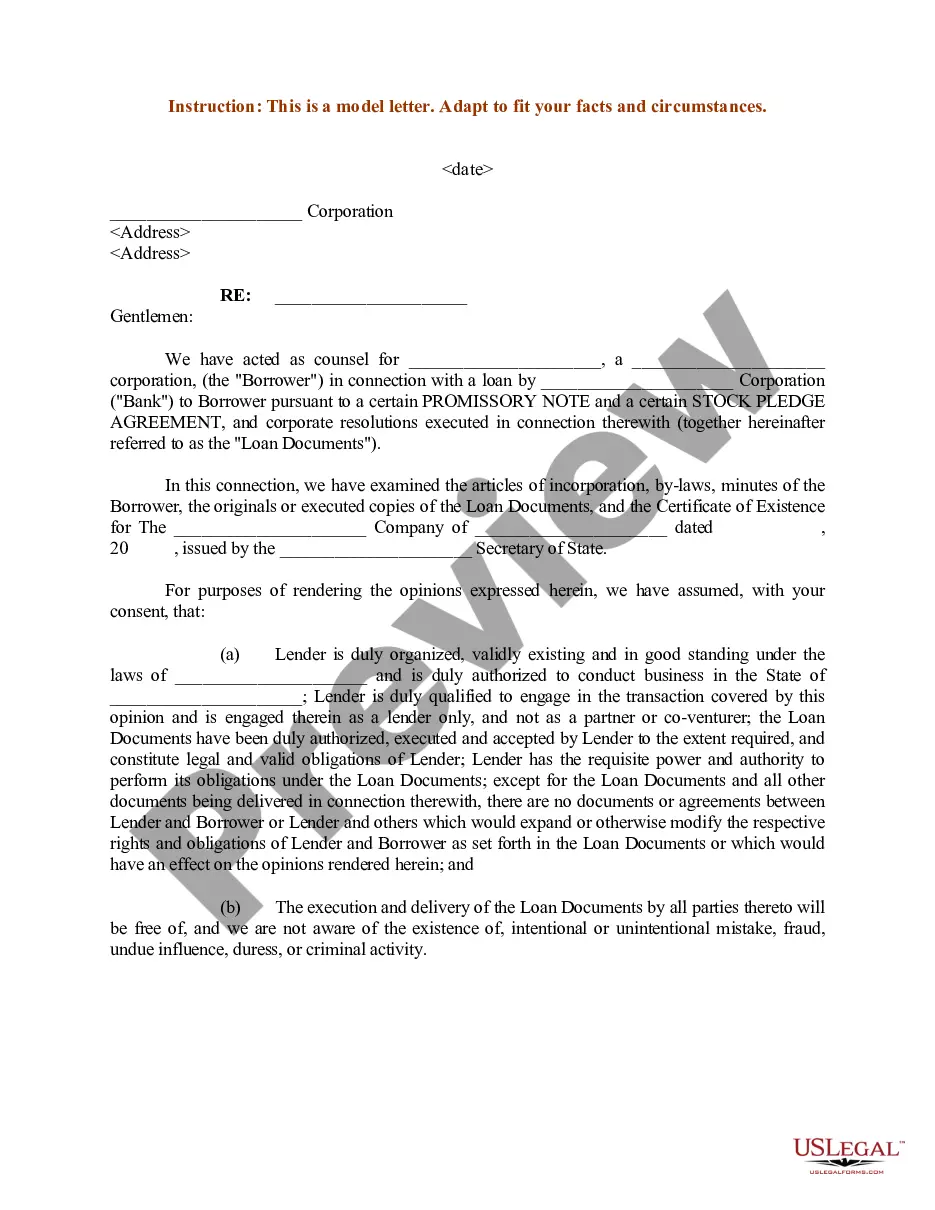

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

Phoenix Arizona Indemnity Provisions — Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations: A Detailed Description In the realm of legal agreements, indemnity provisions play a pivotal role in protecting parties involved from potential losses, risks, or liabilities. This comprehensive description focuses on Phoenix, Arizona's specific indemnity provisions concerning tax and insurance considerations. Understanding the various types of indemnity provisions is vital for individuals and businesses operating in this area: 1. Tax Indemnity Provisions: These provisions aim to safeguard parties from any adverse tax-related consequences that might arise during or after a transaction or agreement. With Phoenix, Arizona's dynamic tax landscape, it is imperative to include tax indemnity provisions that specify who assumes the responsibility for any potential tax liability or audit claims. By clearly defining these indemnity provisions, parties can minimize the risk of financial exposure arising from unforeseen tax consequences. 2. Insurance Indemnity Provisions: In a jurisdiction like Phoenix, Arizona, where insurance regulations play a crucial role in protecting individuals and businesses, insurance indemnity provisions become paramount. These provisions outline the responsibilities and obligations relating to insurance coverage, including liability insurance, property insurance, and workers' compensation. Parties must stipulate who is responsible for securing and maintaining appropriate insurance coverage and what happens in case of any gaps or lapses in coverage. By adequately addressing these indemnity provisions, the parties can mitigate the risk of costly litigation and financial losses associated with uninsured incidents. 3. Dollar Exposure of the Indemnity: Determining the dollar exposure of the indemnity is an essential aspect of drafting indemnity provisions. It involves setting a limit on the maximum financial liability one party can be held responsible for indemnifying the other party. For example, in Phoenix, Arizona, parties may agree to limit the indemnity provided to a specific dollar amount or a certain percentage of the transaction's value. By clarifying this dollar exposure, parties can manage their potential financial risk and ensure an equitable distribution of liability. 4. Additional Considerations: Apart from tax and insurance, Phoenix, Arizona's indemnity provisions may also include clauses addressing other potential contingencies. These considerations could involve intellectual property infringement, environmental liabilities, contractual breaches, or indemnity for third-party claims. The specific nature of these additional indemnity provisions may vary depending on the industry, transaction type, and parties involved. As indemnity provisions play a critical role in clarifying responsibilities and mitigating financial risks, drafting these agreements requires thorough attention to detail. Engaging legal professionals experienced in Arizona's jurisdiction is highly recommended ensuring that all necessary considerations are adequately addressed within the provisions. By customizing indemnity provisions to suit the tax and insurance landscape in Phoenix, Arizona, parties can strengthen their agreements, protect their interests, and maintain a secure business environment.