A Wake North Carolina Gift Deed is a legally binding document used to transfer ownership of real estate in Wake County, North Carolina, as a gift. In this transaction, the current owner, also known as the donor, relinquishes their ownership rights and transfers the property to the recipient, known as the done, without receiving any consideration or payment in return. Gift Deeds are commonly used when gifting real estate to family members, friends, or charitable organizations. These deeds must meet all the legal requirements set forth by the state of North Carolina and Wake County to ensure a valid transfer of property. Some relevant keywords associated with Wake North Carolina Gift Deeds include: 1. Real Estate Transfer: A Wake North Carolina Gift Deed facilitates the legal transfer of real estate from the donor to the done as a gift. 2. Property Ownership: The Gift Deed transfers full ownership rights and interest in the property to the done, allowing them to assume complete control and responsibility. 3. Donor: The current owner of the property who voluntarily gifts their real estate without any expectations of payment or compensation. 4. Done: The recipient of the gifted property who gains full ownership and control over the real estate. 5. Consideration: Unlike traditional property transactions, Gift Deeds do not involve any monetary consideration or payment. 6. Charitable Gift Deed: This type of Gift Deed is commonly used to transfer real estate to charitable organizations or non-profit entities. 7. Family Gift Deed: These Gift Deeds are employed when gifting property within the family, such as parents transferring ownership to their children. 8. Legal Requirements: Wake North Carolina Gift Deeds must adhere to specific legal guidelines and requirements outlined by state laws and Wake County regulations to ensure a valid transfer. 9. Document Preparation: Gift Deeds require accurate and detailed documentation, including property details, signatures of the donor and done, witnesses, and notarization. 10. Tax Implications: It is essential to consider potential tax implications associated with Gift Deeds, such as gift tax or property tax exemptions, and consult with legal and tax professionals for guidance. Overall, a Wake North Carolina Gift Deed is an essential legal document used to gift real estate property without any monetary consideration. It enables the transfer of ownership to the recipient while adhering to state and county legal requirements. Whether it is a charitable or family gift deed, ensuring proper documentation and compliance is crucial to a smooth and valid transfer of property ownership.

Wake North Carolina Gift Deed

Description

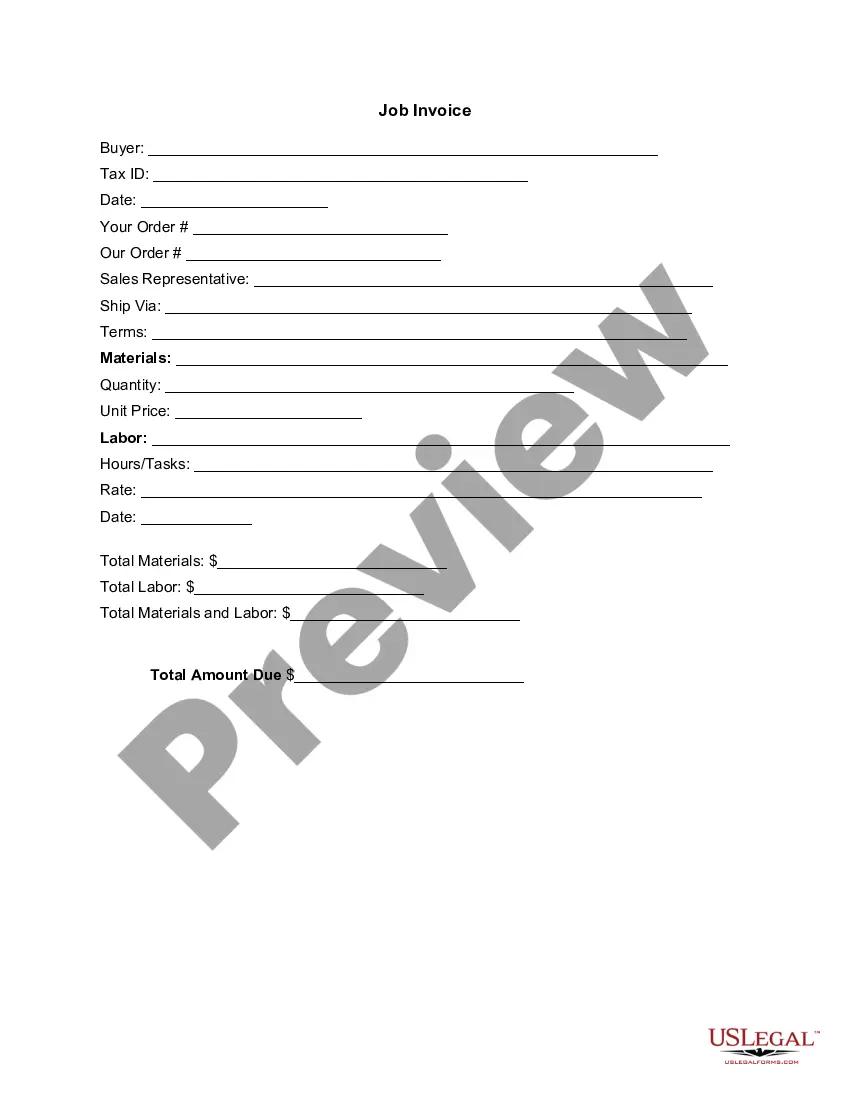

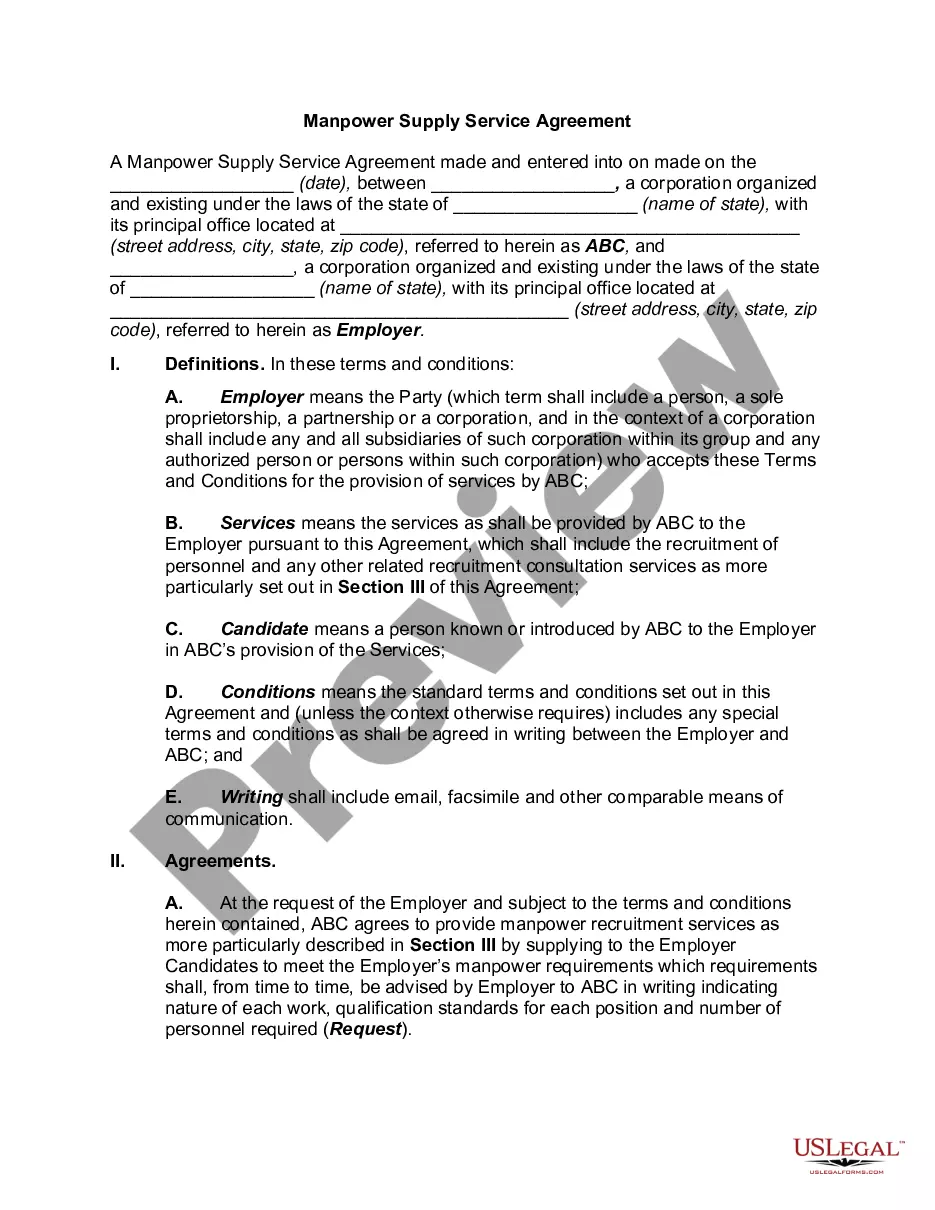

How to fill out Wake North Carolina Gift Deed?

Preparing documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Wake Gift Deed without professional help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Wake Gift Deed by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Wake Gift Deed:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

Gifting property to family members with deed of gift Despite the amounts involved, it is possible to transfer ownership of your property without money changing hands. This process can either be called a deed of gift or transfer of gift, both definitions mean the same thing.

There typically will be a fee to file the quitclaim deed. In Wake County, North Carolina, as of 2019, the fee is $64 for the first 35 pages of the quitclaim deed and $4 for each additional page. Since most quitclaim deeds are much less than 35 pages, the fee in Wake County typically will be $64.

A Gift Deed is a legal document that describes voluntary transfer of gift from donor (owner of property) to donee (receiver of gift) without any exchange of money. The donor must be solvent and should not use this tool for tax evasion and illegal gains.

What Are the Steps to Transfer a Deed Yourself? Retrieve your original deed.Get the appropriate deed form.Draft the deed.Sign the deed before a notary.Record the deed with the county recorder.Obtain the new original deed.

North Carolina Gift Deed Information. A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends.

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

A quitclaim deed is likely the fastest, easiest, and most convenient way to transfer your ownership interest in a property or asset to a family member. Unlike other kinds of deeds, such as general and special warranty deeds, quitclaim deeds make no warranties or promises about what is being transferred.