The Kings New York Term Nonparticipating Royalty Deed from Mineral Owner is a legal document used in the state of New York to transfer the rights of mineral ownership. This type of deed specifically addresses the nonparticipating royalty interests of the mineral owner. A nonparticipating royalty interest refers to the rights held by the owner of the minerals to receive royalty payments, but without the ability to participate in the actual exploration and extraction activities on the property. This means that the mineral owner will not have any control over the operations or decisions made by the lessee or operator. The Kings New York Term Nonparticipating Royalty Deed from Mineral Owner is executed for a specific term, which can vary depending on the agreement between the parties involved. During this term, the mineral owner will be entitled to receive royalty payments based on the production and sale of minerals from the property. Some relevant keywords for the Kings New York Term Nonparticipating Royalty Deed from Mineral Owner include: 1. Mineral ownership transfer: This deed allows the mineral owner to transfer their nonparticipating royalty interests to another party. 2. Nonparticipating royalty interest: Refers to the rights held by the mineral owner to receive royalty payments without participating in the extraction activities. 3. Exploration and extraction activities: The operational activities involved in searching for and extracting minerals from the property. 4. Lessee or operator: The party who is authorized to explore and extract minerals from the property, often referred to as the lessee or operator. 5. Term of the deed: Specifies the duration for which the nonparticipating royalty deed will be valid and in effect. 6. Royalty payments: The compensation received by the mineral owner based on the production and sale of minerals from the property. 7. New York state laws: The legal framework and regulations governing mineral ownership and nonparticipating royalty interests in New York. 8. Agreement between parties: The terms and conditions agreed upon by both the mineral owner and the transferee regarding the nonparticipating royalty interests. Different types of Kings New York Term Nonparticipating Royalty Deeds from Mineral Owners may include variations in terms and conditions such as the duration of the term, percentage of royalty payments, and specific rights and restrictions imposed on the transferee. It is crucial to consult legal professionals and reference the specific deed to determine any unique characteristics or variations.

Kings New York Term Nonparticipating Royalty Deed from Mineral Owner

Description

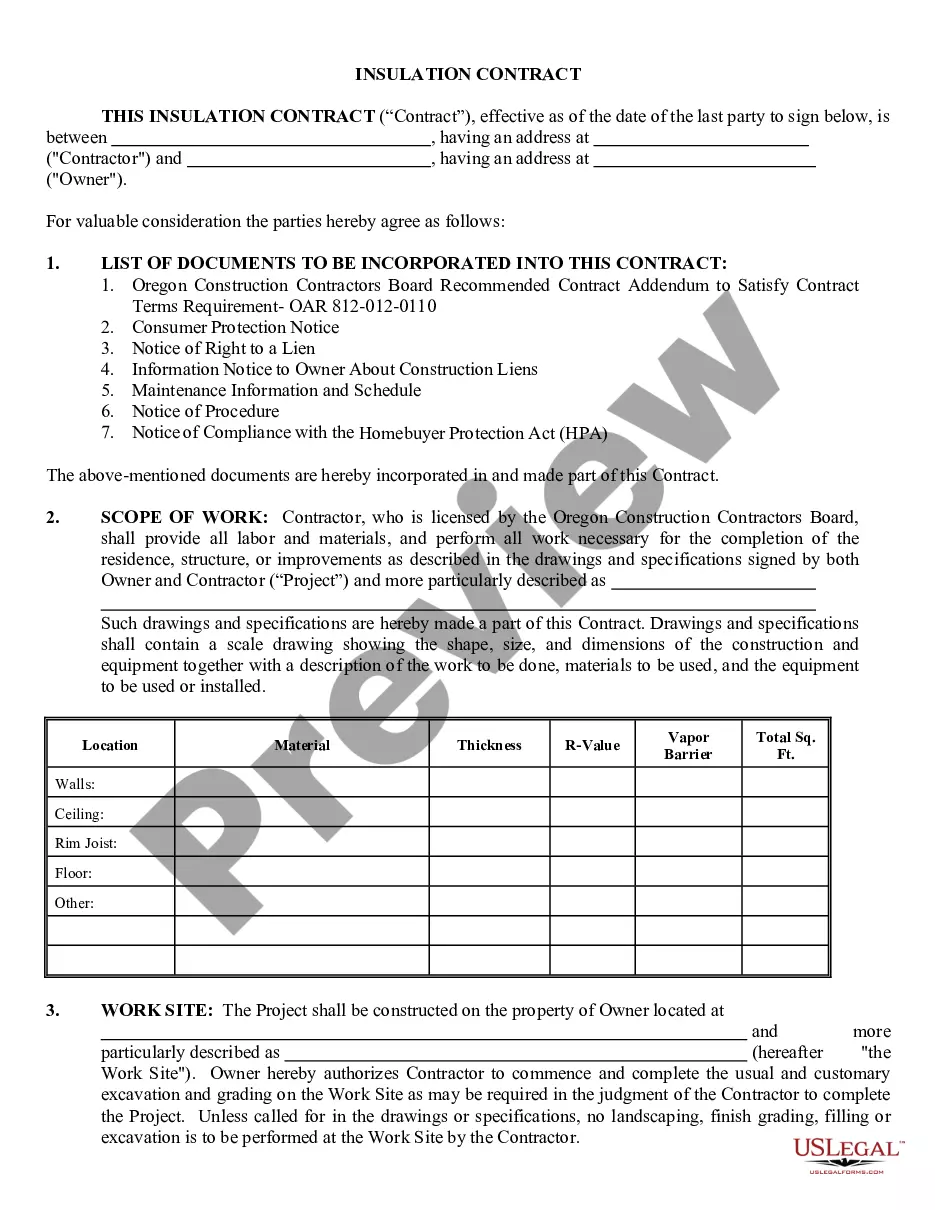

How to fill out Kings New York Term Nonparticipating Royalty Deed From Mineral Owner?

Preparing documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Kings Term Nonparticipating Royalty Deed from Mineral Owner without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Kings Term Nonparticipating Royalty Deed from Mineral Owner by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to get the Kings Term Nonparticipating Royalty Deed from Mineral Owner:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!