Tarrant Texas Term Nonparticipating Royalty Deed from Mineral Owner: Explained in Detail In Tarrant County, Texas, the oil, gas, and mineral rights industry plays a significant role in the local economy. When it comes to transferring these rights, one common instrument used is the Tarrant Texas Term Nonparticipating Royalty Deed from Mineral Owner. This legal document allows the mineral owner to grant a nonparticipating royalty interest in their property for a specified term. A nonparticipating royalty interest refers to a portion of the production or revenue that is paid to the royalty owner, without granting them the right to participate in the decision-making processes or operations related to the mineral lease. This means that the mineral owner will receive a predetermined percentage of the income generated from the mineral extraction, while leaving all the responsibilities and decisions related to the operation in the hands of the lessee or operator. The key feature of the Tarrant Texas Term Nonparticipating Royalty Deed is the term limit. This means that the royalty interest granted by the mineral owner has a specific duration, after which the ownership rights revert to the original mineral owner. The term can range from a few years to several decades, depending on the agreement between the parties involved. It's important to note that there may be different types or variations of the Tarrant Texas Term Nonparticipating Royalty Deed, tailored to specific needs or circumstances. Some of these variations may include: 1. Fixed Term Nonparticipating Royalty Deed: This type of deed specifies a fixed term for the royalty interest, typically with a predetermined expiration date. Once the term expires, the royalty interest returns to the mineral owner. 2. Term Nonparticipating Royalty Deed with Extension Option: In this case, the initial term is defined, but the lessee or operator has the option to extend the royalty interest for an additional term upon meeting certain conditions, such as continued production or reaching a specific production threshold. 3. Convertible Nonparticipating Royalty Deed: This form of the deed grants the mineral owner the right to convert the nonparticipating royalty interest into a working interest or a mineral lease, enabling them to become a participant in the operations and decision-making processes of the mineral lease. 4. Nonparticipating Royalty Deed with Restricted Rights: This variation may limit certain rights associated with the nonparticipating royalty interest, such as the right to inspect records or audit the operator's accounting practices. This allows the operator to maintain control over the operations while still providing a royalty interest to the mineral owner. It is crucial for both parties involved in a Tarrant Texas Term Nonparticipating Royalty Deed to seek legal counsel and carefully review the terms and conditions outlined in the agreement. This ensures a comprehensive understanding of the rights and obligations associated with the nonparticipating royalty interest granted by the mineral owner. Overall, the Tarrant Texas Term Nonparticipating Royalty Deed serves as a vital tool for mineral owners and operators, providing a mechanism to transfer royalty interests in a specified period while maintaining the operational control of the leased property.

Tarrant Texas Term Nonparticipating Royalty Deed from Mineral Owner

Description

How to fill out Tarrant Texas Term Nonparticipating Royalty Deed From Mineral Owner?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Tarrant Term Nonparticipating Royalty Deed from Mineral Owner is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Tarrant Term Nonparticipating Royalty Deed from Mineral Owner. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

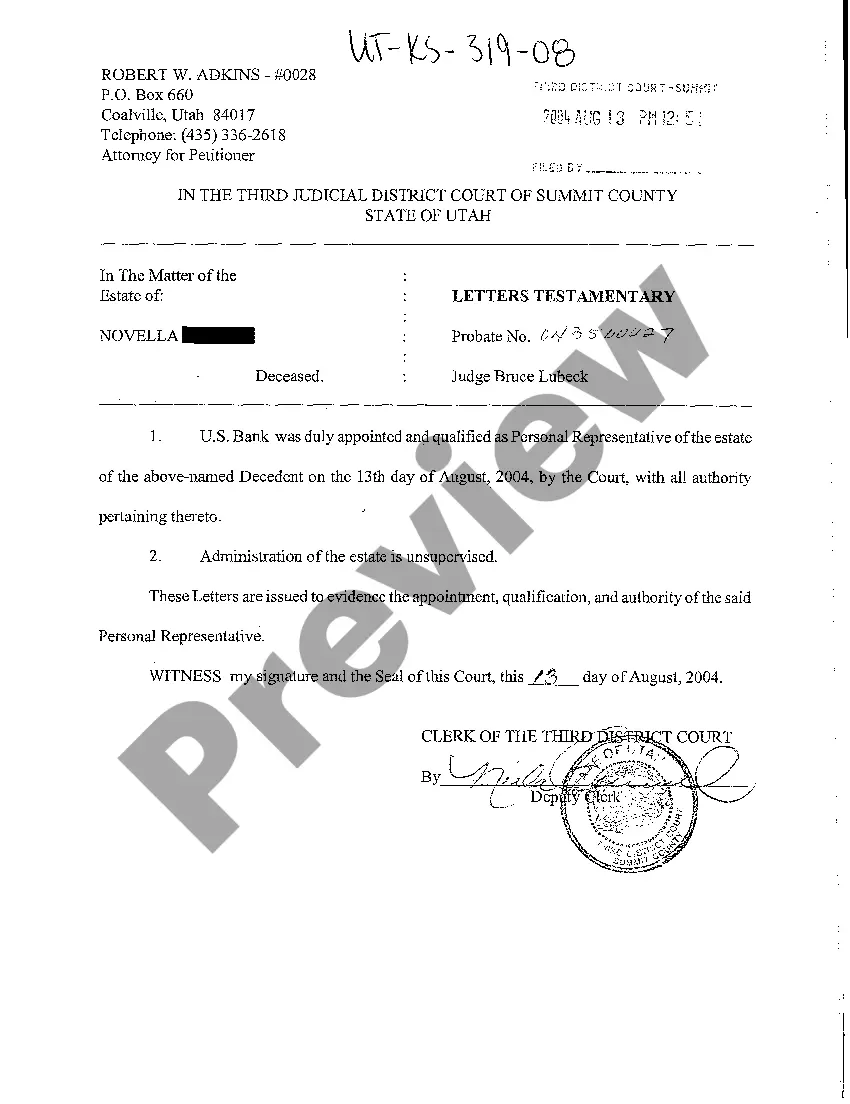

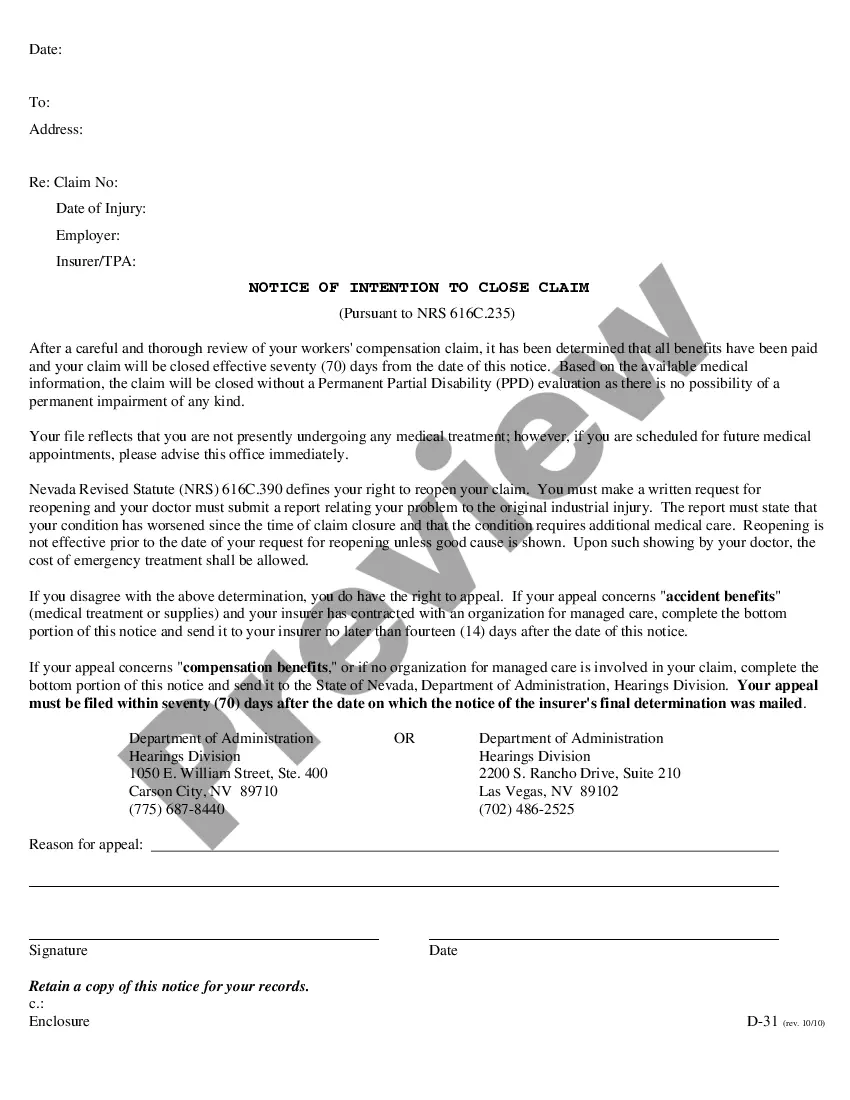

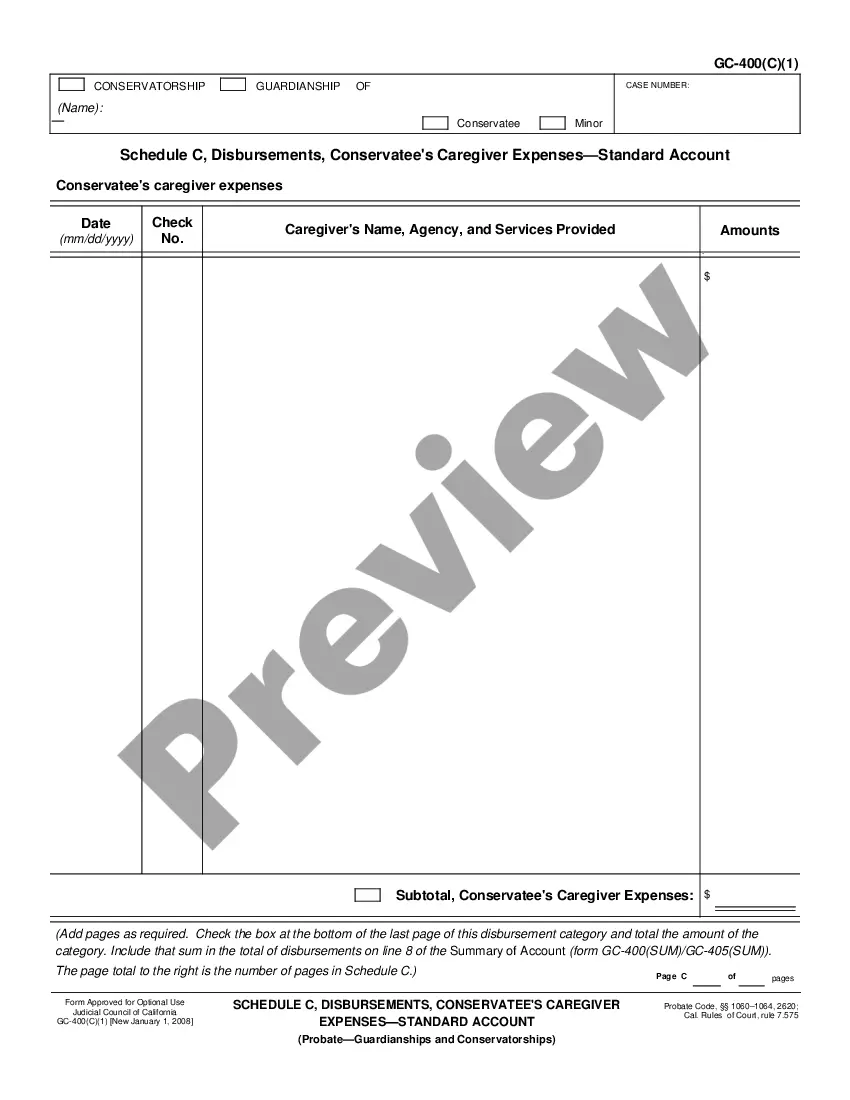

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Term Nonparticipating Royalty Deed from Mineral Owner in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

As a general rule of thumb, the value for non-producing mineral rights will nearly always be less than $1,000/acre. In most cases, the mineral rights value in Texas for non-producing minerals will be $0 to $250, but producing minerals $25,000+ per acre is not unusual.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

1. n. Oil and Gas Business Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Unlike a mineral interest owner, a royalty interest owner does not possess executive rights. In addition, a royalty interest owner does not possess the right to receive lease bonuses, delay rental payments, or shut-in payments.

The owner of a nonparticipating royalty interest, like the owner of a nonparticipating nonexecutive mineral interest, does not have the right to enter into a lease of the minerals nor the right to enter upon the land for the purpose of exploring for or producing oil, natural gas, or other minerals.