Oakland County, Michigan is a vibrant and diverse region located in the southeastern part of the state. Known for its thriving economy, rich cultural heritage, and natural beauty, Oakland County offers a wide range of opportunities for residents and visitors alike. One aspect of Oakland County's economy that has gained significant attention is the oil and gas industry. With numerous oil and gas reserves located throughout the county, there has been a surge in the production and exploration activities in recent years. As a result, the concept of assigning overriding royalty interests in multiple leases has become increasingly important. An assignment of overriding royalty interests refers to the transfer of a portion of the royalty interest from the lessor to a third party, known as the assignee. This arrangement allows the assignee to receive a percentage of the revenue generated from oil and gas production in exchange for an upfront payment or ongoing royalties. These interests can be assigned for multiple leases, meaning that the assignee will receive income from multiple oil and gas sites within Oakland County. There are several types of Oakland Michigan Assignment of Overriding Royalty Interests in Multiple Leases, including fractional assignments, overriding assignments, and perpetuates. 1. Fractional assignments: In this type of assignment, the lessor transfers a specific percentage of their royalty interest to the assignee. For example, if a lessor owns a 100% royalty interest, they may choose to assign 50% of it to an assignee, who would then be entitled to receive 50% of the revenue generated from the leases. 2. Overriding assignments: This type of assignment grants the assignee an overriding royalty interest, which is a percentage of the revenue generated from the leases, typically in addition to the existing lessor's royalty interest. The assignee does not bear any of the costs associated with drilling or production, but they receive a share of the proceeds. 3. Perpetuates: This type of assignment allows the assignee to retain the overriding royalty interest for an extended period, often beyond the lease term. This means that the assignee can continue to receive income from the leases even after the initial lease agreement has expired. By entering into an assignment of overriding royalty interests in multiple leases, lessors in Oakland County can diversify their income streams and share the risks and rewards associated with oil and gas production with assignees. At the same time, assignees can benefit from reliable passive income from multiple oil and gas leases, potentially maximizing their investment returns. It is important for both lessors and assignees to carefully review the terms and conditions of any assignment agreements and seek legal advice to ensure that their interests are protected. Additionally, they should be aware of any specific regulations and requirements imposed by the State of Michigan and Oakland County regarding assignments of overriding royalty interests. In conclusion, Oakland County, Michigan presents a dynamic environment for the oil and gas industry, and the assignment of overriding royalty interests in multiple leases offers a valuable opportunity for lessors and assignees to participate in this lucrative sector. Through these assignments, both parties can benefit from the potential returns generated by oil and gas production while sharing the associated risks.

Oakland Michigan Assignment of Overriding Royalty Interests for Multiple Leases

Description

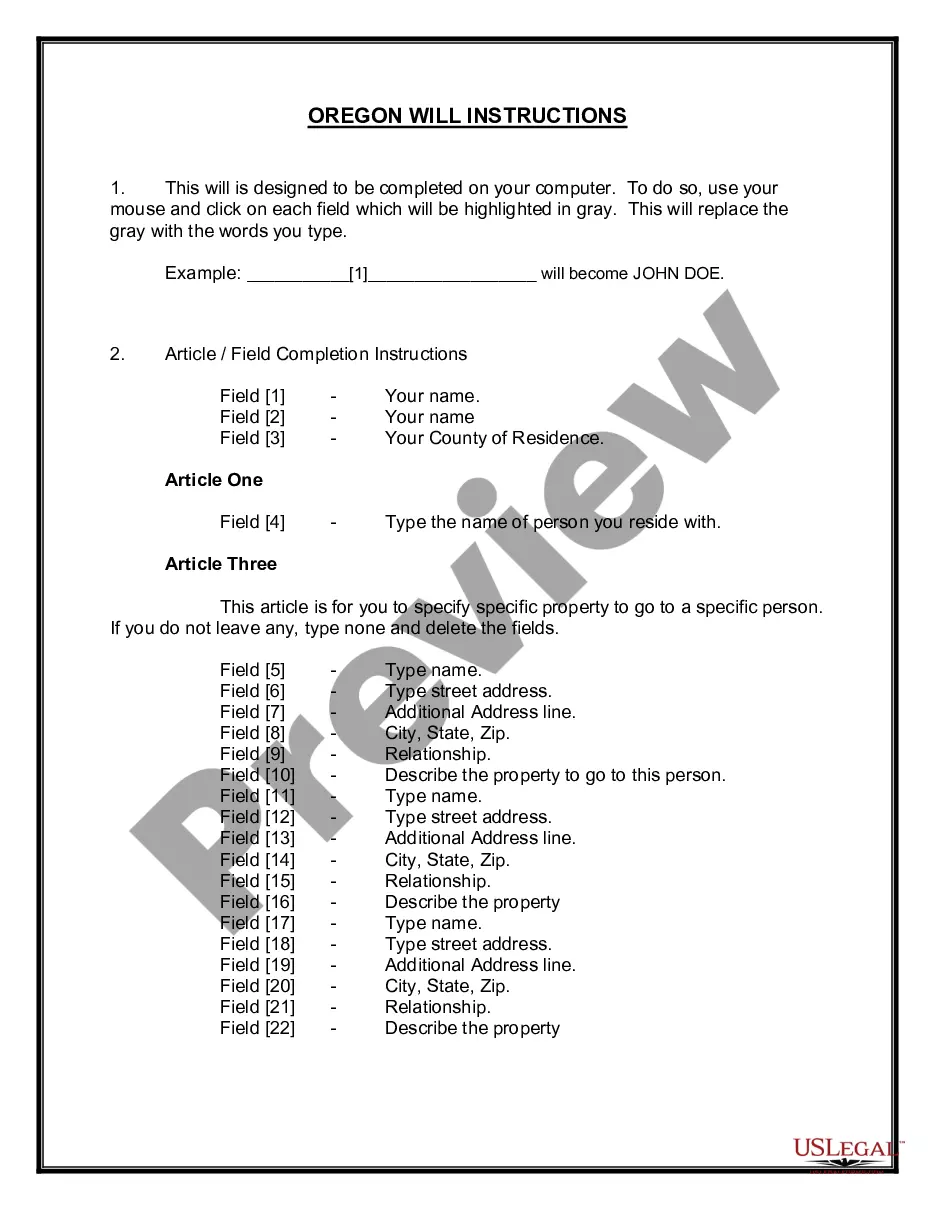

How to fill out Oakland Michigan Assignment Of Overriding Royalty Interests For Multiple Leases?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life sphere, finding a Oakland Assignment of Overriding Royalty Interests for Multiple Leases suiting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Apart from the Oakland Assignment of Overriding Royalty Interests for Multiple Leases, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Oakland Assignment of Overriding Royalty Interests for Multiple Leases:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Oakland Assignment of Overriding Royalty Interests for Multiple Leases.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!