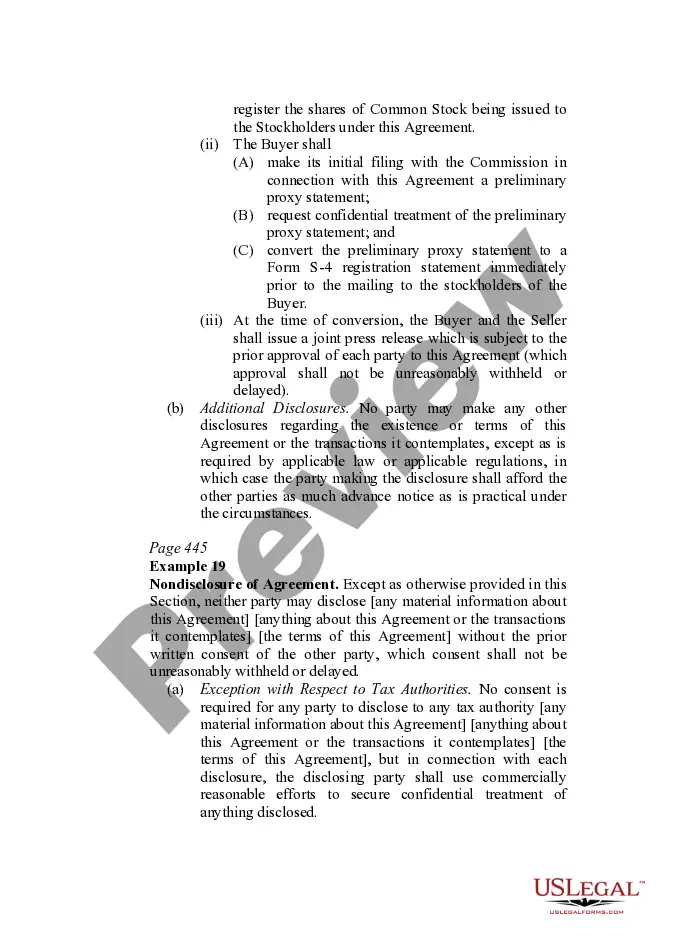

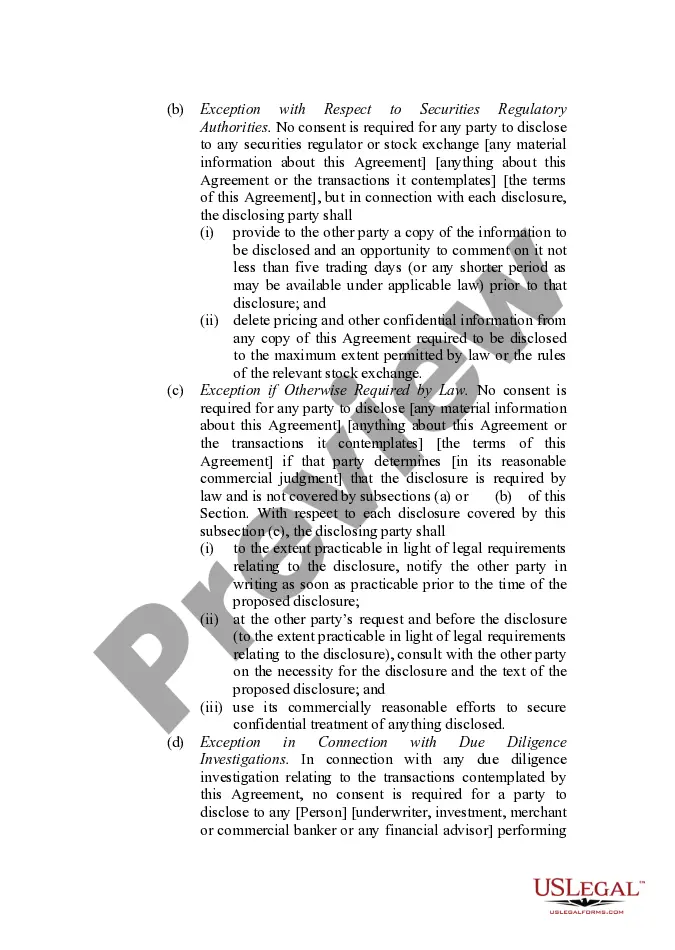

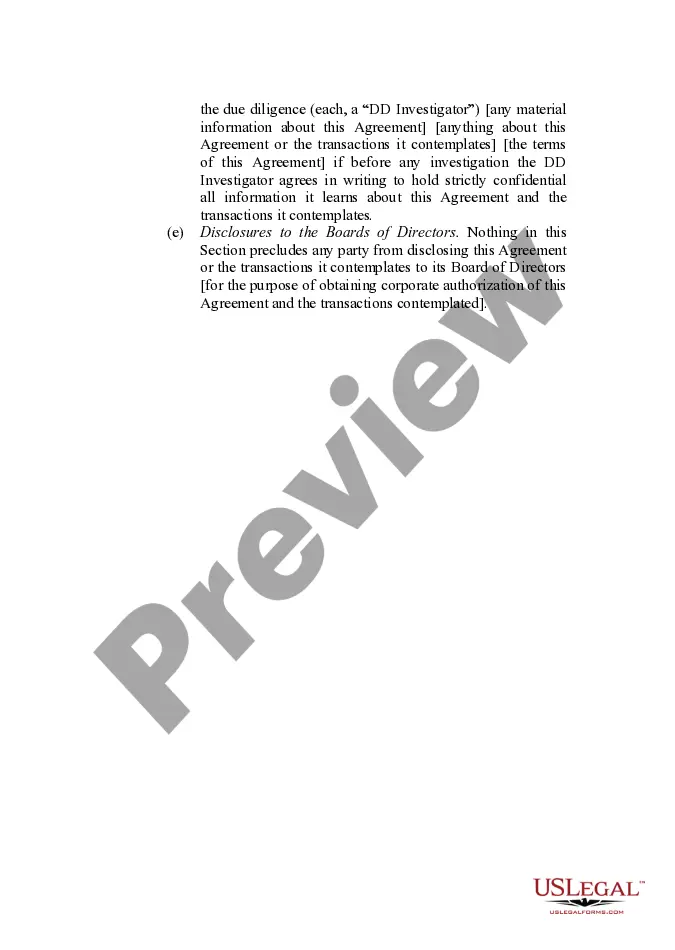

This form provides boilerplate contract clauses that outline the obligations of nondisclosure and the restrictions that apply to public announcements regarding the existence or terms of the contract agreement. Several different language options representing various levels of restriction are included to suit individual needs and circumstances.

Harris Texas Announcement Provisions in the Transactional Context refer to specific clauses or provisions included in a transactional document that require one party (the "Announcing Party") to notify the other party (the "Non-Announcing Party") of certain events or conditions related to the transaction. These provisions are typically included in contracts, agreements, or other legally binding documents to ensure transparency, facilitate communication, and minimize risks for all involved parties. One type of Harris Texas Announcement Provision is the "Material Adverse Change" (MAC) provision. This provision requires the Announcing Party to promptly notify the Non-Announcing Party of any material adverse changes or developments that could have a significant impact on the transaction. Such changes may include a substantial decline in the financial condition of a party, a significant regulatory or legal action affecting the transaction, or any other event that might materially affect the parties' rights or obligations. Another type of Harris Texas Announcement Provision is the "Conditions Precedent" provision. This provision requires the Announcing Party to inform the Non-Announcing Party of specific conditions that must be satisfied before the transaction can proceed. This may include obtaining necessary approvals or consents, securing financing, or completing certain due diligence requirements. The provision ensures that both parties are aware of the steps that need to be taken before the transaction can be finalized. Additionally, there may be "Termination" provisions in Harris Texas Announcement Provisions. These provisions allow either party to terminate the transaction if certain specified events occur. The Announcing Party is required to inform the Non-Announcing Party of such events in a timely manner. Common termination events may include breach of contract, failure to meet agreed-upon milestones, or the occurrence of a force majeure event that renders the transaction impossible or impracticable. Furthermore, Harris Texas Announcement Provisions could also include "Amendment" provisions. These provisions define the process and requirements for making changes or modifications to the transactional document. The Announcing Party must inform the Non-Announcing Party of any proposed amendments and seek their consent or approval. In summary, Harris Texas Announcement Provisions in the Transactional Context are contractual provisions designed to ensure effective communication, provide transparency, and mitigate risks in a transaction. Key types of provisions include Material Adverse Change, Conditions Precedent, Termination, and Amendment provisions. By incorporating these provisions into transactional documents, parties can achieve a better understanding of their rights, responsibilities, and any potential risks associated with the transaction.