San Diego California Affidavit of Banker for Nondeposit of Rentals is a legal document that certifies the nondeposit of rental payments by a banker in San Diego, California. This affidavit is used in situations where a landlord or property owner claims that their tenant's rental payments were not deposited in their designated bank account. The San Diego California Affidavit of Banker for Nondeposit of Rentals serves as evidence that the landlord did not receive the rental payments, and it may be presented in court or used to resolve disputes related to rental transactions. This affidavit helps protect the rights of both tenants and landlords by ensuring transparency and accountability in financial transactions. It is crucial to have supporting keywords to generate relevant content regarding this document. Some relevant keywords related to the San Diego California Affidavit of Banker for Nondeposit of Rentals can include: 1. San Diego, California: This is the specific location where the affidavit is used and holds legal significance within the state. 2. Affidavit: An affidavit is a written statement confirmed by oath or affirmation, often used as evidence in legal proceedings. 3. Banker: Refers to a financial institution or a person employed by a bank who handles financial transactions and deposits. 4. Nondeposit: Implies that the rental payment was not deposited into the designated bank account. 5. Rentals: Indicates the payments made by the tenant to the landlord for the use of a property under a rental agreement. Different types of San Diego California Affidavit of Banker for Nondeposit of Rentals might vary based on specific scenarios or legal requirements. While the core purpose of the document remains constant, variants of this affidavit may include: 1. Affidavit of Banker for Nondeposit of Residential Rentals: Specifically addresses nondeposit instances related to residential rental properties. 2. Affidavit of Banker for Nondeposit of Commercial Rentals: Deals with nondeposit situations concerning commercial rental properties, such as retail spaces or office buildings. 3. Affidavit of Banker for Nondeposit of Vacation Rentals: Applies to nondeposit incidents involving short-term vacation rentals, which have specific regulations and legal considerations. These variants highlight the diverse nature of rental agreements and demonstrate the need for specific documentation within various rental contexts in San Diego, California.

San Diego California Affidavit of Banker for Nondeposit of Rentals

Description

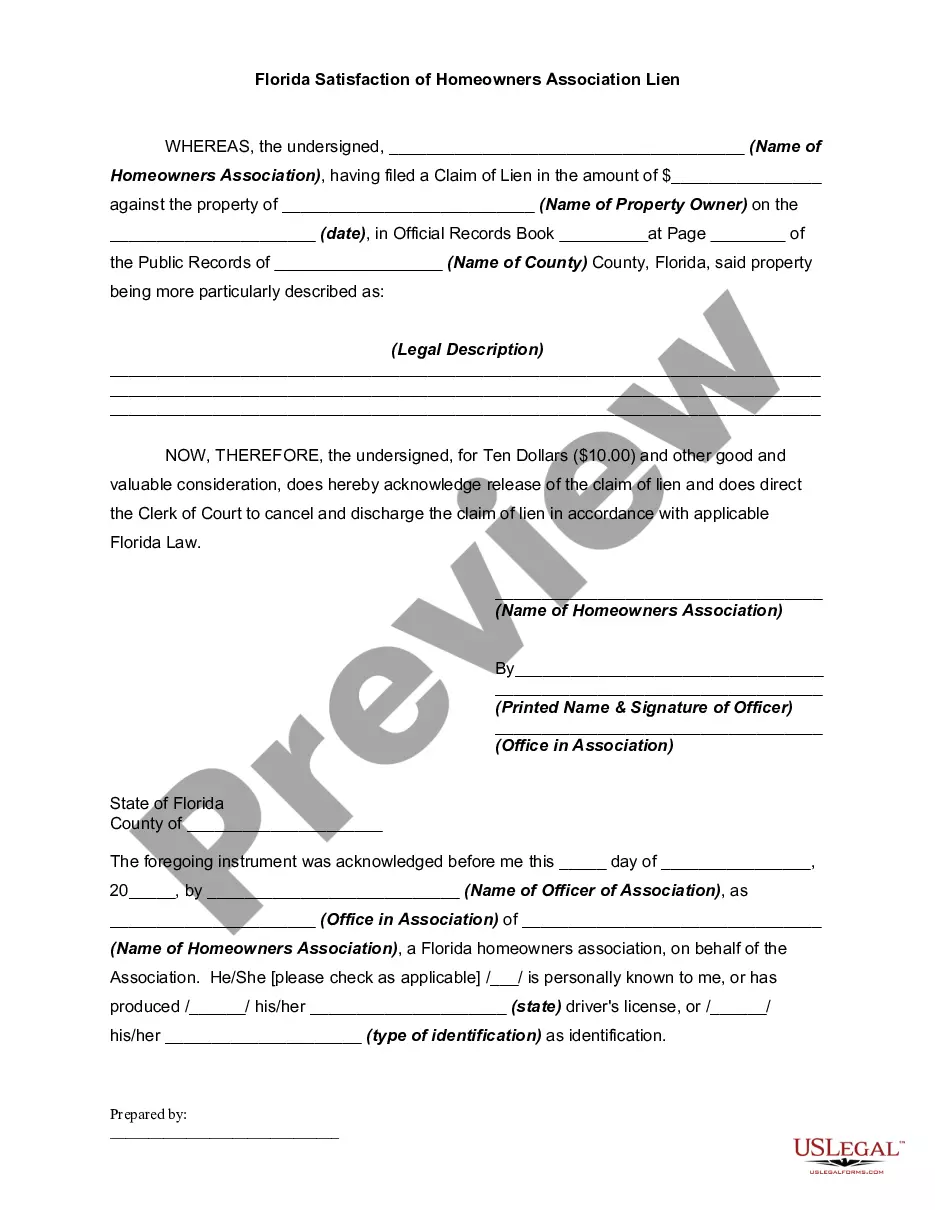

How to fill out San Diego California Affidavit Of Banker For Nondeposit Of Rentals?

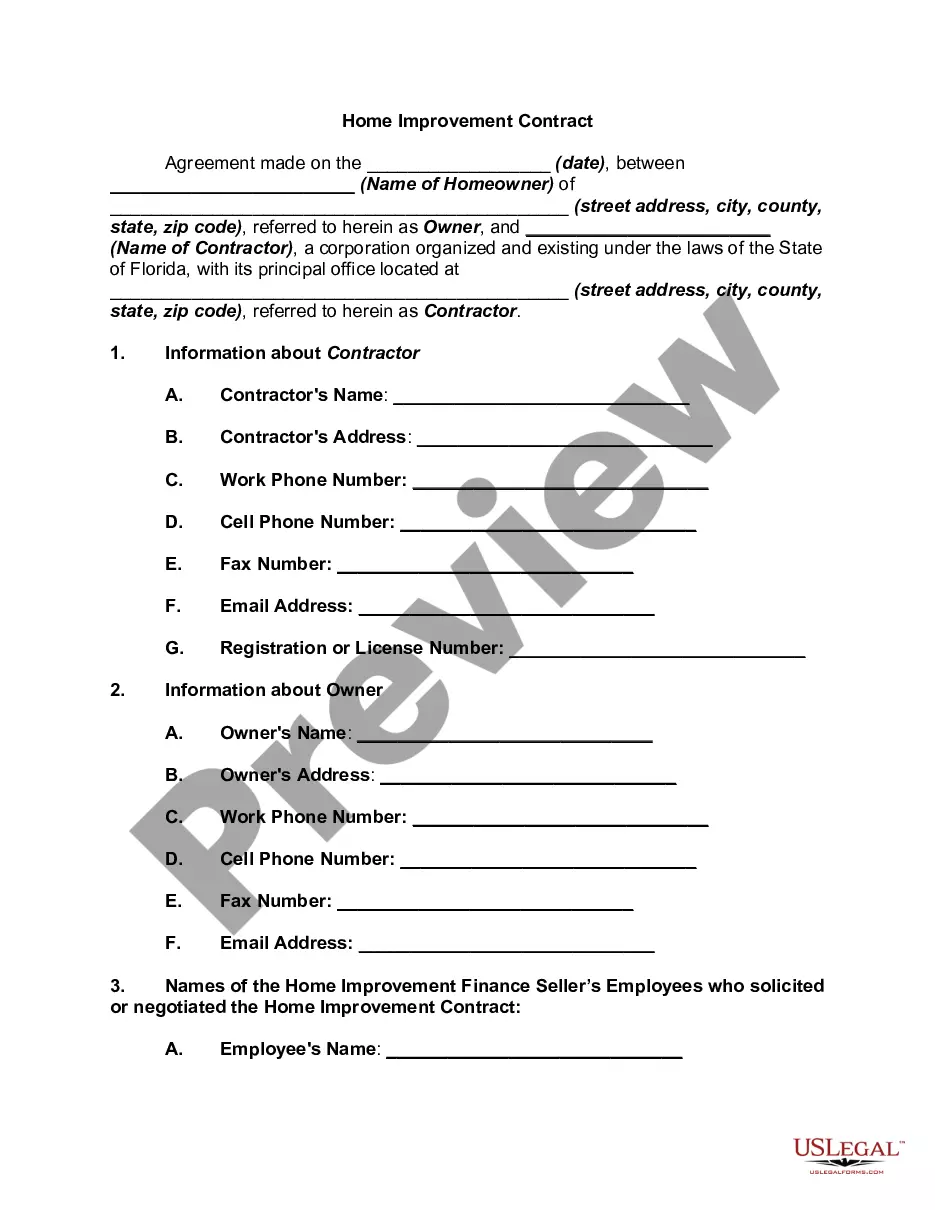

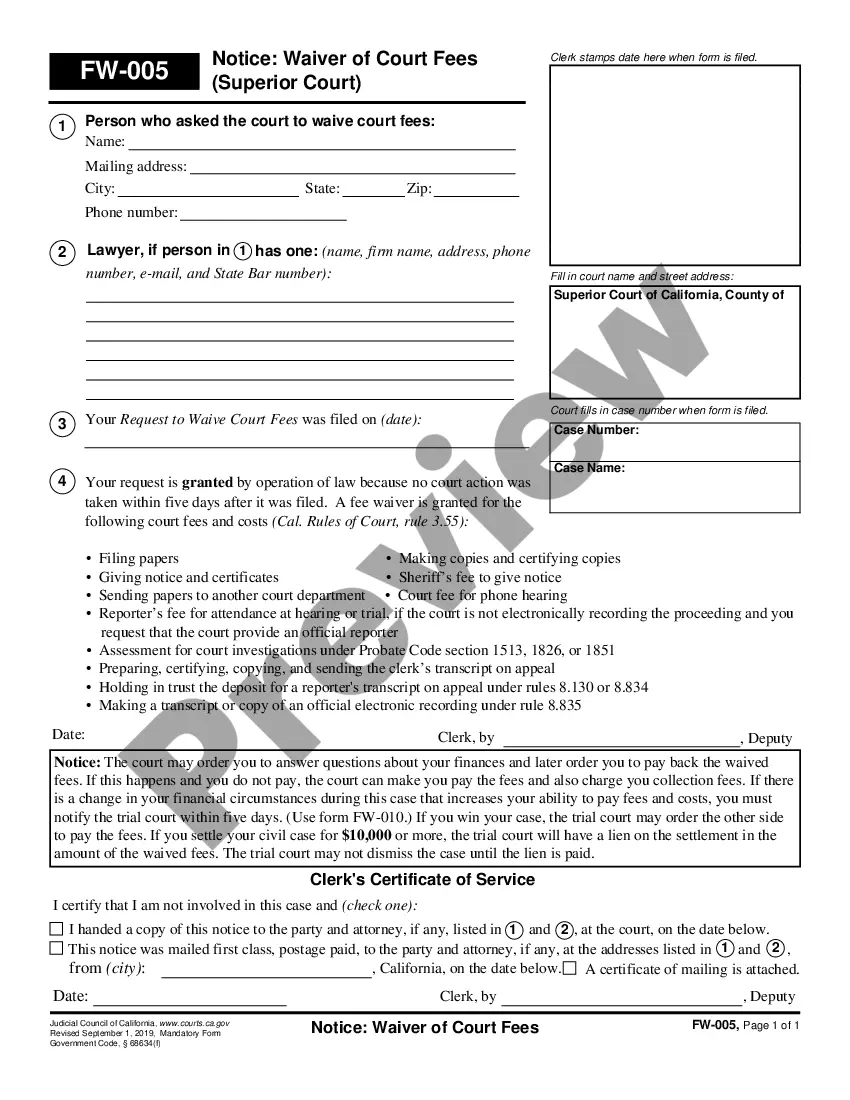

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like San Diego Affidavit of Banker for Nondeposit of Rentals is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the San Diego Affidavit of Banker for Nondeposit of Rentals. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Affidavit of Banker for Nondeposit of Rentals in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

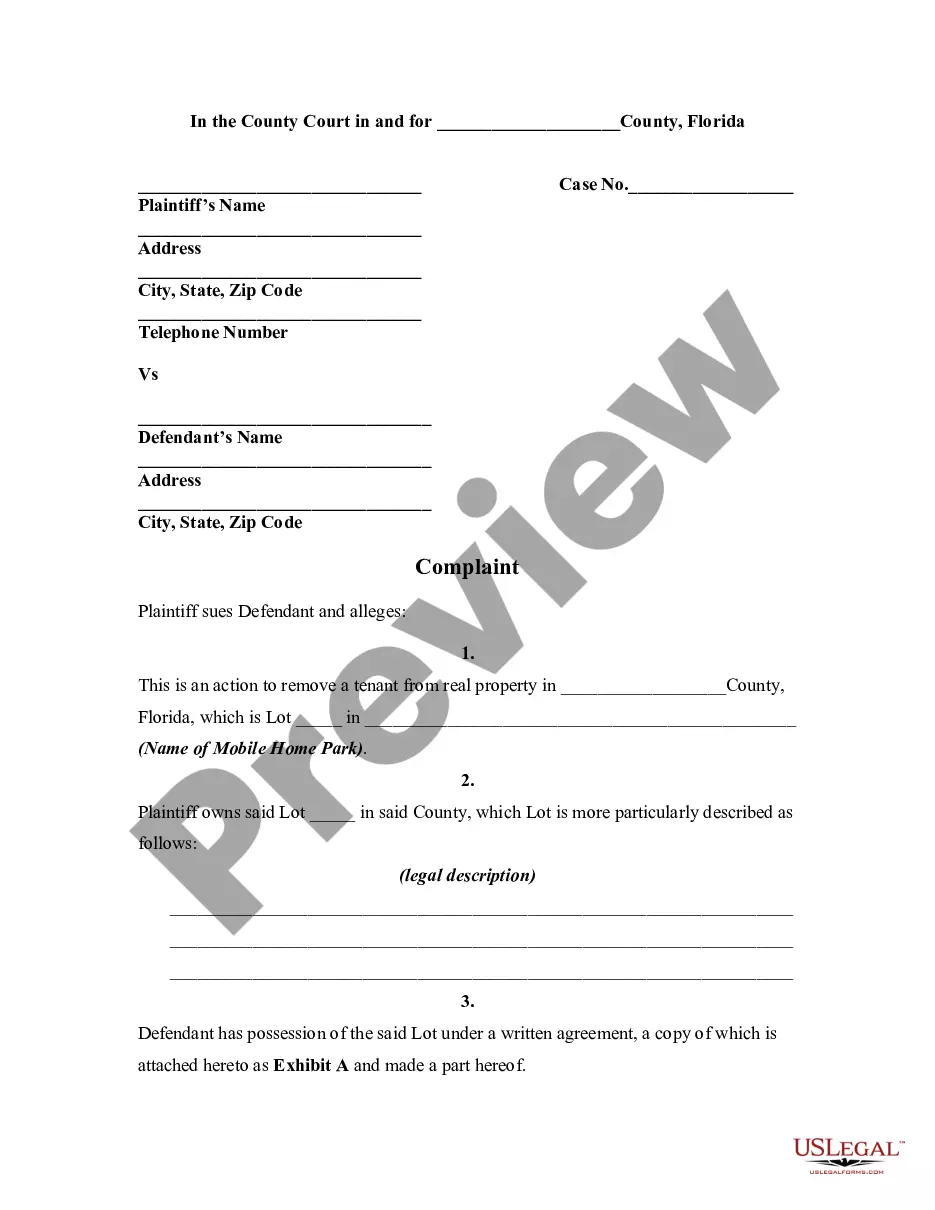

The very first step in evicting a tenant without a lease agreement is to serve a written notice to your tenant. This could be a 3 or 15 day notice for nonpayment of rent, 30 or 60 day notice to terminate the lease, etc. Figuring out which one is the correct one to use is why it's never a good idea to self-evict!

HUD handles complaints about housing discrimination, bad landlords in federal housing and many other issues. For additional local resources, you can also contact a housing counseling agency.

Deposit. The landlord must return the deposit no later than 30 days after the landlord receives possession of the premises (Cal. Civ. Code § 1950.7(c)).

Currently, California has a no-fault law as regards move outs. That means that landlords can evict tenants for just about any or no reason so long as they provide notice of 30 to 60 days.

If your landlord hasn't secured the deposit, which could be the likely in this situation, then you can start the process of taking legal action against your Landlord via a small claims court in order to claim compensation (it's notoriously a relatively straightforward and easy win for tenants).

First, the deposit must be protected within 30 days of your landlord receiving it. The landlord must also provide you, as the tenant, with certain written information within that 30 day window. If that window is not met, then tenants can take action against the landlord.

Return of the Security Deposit According to California security deposit laws, after a tenancy is terminated, a landlord has 21 days to return the tenant's deposit in full.

Make a complaint to a 'designated person' (your MP, a local councillor or a tenant panel) if you cannot resolve the problem with your landlord. Contact your council or local authority if you and your landlord still cannot resolve the problem.

If a landlord does not return the entire amount of the tenant's security deposit within the 21 days required by law, and the tenant disputes the deductions from the deposit: The tenant can write a letter to the landlord explaining why he or she believes he or she is entitled to a larger refund.

The State of California Department of Consumer Affairs can help with questions or complaints regarding landlord/tenant relationships, including repair issues, safety violations, and Health and Safety Code violations. For further information, call (800) 952-5210, or visit the website at .

Interesting Questions

More info

Do you need to pay a security deposit? How will it affect the rent? 111(a); see also A&A Real Estate Co. v. O'Neil (1959); see also First Nat'l Bank in Graham v. Callahan (1983). Does your landlord have to provide keys for your security deposit before handing it over? 113a–d. A copy of the rental application should be enclosed in the rental agreement itself as well as when you sign it. Back to Top A note on the application process: In your effort to find a great place to live, be sure to do as much due diligence as your home situation permits. Make sure that your landlord is a real estate investor, and is qualified to manage a property in your new hometown. Look at the financial reports of current managers. Ask landlords about their financial history. If they are not licensed to do business in your state, ask how they are certified by the licensing board. Ask about the state of their insurance. Ask about potential liabilities they may have. Look at their reputation.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.