Nassau New York is a county located on Long Island, New York, known for its rich history, beautiful landscapes, and vibrant communities. Within the realm of real estate, there is a specific type of legal document known as the "Term Royalty Deed for Term of Existing Lease" that holds significance in Nassau County. This type of deed pertains to the transfer of royalty rights associated with an existing lease for a specified period. The Term Royalty Deed for Term of Existing Lease in Nassau, New York essentially grants the recipient (referred to as the grantee) the right to receive and collect royalties or rental income from a lease for a determined duration. This document assures the grantee that they will enjoy the lease's financial benefits and any associated royalties during the specified term. It is important to note that various types of Nassau New York Term Royalty Deeds for Term of Existing Lease might exist, such as: 1. Residential Term Royalty Deed for Term of Existing Lease: This type of deed is specific to residential properties, enabling the transfer of royalty rights related to a residential lease agreement. It may include single-family homes, apartments, or condominiums within the Nassau County area. 2. Commercial Term Royalty Deed for Term of Existing Lease: This variation applies to commercial properties, like office spaces, retail buildings, or industrial facilities. It facilitates the transfer of royalty rights associated with a commercial lease within Nassau County. 3. Agricultural Term Royalty Deed for Term of Existing Lease: This type of deed relates to agricultural properties or farmland, allowing the transfer of royalty rights from an existing lease specifically associated with agricultural activities. It might encompass crop production, livestock farming, or other agricultural pursuits prevalent in Nassau County. In all these variations, the Nassau New York Term Royalty Deed for Term of Existing Lease ensures that the rights to receive royalties from an existing lease are properly transferred to the grantee for the specified length of the agreement. This legal document acts as a guarantee for the grantee to participate in any financial benefits associated with the lease and assures their rightful ownership of the royalty rights for the given term. Overall, understanding the concept of a Nassau New York Term Royalty Deed for Term of Existing Lease is crucial for individuals involved in real estate transactions, seeking to transfer royalty rights, and looking to secure their financial interests in a lease agreement in Nassau County.

Nassau New York Term Royalty Deed for Term of Existing Lease

Description

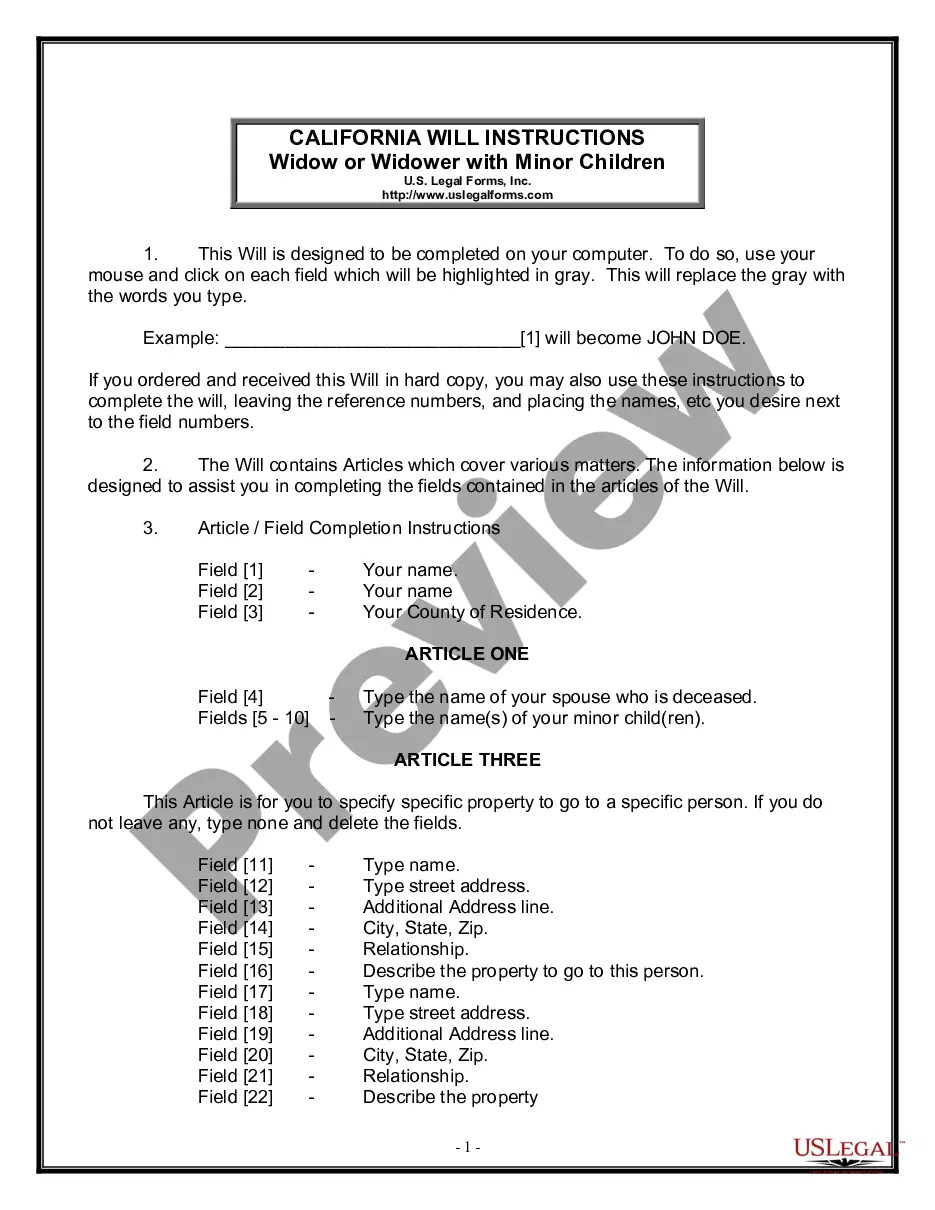

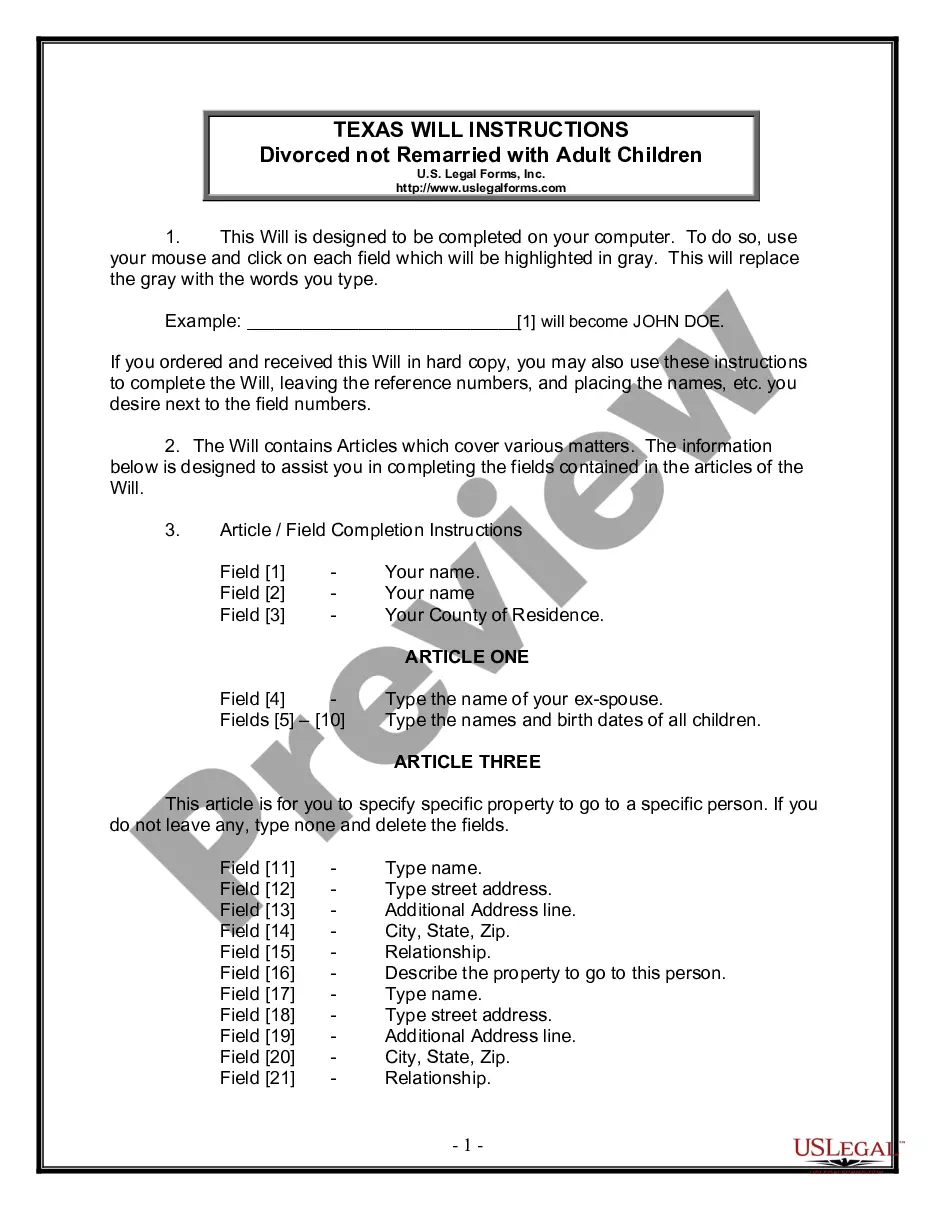

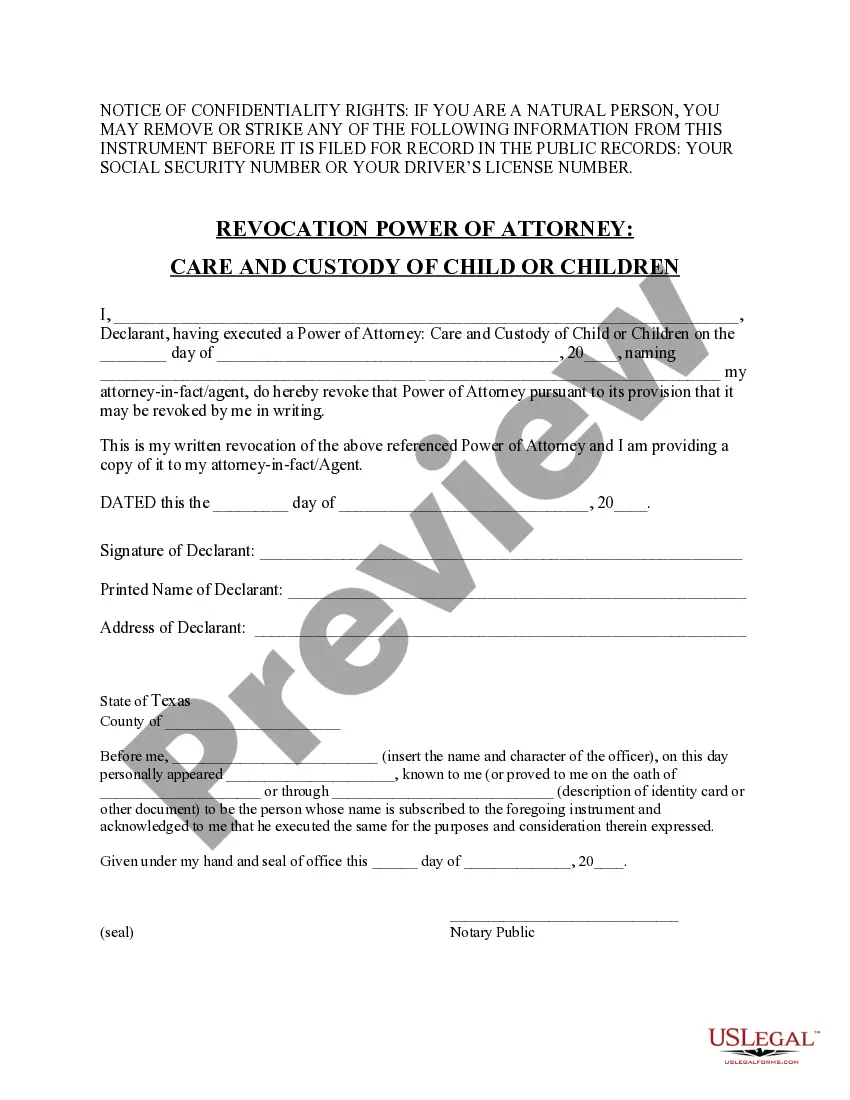

How to fill out Nassau New York Term Royalty Deed For Term Of Existing Lease?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Nassau Term Royalty Deed for Term of Existing Lease, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the recent version of the Nassau Term Royalty Deed for Term of Existing Lease, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Nassau Term Royalty Deed for Term of Existing Lease:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Nassau Term Royalty Deed for Term of Existing Lease and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A royalty interest carved or reserved from the mineral estate is an interest in land, but has no right of use and possession and no right to explore for or produce the mineral estate. Its sole right is to receive royalties once production is established, no more.

A royalty deed is more restrictive than a mineral deed. Another name for a royalty deed is non-participating production interest. In this case, the deed holder has fewer rights and less control over the property below the surface.

Leasehold interest is the share of the mineral estate belonging by contract to a lessor. The leasehold interest owner has the responsibility to pay for exploration, drilling, and production. Any revenue from a well must first pay for royalties before the leasehold interest owner receives any money.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

A conveyance is simply the legal process of transferring certain property or interests from one person to another, or Grantor to Grantee. During the conveyance of the property, oftentimes the person transferring the property, the Grantor, will reserve certain rights attached to the property being conveyed.

A royalty interest is a non-possessory real property interest in oil and gas production free of production and operating expenses, which may be created by grant or by reservation or exception.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

What Is A Royalty Deed? A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.