Santa Clara, California is a vibrant city located in the heart of Silicon Valley. It is known for its thriving technology industry, stunning natural landscapes, and rich cultural heritage. As part of this bustling city, Santa Clara is also home to various types of "Direction For Payment of Royalty to Trustee" by Royalty Owners. One type of Direction For Payment of Royalty to Trustee in Santa Clara involves the tech industry. Many technology giants, such as Intel and Nvidia, have headquarters or significant operations in Santa Clara. Royalty owners in this sector often enter into royalty agreements with these tech companies, allowing them to use their intellectual property or patented technologies. To ensure proper payment of royalties, the royalty owners establish directions for payment to trustees, who act as intermediaries between the royalty owners and the tech companies. Another type of Direction For Payment of Royalty to Trustee in Santa Clara relates to the entertainment industry. Santa Clara is home to the magnificent Levi's Stadium, which hosts major concerts, sports events, and other entertainment shows. Royalty owners in this industry may include musicians, artists, or event production companies who have licensed their intellectual property or performances for use in these events. They may establish directions for payment to trustees to ensure they receive their rightful royalties from ticket sales, merchandise, and other associated revenue streams. Furthermore, Santa Clara's tourism industry also plays a significant role in the city's economy. Visitors from around the world flock to attractions like California's Great America amusement park, the vibrant Santana Row shopping district, and the historic Mission Santa Clara de Asís. Royalty owners who have licensed their brands or intellectual properties to these tourist destinations may utilize directions for payment to trustees to guarantee accurate and timely royalty disbursements. In conclusion, Santa Clara, California, has a diverse range of industries where royalty owners may require a Direction For Payment of Royalty to Trustee. Whether in the technology, entertainment, or tourism sectors, these directions allow royalty owners to safeguard their financial interests and ensure they receive their rightful compensation.

Santa Clara California Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out Santa Clara California Direction For Payment Of Royalty To Trustee By Royalty Owners?

Preparing papers for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Santa Clara Direction For Payment of Royalty to Trustee by Royalty Owners without professional assistance.

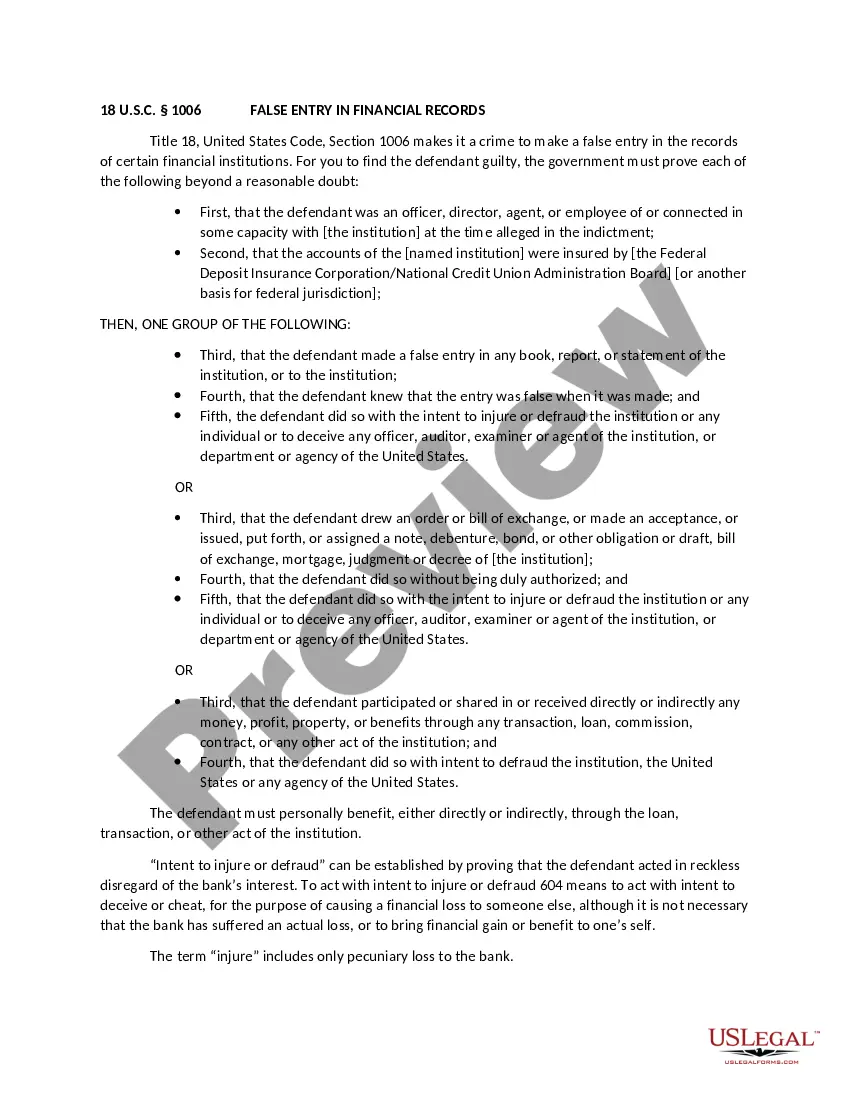

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Santa Clara Direction For Payment of Royalty to Trustee by Royalty Owners by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Santa Clara Direction For Payment of Royalty to Trustee by Royalty Owners:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

If you want to get your money, state officials will ask for evidence supporting your right to the unclaimed oil or gas rights located in your search. You may need to show evidence of inheritance or complete an Affidavit of Heirship (AOH) if you are claiming royalty payments on an inherited property.

As for receiving an oil and gas royalty payment, you will receive it ONLY IF the oil company drills a well and ONLY IF the well is a successful producer. Most wells drilled in a new area have only a 20% probability of being successful. There is a lot of money to be made in receiving monthly royalty checks.

If you receive royalties from someone for use of your property, you must claim these payments as business income, usually on Schedule E (Form 1040 or Form 1040-SR). 1feff Royalties from copyrights, patents, and oil, gas, and mineral properties are taxable as ordinary income.

The indicated funds will be escheated to the State Treasurer's Office per the laws of your state. To claim escheated money, go to . This website has links to all Unclaimed Property offices in the United States and easy-to-follow instructions.

For a producing well, royalties could easily be 10 to 20 times the bonus payment in the first year of production alone. Private landowners are normally offered the standard royalty of 1/8 share of production.

Oil & gas royalties are paid monthly, consistent with the normal accounting cycle of the producer, unless the obligation does not meet the minimum check requirement for that particular state. These laws are generally known as aggregate pay laws, usually set at either $25 or $100.

The payment is made by the publisher/distributor and corresponds to the agreement (license) between the writer and the publisher/distributor as with other music royalties. The agreement is typically non-exclusive to the publisher and the term may vary from 35 years.

Follow up, and be persistent. If your royalty is not being paid because of a title problem or requirement, ascertain what you need to do to solve the problem. It may be as simple as providing an affidavit of relevant facts. The landman with the operator should be able to help you with this.

As a mineral owner, your primary goal is to sell oil and gas royalties for the highest amount possible. You want to put as many dollars in your pocket as you can when you sell oil royalties. To maximize value when you sell royalties, the key is to get your property in front of a large audience of mineral rights buyers.