A Houston Texas Gift Deed of Nonparticipating Royalty Interest with No Warranty is a legal document used to transfer ownership of a nonparticipating royalty interest in an oil, gas, or mineral property located in Houston, Texas, from one party (the donor) to another (the done) as a gift. This type of nonparticipating royalty interest means that the owner of this interest does not have any rights to make decisions or participate in the operations of the property but is entitled to receive a portion of royalties from the production of minerals. The Gift Deed of Nonparticipating Royalty Interest with No Warranty is a legally binding contract that outlines the terms of the gift, including a description of the property, the percentage or fraction of royalty interest being transferred, the names and addresses of the donor and the done, and any specific conditions or restrictions attached to the gift. This document also includes a specific clause indicating that the transfer of the nonparticipating royalty interest is being made without any warranties or guarantees. This means that the donor does not provide any assurances regarding the validity of the interest, potential royalty income, or any other aspects related to the property, leaving the done to assume all risks and responsibilities associated with it. Different types of Houston Texas Gift Deed of Nonparticipating Royalty Interest with No Warranty may include variations based on the specific terms and conditions agreed upon by the donor and done. For example, the agreement may include provisions regarding the payment of taxes or post-transfer liabilities, the ability to transfer or assign the interest in the future, or any particular conditions the donor may impose. It is crucial for both the donor and done to seek legal counsel and conduct due diligence before entering into this type of transaction. Consulting an attorney with expertise in oil, gas, and mineral law can ensure that the gift deed is valid, all necessary legal requirements are met, and that both parties fully understand their rights and obligations. In conclusion, a Houston Texas Gift Deed of Nonparticipating Royalty Interest with No Warranty is a legal document used to transfer ownership of a nonparticipating royalty interest in an oil, gas, or mineral property as a gift. This type of deed signifies that the owner of this interest has no decision-making power but is entitled to a portion of the royalties. Different variations of this deed exist, depending on the terms and conditions agreed upon by the parties involved. Seeking legal advice is highly recommended ensuring a smooth and legally compliant transfer of the royalty interest.

Houston Texas Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

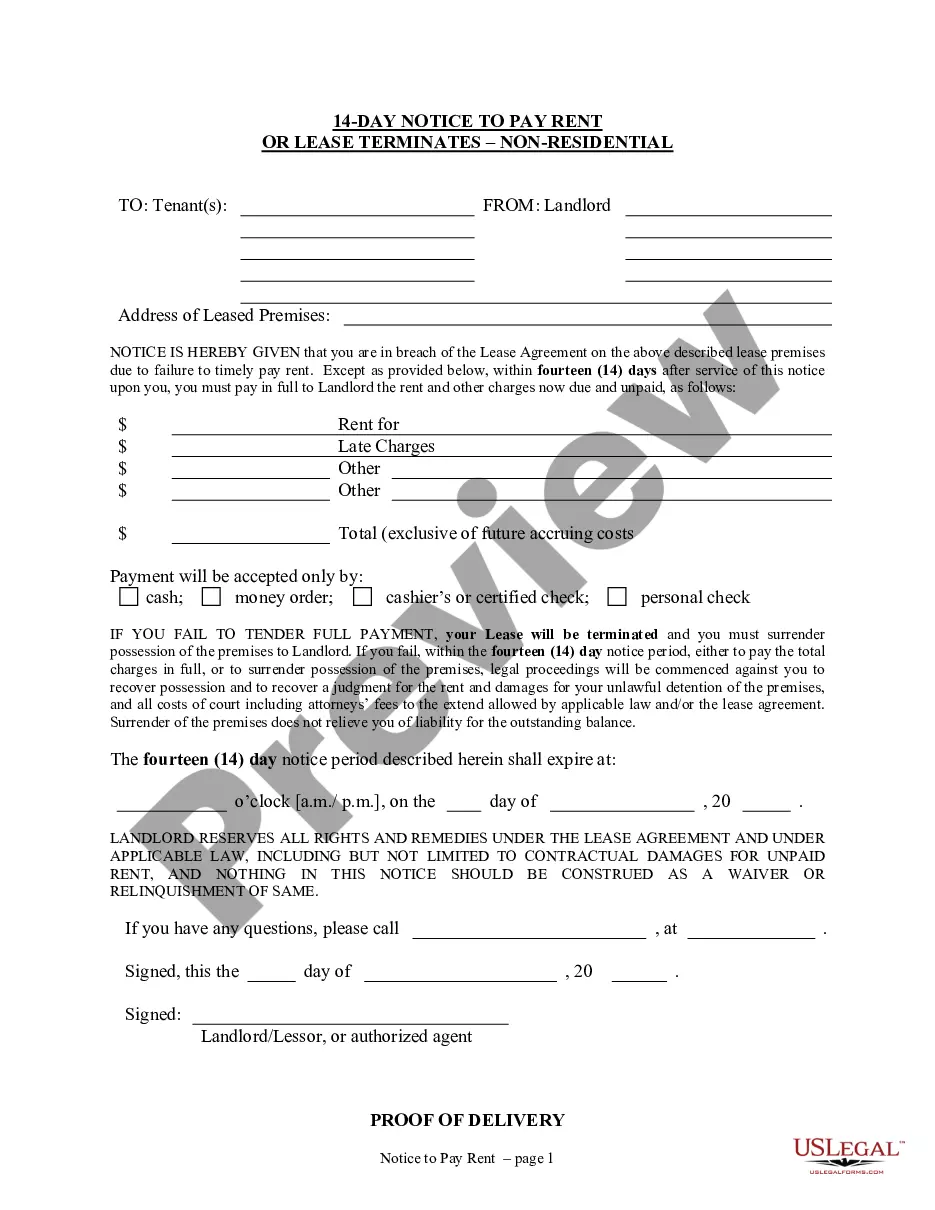

How to fill out Houston Texas Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

Are you looking to quickly create a legally-binding Houston Gift Deed of Nonparticipating Royalty Interest with No Warranty or probably any other document to take control of your own or corporate matters? You can select one of the two options: hire a professional to draft a valid document for you or draft it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Houston Gift Deed of Nonparticipating Royalty Interest with No Warranty and form packages. We offer documents for a myriad of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, carefully verify if the Houston Gift Deed of Nonparticipating Royalty Interest with No Warranty is adapted to your state's or county's regulations.

- If the form includes a desciption, make sure to verify what it's intended for.

- Start the searching process again if the template isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Houston Gift Deed of Nonparticipating Royalty Interest with No Warranty template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the documents we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding Royalty Interest (ORRI) ? a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

What is the difference between working interest and royalty interest? Working interests are oil and gas investments that give owners the right to exploit the resources on a property. Royalty interests are the rights belonging to the landowner who leased out the property to the working interest owner.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

A royalty interest is a non-possessory real property interest in oil and gas production free of production and operating expenses, which may be created by grant or by reservation or exception.

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR RI = NPRI.

Under Texas law, if the mineral rights are separate property, then the bonus payments and royalty payments are separate property. If the mineral rights are community property, then the bonus money and royalties are community property.

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.