Chicago, Illinois Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes In Chicago, Illinois, an estate affidavit serves as a crucial legal document that signifies the proper distribution of assets to devises by the executor or estate representative. This affidavit is designed to provide transparency and assurance that all estate assets have been appropriately disbursed, while also addressing any remaining debts and taxes that may exist. The primary purpose of the Chicago, Illinois Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes is to confirm that the executor or estate representative has fulfilled their duties and responsibilities according to the law. By submitting this affidavit to the court, the executor or estate representative explicitly declares that all estate assets have been thoroughly distributed to the rightful beneficiaries, known as devises. To ensure clarity and accuracy, specific types of affidavits may be utilized depending on the circumstances of the estate: 1. Standard Affidavit: This type of affidavit is typically used when the estate assets are distributed without any complications or disputes among the devises. It confirms that the executor or estate representative has settled and distributed the assets according to the deceased individual's last will and testament. 2. Complicated Estate Affidavit: In more complex cases, where the estate assets require extensive evaluation or when disputes arise among the devises, a complicated estate affidavit might be necessary. This affidavit provides detailed information about the distribution process, including any challenges faced and resolutions achieved to successfully distribute the assets. 3. Affidavit with Statement Concerning Debts and Taxes: This specific type of affidavit is essential in explaining how the executor or estate representative managed and settled any outstanding debts and taxes. It outlines the procedures taken to satisfy these obligations to ensure that creditors and taxing authorities are duly notified and compensated. Regardless of the specific affidavit type, certain key information should be included in each document. This typically entails a comprehensive inventory of the estate assets, a detailed list of the devises, and the methodology used to allocate assets to the beneficiaries, encompassing any specific instructions or bequests as specified in the deceased individual's will. Additionally, it is crucial to provide a full account of the debts and taxes paid from the estate assets, ensuring that all creditors and taxing authorities have been properly addressed. This statement offers transparency to interested parties, illustrating the diligent efforts undertaken to meet these financial obligations. In conclusion, the Chicago, Illinois Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes is a vital document that ensures the lawful and orderly distribution of assets to beneficiaries. By filing this affidavit with the court, the executor or estate representative confirms their compliance with legal requirements, demonstrating their commitment to fulfill the deceased individual's wishes while addressing any outstanding debts and taxes.

Chicago Illinois Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Chicago Illinois Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Chicago Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Chicago Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Chicago Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes:

- Check the content of the page you’re on.

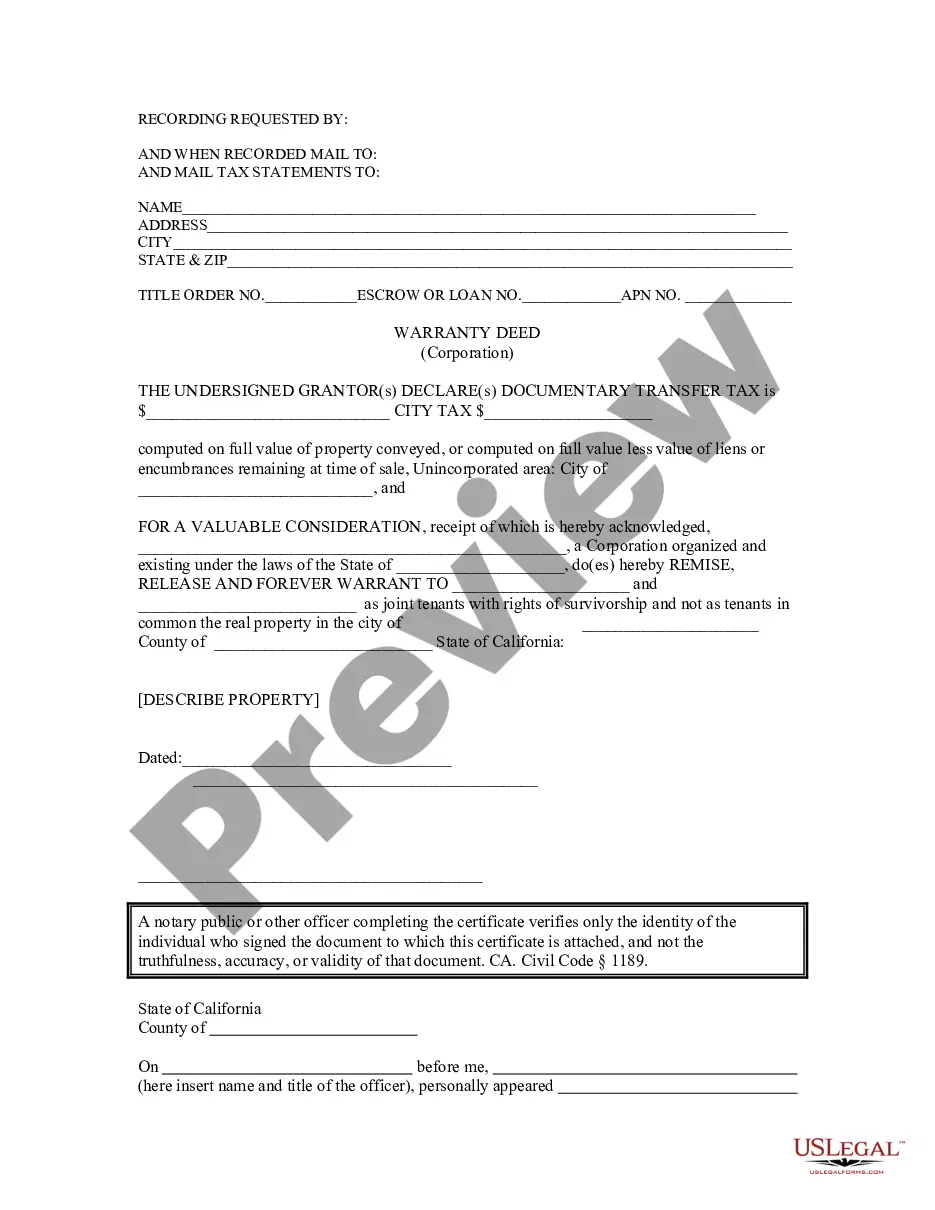

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

An executor is legally responsible for sorting out the finances of the person who died, generally making sure debts and taxes are paid and what remains is properly distributed to the heirs.

Executors and other personal representatives do not have to provide the estate accounts until the process of administration is complete. This can take a long time, especially in more complex estates, so residuary beneficiaries may have to wait for some time in order to receive the final accounts they are entitled to.

An executor is responsible for preparing an accurate and complete inventory of assets and expenses. In some cases, a beneficiary may want to see this information. But does an executor have to give an accounting to beneficiaries? The short answer is yes.

Beneficiaries have every right to see the accounting, including all of an executor's activities before the file is permanently closed. Technically, this is the only time the executor is required to share the accounting with all of the beneficiaries.

Executors should also ask each beneficiary to sign a receipt for the gifts that they receive. This will act as proof of distribution. This receipt should record the gift, the date the distribution was made, the full name of the beneficiary, and the name of the executor.

Legal proceedings against the deceased If there are any legal proceedings or claims against the deceased, at the date of death, which are set to continue despite the deceased's death, the Executor must inform the beneficiaries of these proceedings.

The affidavit of executor includes a statement that the testator did not marry after the will was made. If this is not the case, you should seek legal advice in relation to whether the will has been revoked or not.

A small estate affidavit is a way for a person's property to be transferred when they die without having to go to court. When a person dies, the things they own become part of their estate . The things they own are their assets . Their assets include money, property, and anything else they own.

Primary tabs. An executor is someone named in a will as the person who will carry out the testator's formal wishes. Typical duties of an executor include paying outstanding taxes/debt and distributing any remaining assets among the testator's heirs.

Illinois allows beneficiaries of small estates to file a small estate affidavit for easy distribution of assets. Find out how to qualify and how to fill out the form. by Brette Sember, J.D.