A Franklin Ohio Partition Deed for Mineral/Royalty Interests is a legal document that pertains to the division or distribution of mineral or royalty interests among multiple owners or stakeholders in Franklin, Ohio. This deed serves to resolve potential disputes or disagreements regarding the ownership or rights associated with these interests. The Partition Deed, specific to Franklin, Ohio, is structured to cater to the unique laws and regulations governing mineral and royalty interests in this location. It ensures a fair and equitable division of these interests, taking into account factors such as property boundaries, ownership percentages, and potential extraction or production activity in the area. There are different types of Franklin Ohio Partition Deeds for Mineral/Royalty Interests, which include: 1. "Partition Deed for Mineral Interests" — This document specifically addresses the partition of mineral interests among multiple owners. It outlines how the rights to extract, lease, or profit from the minerals will be distributed, ensuring each party's fair share. 2. "Partition Deed for Royalty Interests" — This type of deed focuses on the division of royalty interests among various stakeholders. It outlines the distribution of financial benefits derived from the extraction or production of minerals, such as oil, gas, or other valuable substances. 3. "Combined Partition Deed for Mineral and Royalty Interests" — In some cases, the partition of both mineral and royalty interests may be required. This comprehensive deed encompasses the division of rights to both the resources themselves and the resulting financial compensation. The Franklin Ohio Partition Deed for Mineral/Royalty Interests is a crucial legal instrument in protecting the rights and interests of various parties involved in mineral or royalty ownership. It ensures transparency and fairness in the distribution of these assets, acting as a crucial document in resolving disputes and facilitating efficient resource management.

Franklin Ohio Partition Deed for Mineral / Royalty Interests

Description

How to fill out Franklin Ohio Partition Deed For Mineral / Royalty Interests?

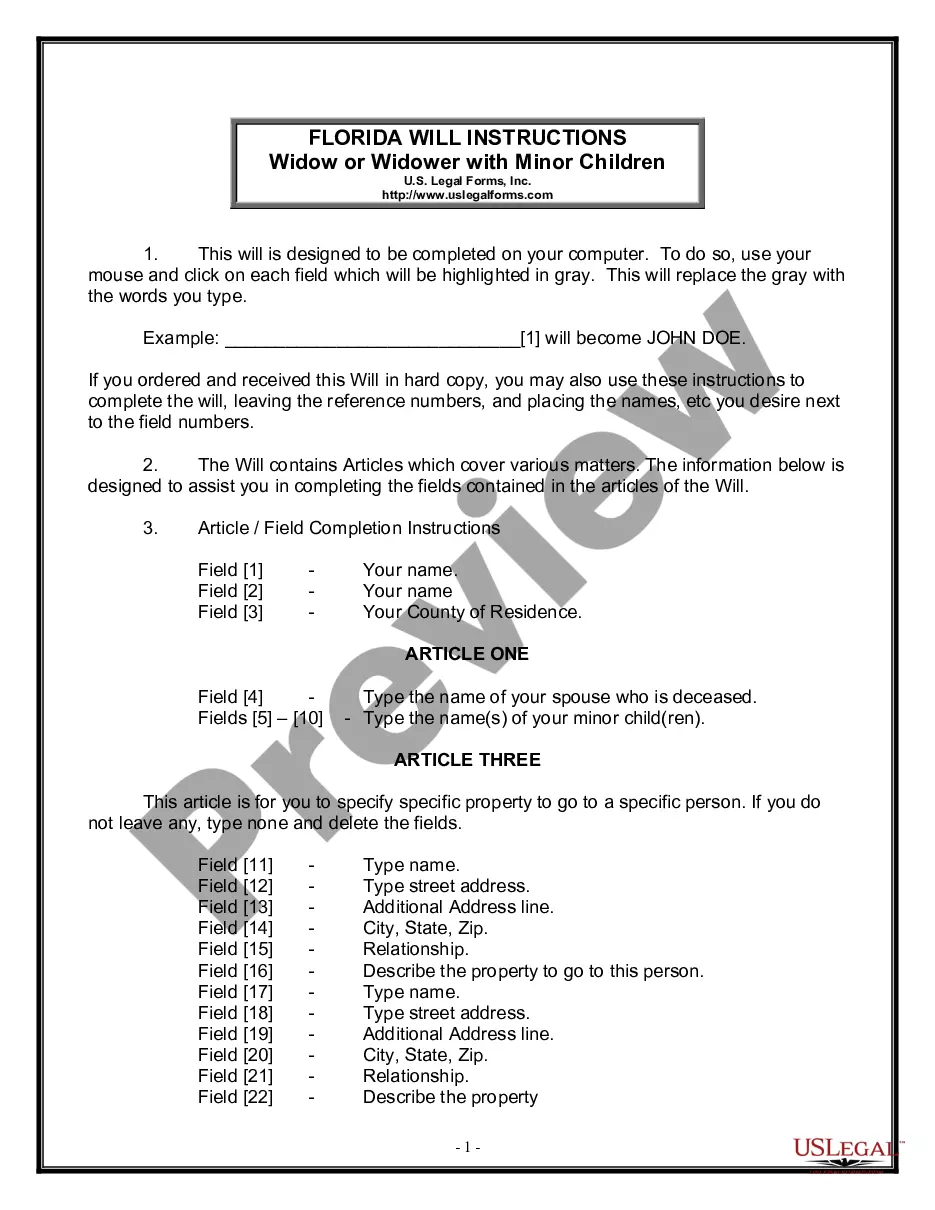

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Franklin Partition Deed for Mineral / Royalty Interests, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any activities associated with document completion straightforward.

Here's how to find and download Franklin Partition Deed for Mineral / Royalty Interests.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Examine the similar forms or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Franklin Partition Deed for Mineral / Royalty Interests.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Franklin Partition Deed for Mineral / Royalty Interests, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you need to deal with an extremely difficult situation, we recommend using the services of an attorney to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant documents with ease!

Form popularity

FAQ

Mineral rights do not necessarily transfer with the property. Typically, a property conveyance (sale) transfers the rights of both the surface land and the minerals underneath until the mineral rights are sold. Mineral rights are conveyed meaning transferred to a new owner through a deed.

Where do you purchase mineral rights? There are multiple ways to buy minerals, the most common being at auction, from brokers, by negotiated sale, tax sales, and directly from mineral owners. The process of buying minerals varies depending on where you buy them.

How can I find out if I own or control my mineral rights? The deed to your property should state whether subsurface ownership has been severed from the surface. Your county office of Recorder of Deeds will also have information about ownership of mineral rights.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

How much are mineral rights worth per acre in PA? Mineral rights can be sold in any Pennsylvania county for anything from $500/acre to $5,000+/acre. Isn't that a pretty wide range? The reason for such a range is because the ranges depend on where you are located in Pennsylvania.

A royalty company serves as a specialized financier that helps fund exploration and production projects for cash-strapped mining companies. In return, it receives royalties on whatever the project produces, or rights to a stream, an agreed-upon amount of gold, silver or other precious metal.

If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

Mineral rights have sold for as high as $40,000 per acre, and usually, the average price can be between $250 and $9,000. If mineral rights buyers and sellers conduct proper due diligence, both parties can negotiate the best mining rights deal and avoid future legal quagmires.

Remember, the property and the mineral rights are two separate entities. You may have inherited the mineral rights, but you need to know who owns the property if you want to drill. The opposite scenario is to check who owns the mineral rights on the property you inherited.

How to transfer mineral rights in Pennsylvania? A copy of the deed for the site must be obtained from a local courthouse in Pennsylvania by the new owner. Verify that the deed matches the description and that the so-called mineral rights are included in the property deed.