Philadelphia, Pennsylvania is a vibrant and historic city located in the northeastern part of the United States. As the largest city in the state of Pennsylvania, Philadelphia is known for its rich cultural heritage, iconic landmarks, and bustling cityscape. From the famous Liberty Bell to the impressive Philadelphia Museum of Art, there are countless attractions and activities for visitors to explore. In terms of its economic landscape, Philadelphia has a diverse and thriving industry. One specific area of interest is the trust and royalty industry, which plays a significant role in the city's financial sector. For royalty owners in Philadelphia, it is crucial to understand the process and direction for payment of royalties to a trustee. The payment of royalties to a trustee by royalty owners in Philadelphia typically involves a structured and legal agreement. This agreement outlines the terms and conditions for the distribution of royalties accrued from various sources, such as intellectual property, mineral rights, or oil and gas leases. The trustee acts as a fiduciary, responsible for managing and distributing these funds in accordance with the terms of the trust or agreement. There are different types of Philadelphia Pennsylvania direction for payment of royalty to trustees by royalty owners, each catering to specific industries or circumstances. These types include: 1. Intellectual Property Royalty Trust: This type of trust is typically established for creators or inventors who have licensed their intellectual property, such as patents, copyrights, or trademarks. Royalty owners in this category rely on the trustee to collect and distribute royalty payments from licensees. 2. Mineral Rights Royalty Trust: Philadelphia is located in a region with abundant natural resources, making it a hub for mineral rights ownership. Mineral owners establish trusts to receive royalties from the extraction and production of minerals, including oil, gas, coal, or minerals like gold and silver. The trustee ensures accurate accounting and distribution of royalties to the rightful owners. 3. Entertainment Royalty Trust: Philadelphia has a thriving arts and entertainment scene, with numerous artists, musicians, and performers calling the city home. Entertainment royalty trusts are set up to manage and distribute royalties earned from creative works, including music albums, films, television shows, or performances. Royalty owners in this industry rely on the trustee to handle licensing agreements, auditing, and payment disbursements. Regardless of the specific type of trust, the process for payment of royalties to trustees in Philadelphia typically involves regular reporting, auditing, and distribution activities. Royalty owners must follow the guidelines and requirements outlined in their trust agreements to ensure accurate and timely payment.

Philadelphia Pennsylvania Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out Philadelphia Pennsylvania Direction For Payment Of Royalty To Trustee By Royalty Owners?

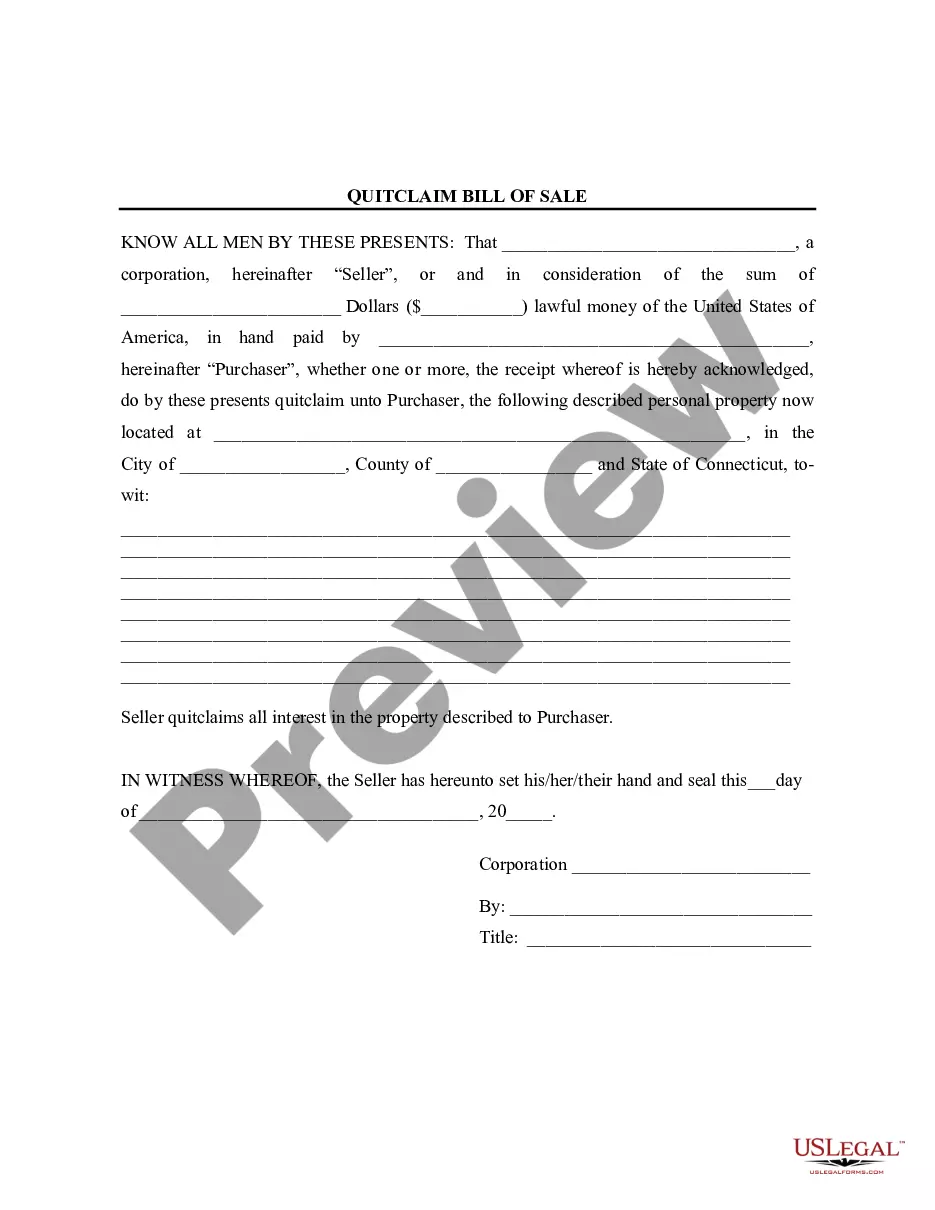

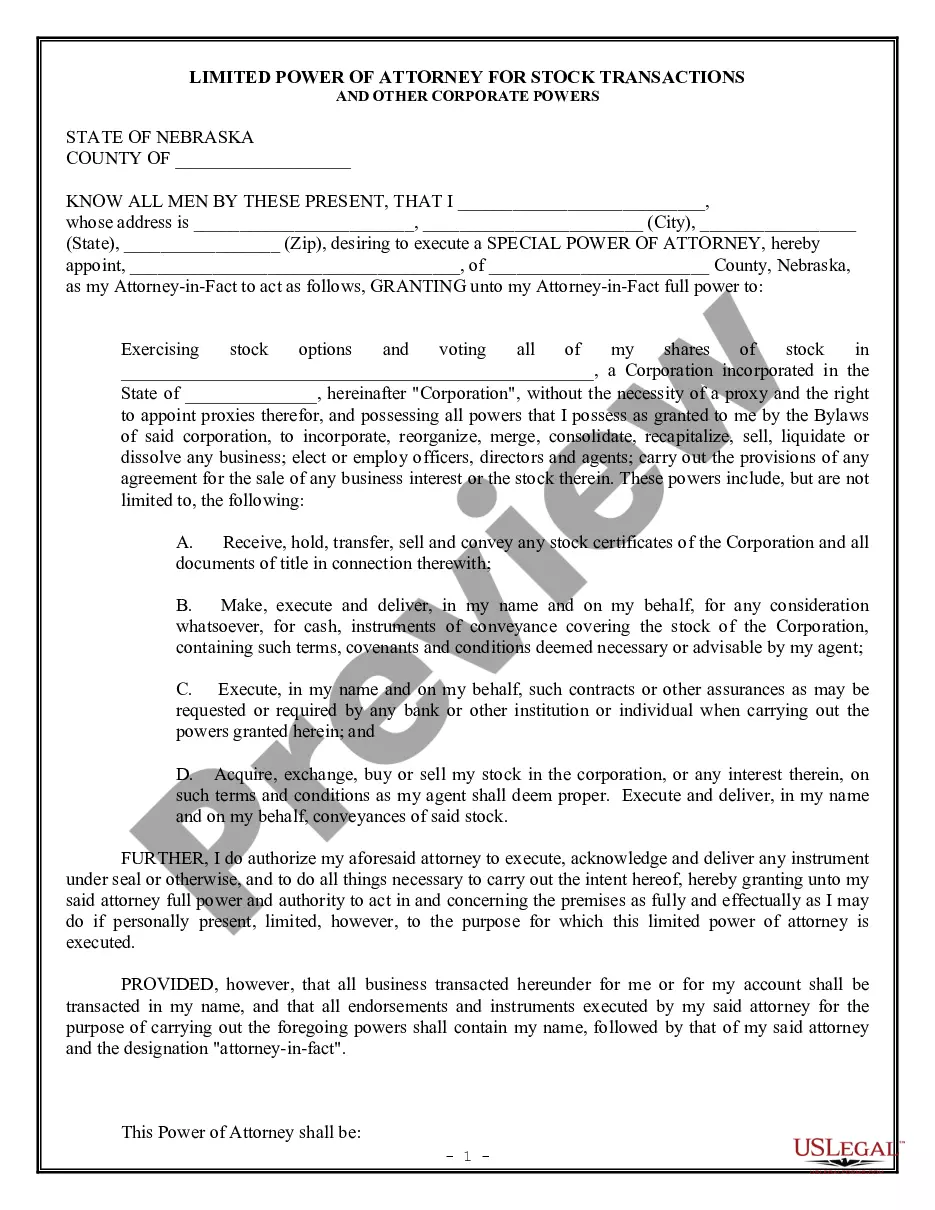

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life situation, finding a Philadelphia Direction For Payment of Royalty to Trustee by Royalty Owners suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. In addition to the Philadelphia Direction For Payment of Royalty to Trustee by Royalty Owners, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Philadelphia Direction For Payment of Royalty to Trustee by Royalty Owners:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Philadelphia Direction For Payment of Royalty to Trustee by Royalty Owners.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!