A Wake North Carolina Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes is a legal document used to verify the distribution of all assets belonging to an estate to the intended beneficiaries, also known as devises. It is typically executed by the executor or estate representative and provides information regarding debts and taxes associated with the estate. Keywords: Wake North Carolina, affidavit, estate assets, distributed, devises, executor, estate representative, debts, taxes. Different types of Wake North Carolina Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes may include: 1. Wake County Specific Affidavit: This type of affidavit conforms to the laws and regulations specific to Wake County, North Carolina. It ensures compliance with local rules and requirements for the proper distribution of estate assets. 2. Simple Affidavit: This is a basic form of the affidavit that contains essential information regarding the distribution of assets to devises, along with a statement regarding debts and taxes owed by the estate. 3. Detailed Affidavit: A more comprehensive version of the affidavit, which includes a thorough breakdown of the assets distributed and their corresponding values. It may also provide an itemized list of debts paid and taxes settled by the executor or estate representative. 4. Modified Affidavit for Complex Estates: In cases where the estate involves complex assets, multiple properties, or significant financial obligations, a modified affidavit is used to provide a more detailed account of the distribution process. This type of affidavit may require additional documentation and attachments to support the claims made. 5. Affidavit with Debt Discharge: This variation of the affidavit includes a specific statement declaring that all debts and obligations of the estate have been fully discharged, providing further assurance to the devises and potential creditors. It is important to consult with legal professionals or estate attorneys to determine the specific requirements and variations of the Wake North Carolina Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes, as the exact format and content may vary depending on the circumstances of the estate.

Wake North Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

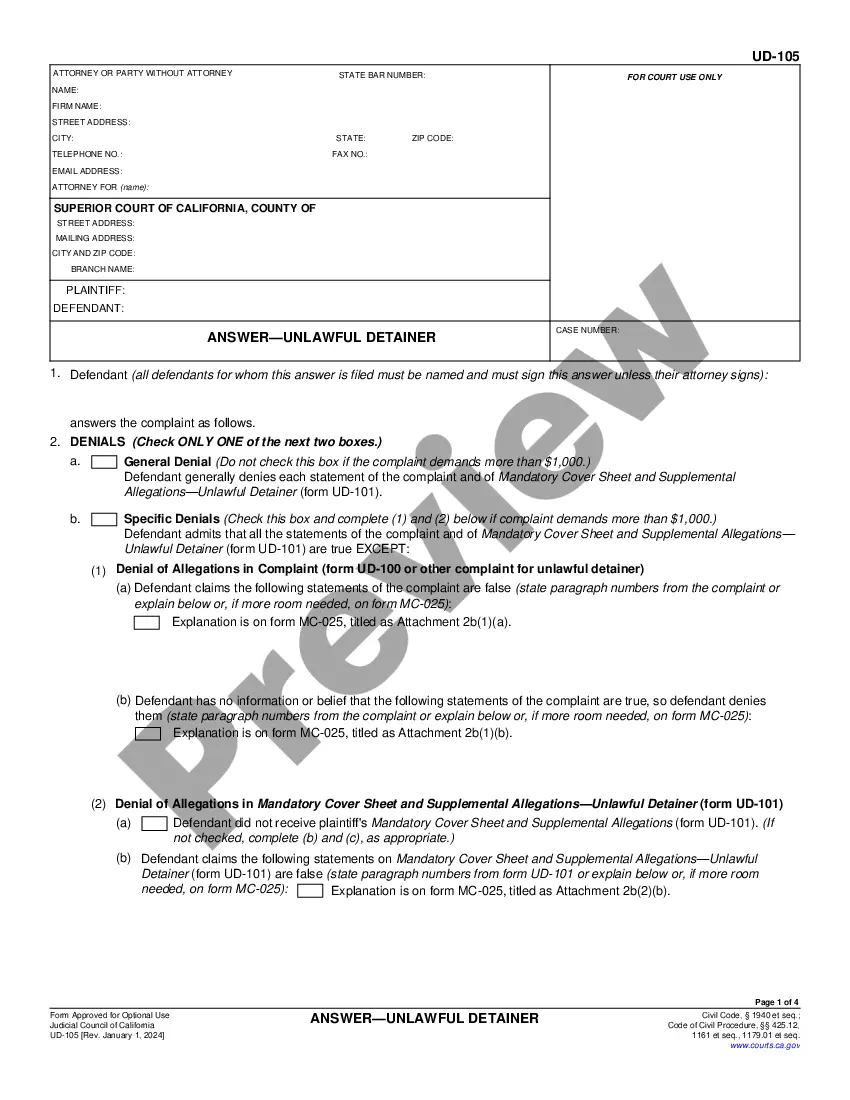

How to fill out Wake North Carolina Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Wake Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the latest version of the Wake Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Wake Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Wake Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

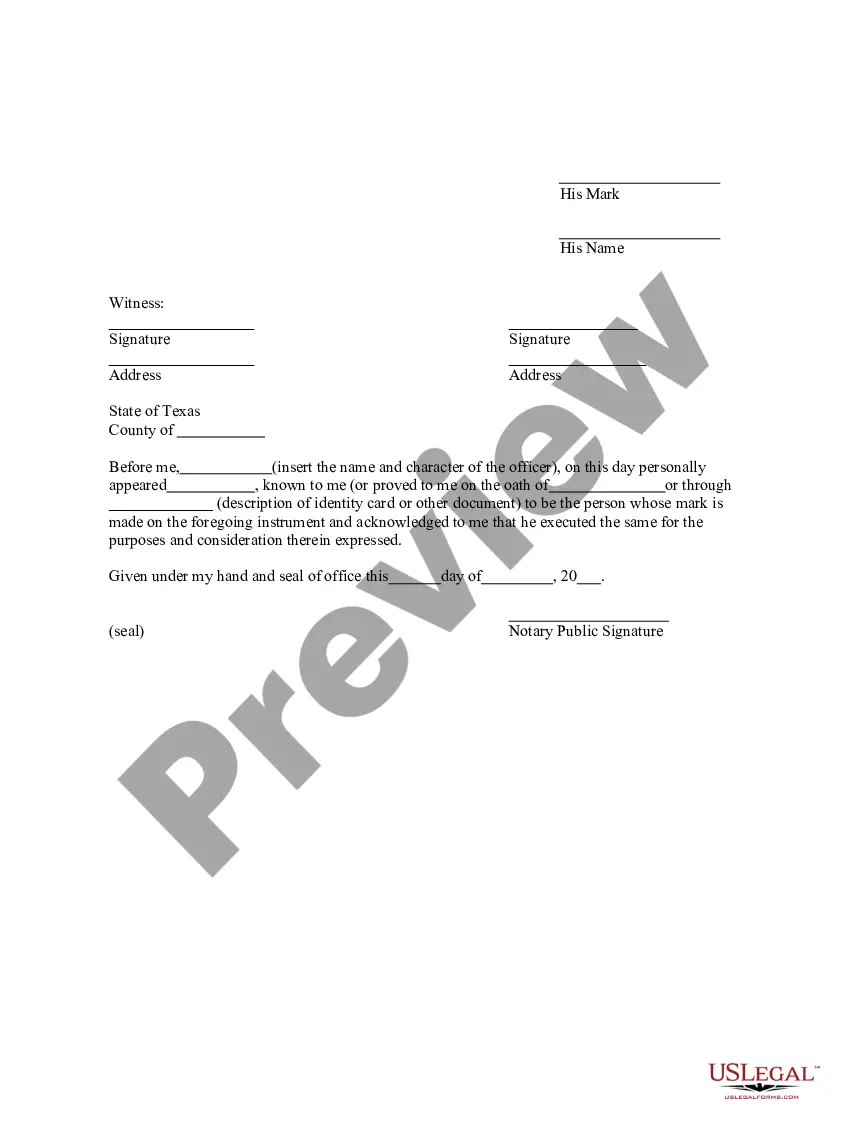

The petitioner has to sign the affidavit in the presence of a notary public who also has to sign itMoreThe petitioner has to sign the affidavit in the presence of a notary public who also has to sign it and affix their seal.

Oregon has a simplified probate process for small estates. To use it, you (as an inheritor) file a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

The Affidavit must be filled out correctly and the mailings completed as required, one copy to Department of Human Services and one copy to the Oregon Health Authority. The filing fee for a Small Estate is $124.00.

Oregon Small Estate Affidavit - EXPLAINED - YouTube YouTube Start of suggested clip End of suggested clip Finally let's discuss how to file the affidavit. Step 1 wait 30 days step 2 confirm there is noMoreFinally let's discuss how to file the affidavit. Step 1 wait 30 days step 2 confirm there is no other personal representative for the estate through the circuit court of oregon.

What this means to you is that the heirs must be a party to the Listing Agreement and Purchase Agreement in order to have valid agreements. Without having the heirs sign the agreement, any heir can come in at any time and kill the deal.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

While there is no set deadline for when an executor must settle an estate in North Carolina, as previously stated it can take several years for this to happen, the executor is responsible for meeting several key deadlines throughout probate proceedings.

It isn't legally possible for one of the co-executors to act without the knowledge or approval of the others. Co-executors will need to work together to deal with the estate of the person who has died. If one of the executors wishes to act alone, they must first get the consent of the other executors.

(ORS 114.515) Estates that are eligible for a administration by affidavit are those that have probate assets: Less than $200,000 worth of real estate. Less than $75,000 worth of personal property.