Cook Illinois Promissory Note with Confessed Judgment Provisions is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower, specifically in the state of Illinois. This type of promissory note is unique as it includes a Confessed Judgment provision, which provides the lender with the ability to obtain a judgment against the borrower without going through a formal legal process. The Cook Illinois Promissory Note with Confessed Judgment Provisions ensures that the lender has a clear recourse in case of default or non-payment by the borrower. The inclusion of Confessed Judgment provisions allows the lender to accelerate the debt and seek legal remedies swiftly, potentially bypassing the standard court procedures. There are several types of Cook Illinois Promissory Note with Confessed Judgment Provisions that may vary based on specific loan terms or borrower circumstances. These include: 1. Installment Promissory Note with Confessed Judgment Provisions: This type of promissory note sets the repayment terms in multiple installments, specifying the amount, due dates, and interest calculation methods. The Confessed Judgment provision grants the lender the authority to obtain a judgment if the borrower defaults on the agreed installment payments. 2. Balloon Promissory Note with Confessed Judgment Provisions: In this case, the borrower agrees to make regular payments of interest and a portion of the principal over a certain period. However, there is a larger payment due at the end of the term, known as a balloon payment. The Confessed Judgment provision allows the lender to take legal action if the borrower fails to make the balloon payment. 3. Secured Promissory Note with Confessed Judgment Provisions: This type of promissory note includes collateral that secures the loan in the form of assets like real estate, vehicles, or other valuable possessions. The Confessed Judgment provision enables the lender to pursue legal remedies and enforce the judgment against the secured collateral in the event of default. 4. Unsecured Promissory Note with Confessed Judgment Provisions: Unlike the secured note, this type of promissory note does not require any collateral. The Confessed Judgment provision gives the lender the ability to obtain a judgment against the borrower's assets without any specific collateral backing the loan. It is essential to carefully review and understand the terms, conditions, and legal implications of any Cook Illinois Promissory Note with Confessed Judgment Provisions before signing it. Consulting with a legal professional and seeking expert advice would be prudent to ensure full comprehension and protection of all parties involved.

Cook Illinois Promissory Note with Confessed Judgment Provisions

Description

How to fill out Cook Illinois Promissory Note With Confessed Judgment Provisions?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Cook Promissory Note with Confessed Judgment Provisions, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Cook Promissory Note with Confessed Judgment Provisions from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Cook Promissory Note with Confessed Judgment Provisions:

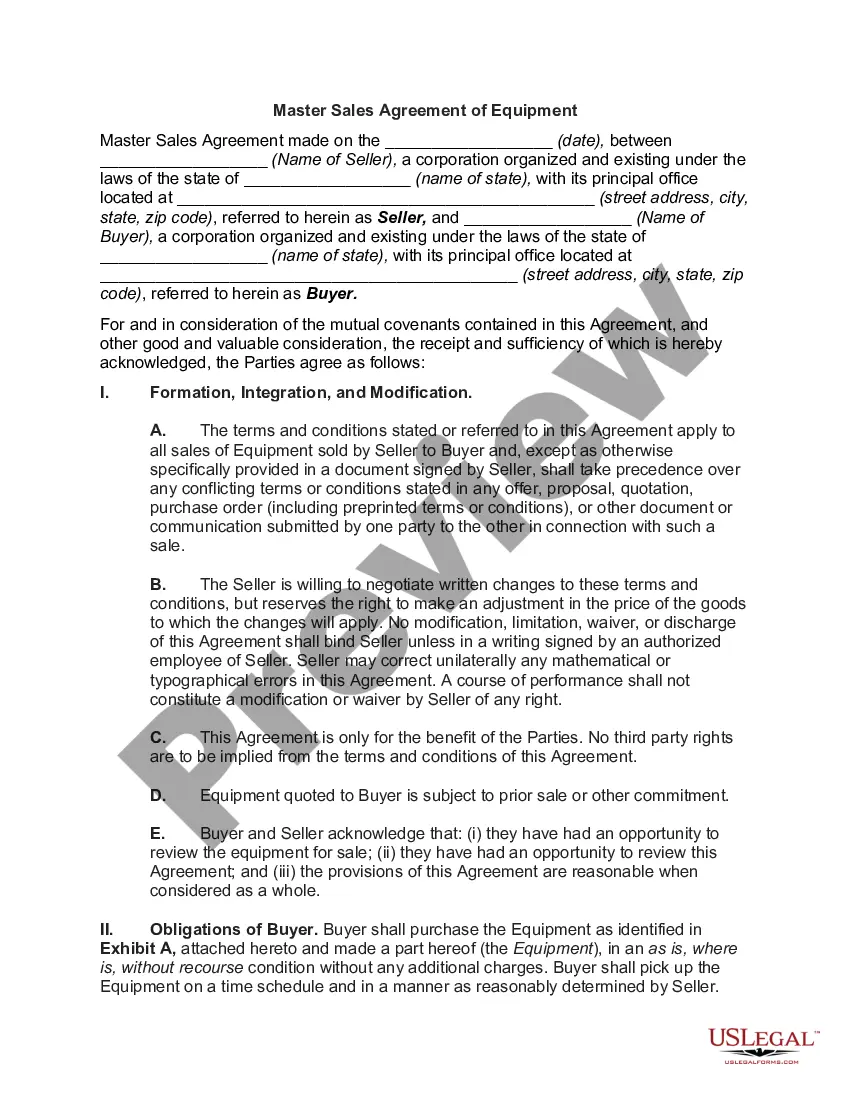

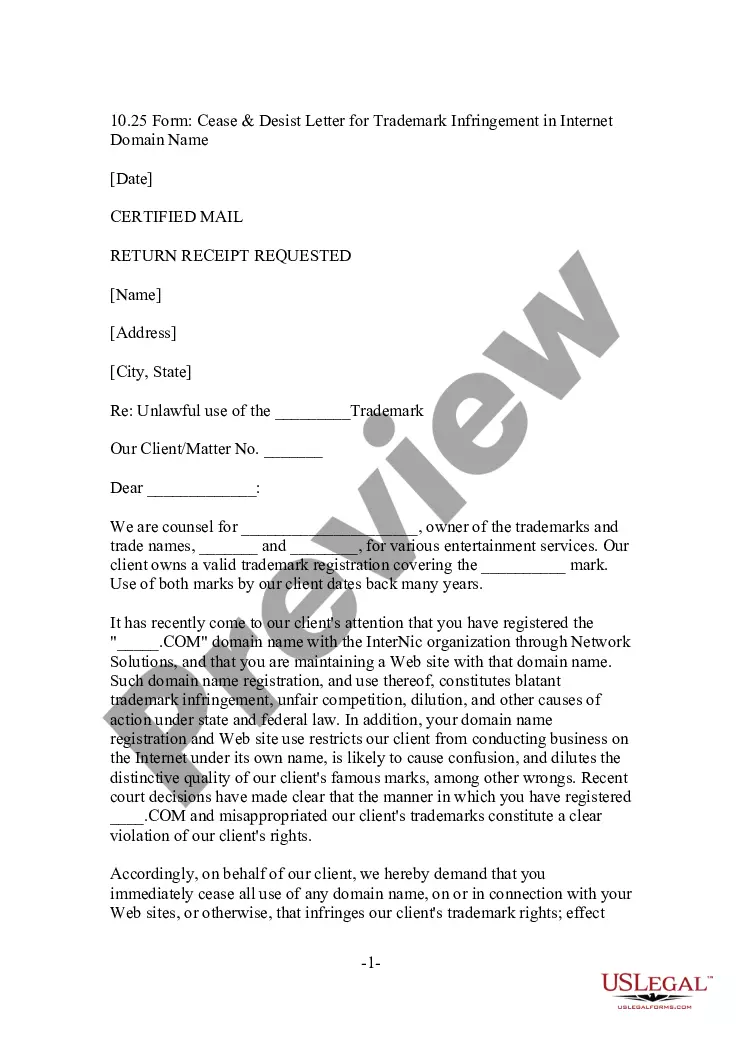

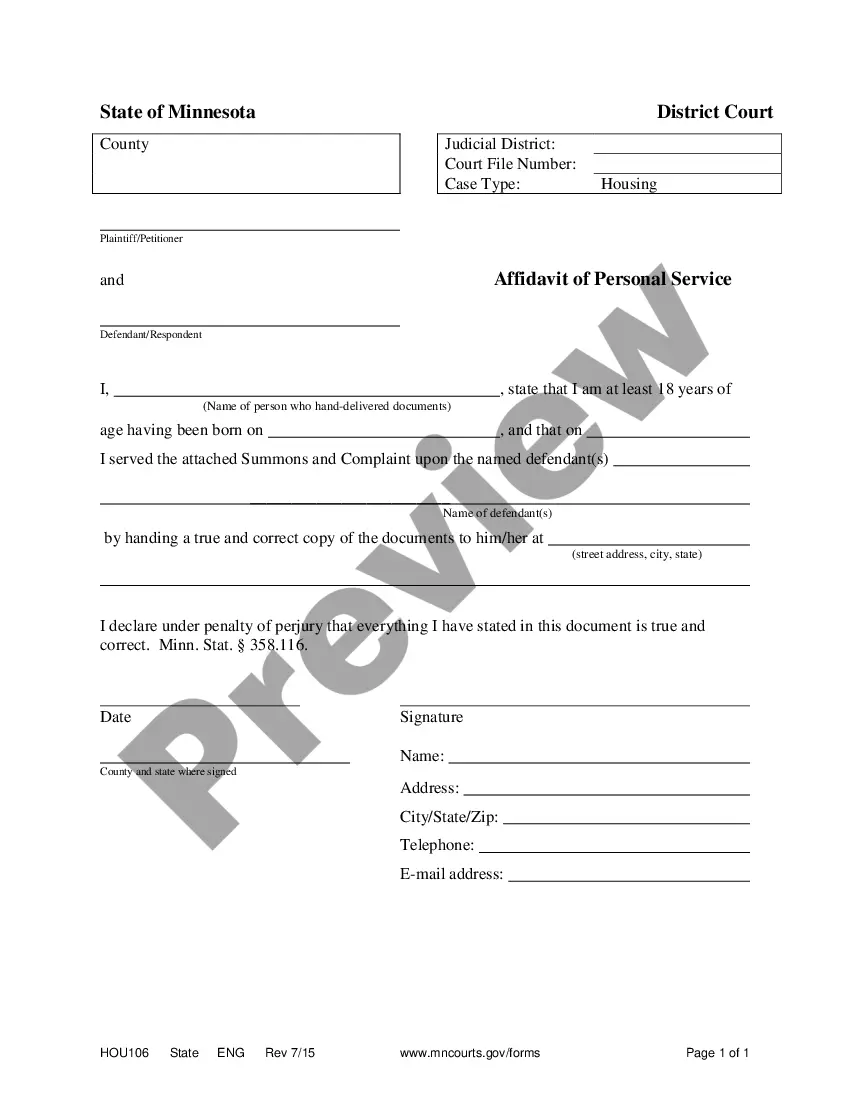

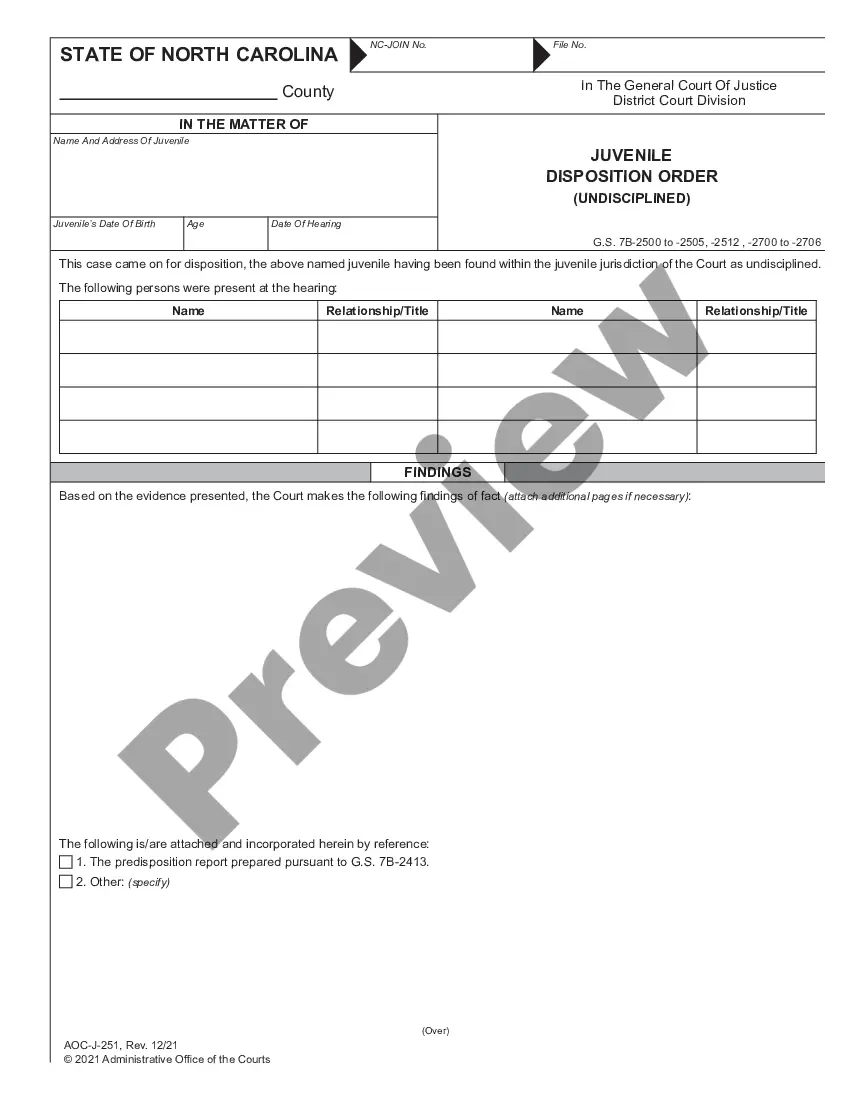

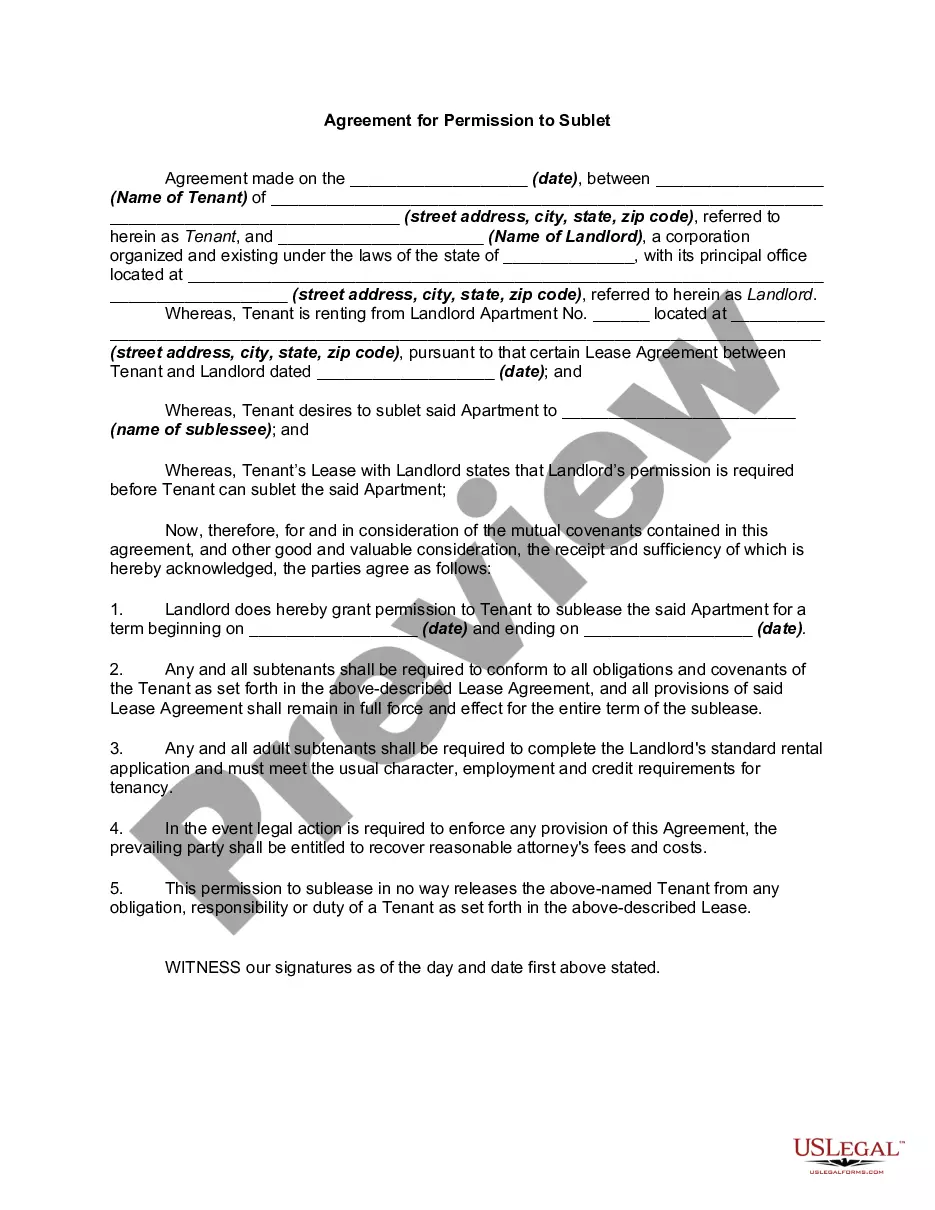

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A Virginia confession of judgment is an extraordinary remedy that allows banks to short circuit the court process and immediately get a judgment in the event of a default. A skilled lender liability lawyer can often attack the confession on procedural grounds.

A typical confession of judgment provision in a commercial contract (e.g., a promissory note) authorizes the creditor upon a default under the agreement to obtain a judgment for the amount owed without notice to the debtor(s) or guarantor(s), and allows the creditor to immediately execute on the judgment.

THIS INSTRUMENT CONTAINS A CONFESSION OF JUDGMENT PROVISION WHICH CONSTITUTES A WAIVER OF IMPORTANT RIGHTS YOU MAY HAVE AS A DEBTOR AND ALLOWS THE CREDITOR TO OBTAIN A JUDGMENT AGAINST YOU WITHOUT ANY FURTHER NOTICE.

In Maryland, a judgment is only valid for 12 years. If you have not been able to collect your judgment within that time, you will have to renew the judgment to continue your collection efforts. Complete the Request to Renew Judgment (form DC-CV-023) and file it with the court.

About Confessed Judgments A confessed judgment clause allows a creditor's attorney to file an affidavit with the lawsuit and effectively confess, on behalf of the debtor, that the judgment is owed. If filed correctly, the Court can immediately enter judgment against a debtor.

A confession of judgment (COJ) in New York is a way for a party to obtain a judgment without the need to bring a lawsuit. It is a document in the form of an affidavit by the party confessing judgment. Both individuals and entities (i.e., such as corporations and LLCs) can confess judgment.

Code, Commercial Law § 13-301(12), the Court determined that the Maryland CPA prohibits all confessed judgment clauses in consumer transactions.

A confession of judgment is a significant legal concession, so it requires appropriate formalities to be executed and subsequently enforceable. California Code of Civil Procedure (CCP) sections 1132, 1133, and 1134 govern confessions of judgment.

A confession of judgment is a legal device - usually a clause within a contract - in which a debtor agrees to allow a creditor, upon the nonoccurrence of a payment, to obtain a judgment against the debtor, often without advanced notice or a hearing.