Tarrant Texas Term Royalty Deed is a legal document that grants the rights to the minerals found on a certain tract of land in Tarrant County, Texas, for a specific period of time. It outlines the terms and conditions under which the minerals may be extracted and the royalties paid to the landowner. The Tarrant Texas Term Royalty Deed is commonly used in the oil and gas industry, where mineral rights are often leased or sold to operators who wish to explore and extract resources from the land. The deed provides a time-limited agreement that allows the operator access to the minerals for a set period, typically ranging from a few years to a couple of decades. The deed includes important details such as the exact location and size of the land, the duration of the term, the agreed royalty rate, and any additional terms and conditions negotiated between the landowner and the operator. It also specifies the responsibilities of both parties, including the landowner's right to inspect operations and the operator's obligation to restore the land after extraction activities are completed. It is important to note that there are different types of Tarrant Texas Term Royalty Deeds, including: 1. Fixed Term Royalty Deed: This type of deed grants the mineral rights to the operator for a specific, predetermined period. Once the term expires, the rights automatically revert to the landowner. 2. Renewable Term Royalty Deed: This variation allows the option for renewal of the agreement at the end of the initial term. If both parties agree, the operator can continue to access the minerals for an extended period. 3. Conditional Term Royalty Deed: This type of deed includes specific conditions that must be met for the agreement to remain valid. For example, the operator may need to reach a certain level of production or fulfill environmental requirements to keep the rights. Regardless of the type, Tarrant Texas Term Royalty Deed provides a legal framework that protects both the landowner's rights and the operator's access to valuable mineral resources. It ensures that the extraction activities are conducted responsibly and fairly, benefiting both parties involved in the agreement.

Tarrant Texas Term Royalty Deed

Description

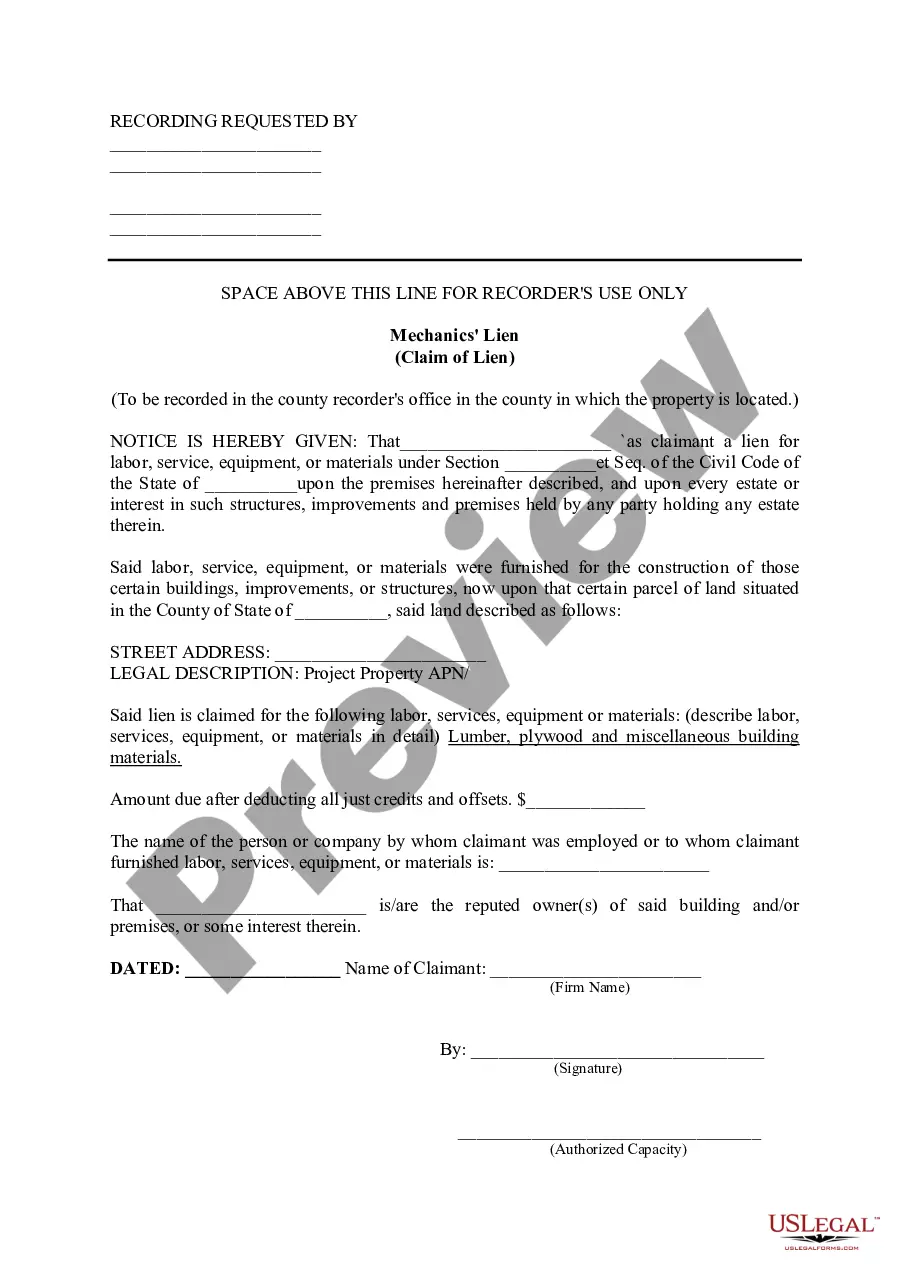

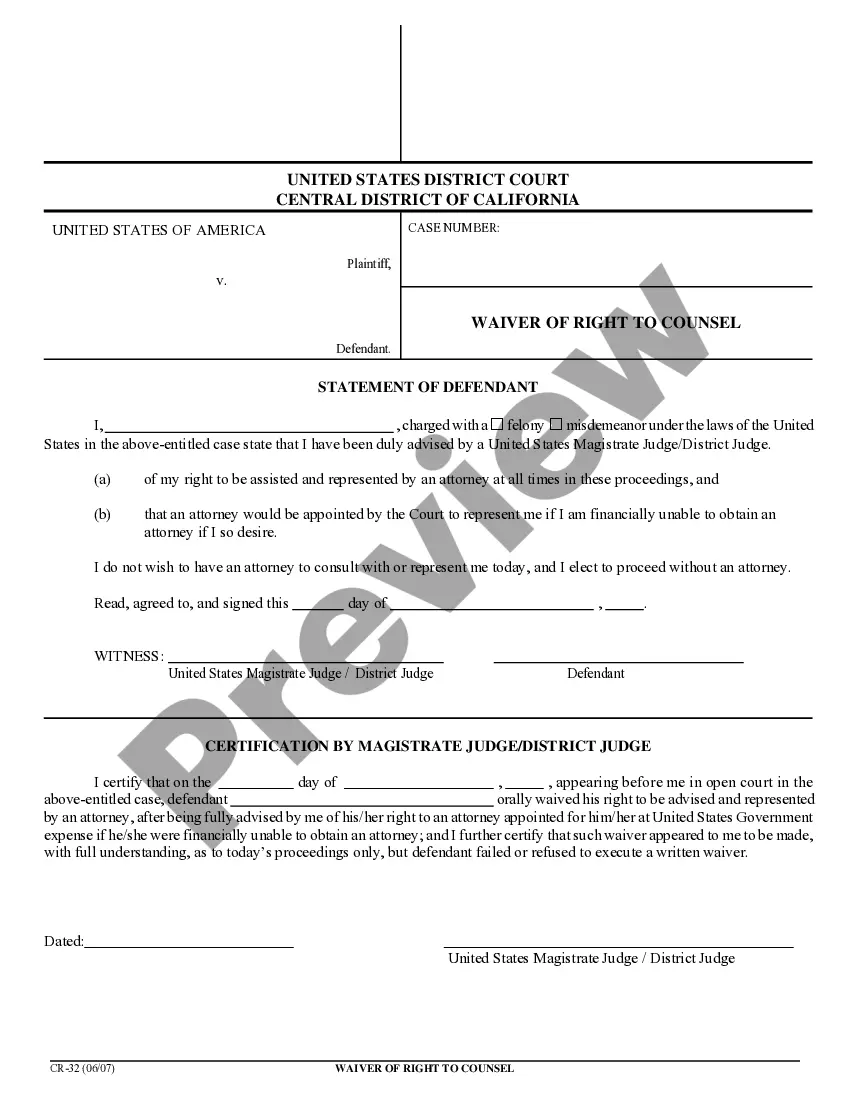

How to fill out Tarrant Texas Term Royalty Deed?

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Tarrant Term Royalty Deed is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the Tarrant Term Royalty Deed. Adhere to the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Term Royalty Deed in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Under Texas law, if the mineral rights are separate property, then the bonus payments and royalty payments are separate property. If the mineral rights are community property, then the bonus money and royalties are community property.

What Is A Royalty Deed? A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

Royalty is at the intersection of Farm Road 1219 and State Highway 18, two miles north of Grandfalls in southern Ward County. It was named for royalties paid to landowners after the discovery of oil at Grandfalls in 1927. Royalty was established to serve the neighboring oilfield and its workers.

A royalty deed is more restrictive than a mineral deed. Another name for a royalty deed is non-participating production interest. In this case, the deed holder has fewer rights and less control over the property below the surface.