Phoenix, Arizona is a thriving city known for its picturesque desert landscapes, vibrant culture, and diverse economy. As the capital of Arizona, Phoenix offers a unique blend of urban sophistication and natural beauty, making it an attractive destination for residents and tourists alike. With its warm climate, robust job market, and countless recreational opportunities, Phoenix has become a favored location for individuals and families looking to settle down or explore new opportunities. In relation to the Direction for Payment of Royalty to Trustee by Royalty Owners, Phoenix, Arizona is home to a significant number of individuals who receive royalty payments from various sources. These could include royalty owners in the oil and gas industry, intellectual property rights holders, artists, songwriters, and authors, among others. These royalty payments often serve as a dependable and steady source of income, allowing royalty owners to enjoy financial stability and pursue their passions. When it comes to the different types of Phoenix, Arizona Directions for Payment of Royalty to Trustee by Royalty Owners, they can vary based on the specific agreement or contract established between the royalty owner and the trustee. Some common variations may include: 1. Oil and Gas Royalties: Phoenix, Arizona boasts a rich history in oil and gas production, which has led to numerous royalty owners in this sector. These individuals receive royalties based on their ownership interests in oil and gas producing properties located within or outside the state. 2. Intellectual Property Royalties: Phoenix is home to many talented artists, authors, and inventors. These creative minds often rely on intellectual property licensing agreements, where royalties are paid to them by trustees or licensees for the use or exploitation of their copyrighted works, patents, or trademarks. 3. Music and Entertainment Royalties: Phoenix has a vibrant music and entertainment scene, with many talented musicians, songwriters, and performers calling the city home. As such, there are numerous royalty owners in this industry who receive payments from music streaming platforms, radio stations, live performances, and other related avenues. 4. Real Estate Royalties: Phoenix's real estate market has experienced significant growth over the years. Royalty owners in this sector may include individuals who receive payments from the use or lease of their land, properties, or other real estate assets within the region. In order to ensure a seamless and efficient payment process, royalty owners in Phoenix, Arizona often direct the payment of their royalties to a trustee. This trustee acts as an intermediary, responsible for collecting and disbursing the royalty payments to the designated royalty owners as specified in the agreement. Payments can be made through various methods such as direct deposit, mailed checks, or wire transfers, depending on the preference and arrangement of the royalty owner and trustee. In essence, Phoenix, Arizona offers a diverse range of industries where royalty owners play a significant role. Whether it's in the oil and gas sector, intellectual property, music and entertainment, or real estate, royalty owners in Phoenix rely on the precise Direction for Payment of Royalty to Trustee to ensure that their income is accurately and promptly distributed, allowing them to maintain financial stability and find success in their respective fields.

Phoenix Arizona Direction For Payment of Royalty to Trustee by Royalty Owners

Description

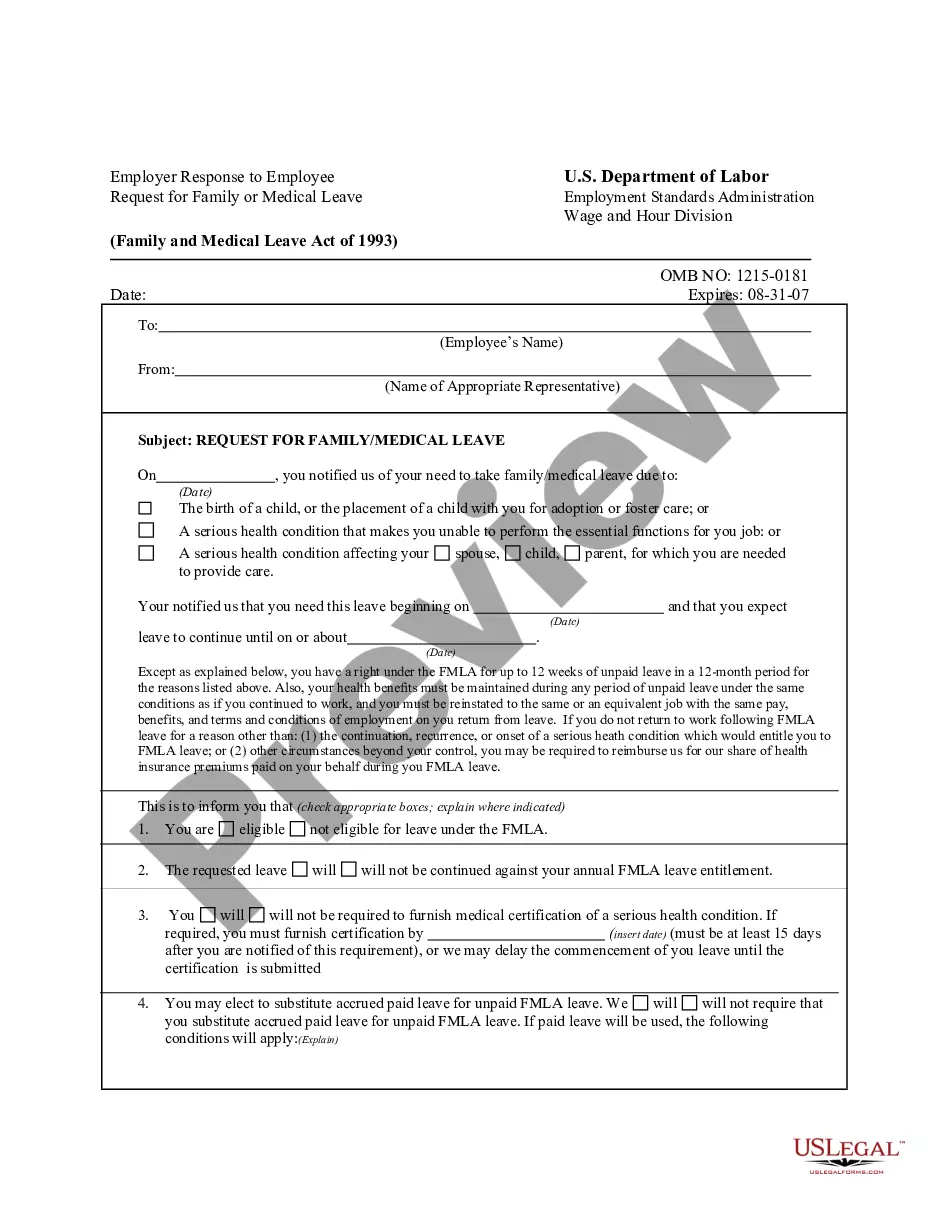

How to fill out Phoenix Arizona Direction For Payment Of Royalty To Trustee By Royalty Owners?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Phoenix Direction For Payment of Royalty to Trustee by Royalty Owners without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Phoenix Direction For Payment of Royalty to Trustee by Royalty Owners by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Phoenix Direction For Payment of Royalty to Trustee by Royalty Owners:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

Composition: Songwriters often sign with publishers in what's called a publishing deal. The publisher takes ownership of the copyright and in return has the task of licensing the composition and collecting royalties. Royalties generated are typically split 50/50 between songwriter and publisher.

Established writers favor certain publishers/distributors and usually receive higher royalties. All of the royalty does not go directly to the writer. Rather, it is shared with the publisher on a basis. If a book involved is a play, it might be dramatized.

Royalties take the form of agreements or licenses that lay out the terms by which a third party can use assets that belong to someone else. Intellectual property comes in the form of copyrights, patents, or trademarks. Royalties can be earned on books, music, minerals, franchises, and many other assets.

Royalty Income Tax Rates 10% for income $0-8,700. 15% for income $8,700-34,500. 25% for income $34,500-83,600. 28% for income $83,600-174,400.

U.S. federal oil and gas royalties are payments made by companies to the federal government for the oil and gas extracted on public lands and waters. With a royalty, owners of the resource?in this case, U.S. taxpayers?collect a share of the profits based on the value or volume of the oil and gas extracted.

To find unclaimed royalties, we recommend searching the following states: National Database. We recommend searching the national unclaimed property database, MissingMoney.com.State Where Minerals are Located.State Where the Mineral Owner Resides.State Where the Operator is Located (or Incorporated)

Royalty payments are negotiated once through a legal agreement and paid on a continuing basis by licensees to owners granting a license to use their intellectual property or assets over the term of the license period. Royalty payments are often structured as a percentage of gross or net revenues.

To get a royalty check, you need to have it specified in the contract. Some publishers, for example, will pay a flat fee instead of royalties. The exact terms are in the licensing agreement between the third party and the owner.

Franchise royalties are usually collected by your franchisor on a monthly basis. Like marketing fees, these fees are based on a percentage of your revenue. But there's one major difference; the percentages are higher. Franchise royalties range from 4% of your revenue all the way up to 12% or more.

This income is subject to self-employment tax on Schedule SE. Royalty income is reported on Form 1099-MISC, Box 2, Royalties. The oil and gas company will generally also report related expenses, including production tax. The person will continue to receive these royalty payments while the well is still producing.

Interesting Questions

More info

This is a notice of an outbreak among three homeless service sites in King County, Washington, during the preceding six months due to human waste related to the use of recreational activities in a common area. The three sites are located. At the time of this outbreak, all the service sites (collectively) were not in compliance with applicable State and local laws and regulations governing homeless activities. As a result, the King County Health Department conducted an investigation on the conditions of each service site that occurred at the same time. The King County Health Department determined that all services offered were not in compliance with applicable State and County laws and regulations and were potentially unsafe for the homeless people who visit them, as outlined in local ordinances and law enforcement reports.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.