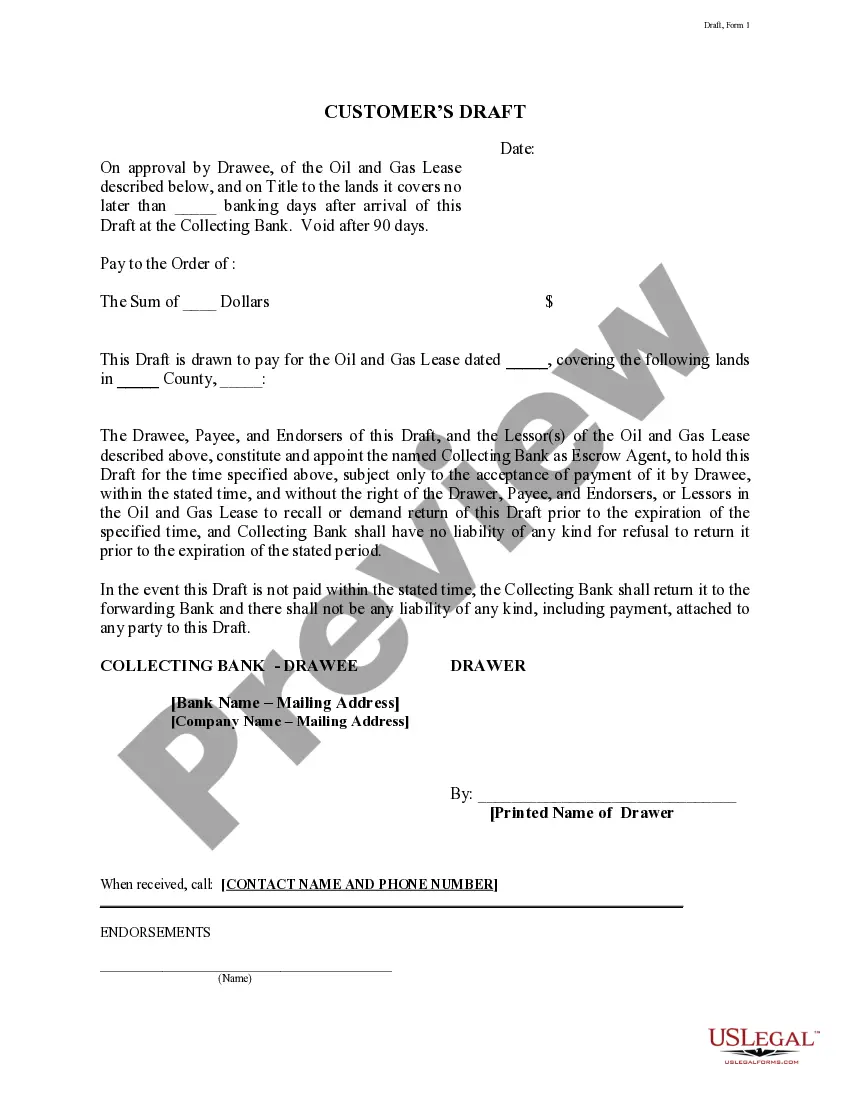

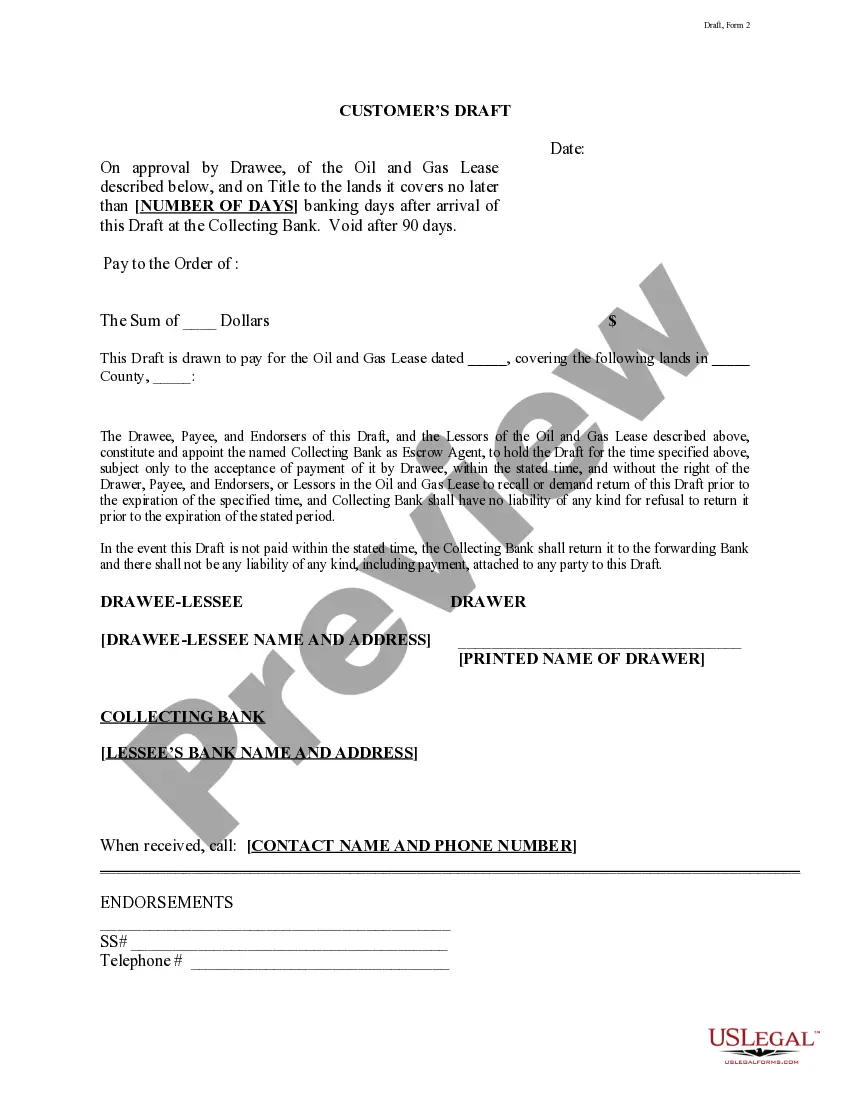

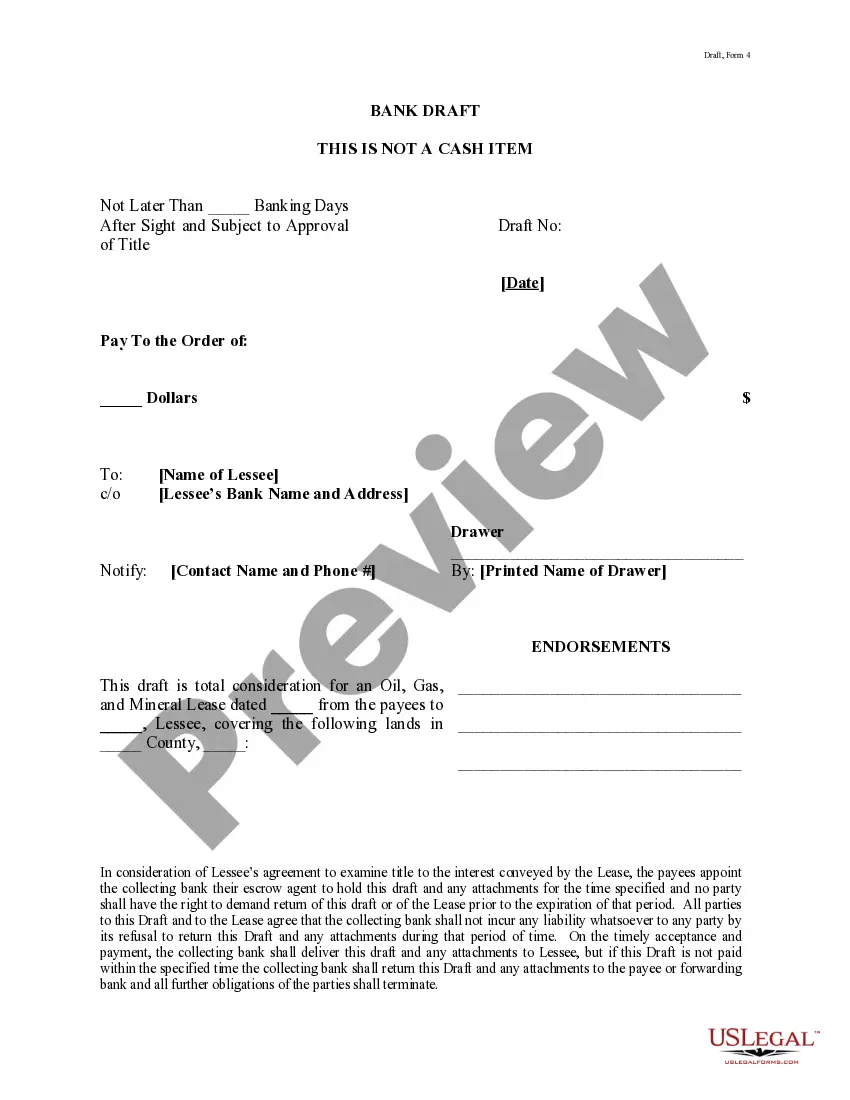

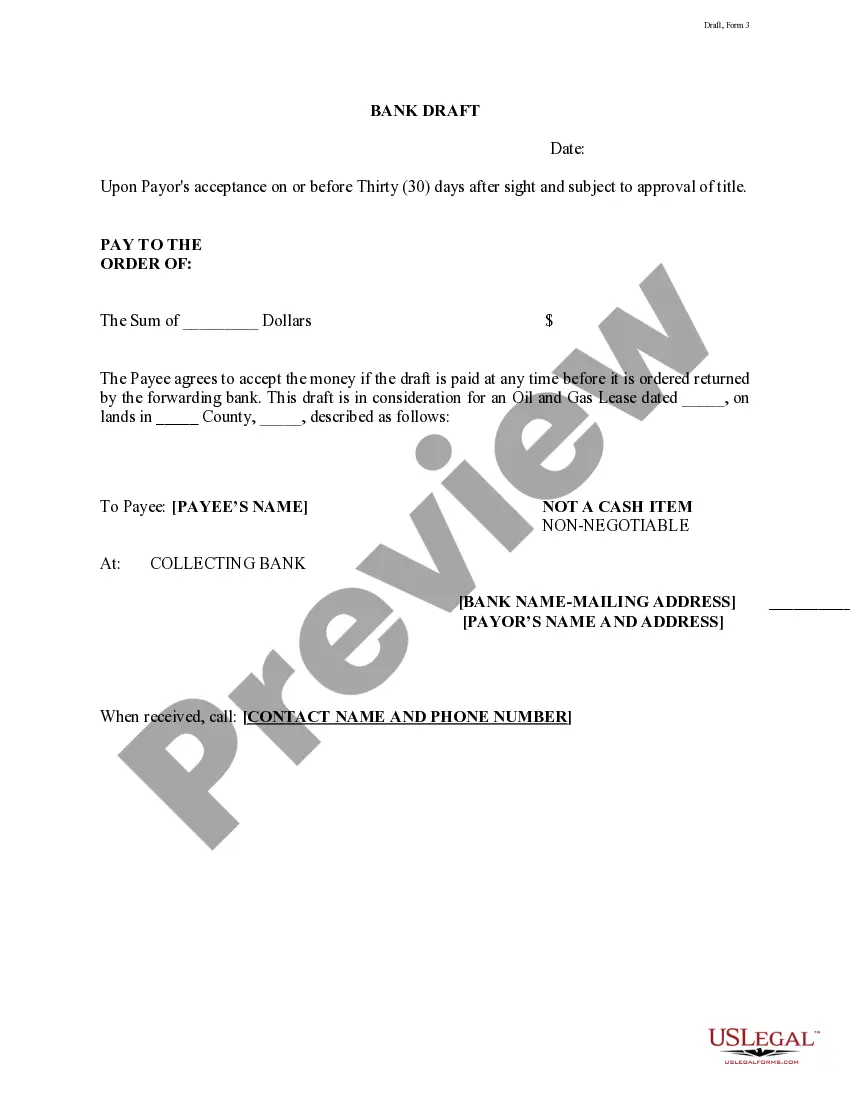

This form brings together several boilerplate contract clauses that work together to outline the procedures, restrictions, exclusivity and other aspects of an indemnity provided for under the terms of the contract agreement.

Dallas Texas Indemnification — Long-Form Provision is a legal term used to describe a specific provision in contracts or agreements that aims to protect parties involved from potential losses or damages. This provision establishes the responsibilities and liabilities of each party, ensuring fair protection against any legal claims, expenses, or losses that may arise during the course of the agreement. In Dallas, Texas, the Indemnification — Long-Form Provision is employed in various industries and sectors, such as real estate, construction, finance, and technology. This provision is crucial to safeguard the rights and interests of the parties involved, providing the necessary legal protection in case of unforeseen events or actions that might lead to financial harm. The long-form provision includes several key elements and keywords that define its scope and implications. Some relevant keywords commonly associated with the Dallas Texas Indemnification — Long-Form Provision include: 1Indemnityor: The party or parties assuming the obligation to indemnify and hold harmless the other party. They agree to compensate and protect the other party from any losses, damages, or claims that may arise due to acts or omissions. 2. Indemnity: The party being indemnified and protected from potential liabilities and losses. They are entitled to seek reimbursement or compensation for any losses incurred within the agreed terms and conditions. 3. Third-Party Claims: Refers to claims made by individuals or entities who are not a direct party to the contract but may be affected by the actions or omissions of one of the parties involved. The indemnification provision may specify how such claims are addressed and who assumes responsibility for them. 4. Broad Indemnity: This type of indemnification is comprehensive and covers a wide range of potential claims and liabilities, ensuring that the indemnity takes responsibility for any losses, damages, or expenses incurred by the indemnity. 5. Comparative Fault: In some cases, the indemnification provision may include clauses that address situations where both parties contributed to the loss or damage. These clauses dictate how the responsibilities and liabilities are allocated between the parties based on their relative fault or negligence. 6. Legal Expenses: The provision may also include reimbursement for legal fees and costs incurred by the indemnity in defending against claims or enforcing the indemnification provisions. It is important to note that the specific types of Dallas Texas Indemnification — Long-Form Provisions may vary depending on the industry, nature of the agreement, and the unique requirements of the involved parties.