Collin Texas Deed and Assignment from Trustee to Trust Beneficiaries In Collin, Texas, a Deed and Assignment from Trustee to Trust Beneficiaries is a legal document that transfers ownership of property held in a trust to the beneficiaries of that trust. This process typically occurs when the trust has fulfilled its purpose or upon the death of the trust's creator, also known as the settler. The Collin Texas Deed and Assignment from Trustee to Trust Beneficiaries serves as a vital step in completing the distribution and transfer of assets from the trust to the beneficiaries. It ensures a smooth transition of property ownership while adhering to the legal requirements outlined in the trust agreement. The specifics of a Collin Texas Deed and Assignment from Trustee to Trust Beneficiaries may vary depending on the type of trust involved. Some common types of trusts in Collin, Texas, could include: 1. Revocable Living Trust: This type of trust can be altered or amended during the settler's lifetime and becomes irrevocable upon their death. The Deed and Assignment are executed when the trustee, who manages the trust during the settler's lifetime, assigns the trust assets to the beneficiaries. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked once it is created. Therefore, the Deed and Assignment from Trustee to Trust Beneficiaries are crucial to transferring assets from the trust to the beneficiaries in compliance with the trust's terms. 3. Testamentary Trust: This trust is established through the settler's will and comes into effect upon their death. The Collin Texas Deed and Assignment from Trustee to Trust Beneficiaries would be executed by the trustee after the probate process concludes, ensuring that assets are properly transferred to the beneficiaries according to the trust provisions. Regardless of the specific type of trust, the Collin Texas Deed and Assignment from Trustee to Trust Beneficiaries generally includes details such as the name and address of the trustee, the names and addresses of all beneficiaries, the legal description of the property being transferred, and the terms and conditions of the transfer as stipulated in the trust agreement. Professional legal assistance is recommended when preparing and executing a Collin Texas Deed and Assignment from Trustee to Trust Beneficiaries to ensure compliance with applicable laws and to protect the interests of all parties involved, including the trustee and beneficiaries. In conclusion, a Collin Texas Deed and Assignment from Trustee to Trust Beneficiaries is an essential legal document used to transfer ownership of trust property to the beneficiaries. The specific content and requirements of this documentation may vary depending on the type of trust involved, such as revocable living trusts, irrevocable trusts, or testamentary trusts. Seeking professional guidance during this process is highly advised to ensure a seamless and lawful transfer of assets in Collin, Texas.

Collin Texas Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Collin Texas Deed And Assignment From Trustee To Trust Beneficiaries?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Collin Deed and Assignment from Trustee to Trust Beneficiaries, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Collin Deed and Assignment from Trustee to Trust Beneficiaries from the My Forms tab.

For new users, it's necessary to make several more steps to get the Collin Deed and Assignment from Trustee to Trust Beneficiaries:

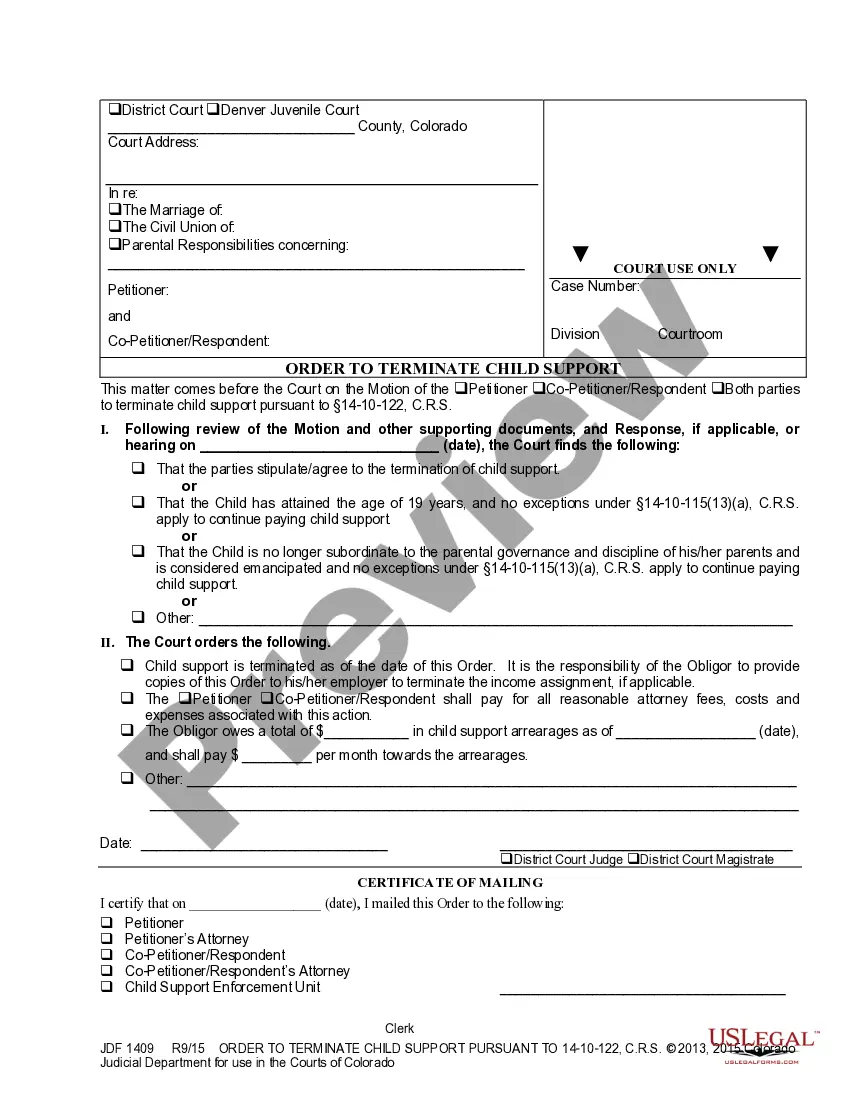

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!