The Nassau New York Executor's Deed of Distribution is a legal document used in estate administration to transfer ownership and distribute assets of a deceased individual among their beneficiaries or heirs. It serves as proof of the executor's authority to oversee the distribution process and ensures a smooth transfer of assets. This deed is specific to Nassau County in New York and must comply with the county's laws and regulations. It outlines the executor's responsibilities and provides detailed instructions on how the assets are to be distributed based on the deceased's will or New York's intestate succession laws if no will exists. Keywords: Nassau New York, Executor's Deed of Distribution, legal document, estate administration, transfer ownership, distribute assets, beneficiaries, heirs, proof of authority, smooth transfer, assets, executor's responsibilities, instructions, deceased, will, intestate succession laws. Different types of Nassau New York Executor's Deed of Distribution may include: 1. Testate Executor's Deed of Distribution: This type of deed is used when the deceased individual left a valid will that outlines how their assets should be distributed. The executor follows the instructions stated in the will and prepares the deed accordingly. 2. Intestate Executor's Deed of Distribution: In cases where the deceased individual did not have a valid will, the assets will be distributed according to New York's intestate succession laws. The executor follows the legal order of inheritance and prepares the deed accordingly. 3. Partial Executor's Deed of Distribution: This type of deed may be used when only a portion of the deceased individual's assets needs to be distributed. For example, if specific bequests were made in the will while the rest of the estate remains undistributed. 4. Final Executor's Deed of Distribution: This type of deed is prepared when all the necessary steps in the estate administration process have been completed, and all assets have been distributed to the beneficiaries. It serves as a final record of the distribution process. 5. Contingent Executor's Deed of Distribution: This type of deed is used when there are contingencies or conditions that need to be met before the distribution of assets can take place. For example, if a beneficiary has to reach a certain age or satisfy specific legal requirements before receiving their share. It is important to consult with a qualified attorney or probate professional in Nassau County, New York, to ensure compliance with local laws and to determine the specific type of Executor's Deed of Distribution applicable to your circumstances.

Nassau New York Executor's Deed of Distribution

Description

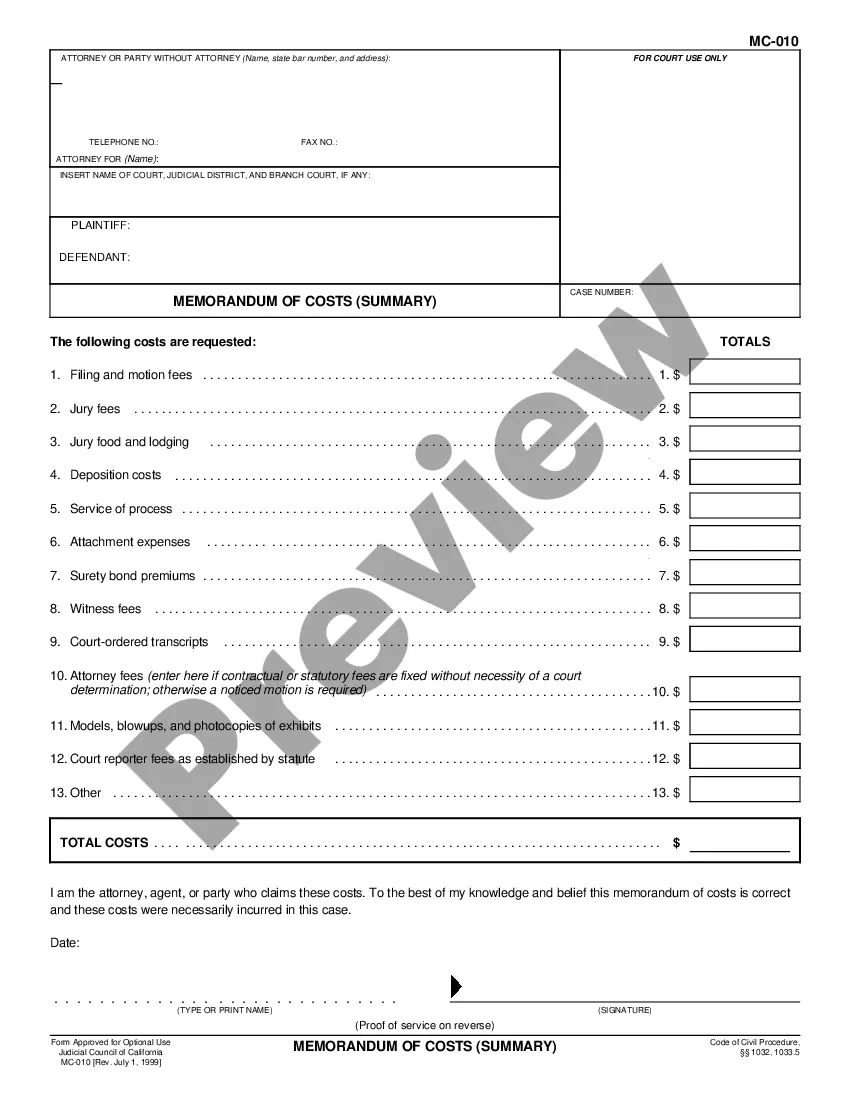

How to fill out Nassau New York Executor's Deed Of Distribution?

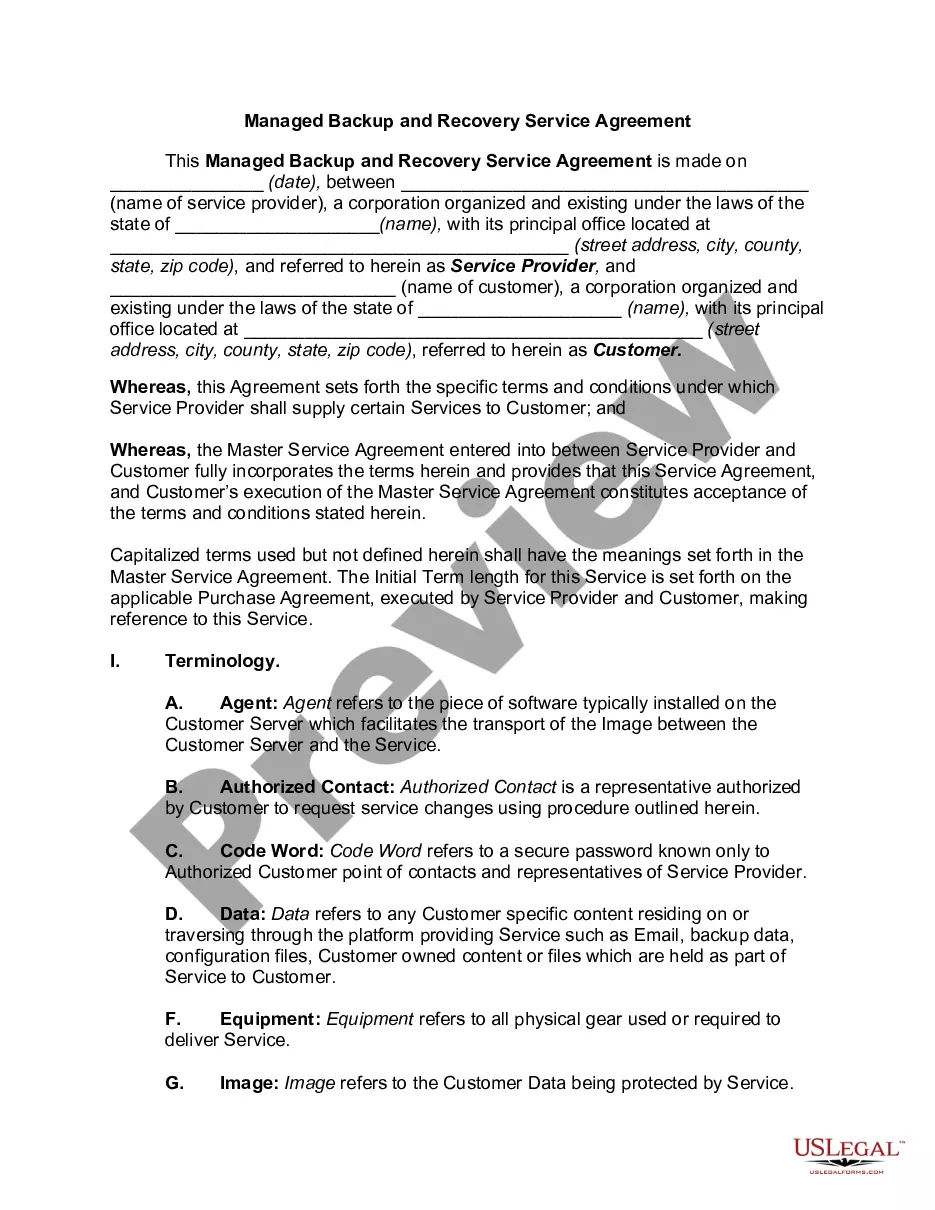

If you need to find a reliable legal document supplier to find the Nassau Executor's Deed of Distribution, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can search from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it easy to get and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to look for or browse Nassau Executor's Deed of Distribution, either by a keyword or by the state/county the form is intended for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Nassau Executor's Deed of Distribution template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less pricey and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate agreement, or execute the Nassau Executor's Deed of Distribution - all from the convenience of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

The final accounting is a summary of accounts filed by the probate executor, showing details of important financial undertakings during the accounting period. This form may not outline all the information, but those records are kept for future use.

Yes. Before the executor distributes the estate, they have to give the beneficiaries a final accounting of their administration of the estate, including any fee they're charging. And the beneficiaries must agree with it for the executor to proceed.

Request an audit of the estate through the probate court. The audit checks into whether any assets have been used frivolously by the executor. Once the audit determines that the executor has acted corruptly, the court will remove that person from the position of executor.

A beneficiary of an estate or a trust has the right to review the actions of the executor or trustee by asking for an accounting. To be prudent, an executor or trustee should provide the beneficiary with updates on the status of the estate or trust.

In New York State, an estate should remain open for seven months before distributions are made. After this seven month period, the executor may be able to start making distributions to the beneficiaries, if all expenses and taxes are paid.

An executor may decide to send a copy of the will to family members or close friends and allow them to read its contents, and usually, there is little reason not to disclose the contents of a will. However, strictly speaking, an executor does not have to do this.

How Long to Settle an Estate in New York? The short answer: from 7 months to 3 years. Typically 9 months. Estate settlement (also known as estate administration) is the phase during which you, as the court-appointed executor, must collect the estate assets, organize and pays debts, and file all final taxes.

An executor must account to the residuary beneficiaries named in the Will (and sometimes to others) for all the assets of the estate, including all receipts and disbursements occurring over the course of administration.

The asset distribution to the descendants of a deceased owner of an estate is determined during the estate planning process. In this process, the owner of the estate identifies all their heirs who are due to receive a portion of the inheritance. The owner lists all the assets that he/she owns.

How Long to Settle an Estate in New York? The short answer: from 7 months to 3 years. Typically 9 months. Estate settlement (also known as estate administration) is the phase during which you, as the court-appointed executor, must collect the estate assets, organize and pays debts, and file all final taxes.