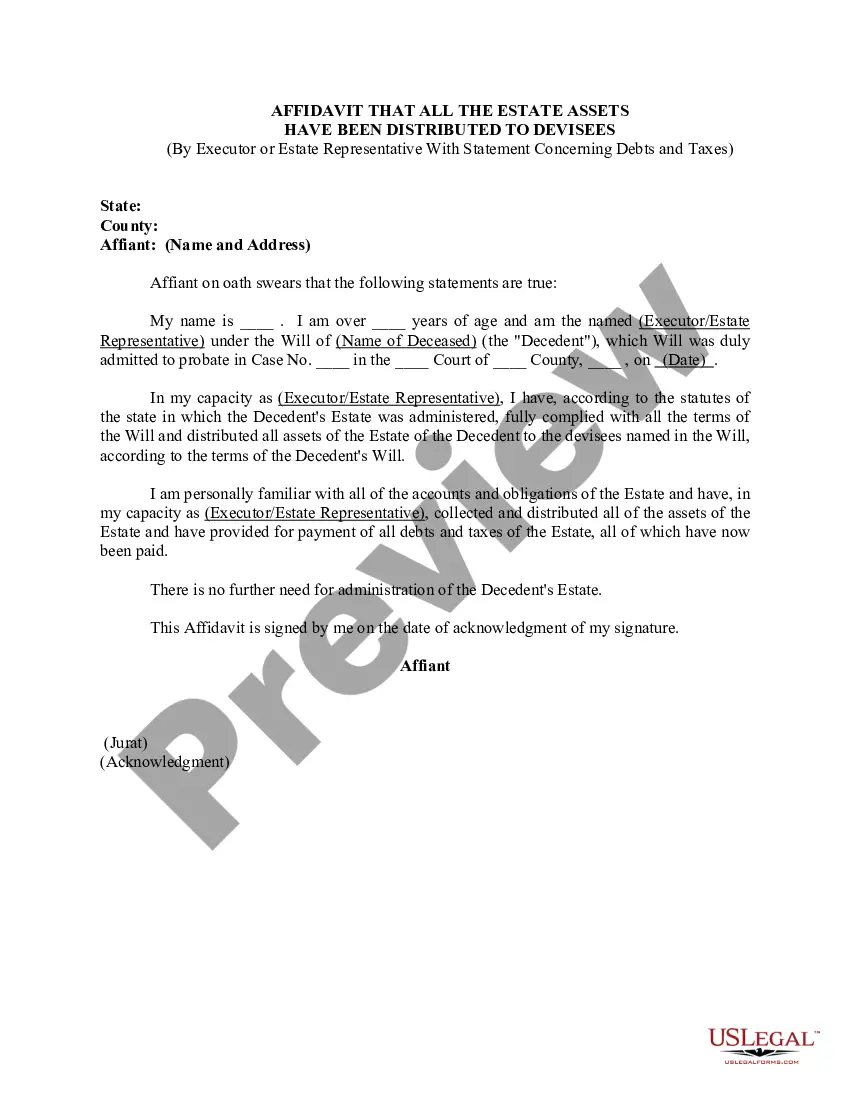

Alameda, California is a vibrant city located in the East Bay region of the San Francisco Bay Area. This bustling city is known for its picturesque landscapes, diverse communities, and rich cultural heritage. In addition to its natural beauty, it also offers a wide range of recreational activities and amenities for residents and visitors alike. An affidavit that all the estate assets have been distributed to devises by an executor or estate representative with a statement concerning debts and taxes is a crucial legal document filed during the probate process in Alameda, California. This affidavit serves as evidence that all assets, such as property, possessions, and financial accounts, have been appropriately distributed to the designated beneficiaries according to the deceased person's will or trust. In Alameda, California, there are different types of affidavits related to estate distribution that vary depending on the circumstances. These may include: 1. Affidavit of Real Property Transfer: This type of affidavit specifically addresses the transfer of real estate property to the devises mentioned in the will or trust. It outlines the locations, legal descriptions, and other relevant details of the properties distributed. 2. Affidavit of Personal Property Transfer: Focusing on personal belongings, this affidavit highlights the distribution of non-real estate assets such as jewelry, vehicles, artwork, and other valuable possessions. It documents the identity of the beneficiaries and the specific items they receive. 3. Affidavit for Debts and Taxes: In this affidavit, the executor or estate representative provides a comprehensive statement regarding any outstanding debts and taxes owed by the deceased. It confirms that all appropriate payments have been made, ensuring that the estate is clear of any financial obligations. By filing these affidavits with the Alameda County Probate Court, the executor or estate representative provides a formal record demonstrating that the estate assets have been properly administered and distributed. This legal process ensures transparency, protects the rights of the beneficiaries, and facilitates the efficient closure of the deceased's estate in Alameda, California.

Alameda California Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Alameda California Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

If you need to get a trustworthy legal paperwork supplier to get the Alameda Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can select from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to locate and execute various documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to search or browse Alameda Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Alameda Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or execute the Alameda Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes - all from the comfort of your sofa.

Join US Legal Forms now!