San Antonio, Texas is a vibrant city located in the southern part of the state. It is known for its rich history, diverse culture, and thriving economy. With a population of over 1.5 million people, San Antonio is the seventh-largest city in the United States. One aspect that contributes to San Antonio's economy is the vast natural resources found in the region, particularly oil and gas. Many residents in San Antonio, as well as neighboring areas, are royalty owners — individuals or entities that own a share of the proceeds generated from the production of oil or gas on their properties. When it comes to the direction for payment of royalty to a trustee by royalty owners in San Antonio, several types may exist. These different types can include: 1. Mineral Trust: A mineral trust is established when the ownership of mineral rights is transferred to a trustee. This enables the trustee to manage the production and payment of royalty to multiple beneficiaries or royalty owners. 2. Royalty Trust: A royalty trust is similar to a mineral trust but typically involves the management of royalties from oil and gas production exclusively. The trustee acts as a fiduciary, distributing the proceeds from production to the respective royalty owners. 3. Escrow Agreement: In some cases, royalty owners may choose to utilize an escrow agreement to ensure proper payment. This involves appointing a neutral third party, often a financial institution or attorney, to hold the royalty payments in an escrow account until they are distributed to the royalty owners according to agreed-upon terms. Regardless of the type of direction for payment of royalty to a trustee by royalty owners in San Antonio, ensuring timely and accurate royalty payments is crucial for all parties involved. Trust is placed in the trustee to handle the administration of these payments efficiently, transparently, and in compliance with applicable laws. Communication between royalty owners and the trustee is vital to establish clear expectations regarding payment schedules, reporting, and any relevant taxation obligations. Understanding the documentation required, such as ownership deeds, leases, and other related agreements, helps facilitate smooth payment processes and fosters a strong working relationship between the trustee and royalty owners. In conclusion, San Antonio, Texas is a city where many individuals and entities benefit from oil and gas production as royalty owners. Different types of direction for payment of royalty to a trustee, such as mineral trusts, royalty trusts, and escrow agreements, exist to ensure the proper management and distribution of royalty payments. Establishing clear communication and understanding of the payment process is essential for a successful relationship between the trustee and royalty owners.

San Antonio Texas Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out San Antonio Texas Direction For Payment Of Royalty To Trustee By Royalty Owners?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, locating a San Antonio Direction For Payment of Royalty to Trustee by Royalty Owners suiting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the San Antonio Direction For Payment of Royalty to Trustee by Royalty Owners, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your San Antonio Direction For Payment of Royalty to Trustee by Royalty Owners:

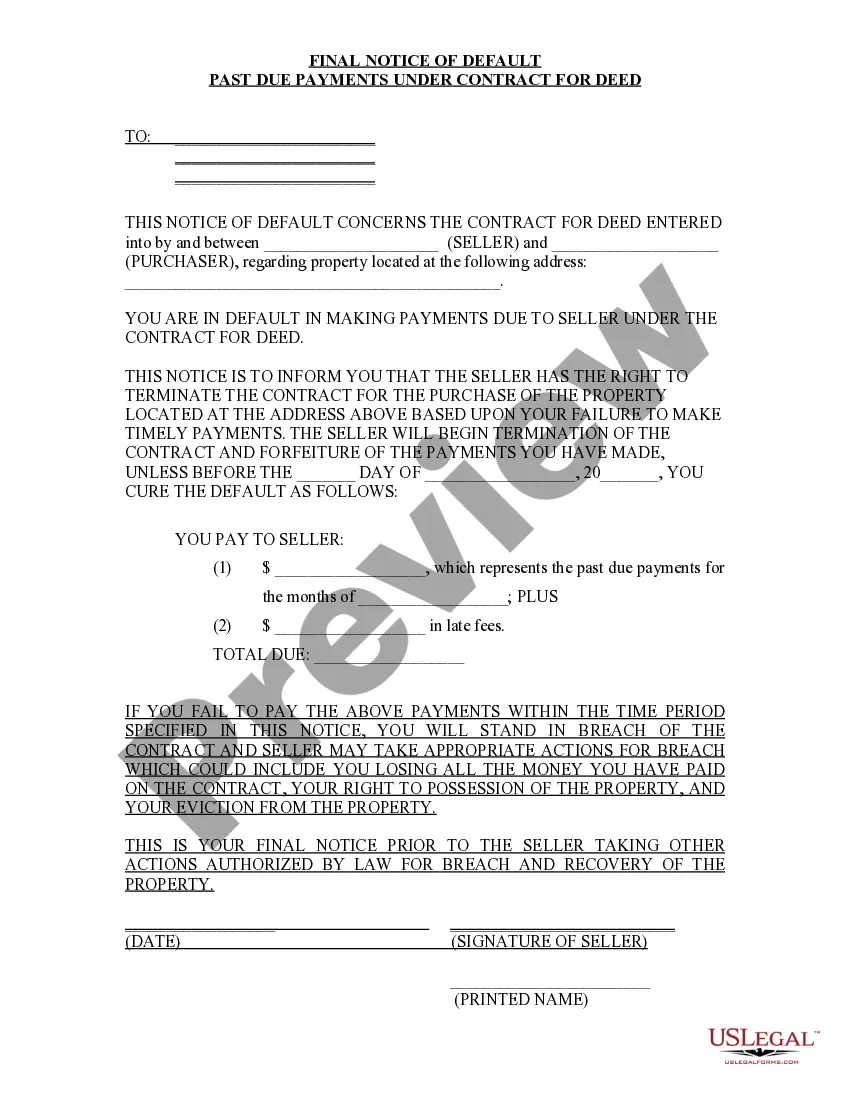

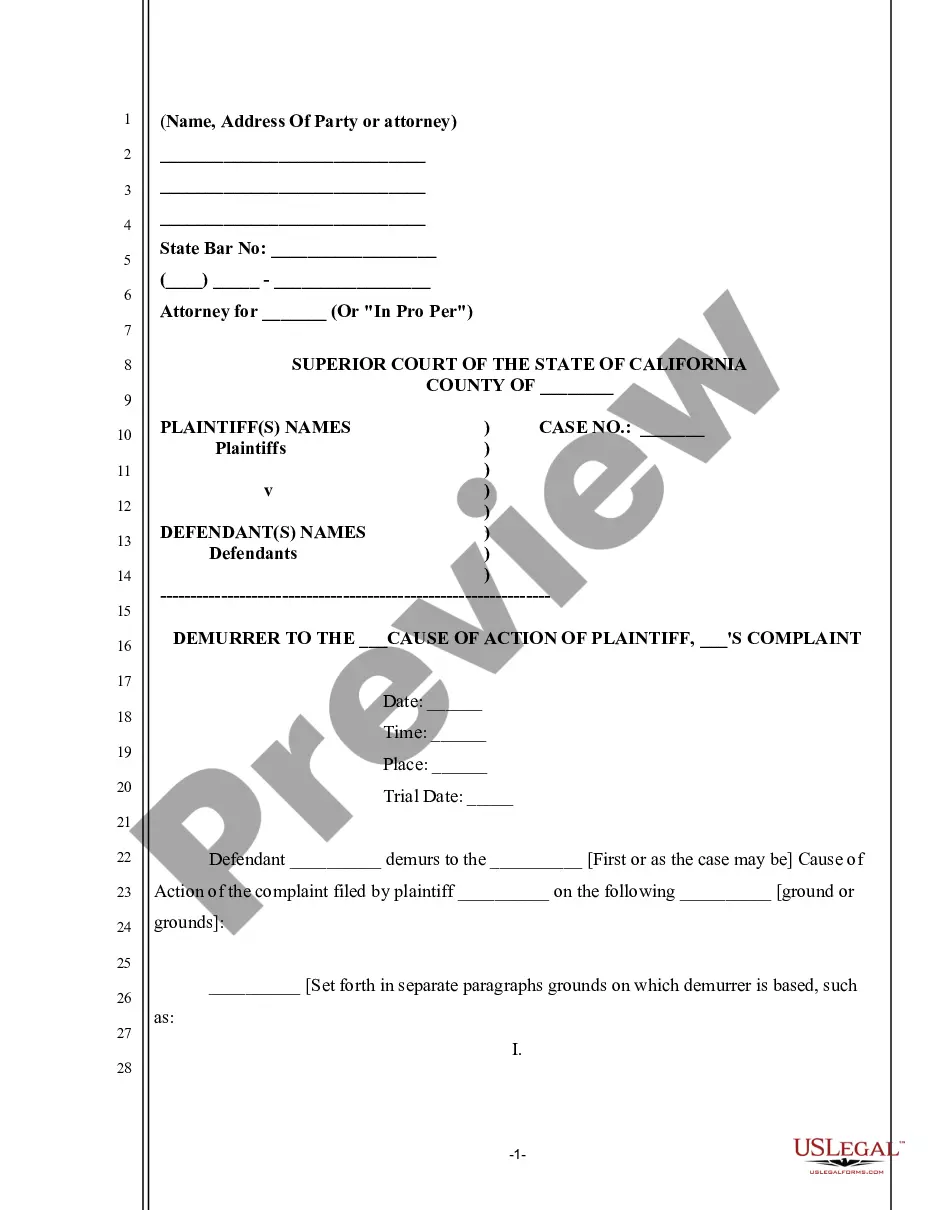

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Antonio Direction For Payment of Royalty to Trustee by Royalty Owners.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!