San Diego California Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

How to fill out Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

Drafting documents, such as the San Diego Gift Deed of Nonparticipating Royalty Interest with No Warranty, to oversee your legal concerns is a difficult and time-consuming endeavor.

Many situations necessitate an attorney’s involvement, which also renders this task not particularly economical.

Nonetheless, you can take charge of your legal issues and manage them independently.

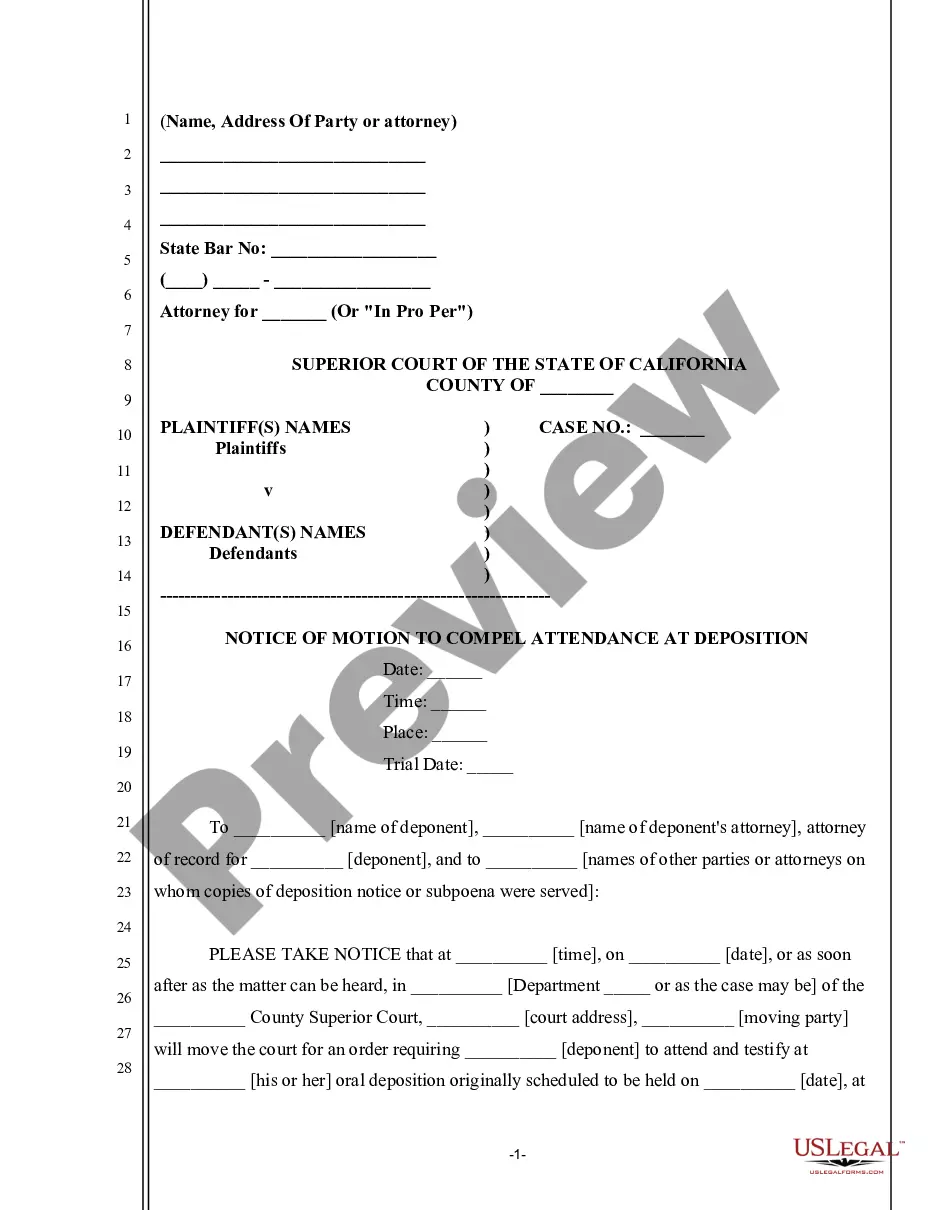

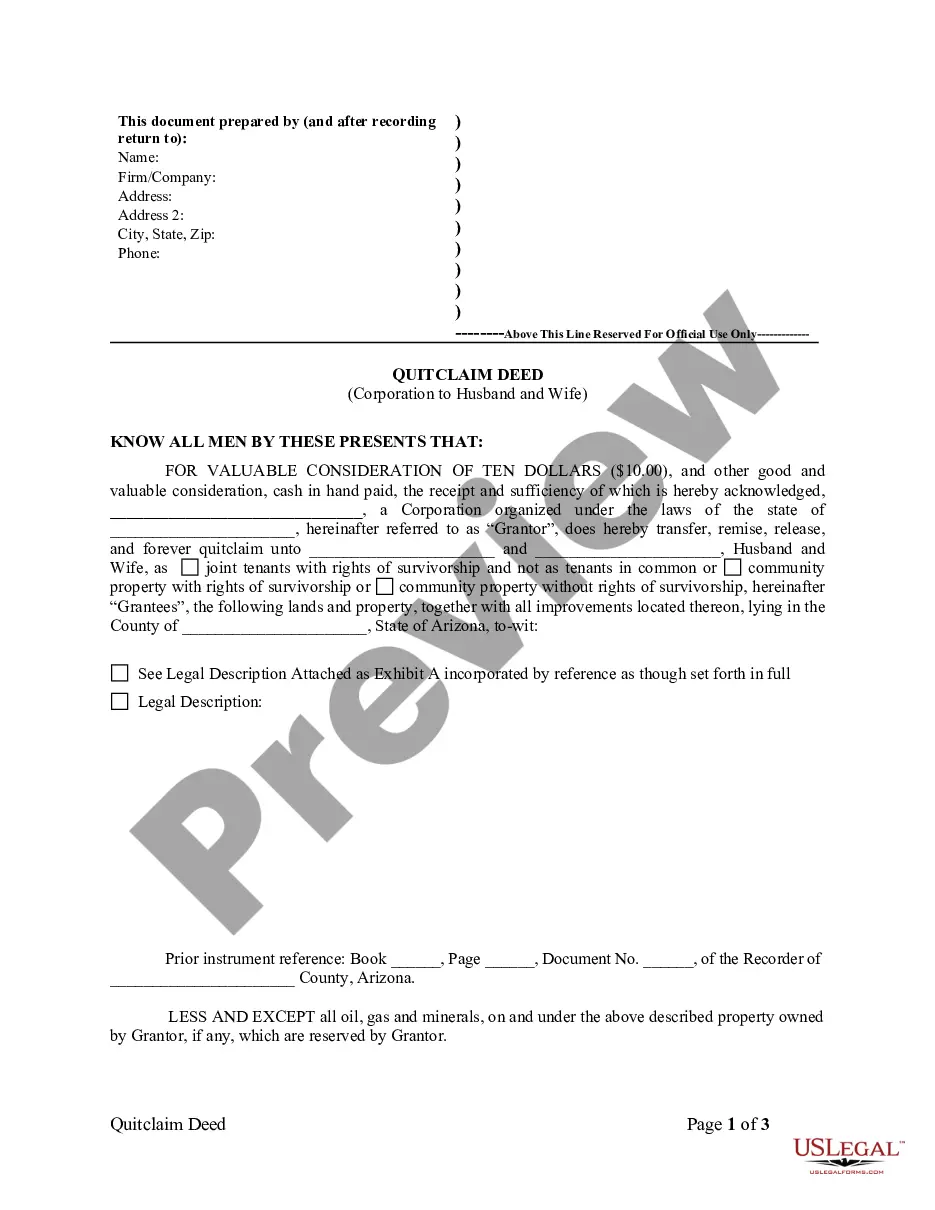

The onboarding process for new users is equally straightforward! Here’s what you need to do prior to downloading the San Diego Gift Deed of Nonparticipating Royalty Interest with No Warranty: Ensure that your document aligns with your state/county requirements, as regulations for drafting legal documents can differ from one state to another. Get more insights about the form by previewing it or reading a brief introduction. If the San Diego Gift Deed of Nonparticipating Royalty Interest with No Warranty isn't what you expected to find, then utilize the header to search for another option. Log In or register an account to start using our website and obtain the document. Is everything satisfactory on your end? Click the Buy now button and choose a subscription plan. Select the payment platform and input your payment details. Your template is prepared for download. Finding and purchasing the suitable document with US Legal Forms is straightforward. Thousands of businesses and individuals are already reaping the benefits of our extensive library. Subscribe now if you want to discover additional advantages available with US Legal Forms!

- US Legal Forms is here to assist you.

- Our platform offers over 85,000 legal documents crafted for numerous circumstances and life events.

- We guarantee every document adheres to the laws of each state, so you won’t have to fret about possible legal compliance issues.

- If you're already acquainted with our site and have a subscription with US, you understand how simple it is to acquire the San Diego Gift Deed of Nonparticipating Royalty Interest with No Warranty form.

- Proceed to Log In to your account, download the template, and customize it according to your requirements.

- Have you misplaced your document? Don’t fret. You can retrieve it in the My documents tab in your account - available on both desktop and mobile.

Form popularity

FAQ

operated working interest allows the holder to have a stake in the operation and related costs of resource extraction, while a royalty interest does not come with operational responsibilities. Therefore, working interest owners can influence decisions, whereas royalty owners primarily receive financial benefits. When utilizing a San Diego California Gift Deed of Nonparticipating Royalty Interest with No Warranty, understand that the gifts relate more to royalty interests rather than working interests.

Under Texas law, if the mineral rights are separate property, then the bonus payments and royalty payments are separate property. If the mineral rights are community property, then the bonus money and royalties are community property.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

What is an NPRI? A non-participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals.

Unlike a mineral interest owner, a royalty interest owner does not possess executive rights. In addition, a royalty interest owner does not possess the right to receive lease bonuses, delay rental payments, or shut-in payments.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

In the oil & gas industry, an NEMI is a mineral interest the owner of which does not have the right to execute an oil and gas lease. As with a non-participating royalty interest (NPRI), a NEMI owner must consent for its interest to be pooled with other oil and gas interests.

A royalty interest is a non-possessory real property interest in oil and gas production free of production and operating expenses, which may be created by grant or by reservation or exception.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.