Chicago Illinois Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties In Chicago, Illinois, a Trustee's Deed and Assignment for Distribution of Trust is a legal document used to transfer ownership of oil and gas properties held within a trust. This deed is executed by the trustee of the trust, who acts as the authorized representative of the trust's beneficiaries. The Trustee's Deed and Assignment for Distribution of Trust serves as an instrument to convey the rights, interests, and title to oil and gas properties from the trust to designated beneficiaries. It outlines the specific details of the properties being transferred, including legal descriptions, parcel numbers, and any relevant encumbrances or liens. Keywords: Chicago Illinois, Trustee's Deed, Assignment for Distribution, Trust, Oil properties, Gas properties, legal document, ownership transfer, trustee, beneficiaries, rights, interests, title, legal description, parcel number, encumbrances, liens. Types of Chicago Illinois Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties: 1. Conveyance Deed: This type of Trustee's Deed and Assignment is the most common, typically used when the trust beneficiaries are receiving the entire ownership and control of the oil and gas properties. It transfers the properties from the trust to the beneficiaries outright, without any restrictions or conditions. 2. Partial Assignment: In some cases, a trust may choose to distribute partial ownership of oil and gas properties to multiple beneficiaries. A Partial Assignment Trustee's Deed and Assignment specifies the percentage or share of ownership being transferred to each designated beneficiary. This document ensures a fair distribution of rights and interests among the beneficiaries. 3. Conditional Assignment: When certain conditions or restrictions are placed on the distribution of trust assets, such as time limitations or performance-based criteria, a Conditional Assignment Trustee's Deed and Assignment is utilized. This type of deed ensures that the beneficiaries meet the specified conditions before obtaining complete ownership of the oil and gas properties. 4. Trustee to Trustee Assignment: In situations where a trust is transferring oil and gas properties from one trust to another, a Trustee to Trustee Assignment Deed is executed. This allows for the seamless transfer of assets between trusts, ensuring continuity and protection of the beneficiaries' interests. By employing the appropriate Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties, Chicago residents can ensure a smooth and legally compliant transfer of ownership rights, interests, and title from a trust to the beneficiaries or other trusts involved. It is essential to consult with legal professionals well-versed in real estate and trust laws to facilitate these important transactions accurately.

Chicago Illinois Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties

Description

How to fill out Chicago Illinois Trustee's Deed And Assignment For Distribution Of Trust, Oil And Gas Properties?

Drafting documents for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Chicago Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties without expert help.

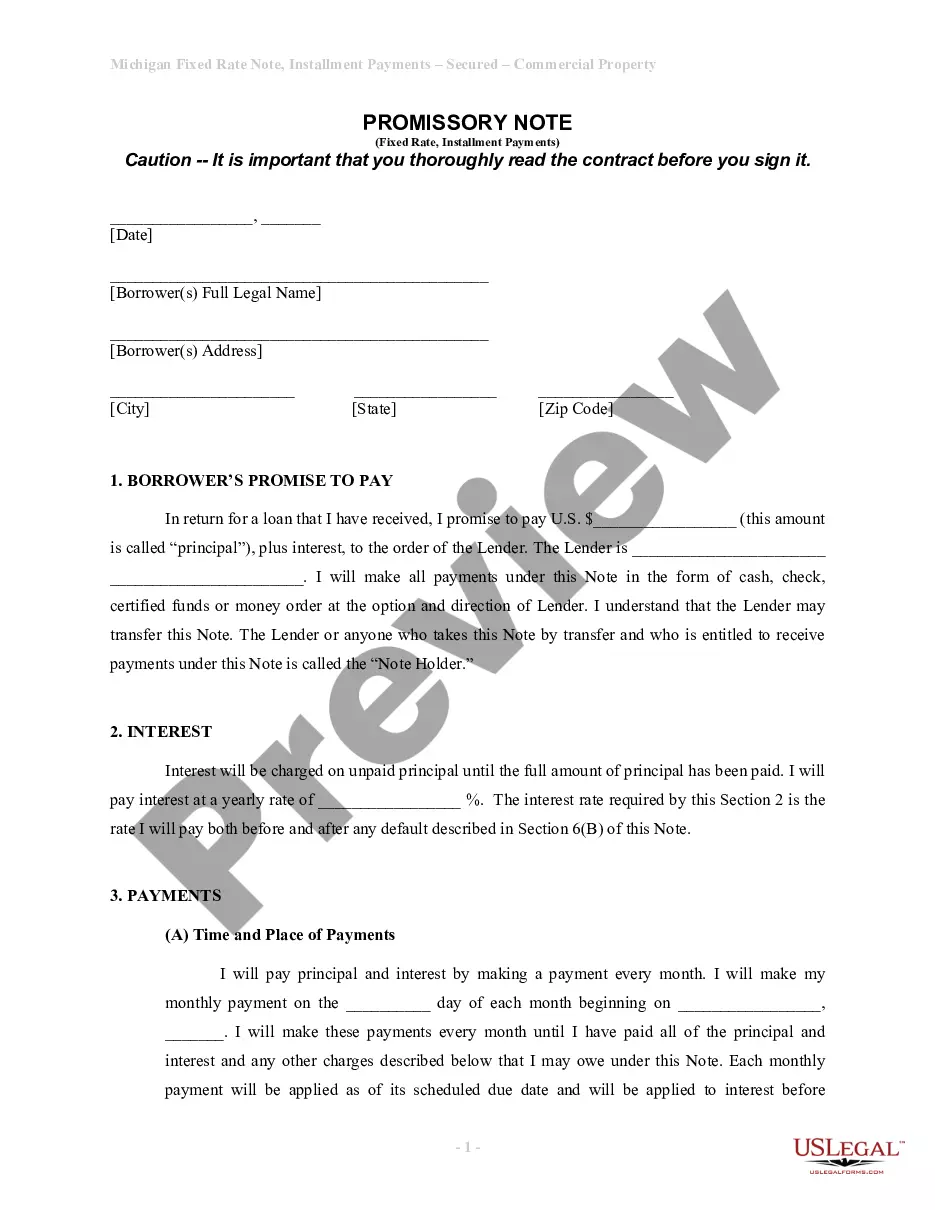

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Chicago Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Chicago Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

Mechanism of Transfer Real estate is transferred through the execution of the appropriate deed transferring the real estate property to the Trust. You or your attorney must then record the deed with the Recorder of Deeds for your county.

There is no definite timeframe stated in our statutes. But the reasonableness standard still mandates a distribution be made timely. In fact, a Trust that has no issues, and only cash, may be reasonably distributed within four or five months of the settlor's death, not two years.

After property is placed in a land trust and legal title is passed to the corporate trustee, the identity of the true owner of the property is essentially hidden. That's because the Deed in Trust on record with the county indicates that the property is owned by the land trust instead of in the individual's name.

Beneficiary notifications. Trustees will be required to notify each qualified beneficiary of the trust's existence within 90 days of a trust becoming irrevocable, as well as whether or not the beneficiary may request trust accountings.

Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

A trust deed is used in place of a mortgage. A person (the lendee) buys a home and finances it through a bank (the lender). A third party?the trustee, usually an escrow company?legally holds title to the home for the lender as security against the loan.

Beneficiaries have the right to receive certain information about the trust. The trustee needs to provide beneficiaries with an annual accounting describing payments and income of the trust. This requirement is waived only if the trust document says so or if the beneficiary declines to receive the accounting.

A trustee does not need beneficiary approval to sell trust property. However, a trustee who wants to avoid litigation would be wise to at least seek approval of the trust beneficiaries, and, at a minimum, be able to substantiate why the property was sold and how that sale benefited the trust beneficiaries.