Houston, Texas is a bustling and diverse city located in Southeast Texas. Known for its vibrant cultural scene, world-class museums, and thriving culinary scene, Houston offers a plethora of activities and attractions for visitors and residents alike. In the realm of oil and gas, Houston serves as a significant hub and is home to numerous companies and individuals involved in the industry. Royalty ownership is a common aspect of this sector, with many individuals earning revenue from the extraction and production of oil, gas, or mineral resources. For royalty owners in Houston, Texas, it is crucial to understand the direction for payment of royalties to the trustee. This involves ensuring that the rightful recipients receive their fair share of the revenue generated from their mineral rights. By having a clear understanding of this process, royalty owners can ensure that their payments are received promptly and accurately. There are various types of Houston, Texas direction for payment of royalty to trustee by royalty owners. These include: 1. Mineral Trusts: In this arrangement, royalty owners establish a trust fund to manage and distribute their royalty payments. The trustee is responsible for receiving the funds from the companies or operators and then disbursing the appropriate amounts to the beneficiaries of the trust, in accordance with the terms and conditions outlined in the trust agreement. 2. Royalty Payment Assignments: Royalty owners may choose to assign their right to receive royalty payments to a trustee or third party. This assignment can be temporary or permanent, depending on the terms agreed upon. The trustee then assumes the responsibility of collecting the payments and distributing them to the designated individuals or entities. 3. Direct Payment to Royalty Owners: In some cases, royalty owners may opt for direct payment from the oil and gas companies or operators. This means that the payments are made directly to the owners, bypassing the need for a trustee. However, it is still essential for owners to understand the proper methods and protocols for receiving these payments to ensure accuracy and avoid any delays or complications. Regardless of the type of direction for payment of royalty to trustee by royalty owners in Houston, Texas, there are common keywords and phrases associated with this topic. These include royalty payments, trustee, mineral trusts, assignments, revenue distribution, oil and gas industry, mineral ownership, payment protocols, accurate disbursement, and trust agreements. Understanding these keywords will enable royalty owners to familiarize themselves with the necessary information and ensure smooth and efficient payment processes.

Houston Texas Direction For Payment of Royalty to Trustee by Royalty Owners

Description

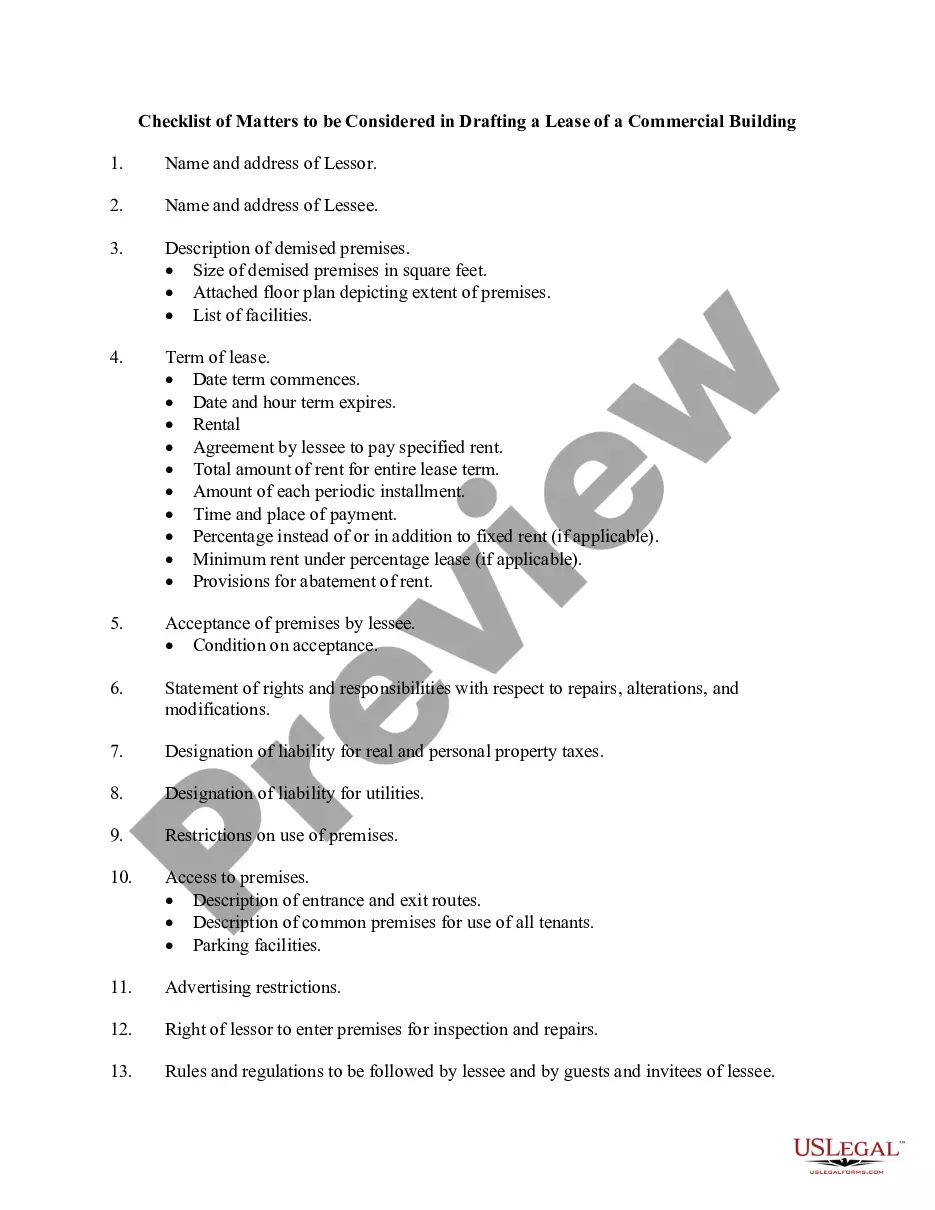

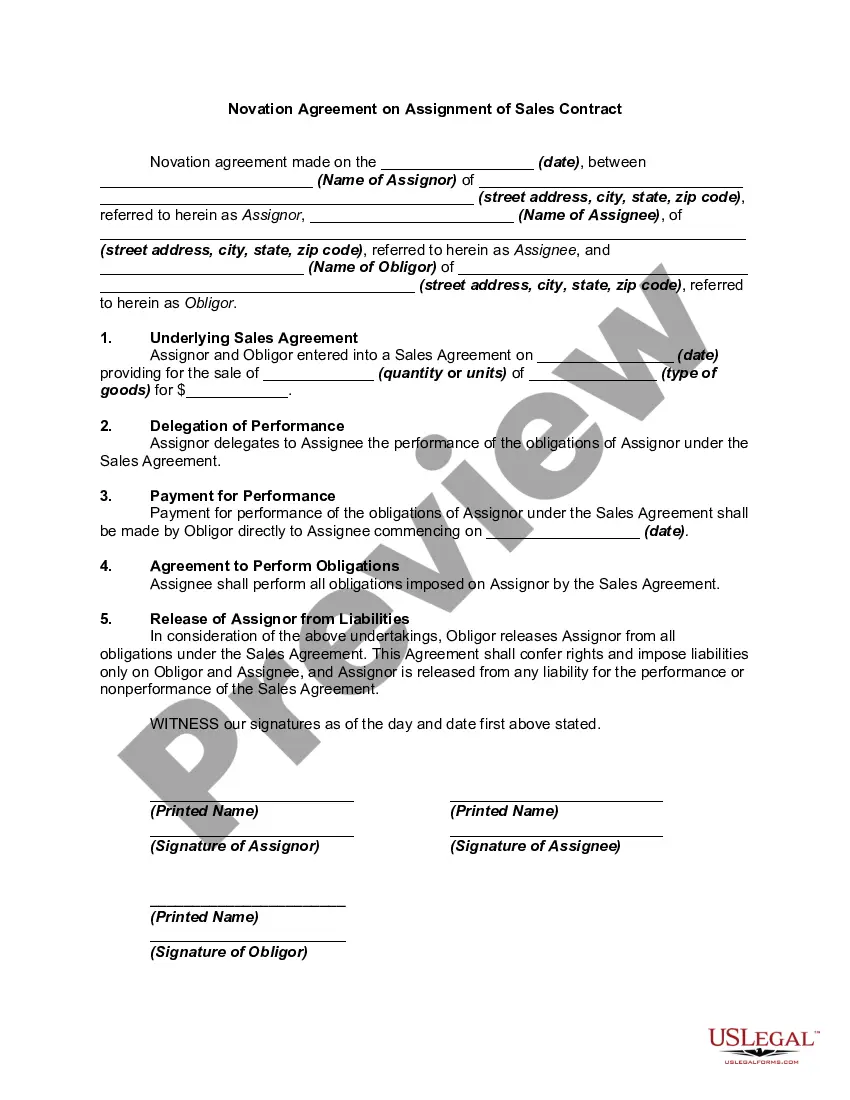

How to fill out Houston Texas Direction For Payment Of Royalty To Trustee By Royalty Owners?

If you need to find a trustworthy legal paperwork supplier to find the Houston Direction For Payment of Royalty to Trustee by Royalty Owners, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support team make it simple to find and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to search or browse Houston Direction For Payment of Royalty to Trustee by Royalty Owners, either by a keyword or by the state/county the document is intended for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Houston Direction For Payment of Royalty to Trustee by Royalty Owners template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less expensive and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or execute the Houston Direction For Payment of Royalty to Trustee by Royalty Owners - all from the convenience of your sofa.

Sign up for US Legal Forms now!