Hennepin County, Minnesota, is one of the most populous counties in the state. Located in the eastern part of Minnesota, it encompasses the city of Minneapolis, one of the major economic and cultural hubs of the Midwest. With a diverse population of over one million residents, Hennepin County is known for its vibrant arts scene, stunning natural beauty, and thriving business community. When it comes to royalties, Hennepin County is home to several industries that rely on payments to trustees by royalty owners. Major sectors include oil and gas, mining, intellectual property, and real estate. Each industry has its own specific Hennepin Minnesota direction for payment of royalty to trustee guidelines, ensuring that all parties involved are properly compensated. In the oil and gas industry, Hennepin Minnesota direction for payment of royalty to trustee by royalty owners involves following the stipulations outlined in lease agreements and contracts. Royalty owners, who hold an ownership interest in the land where oil and gas resources are extracted, receive payment based on a percentage of the revenue generated from the production and sale of these resources. The guidelines specify the frequency of payment, method of calculation, and any additional royalties due. Similarly, in the mining industry, Hennepin Minnesota direction for payment of royalty to trustee by royalty owners pertains to royalties earned from the extraction of minerals such as iron ore, limestone, or sand and gravel. These royalties are typically based on the volume or weight of minerals extracted and sold. Trustee payment guidelines ensure that mining companies fulfill their contractual obligations to royalty owners, guaranteeing a fair and transparent distribution of revenues. In the realm of intellectual property, Hennepin Minnesota direction for payment of royalty to trustee by royalty owners refers to the compensation received by creators, inventors, or copyright holders for the use of their copyrighted material, patents, or trade secrets. Trustee agreements dictate the terms of payment, such as licensing fees, royalties from sales or usage, and conditions for termination or renewal. In real estate, Hennepin Minnesota direction for payment of royalty to trustee by royalty owners involves royalties earned from leases or sales of specific properties. These can include land, buildings, or natural resources like timber or water rights. Trustees manage the payment process, ensuring that royalty owners receive their entitled share while complying with legal requirements and industry best practices. It is important for royalty owners and trustees in Hennepin County to adhere to the specific direction for payment guidelines in each industry. Clear communication, accurate record-keeping, and regular audits are essential to maintain transparency and trust between all parties involved. By following these guidelines, Hennepin County promotes a fair and equitable distribution of royalties, fostering economic growth and development within the region.

Hennepin Minnesota Direction For Payment of Royalty to Trustee by Royalty Owners

Description

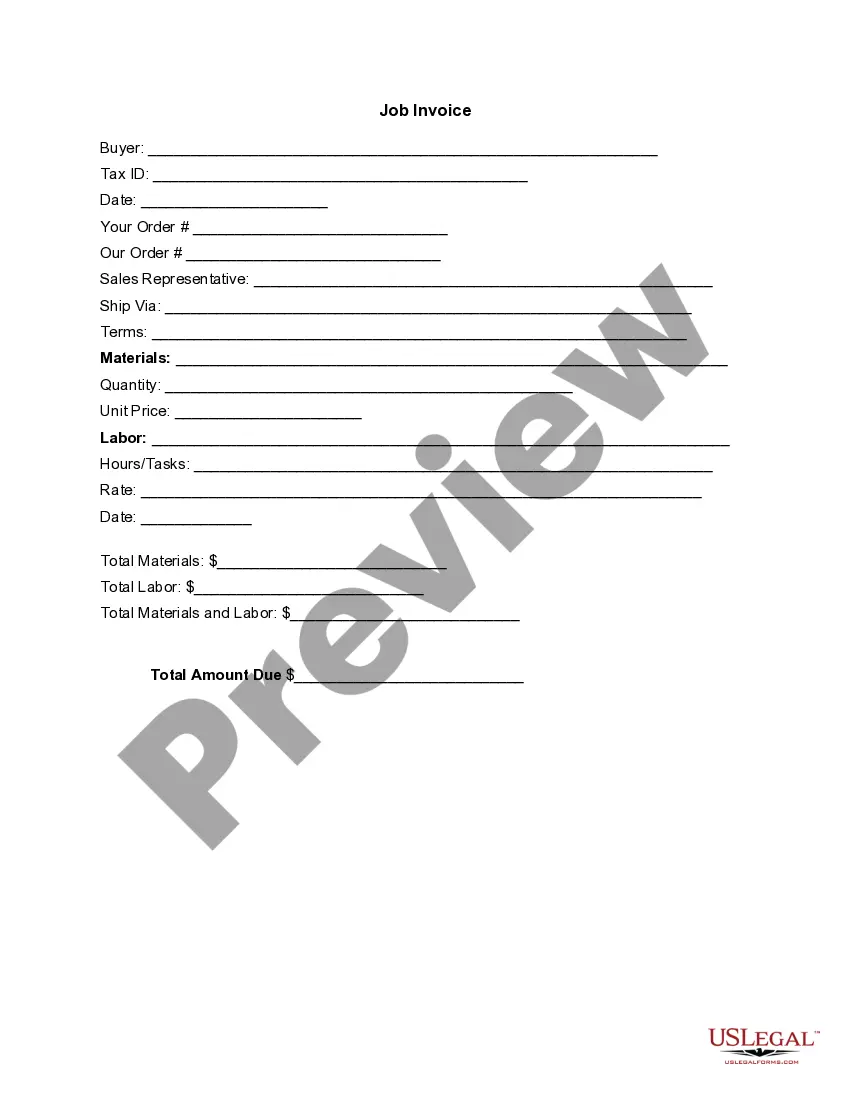

How to fill out Hennepin Minnesota Direction For Payment Of Royalty To Trustee By Royalty Owners?

Creating forms, like Hennepin Direction For Payment of Royalty to Trustee by Royalty Owners, to take care of your legal matters is a tough and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. However, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for a variety of cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Hennepin Direction For Payment of Royalty to Trustee by Royalty Owners form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before downloading Hennepin Direction For Payment of Royalty to Trustee by Royalty Owners:

- Ensure that your form is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Hennepin Direction For Payment of Royalty to Trustee by Royalty Owners isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our service and get the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Royalty charges are usually agreed as a percentage of sales generated by the licensed asset. In some circumstances, they are set as a fixed price. Royalties are charged on an ongoing basis. The amount that the licensee must pay is outlined in a royalty agreement.

A royalty charge is a payment that a licensee makes to a licensor in exchange for the use of their licensed asset. In construction, this asset could be a new technology, product, system, material or design, perhaps incorporating intellectual property assets like patents, know-how and trademarks.

Composition: Songwriters often sign with publishers in what's called a publishing deal. The publisher takes ownership of the copyright and in return has the task of licensing the composition and collecting royalties. Royalties generated are typically split 50/50 between songwriter and publisher.

Weekly, monthly, quarterly or annual payments: Royalties are paid on a regular basis, according to the payment schedule outlined in the royalty payment agreement. Fixed or tiered royalties: Some royalty rates are fixed, which means that they remain the same for the duration of the licensing agreement.

Established writers favor certain publishers/distributors and usually receive higher royalties. All of the royalty does not go directly to the writer. Rather, it is shared with the publisher on a basis. If a book involved is a play, it might be dramatized.

Royalties take the form of agreements or licenses that lay out the terms by which a third party can use assets that belong to someone else. Intellectual property comes in the form of copyrights, patents, or trademarks. Royalties can be earned on books, music, minerals, franchises, and many other assets.

It can take up to a year for royalties to start coming in. It will generally take an average of 9-12 months before you see your first royalty payment.

To get a royalty check, you need to have it specified in the contract. Some publishers, for example, will pay a flat fee instead of royalties. The exact terms are in the licensing agreement between the third party and the owner.

Royalty payments are negotiated once through a legal agreement and paid on a continuing basis by licensees to owners granting a license to use their intellectual property or assets over the term of the license period. Royalty payments are often structured as a percentage of gross or net revenues.

Franchise royalties are usually collected by your franchisor on a monthly basis. Like marketing fees, these fees are based on a percentage of your revenue. But there's one major difference; the percentages are higher. Franchise royalties range from 4% of your revenue all the way up to 12% or more.