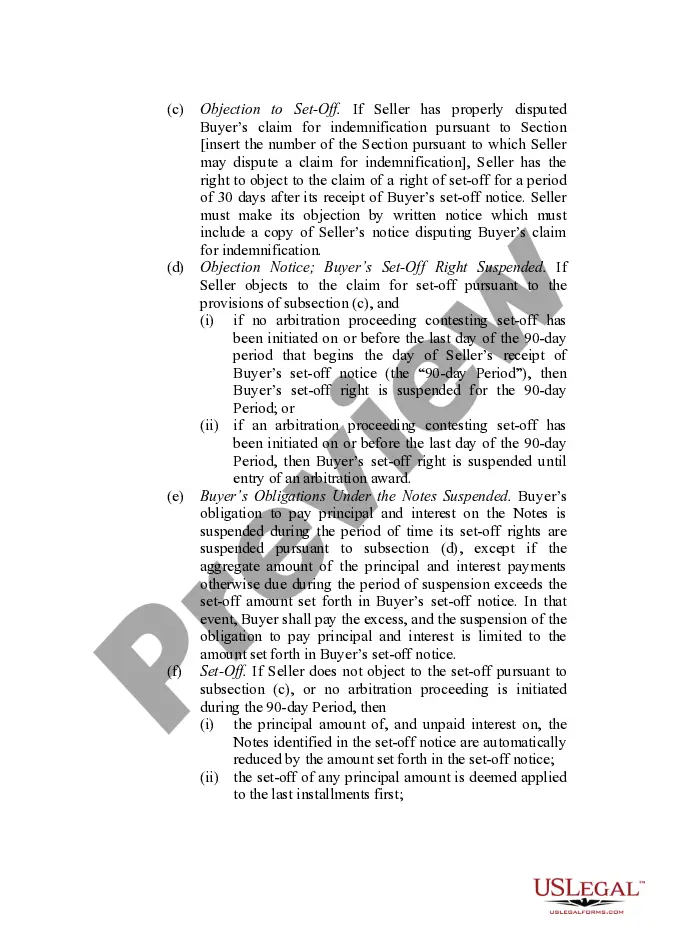

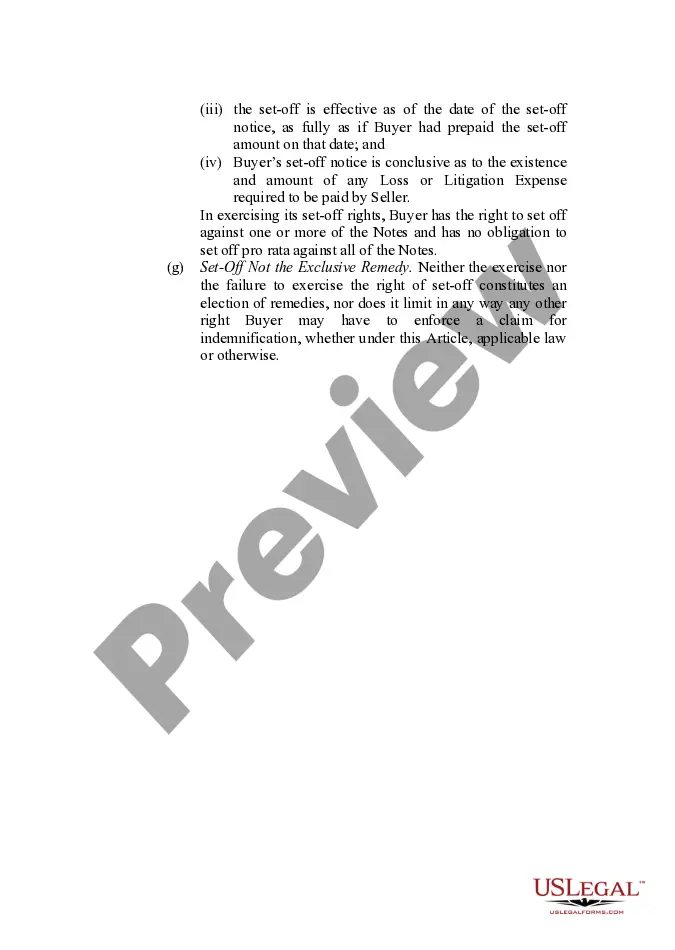

This form provides boilerplate contract clauses that outline means of securing the funds for payment of any indemnity, including use of an escrow fund or set-offs.

Cook Illinois Indemnity Provisions refer to the legal clauses within an agreement or contract that outline the means of securing payment for any indemnity owed. These provisions are in place to protect parties from potential financial losses or damages that may arise during the course of a business arrangement or transaction. By including indemnity provisions, parties can ensure that they are adequately compensated for any losses, liabilities, or expenses incurred due to the actions or omissions of the other party. Cook Illinois Indemnity Provisions commonly include various means of securing the payment of indemnity. Some different types of provisions that may be included are: 1. Security Deposit: This is a common means of securing payment. Parties may agree to set aside a certain amount of money as a security deposit, which can be used to cover any indemnity owed in the event of a breach or default. 2. Letter of Credit: A letter of credit can be used as a form of financial guarantee. It is typically issued by a bank and ensures that a specific amount of funds will be available to pay indemnity if needed. 3. Escrow Account: Parties may choose to establish an escrow account where funds are held by a neutral third party. These funds can be utilized to satisfy any indemnity claims in case of a breach or default. 4. Surety Bond: A surety bond involves a third party company that guarantees payment of indemnity on behalf of the party in question. This type of provision provides an additional layer of assurance to the indemnified party. 5. Parental Guarantee: In certain situations, a parent company may provide a guarantee of payment on behalf of its subsidiary or affiliated entity. This can strengthen the party's ability to secure the payment of indemnity. 6. Irrevocable Standby Letter of Credit: Similar to a letter of credit, an irrevocable standby letter of credit ensures the availability of funds in case of indemnity payment. It acts as a promise from a bank to pay the recipient if certain conditions are met. It is important to note that the specific terms and conditions of Cook Illinois Indemnity Provisions — Means of Securing the Payment of the Indemnity may vary depending on the nature of the agreement and the parties involved. Furthermore, it is advisable to consult with legal professionals to ensure the inclusion of appropriate indemnity provisions and the selection of the most suitable means of securing payment.Cook Illinois Indemnity Provisions refer to the legal clauses within an agreement or contract that outline the means of securing payment for any indemnity owed. These provisions are in place to protect parties from potential financial losses or damages that may arise during the course of a business arrangement or transaction. By including indemnity provisions, parties can ensure that they are adequately compensated for any losses, liabilities, or expenses incurred due to the actions or omissions of the other party. Cook Illinois Indemnity Provisions commonly include various means of securing the payment of indemnity. Some different types of provisions that may be included are: 1. Security Deposit: This is a common means of securing payment. Parties may agree to set aside a certain amount of money as a security deposit, which can be used to cover any indemnity owed in the event of a breach or default. 2. Letter of Credit: A letter of credit can be used as a form of financial guarantee. It is typically issued by a bank and ensures that a specific amount of funds will be available to pay indemnity if needed. 3. Escrow Account: Parties may choose to establish an escrow account where funds are held by a neutral third party. These funds can be utilized to satisfy any indemnity claims in case of a breach or default. 4. Surety Bond: A surety bond involves a third party company that guarantees payment of indemnity on behalf of the party in question. This type of provision provides an additional layer of assurance to the indemnified party. 5. Parental Guarantee: In certain situations, a parent company may provide a guarantee of payment on behalf of its subsidiary or affiliated entity. This can strengthen the party's ability to secure the payment of indemnity. 6. Irrevocable Standby Letter of Credit: Similar to a letter of credit, an irrevocable standby letter of credit ensures the availability of funds in case of indemnity payment. It acts as a promise from a bank to pay the recipient if certain conditions are met. It is important to note that the specific terms and conditions of Cook Illinois Indemnity Provisions — Means of Securing the Payment of the Indemnity may vary depending on the nature of the agreement and the parties involved. Furthermore, it is advisable to consult with legal professionals to ensure the inclusion of appropriate indemnity provisions and the selection of the most suitable means of securing payment.