Cook Illinois is a legal document used in the United States to transfer nonparticipating royalty interests in oil, gas, or mineral rights as a gift. This type of deed is commonly used when the granter wishes to transfer their ownership rights to another party without any warranties or guarantees. A Cook Illinois Gift Deed of Nonparticipating Royalty Interest with No Warranty is a specific form of deed that is used in the state of Illinois. It allows the granter to gift their nonparticipating royalty interests to a recipient, who will then become the new owner of these interests. The nonparticipating royalty interests refer to the right to receive a portion of the royalties generated from the extraction and sale of oil, gas, or minerals on a specific property. This means that the recipient of the gift deed will not have any decision-making power or the right to participate in any activities related to the property's development. Their sole benefit will be receiving the agreed-upon royalties. The "no warranty" aspect of the Cook Illinois Gift Deed of Nonparticipating Royalty Interest means that the granter does not provide any assurances regarding the ownership or the quality of the interests being transferred. The recipient accepts the interests "as is" and assumes all risks associated with them. It's important to note that there may be different variations or types of Cook Illinois Gift Deed of Nonparticipating Royalty Interest with No Warranty, depending on specific legal requirements or preferences of the parties involved in the transfer. Some potential variations may include specific clauses or additional terms to address unique circumstances. For instance, there may be a variation of the deed that outlines the exact property for which the nonparticipating royalty interests are being transferred. This can provide clarity and prevent any confusion regarding the boundaries or specific income sources included in the gift. Another type of Cook Illinois Gift Deed of Nonparticipating Royalty Interest with No Warranty may involve a duration or termination clause. This clause would specify the period for which the recipient will hold the interests and any circumstances under which the granter or recipient can terminate the transfer. In conclusion, a Cook Illinois Gift Deed of Nonparticipating Royalty Interest with No Warranty allows for the gifting of nonparticipating royalty interests without any warranties or guarantees. It's essential for parties involved in such a transfer to consult legal professionals to ensure all requirements and variations of the deed are correctly addressed.

Cook Illinois Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

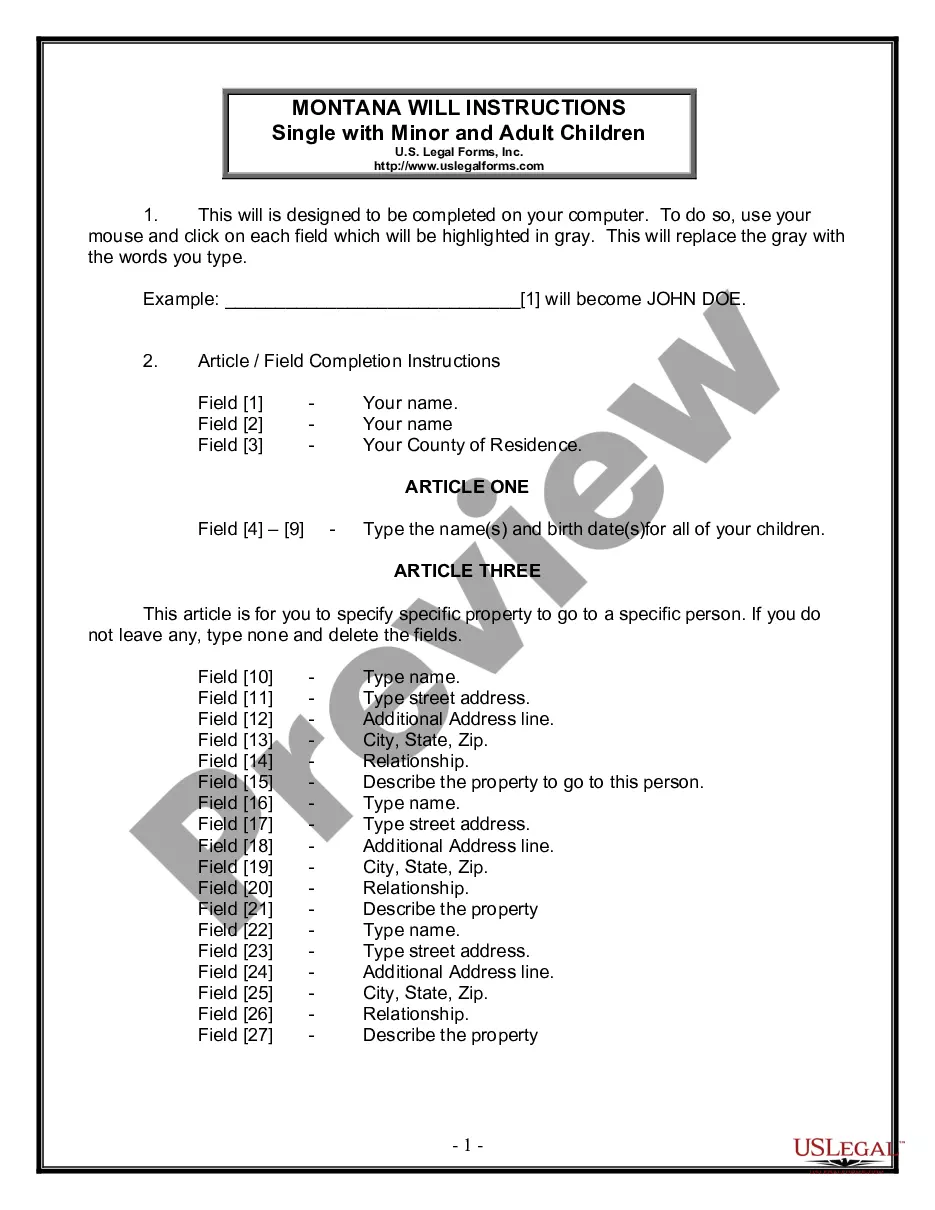

How to fill out Cook Illinois Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

If you need to find a trustworthy legal document provider to get the Cook Gift Deed of Nonparticipating Royalty Interest with No Warranty, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it simple to find and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to search or browse Cook Gift Deed of Nonparticipating Royalty Interest with No Warranty, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Cook Gift Deed of Nonparticipating Royalty Interest with No Warranty template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less expensive and more affordable. Create your first business, arrange your advance care planning, draft a real estate agreement, or complete the Cook Gift Deed of Nonparticipating Royalty Interest with No Warranty - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

A conveyance is simply the legal process of transferring certain property or interests from one person to another, or Grantor to Grantee. During the conveyance of the property, oftentimes the person transferring the property, the Grantor, will reserve certain rights attached to the property being conveyed.

In the oil & gas industry, an NEMI is a mineral interest the owner of which does not have the right to execute an oil and gas lease. As with a non-participating royalty interest (NPRI), a NEMI owner must consent for its interest to be pooled with other oil and gas interests.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

Unlike a mineral interest owner, a royalty interest owner does not possess executive rights. In addition, a royalty interest owner does not possess the right to receive lease bonuses, delay rental payments, or shut-in payments.

When dealing with the quantum of royalty to be conveyed or reserved, the word of has the same mathematical effect that fractions multiplied against each other have. Simply put, the interest is reduced. A fraction of royalty might be expressed as 1/2 of 1/8 royalty, which equals a one-sixteenth (1/16) royalty.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Unlike a mineral interest owner, a royalty interest owner does not possess executive rights. In addition, a royalty interest owner does not possess the right to receive lease bonuses, delay rental payments, or shut-in payments.

What is an NPRI? A non-participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals.

The royalty interest is created by a conveyance or a reservation in and to a particular parcel of land or mineral interest and is usually done prior to being leased. This is a bona fide interest that one will own in perpetuity.