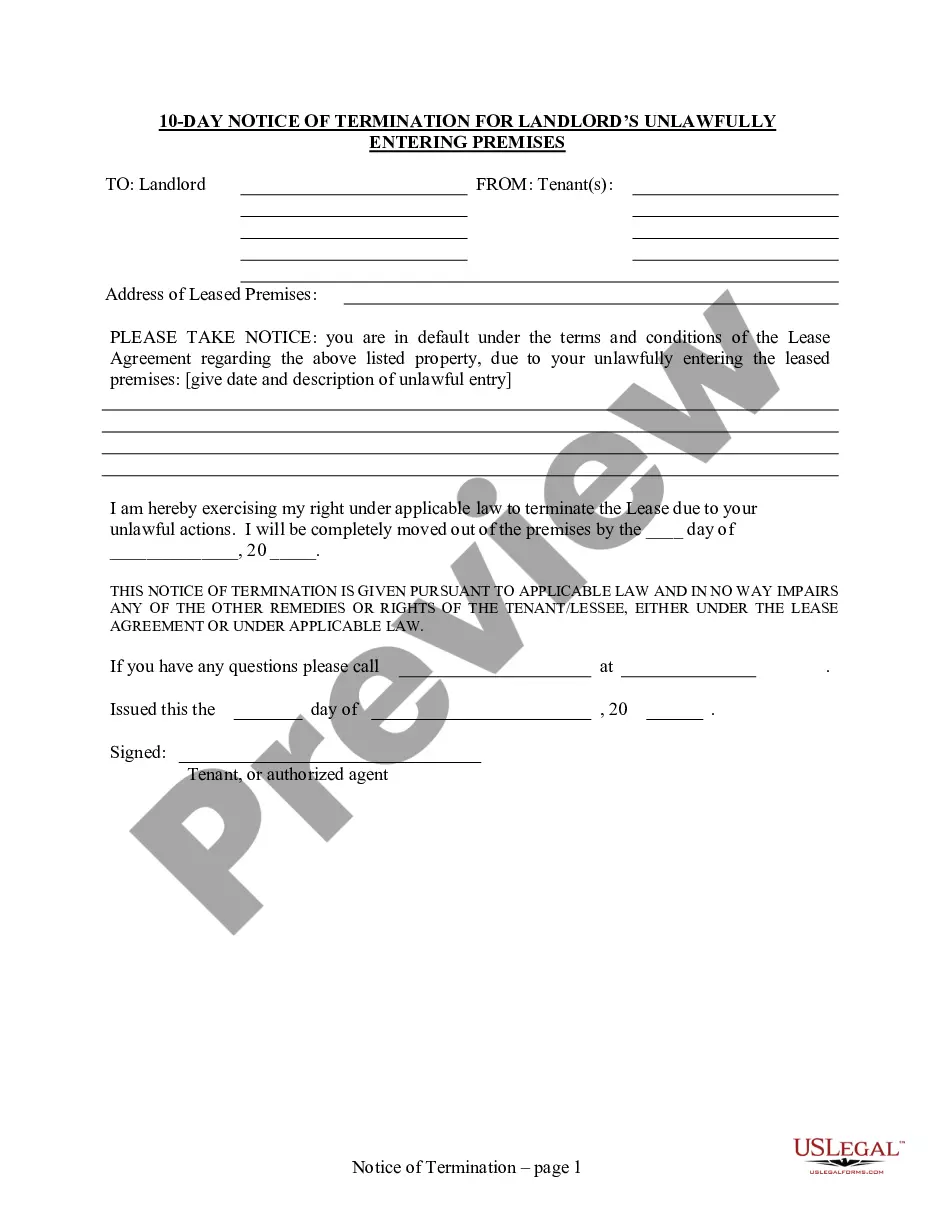

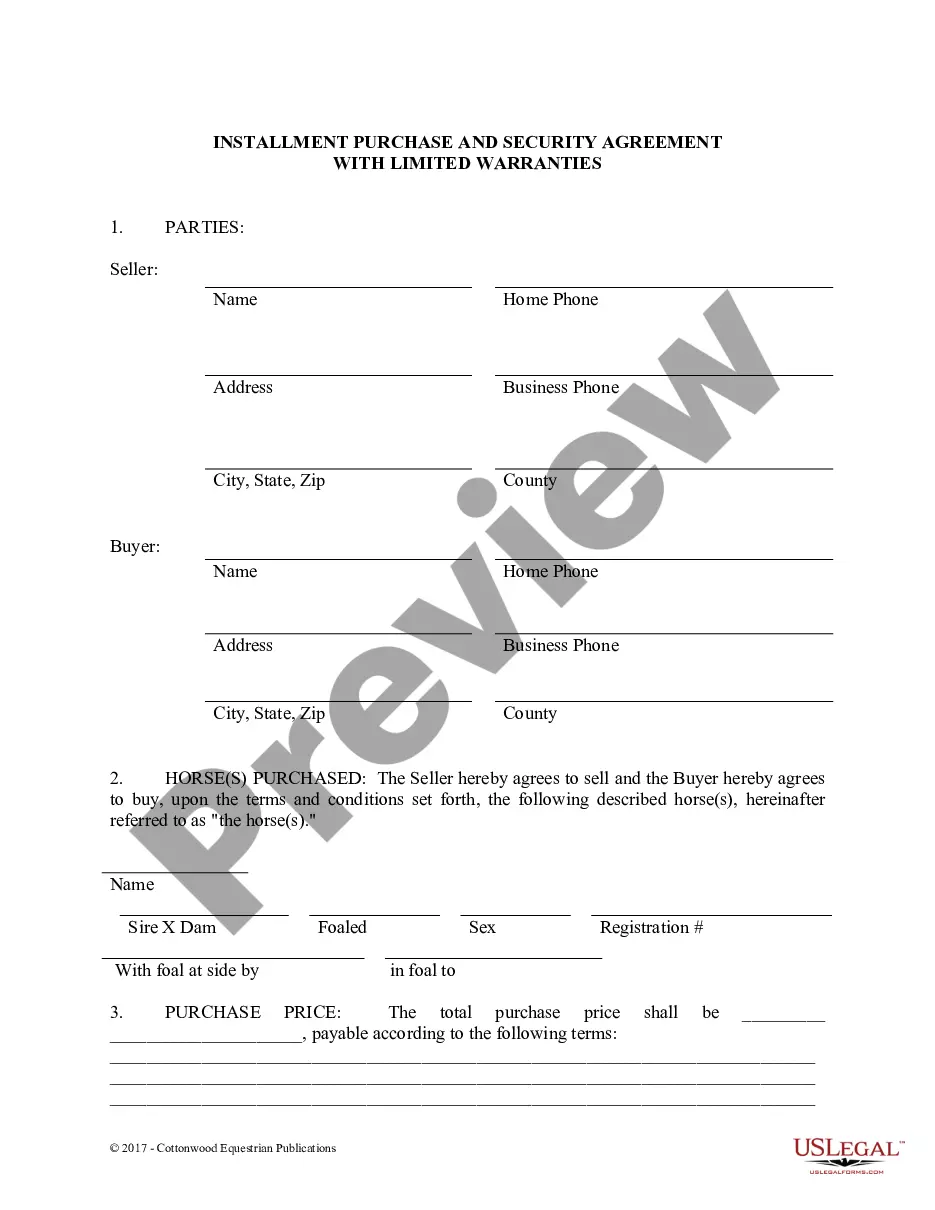

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Contractual Liability Coverage The indemnity provision is the key to affording liability coverage to persons other than the insured. Absent an indemnity provision, coverage is available only to those named as insureds under the liability policy.

Indemnity Payments (1) The losses paid or expected to be paid directly to an insured by an insurer for first-party (e.g., property) coverages or on behalf of an insured for third-party (e.g., liability) coverages. (2) Payments made by the indemnitor under a hold harmless clause on behalf of the indemnitee.

Sometimes a person or a business will compensation another for paying the tax liability of the former. An agreement for this arrangement is called a tax indemnification agreement. As an example, Company #1 compensates Company #2 for the taxes that were levied against Company #2.

Fixed indemnity payments are taxable when premiums are paid by the employer or by employees on a pre-tax basis. When fixed indemnity payments are taxable, employers may need to work with insurance carriers to implement a process for tax withholding.

Tax Indemnity means the deed of covenant against Taxation in the Agreed Terms to be entered into on or around the date of this Agreement and a Tax Indemnity Claim means a claim for breach of, or under, the Tax Indemnity; Sample 2. Sample 3. Based on 8 documents. 8.

Tax law, however, does not generally treat indemnity payments as taxable income to the target corporation, but instead as a tax-free recovery of capital. 7 Thus, the target corporation may get a deduction for the loss without offsetting income from the indemnity payment.

In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.

Enforcement of Contract of Indemnity A contract of indemnity can be invoked according to its terms like the express promise. Damages, legal costs of judgement, the amount paid under the terms of the agreement are some of the claims which Indemnity holder can include in its claims.

No, generally. The proceeds of an accident and health policy, like AFLAC are not reportable as income so long as you did not deduct the premiums, and so long as this is not an employer provided fringe benefit.