Harris Texas Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties is a legal document that outlines the transfer of ownership of oil and gas properties held in a trust. This deed is commonly used in Harris County, Texas, and is governed by specific laws and regulations. In the context of trust and estate planning, a trustee is appointed to manage and distribute assets held in a trust to the beneficiaries. This includes real estate properties, including oil and gas assets. When it comes to such assets, a Trustee's Deed and Assignment is used to document the transfer of these properties from the trust to the beneficiaries. There are different types of Harris Texas Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties, depending on the specific details and circumstances of the trust. Some variations of the deed may include: 1. General Trustee's Deed and Assignment: This document is used for the general transfer of oil and gas properties from the trust to the beneficiaries. It outlines the legal description of the properties, the names of the parties involved, and any conditions or terms of the transfer. 2. Special Warranty Trustee's Deed and Assignment: This type of deed provides specific warranties from the trustee regarding the transfer of the properties. It assures the beneficiaries that the trustee has taken necessary measures to protect the property rights during their ownership. 3. Quitclaim Trustee's Deed and Assignment: This deed releases any claim or interest the trustee may have in the oil and gas properties, providing a transfer without any further warranties or assurances. 4. Trustee's Deed and Assignment for Specific Trust Purposes: In some cases, trusts may have specific purposes or conditions attached to the distribution of oil and gas properties. This type of deed is customized to include these specific provisions and fulfill the unique requirements of the trust. When executing a Harris Texas Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties, it is important to follow the specific legal guidelines and consult with experienced legal professionals familiar with trust and estate laws in Harris County, Texas.

Harris Texas Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties

Description

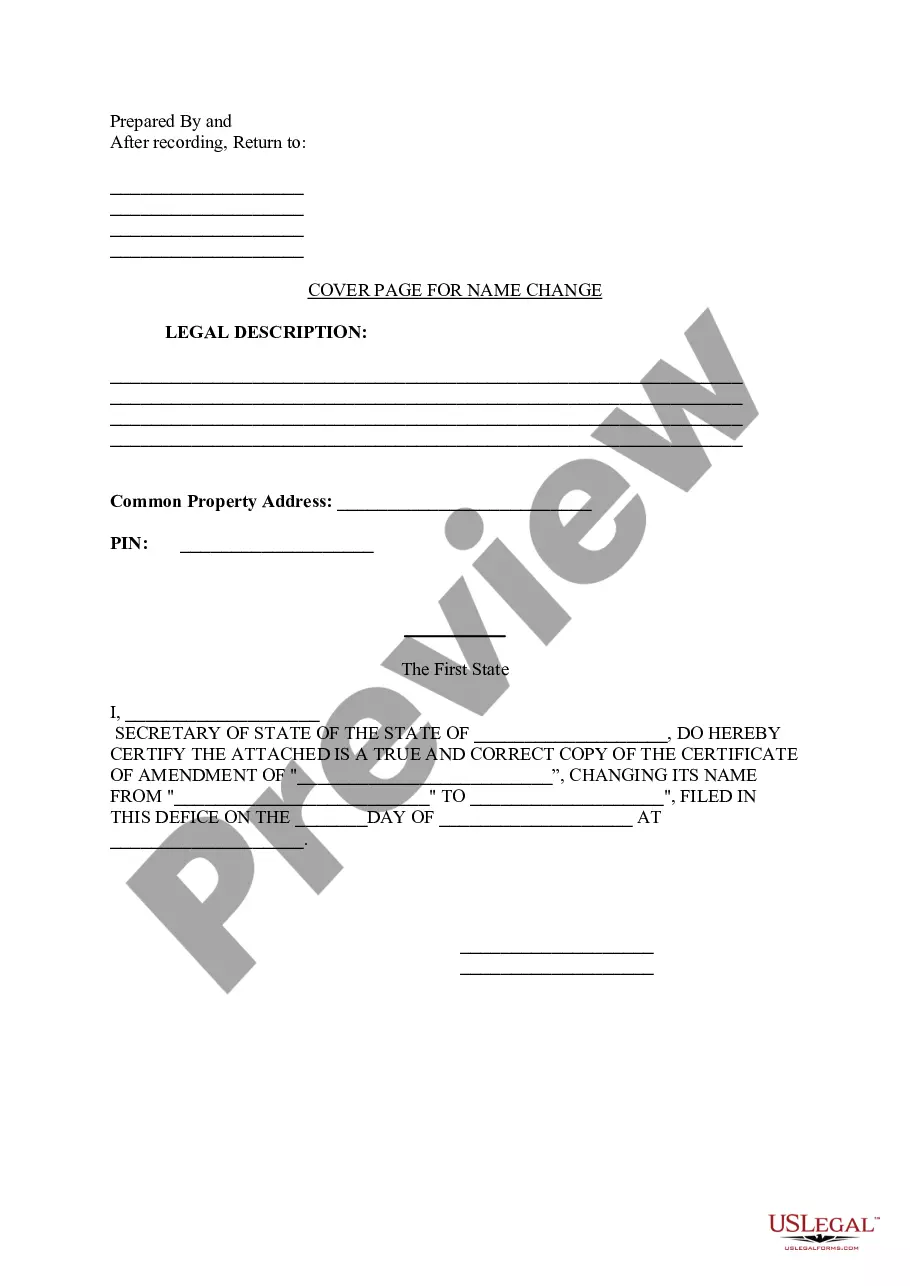

How to fill out Harris Texas Trustee's Deed And Assignment For Distribution Of Trust, Oil And Gas Properties?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Harris Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Harris Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Harris Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A PCOR Must Be Submitted With Every Deed In California In California and almost every state you are essentially informing them it is a transfer to your revocable living trust and thus exempt from reassessment.

A trust can give your chosen charity long-term benefits through tax effective income from your estate, such as through a scholarship or medical research. These trusts assist families to make financial provision for the current and future needs of a family member with a severe disability.

A trustee's deed is often used, for example, by a trustee in bankruptcy to sell real property of the debtor. The deed must describe the real property, name the party transferring the property (grantor), the party receiving the property (grantee) and be signed and notarized by the grantor.

The PCOR must be filed at the time of recording and attached to the recording ownership transfer document. Otherwise, the buyer will incur a $20.00 fee. The PCOR is filed with the county recorder's office. It is a private document, which means it isn't available for public inspection.

The PCOR must be completed, signed and filed with any conveyance document except for Easements, Trustee's Deeds Upon Sale, Deeds in Lieu of Foreclosure and Affidavits of Death (when the decedent is a beneficiary under a Deed of Trust).

A trustee deedsometimes called a deed of trust or a trust deedis a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage.

A new owner fills out, dates, and signs the PCOR. It does NOT need to be notarized. Describe the property being transferred, and any included personal property or manufactured homes.

Transferring Texas real estate usually involves four steps: Find the most recent deed to the property.Create a new deed.Sign and notarize the deed.File the documents in the county land records.

The purpose of this form is to notify the county assessor that there has been a change in ownership of a real property. It's also to notify the county assessor that you may qualify for a tax exclusion.

A trustee deedsometimes called a deed of trust or a trust deedis a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage.