A Collin Texas Mineral Deed with Granter Reserving Executive Rights in the Interest Conveyed — Transfer is an important legal document used in the transfer of mineral rights in the Collin County, Texas area. This detailed description will explain the key aspects of this type of deed and provide insights into its different variations. In a Collin Texas Mineral Deed with Granter Reserving Executive Rights in the Interest Conveyed — Transfer, thgranteror (the current owner of the mineral rights) transfers the interest in the minerals to the grantee (the recipient) while reserving the executive rights. The executive rights refer to the authority and control over the rights, such as the ability to lease, negotiate contracts, and receive bonus and royalty payments. The primary purpose of this type of deed is to establish the transfer of mineral rights while allowing the granter to retain control over the management and decision-making associated with those rights. This means that the grantee will have ownership and the right to benefit from the mineral rights, but the granter retains the power to negotiate leases, sign agreements, and receive compensation. It is crucial to understand that there can be different variations of a Collin Texas Mineral Deed with Granter Reserving Executive Rights in the Interest Conveyed — Transfer, depending on the specific terms and conditions agreed upon by the parties involved. Some variations may include the duration or scope of the executive rights reserved by the granter, the transfer of specific mineral interests or divisions, or the inclusion of additional provisions to protect the interests of both parties. By utilizing keywords related to this topic, one can create valuable content that provides further clarity. Some relevant keywords include: — Collin County, Texas mineraDeeee— - Mineral rights transfer — Executive rights reservation in mineral deed — Collin Texas mineral rights conveyance — Types of Collin Texas mineral deed variations Overall, a Collin Texas Mineral Deed with Granter Reserving Executive Rights in the Interest Conveyed — Transfer is a legal instrument that allows for the transfer of mineral rights while granting the granter control over the management and decision-making of those rights. Understanding the nuances and different variations of these deeds is vital for individuals engaged in mineral rights transactions in Collin County, Texas.

Collin Texas Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

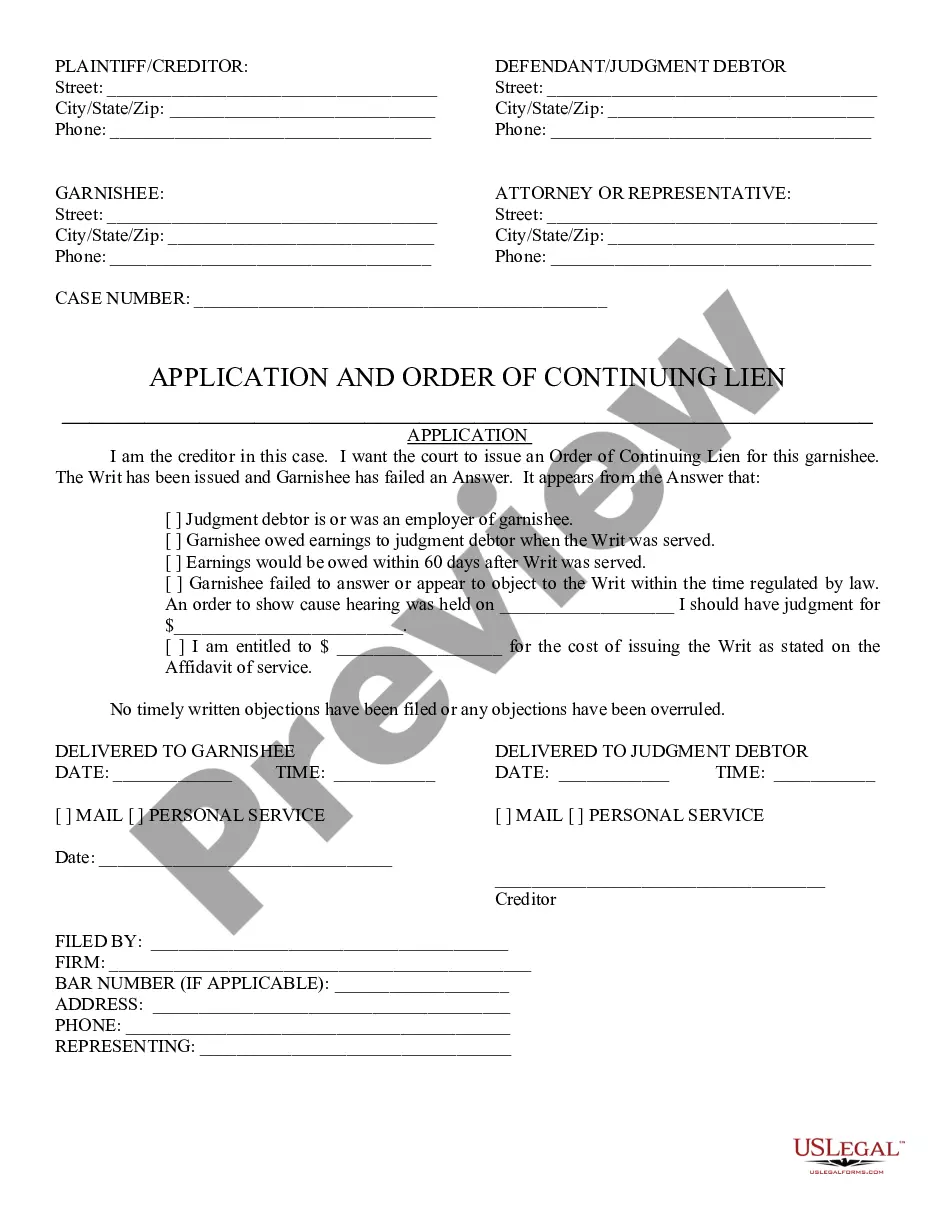

How to fill out Collin Texas Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

Creating paperwork, like Collin Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer, to manage your legal affairs is a tough and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for different cases and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Collin Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Collin Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Collin Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our service and get the document.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

As a general rule of thumb, you can expect to sell mineral rights in Texas for 4 years to 6 years times the average monthly income.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Texas mineral rights are even written in the state's constitutions of 1869 and 1876. Under current Texas law, mineral rights can be severed from the surface rights and sold and transferred as a separate unit.

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.

Oklahoma law allows for certain mineral interests to be transferred by filing an affidavit in the county real estate records.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Remember, the property and the mineral rights are two separate entities. You may have inherited the mineral rights, but you need to know who owns the property if you want to drill. The opposite scenario is to check who owns the mineral rights on the property you inherited.