Title: Understanding Maricopa, Arizona's Assignment of Overriding Royalty Interests in Multiple Leases Introduction: Maricopa, Arizona, located in Pinal County, is a vibrant city known for its economic growth and development in the oil and gas industry. One important aspect of this industry is the Assignment of Overriding Royalty Interests (ORRIS) for multiple leases. In this article, we will explore what Maricopa's ORRIS entails, its significance, and some common types of assignments. Keywords: Maricopa, Arizona, Assignment of Overriding Royalty Interests, Multiple Leases, ORRIS, Pinal County, oil and gas industry 1. Understanding Assignment of Overriding Royalty Interests (ORRIS): The Assignment of Overriding Royalty Interests is a legal process where an entity transfers its right to receive a portion of the proceeds from oil and gas production in exchange for a monetary consideration. It is typically executed between the original leaseholder and a third party. 2. Significance of ORRIS in Maricopa, Arizona: Maricopa, Arizona's oil and gas industry relies on Operating Agreements that allow the assignment of Orris to encourage exploration and production. Orris provides financial incentives for leaseholders and third parties, leading to increased investments and exploration activities in the region. 3. Types of Maricopa Arizona Assignment of Overriding Royalty Interests in Multiple Leases: a) Single Lease Orris: With this type of assignment, the overriding royalty interest applies to a specific lease. It grants the assignee a percentage of the production revenue generated from that lease, without granting ownership rights or assuming any related liabilities. b) Multiple Lease Orris: This type involves assigning overriding royalty interests across multiple leases held by a single entity or landowner. This allows the assignee to gain potential revenue from several leases simultaneously. c) Area of Mutual Interest (AMI) Orris: In certain cases, Orris can be assigned within an AMI. An AMI is an agreed-upon geographic area in which a group of lessees has a mutual interest in executing exploration and development activities. AMI Orris allow assignees to participate in revenue from multiple leases within the predefined area. 4. Benefits of Maricopa's ORRIS Assignments: a) Diversification of Revenue: By assigning Orris across multiple leases, individuals or entities can diversify their revenue stream, reducing dependency on a single lease's production. b) Risk Mitigation: Orris offer a level of risk mitigation since assignees are entitled to revenue from production on leased properties without having ownership or operational responsibilities. c) Financial Flexibility: The upfront payment received in exchange for the ORRIS assignment provides leaseholders with financial flexibility to reinvest in new projects or cover operating expenses. Conclusion: Maricopa, Arizona's Assignment of Overriding Royalty Interests in Multiple Leases is a crucial aspect of the region's oil and gas industry. It provides opportunities for leaseholders to attract new investment, encourages exploration and production, and allows assignees to benefit from oil and gas revenues without the associated liabilities. Understanding the different types of assignments and their significance is vital for those involved in the industry.

Maricopa Arizona Assignment of Overriding Royalty Interests for Multiple Leases

Description

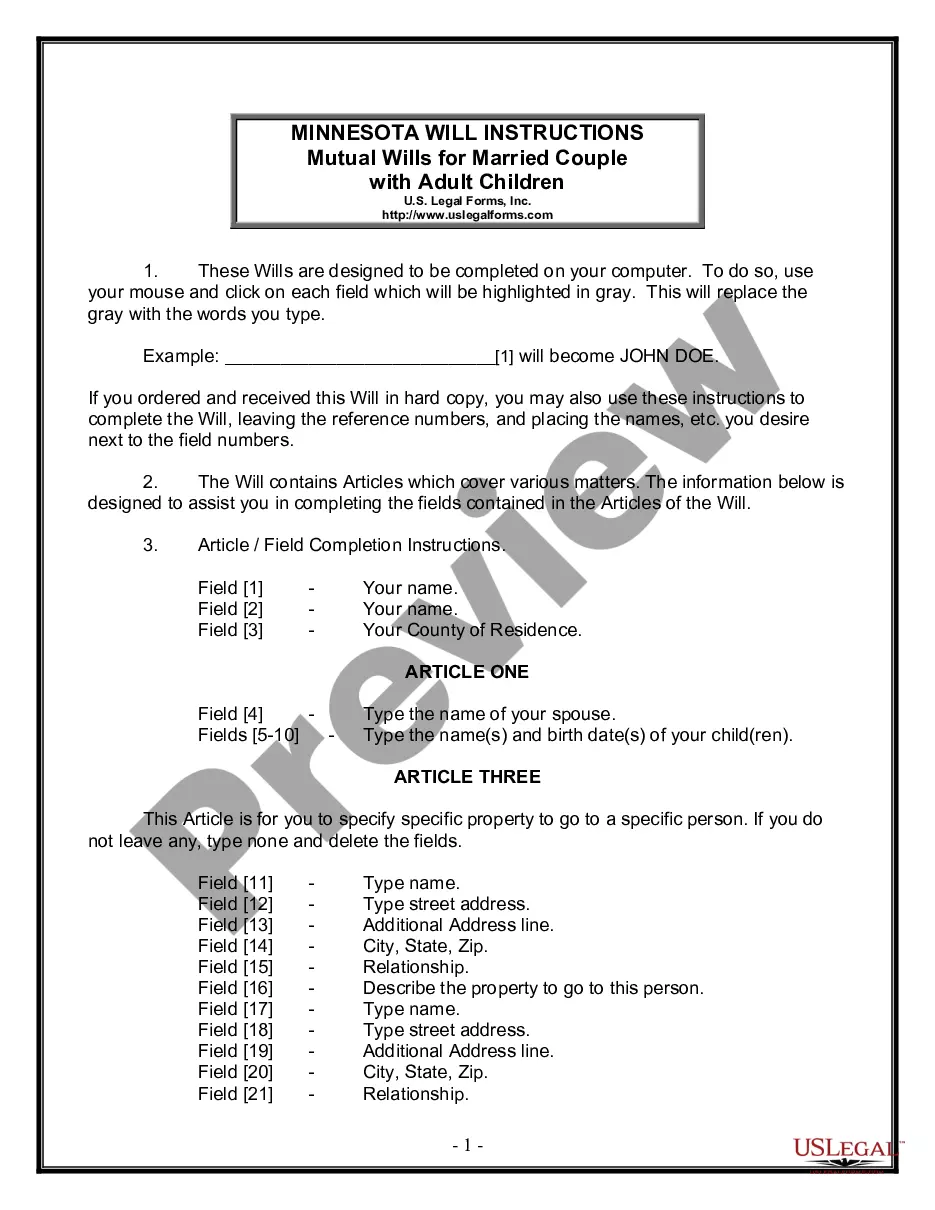

How to fill out Maricopa Arizona Assignment Of Overriding Royalty Interests For Multiple Leases?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Maricopa Assignment of Overriding Royalty Interests for Multiple Leases, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the latest version of the Maricopa Assignment of Overriding Royalty Interests for Multiple Leases, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Assignment of Overriding Royalty Interests for Multiple Leases:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Maricopa Assignment of Overriding Royalty Interests for Multiple Leases and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!