Allegheny County, Pennsylvania is a county located in the southwest region of the state. It is home to the city of Pittsburgh, which is known for its rich history, diverse culture, and vibrant sports scene. A Term Royalty Deed for the Term of Existing Lease in Allegheny County refers to a legal document that grants a royalty interest to a party in connection with an existing lease agreement. This type of deed is commonly used in the oil and gas industry, where landowners lease their mineral rights to operators for exploration and production. With the Allegheny Pennsylvania Term Royalty Deed for the Term of Existing Lease, the landowner (referred to as the lessor) entrusts a specific percentage or fraction of the royalty interest to another party (referred to as the lessee). This document establishes the terms and conditions under which the lessee can collect royalty payments from the production and sale of minerals on the leased property. The advantages of using a Term Royalty Deed for the Term of Existing Lease include providing an avenue for landowners to earn passive income from the lease while retaining ownership of the property. It allows lessees to benefit from the resource extraction without having to legally acquire the land or bear the burden of property taxes. In Allegheny County, you may come across various types of Term Royalty Deeds for the Term of Existing Lease, including: 1. Conventional Term Royalty Deed: This is the most common type of royalty deed wherein the lessor agrees to a fixed percentage or fraction of the royalty interest. 2. Flat Royalty Rate Term Royalty Deed: In this type, the lessor and lessee agree on a fixed amount per unit of produced minerals, disregarding the prevailing market price. 3. Sliding Scale Royalty Deed: Under this agreement, the royalty rate varies based on the volume of production or the market price of the extracted minerals. It offers flexibility to adapt to changing market conditions. 4. Net Royalty Interest Term Royalty Deed: Here, the royalty interest is calculated after deducting production costs and other expenses incurred for extracting and selling the minerals. 5. Overriding Royalty Interest Term Royalty Deed: In some cases, an additional royalty interest is granted to a third party, known as an overriding royalty interest owner. This interest is limited to a percentage of the lessee's revenue, without having any share in the leasehold. Therefore, the use of Allegheny Pennsylvania Term Royalty Deed for the Term of Existing Lease has become integral in facilitating the leasing and extraction of mineral resources while ensuring fair compensation to both landowners and lessees in the region.

Allegheny Pennsylvania Term Royalty Deed for Term of Existing Lease

Description

How to fill out Allegheny Pennsylvania Term Royalty Deed For Term Of Existing Lease?

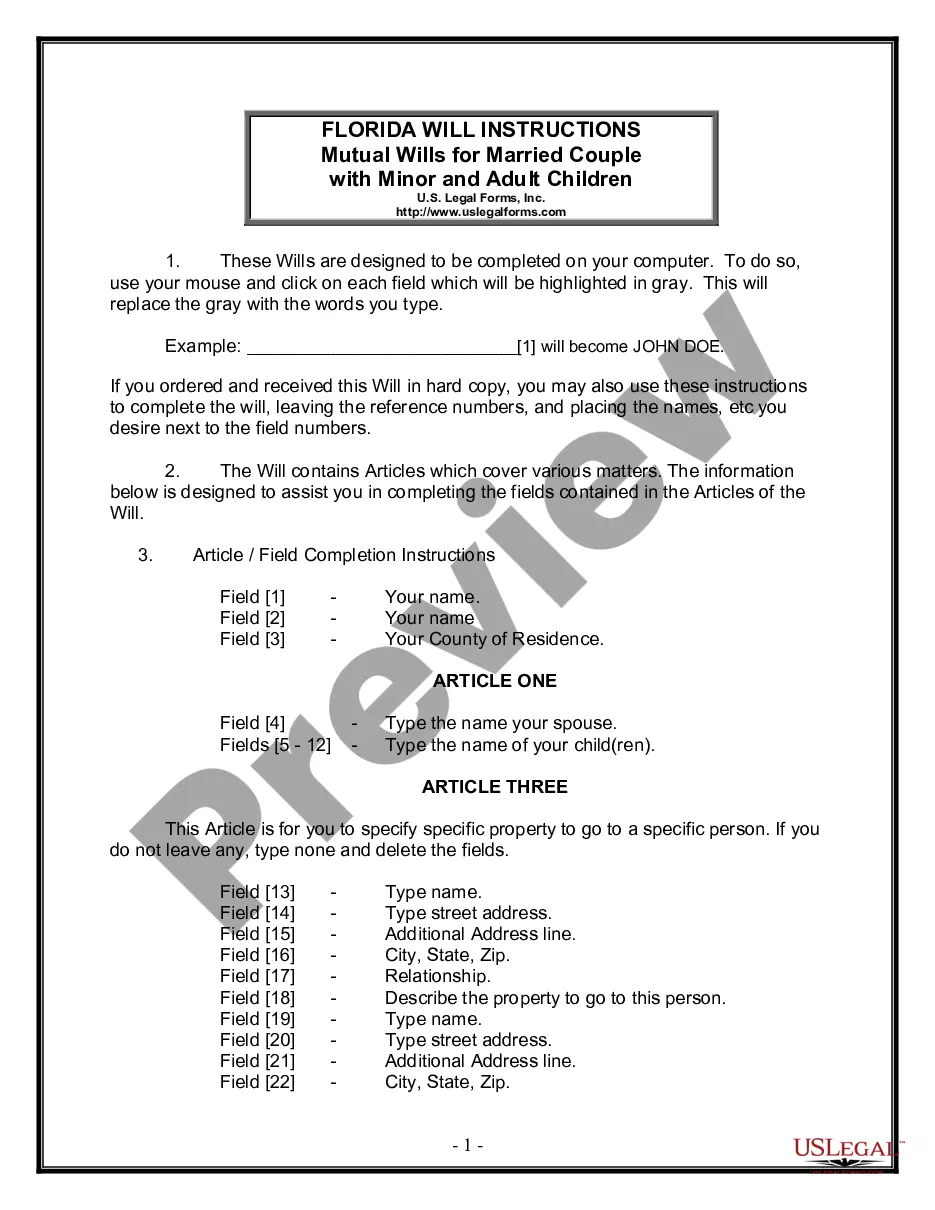

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Allegheny Term Royalty Deed for Term of Existing Lease, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any activities associated with document execution simple.

Here's how to purchase and download Allegheny Term Royalty Deed for Term of Existing Lease.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Examine the similar document templates or start the search over to locate the right file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Allegheny Term Royalty Deed for Term of Existing Lease.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Allegheny Term Royalty Deed for Term of Existing Lease, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you need to deal with an exceptionally difficult case, we advise using the services of an attorney to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!

Form popularity

FAQ

A mineral deed with special warranty in Texas conveys all or part of the oil, gas, and other minerals of a grantor in real property to a grantee, subject to certain warranties covering the grantor's period of ownership.

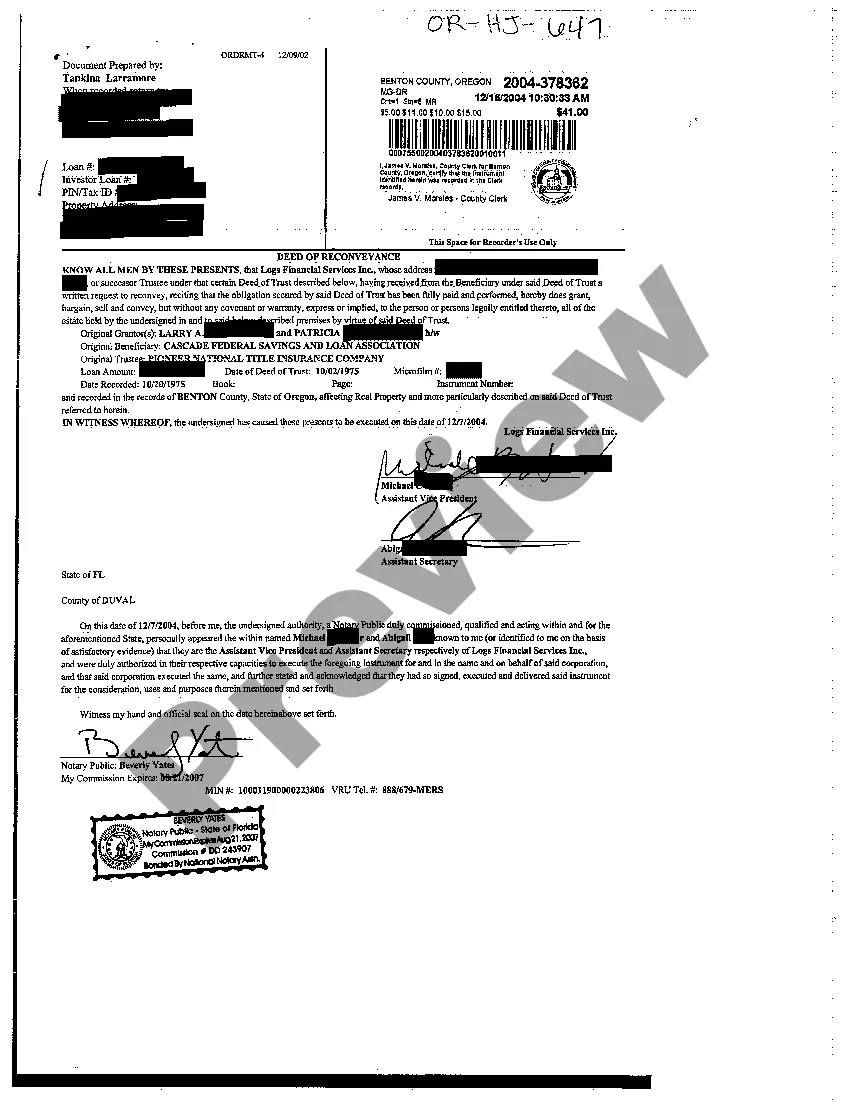

Recording requirements in Pennsylvania require that all mortgages presented for recording must have the signature of the holder, owner, assignee on any mortgage presented for recording. The document should contain the full name, residence (including street number) and the address of such holder, owner or assignee.

MONTGOMERY COUNTY RECORDER OF DEEDS Document TypeBase Fee Up to 4 names, 4 pages, 1 parcelEach Add'l page over 4Deed Miscellaneous$73.75$2.00Assignments of Rents/Leases$73.75$2.00Condo Codes of Regulation$73.75$2.00Consent Form$73.75$2.0062 more rows

Where do you purchase mineral rights? There are multiple ways to buy minerals, the most common being at auction, from brokers, by negotiated sale, tax sales, and directly from mineral owners. The process of buying minerals varies depending on where you buy them.

How to transfer mineral rights in Pennsylvania? A copy of the deed for the site must be obtained from a local courthouse in Pennsylvania by the new owner. Verify that the deed matches the description and that the so-called mineral rights are included in the property deed.

A royalty deed is more restrictive than a mineral deed. Another name for a royalty deed is non-participating production interest. In this case, the deed holder has fewer rights and less control over the property below the surface.

To add a name to a house deed in Pennsylvania, a new deed is prepared. The owner can prepare his own deed or contact an attorney or document service to provide one. Using an attorney is the best route because the attorney ensures that the deed is prepared per the requirements of the state.

Recording Fees The fee to record a deed, mortgage or easement is $181.75. Or if there are over 30 parcels (only parcels that require deed certification, $10.00 per parcel). This does not apply to leases or mortgages. The Department of Real Estate will accept certified checks, business checks, or money orders.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.