Dallas, Texas is a vibrant and bustling city, known for its rich history, diverse culture, and thriving economy. It is the fourth-most populous city in the United States and offers a wide range of opportunities for residents and visitors alike. When it comes to the topic of Assignment of Overriding Royalty Interest — Short Form in Dallas, Texas, there are a few different types that are important to be aware of. These types include: 1. Oil and Gas Assignments: Dallas, Texas, situated in the heart of the state's oil and gas industry, sees numerous transactions involving the assignment of overriding royalty interests in oil and gas leases. These assignments allow individuals or entities to transfer their rights to a portion of the royalty revenue generated from the production of oil or gas. 2. Real Estate Assignments: Dallas is not only renowned for its energy sector but also for its vibrant real estate market. Assignments of overriding royalty interests in real estate allow for the transfer of certain rights to a portion of the profits or income generated from a property. This can include royalties from licensing, leasing, or any other revenue-generating activities related to the property. 3. Technology Assignments: In recent years, Dallas has become a thriving hub for technology and innovation. With numerous Tech companies, startups, and entrepreneurs flocking to the city, assignment of overriding royalty interests in the tech industry has gained significant importance. These assignments enable individuals or entities to transfer their rights to a portion of the income or profits generated from technological advancements, patents, or intellectual property rights. In conclusion, Dallas, Texas is a city with a wide range of opportunities for assignment of overriding royalty interests in various sectors such as oil and gas, real estate, and technology. These assignments allow interested parties to transfer their rights to a portion of the revenue or income generated from their respective industries, contributing to the city's economic growth and providing potential financial benefits to the parties involved.

Dallas Texas Assignment of Overriding Royalty Interest - Short Form

Description

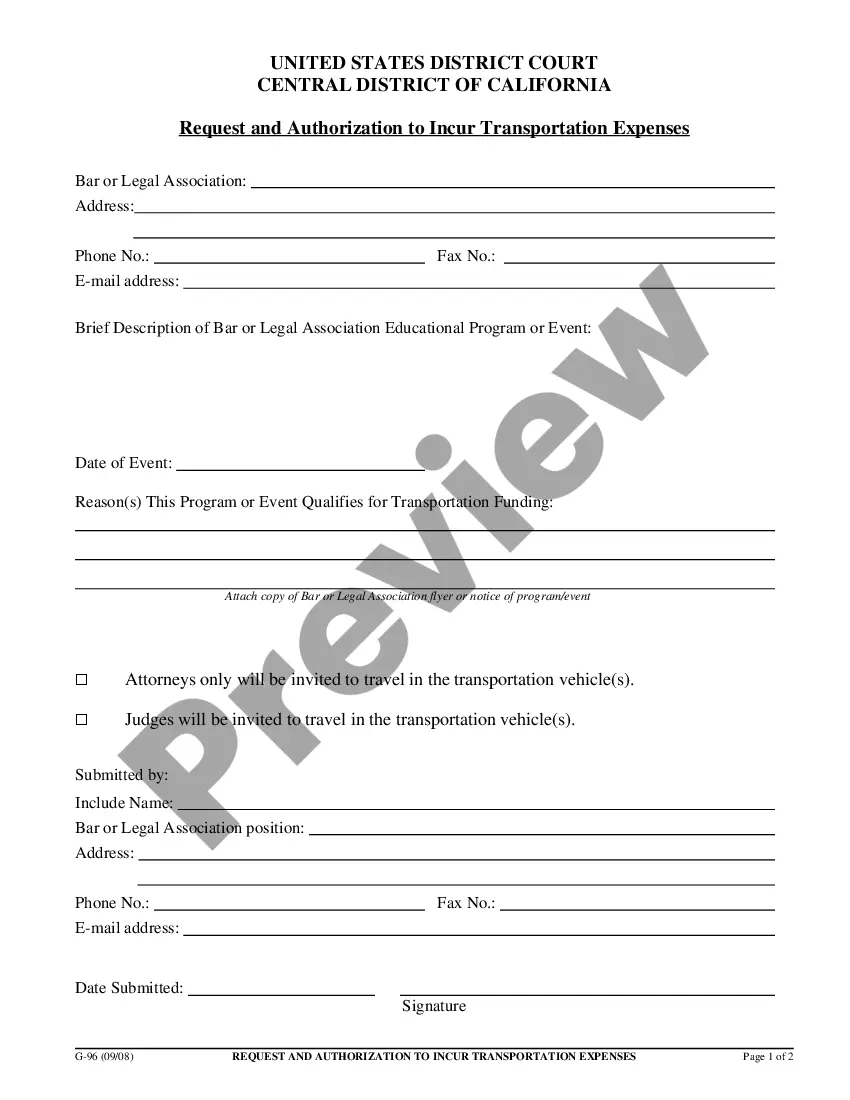

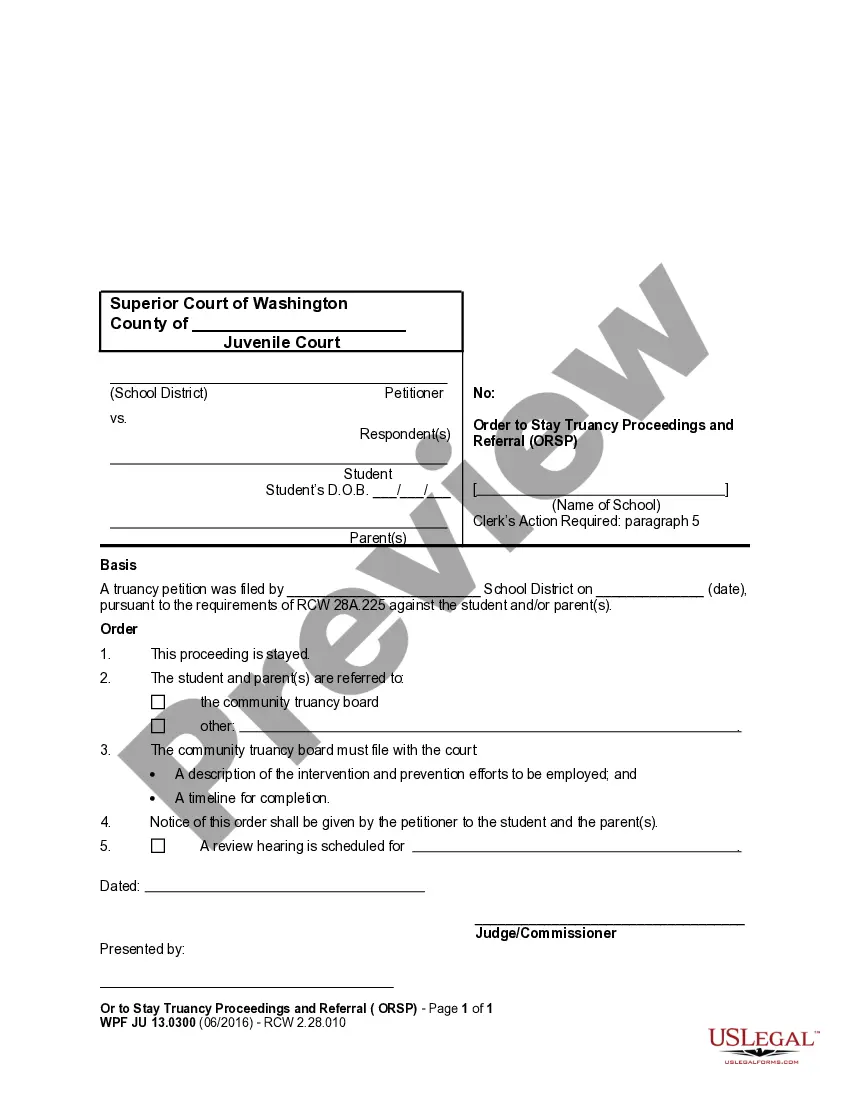

How to fill out Dallas Texas Assignment Of Overriding Royalty Interest - Short Form?

Whether you intend to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Dallas Assignment of Overriding Royalty Interest - Short Form is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Dallas Assignment of Overriding Royalty Interest - Short Form. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Assignment of Overriding Royalty Interest - Short Form in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Legal Definition of overriding royalty : an interest in and royalty on the oil, gas, or minerals extracted from another's land that is carved out of the producer's working interest and is not tied to production costs compare royalty.

ORRI is a non-possessory burden against the NRI. If the working interest owner carves out a 5% ORRI from its 75% NRI, without proportionate reduction, the calculation is (SNRI ORRI = NRI), meaning the working interest owner is left with 70% NRI.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR RI = NPRI.

ORRI means overriding royalty interest, or interest in oil and gas produced at the surface, free of the expense of Production, and in addition to the usual land owner's royalty reserved to the lessor in an oil and gas lease.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests. 100 25 = 75 percent (NRI) $1,000,000 $250,000 = $750,000 (monthly NRI)

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.