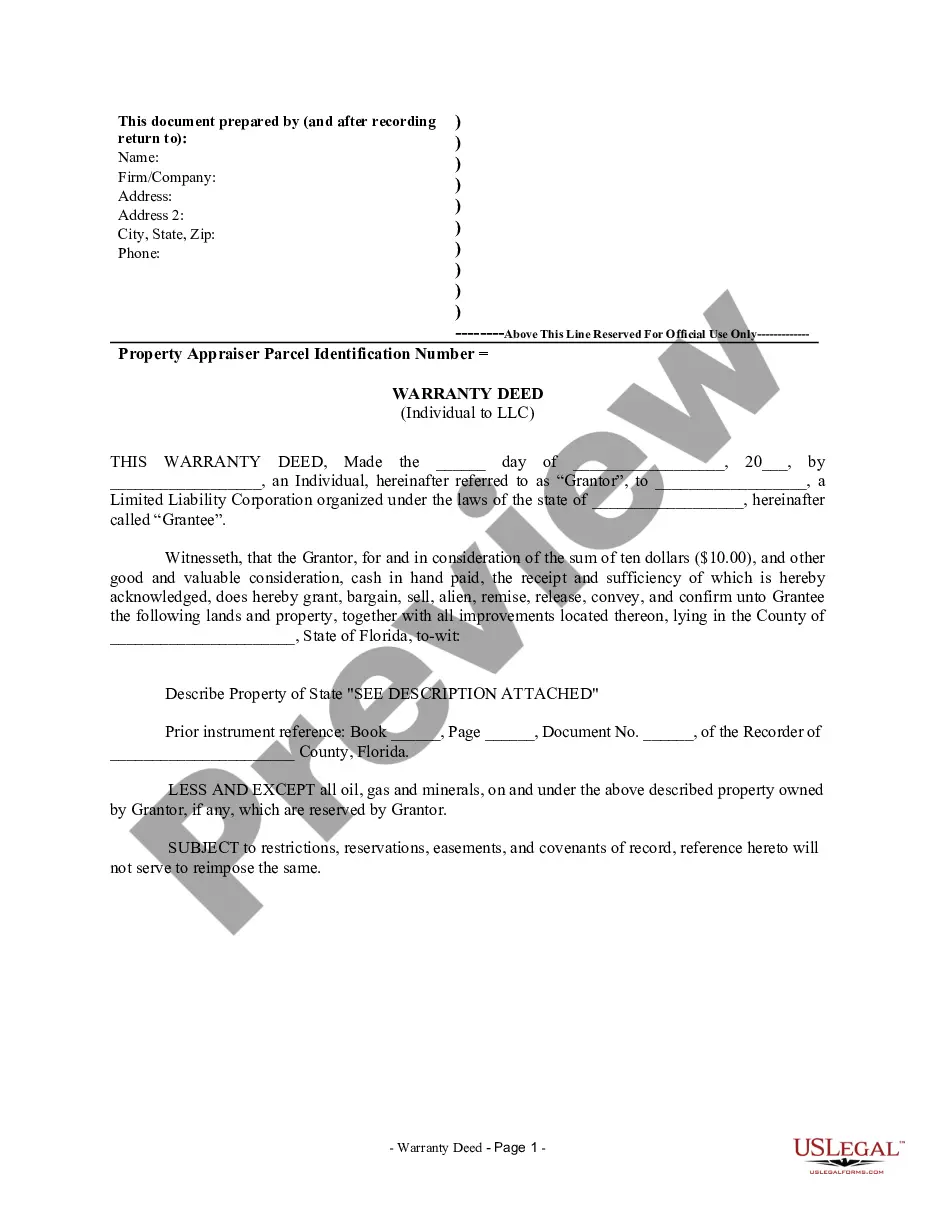

A San Diego California Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries is a legal document that outlines the transfer of property and assets from a trust to the beneficiaries of a testamentary trust in San Diego, California. This type of deed is specifically designed for situations where property or assets are held in a trust and need to be distributed to beneficiaries according to the terms of a will or trust agreement. There are different variations of Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries that can be used in San Diego, California, depending on the specific circumstances and legal requirements. Some common types include: 1. Trustee's Deed and Assignment for Distribution of Real Property: This type of deed is used when the trust holds real estate property that needs to be transferred to the designated beneficiaries. It outlines the legal process of transferring ownership from the trust to the beneficiaries. 2. Trustee's Deed and Assignment for Distribution of Financial Assets: If the trust contains financial assets such as bank accounts, stocks, or bonds, this type of deed is used. It specifies how the trustee will distribute these assets to the testamentary trust beneficiaries. 3. Trustee's Deed and Assignment for Distribution of Personal Property: Personal property, such as vehicles, artwork, or jewelry, held within the trust can be transferred to beneficiaries through this type of deed. It ensures a lawful transfer of personal belongings to the testamentary trust beneficiaries. 4. Trustee's Deed and Assignment for Distribution of Business Interests: In cases where the trust holds ownership interests in a business or company, this type of deed is required. It outlines the process of transferring ownership and management control of the business to the designated beneficiaries. Regardless of the specific type, a San Diego California Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries is an important legal document that ensures the proper distribution of assets to beneficiaries as per the wishes of the trust or. It should be prepared and executed in compliance with the relevant California probate laws and regulations.

A San Diego California Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries is a legal document that outlines the transfer of property and assets from a trust to the beneficiaries of a testamentary trust in San Diego, California. This type of deed is specifically designed for situations where property or assets are held in a trust and need to be distributed to beneficiaries according to the terms of a will or trust agreement. There are different variations of Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries that can be used in San Diego, California, depending on the specific circumstances and legal requirements. Some common types include: 1. Trustee's Deed and Assignment for Distribution of Real Property: This type of deed is used when the trust holds real estate property that needs to be transferred to the designated beneficiaries. It outlines the legal process of transferring ownership from the trust to the beneficiaries. 2. Trustee's Deed and Assignment for Distribution of Financial Assets: If the trust contains financial assets such as bank accounts, stocks, or bonds, this type of deed is used. It specifies how the trustee will distribute these assets to the testamentary trust beneficiaries. 3. Trustee's Deed and Assignment for Distribution of Personal Property: Personal property, such as vehicles, artwork, or jewelry, held within the trust can be transferred to beneficiaries through this type of deed. It ensures a lawful transfer of personal belongings to the testamentary trust beneficiaries. 4. Trustee's Deed and Assignment for Distribution of Business Interests: In cases where the trust holds ownership interests in a business or company, this type of deed is required. It outlines the process of transferring ownership and management control of the business to the designated beneficiaries. Regardless of the specific type, a San Diego California Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries is an important legal document that ensures the proper distribution of assets to beneficiaries as per the wishes of the trust or. It should be prepared and executed in compliance with the relevant California probate laws and regulations.