Chicago, Illinois Correction Assignment of Overriding Royalty Interest Correcting Lease Description, commonly known as a correction assignment, is a legal document used in the oil and gas industry to rectify mistakes or discrepancies in the lease description. In Chicago, Illinois, where the oil and gas industry is booming, correction assignments play a crucial role in ensuring accurate lease descriptions for properties. These correction assignments help in clarifying any errors made in lease agreements, preventing any potential disputes between parties involved. There are different types of correction assignments when it comes to overriding royalty interest (ORI) leases in Chicago, Illinois. Some of these include: 1. Correction of Legal Description: This type of correction assignment is used when there is an error or ambiguity in the legal description of the leased property. It can be caused by various factors such as typographical mistakes or inaccuracies in the preliminary lease agreement. The correction assignment will rectify these errors to ensure a correct and precise legal description. 2. Correction of Mineral Ownership Interest: This type of correction assignment is necessary when there is an error or dispute regarding the ownership interest in the minerals being leased. It arises when there are multiple owners or confusion in the initial lease agreement. The correction assignment will clarify the ownership interest and outline the correct allocation of royalties. 3. Correction of Royalty Payment Terms: This type of correction assignment is used when there is a mistake in the original lease agreement regarding the calculation or distribution of royalties. It may involve incorrect percentages, outdated terms, or missing provisions. The correction assignment will amend the terms and ensure that the royalties are calculated and paid accurately. The process of completing a Chicago, Illinois Correction Assignment of Overriding Royalty Interest Correcting Lease Description involves several steps. First, the parties involved must identify the errors or discrepancies in the lease agreement. Then, they must draft a correction assignment that clearly outlines the corrections to be made and the updated lease description. Once the correction assignment is drafted, it must be reviewed and signed by all parties involved, including the lessor and lessee. By utilizing correction assignments, the oil and gas industry in Chicago, Illinois, can maintain accurate and reliable lease descriptions, minimizing the chances of misunderstandings or legal disputes. These correction assignments ensure that the rights and interests of all parties are protected and that the royalties are distributed correctly based on the updated lease description.

Chicago Illinois Correction Assignment of Overriding Royalty Interest Correcting Lease Description

Description

How to fill out Chicago Illinois Correction Assignment Of Overriding Royalty Interest Correcting Lease Description?

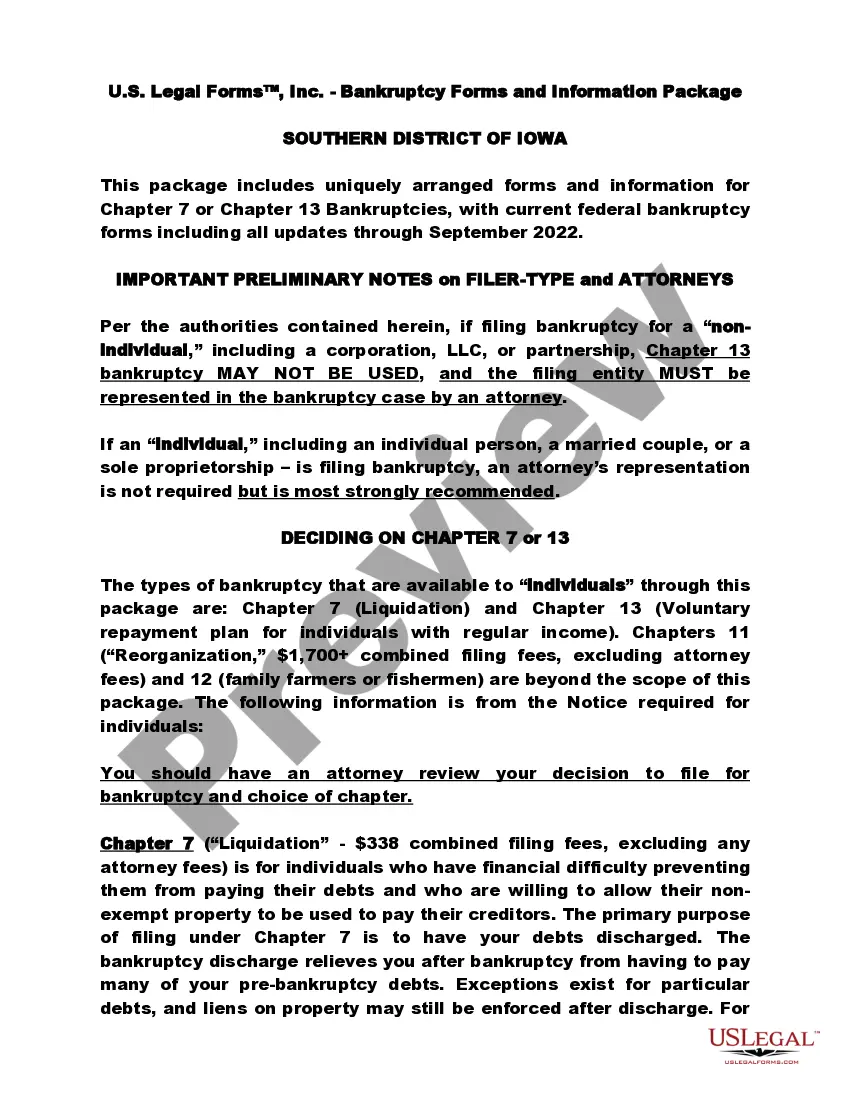

Do you need to quickly draft a legally-binding Chicago Correction Assignment of Overriding Royalty Interest Correcting Lease Description or probably any other form to take control of your own or business affairs? You can select one of the two options: hire a legal advisor to write a legal document for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive professionally written legal documents without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant form templates, including Chicago Correction Assignment of Overriding Royalty Interest Correcting Lease Description and form packages. We provide templates for an array of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the Chicago Correction Assignment of Overriding Royalty Interest Correcting Lease Description is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were hoping to find by using the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Chicago Correction Assignment of Overriding Royalty Interest Correcting Lease Description template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

Overriding Royalty Interest (ORRI) ? a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

ORRI means overriding royalty interest, or interest in oil and gas produced at the surface, free of the expense of Production, and in addition to the usual land owner's royalty reserved to the lessor in an oil and gas lease.

The Bankruptcy Code defines a production payment as a type of ?term overriding royalty? or ?an interest in liquid or gaseous hydrocarbons in place or to be produced from particular real property that entitles the owner thereof to a share of production, or the value thereof, for a term limited by time, quantity, or

The holders of the term ORRI interests moved for summary judgment on the characterization issue, arguing that as a matter of Louisiana state law, a term ORRI is an absolute conveyance of a real property interest.