Orange California Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

How to fill out Orange California Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Orange Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Orange Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Orange Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer:

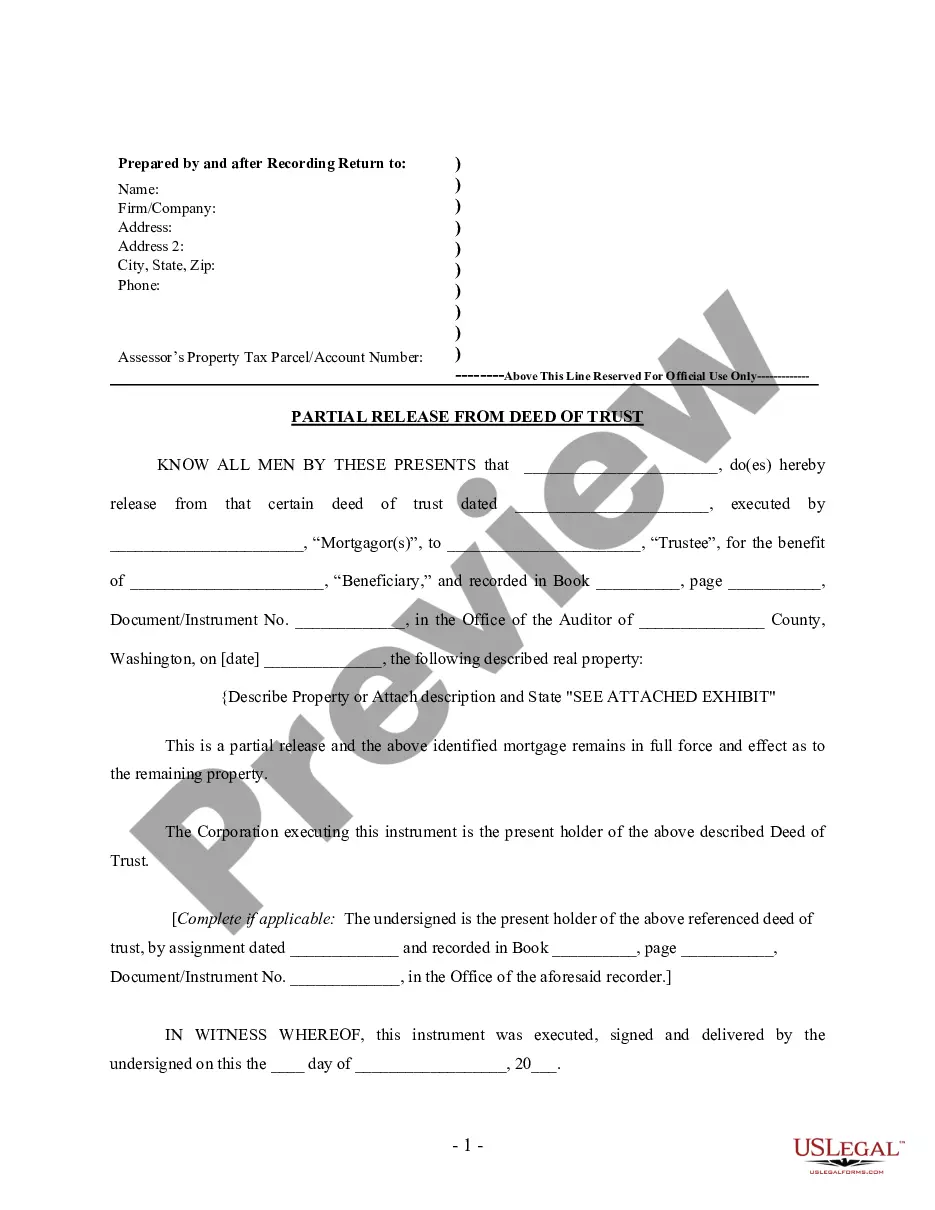

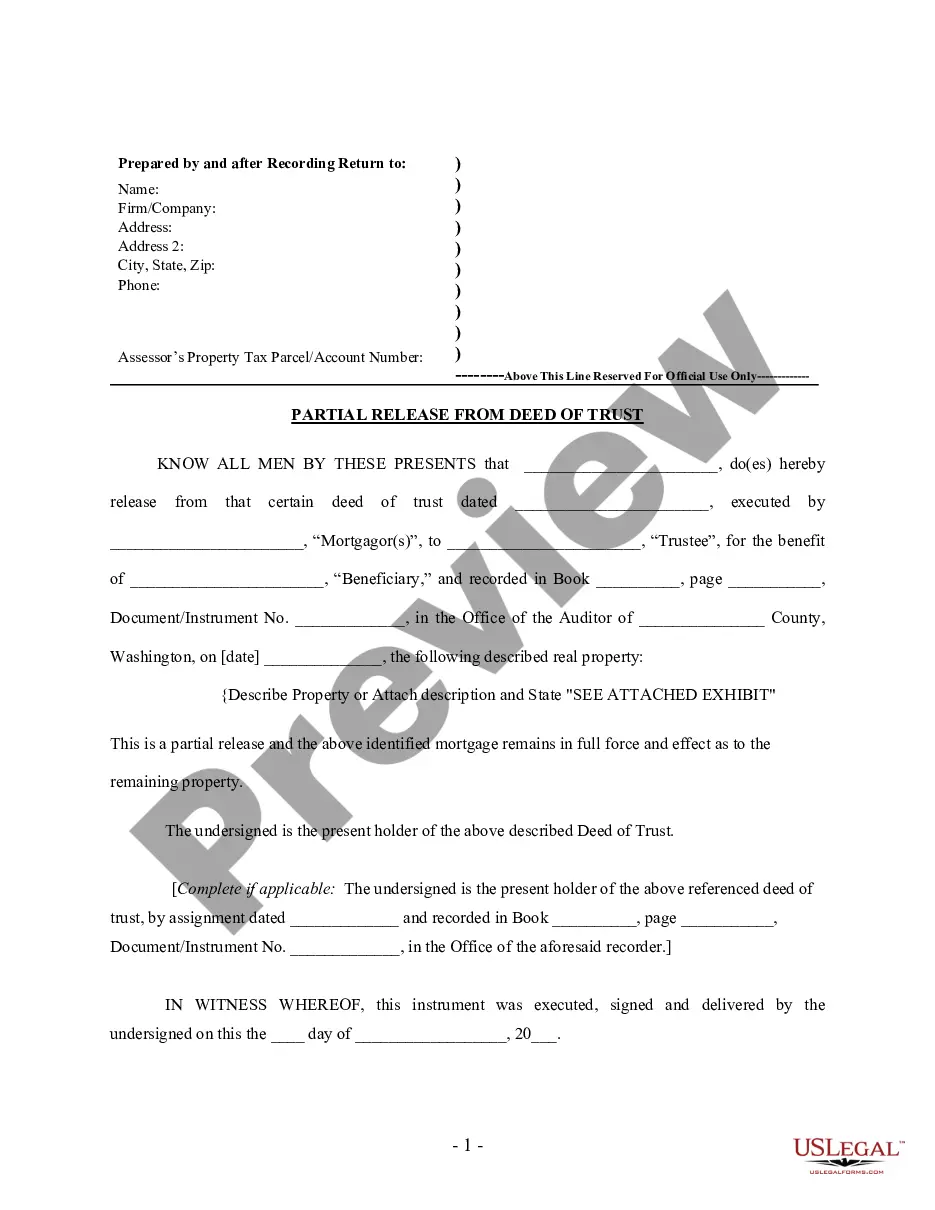

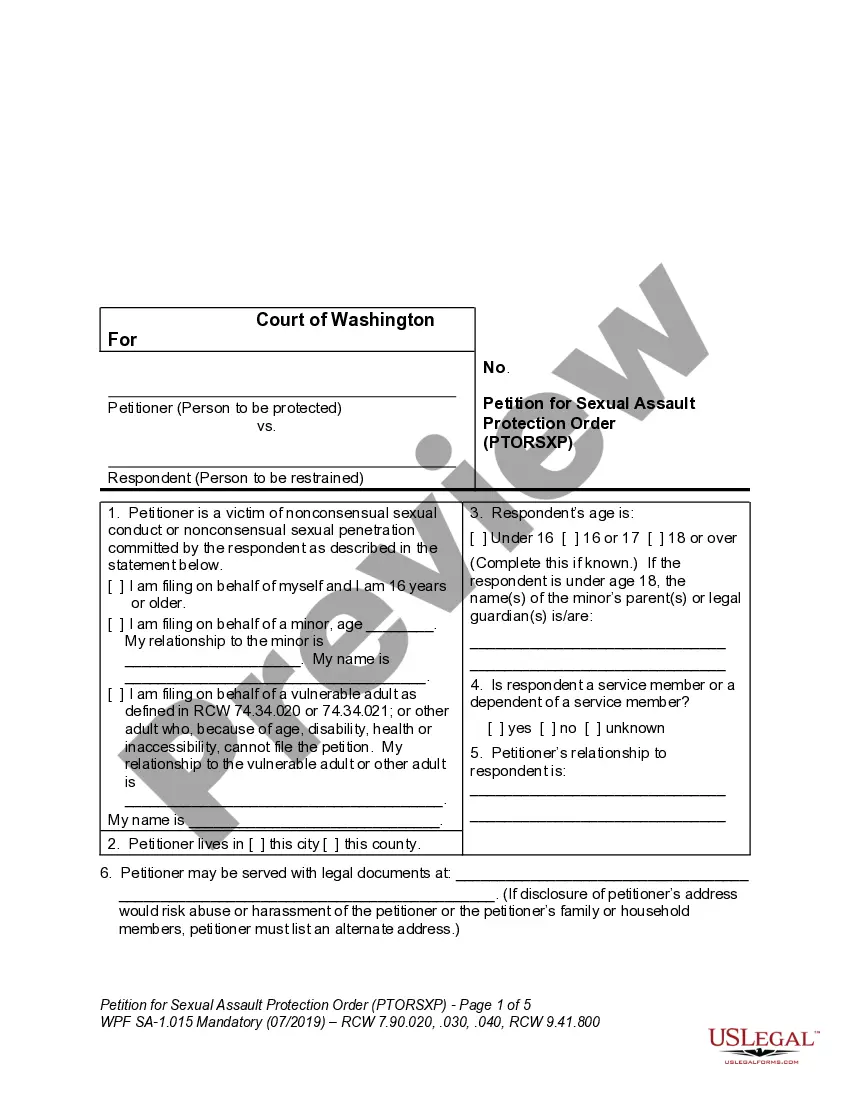

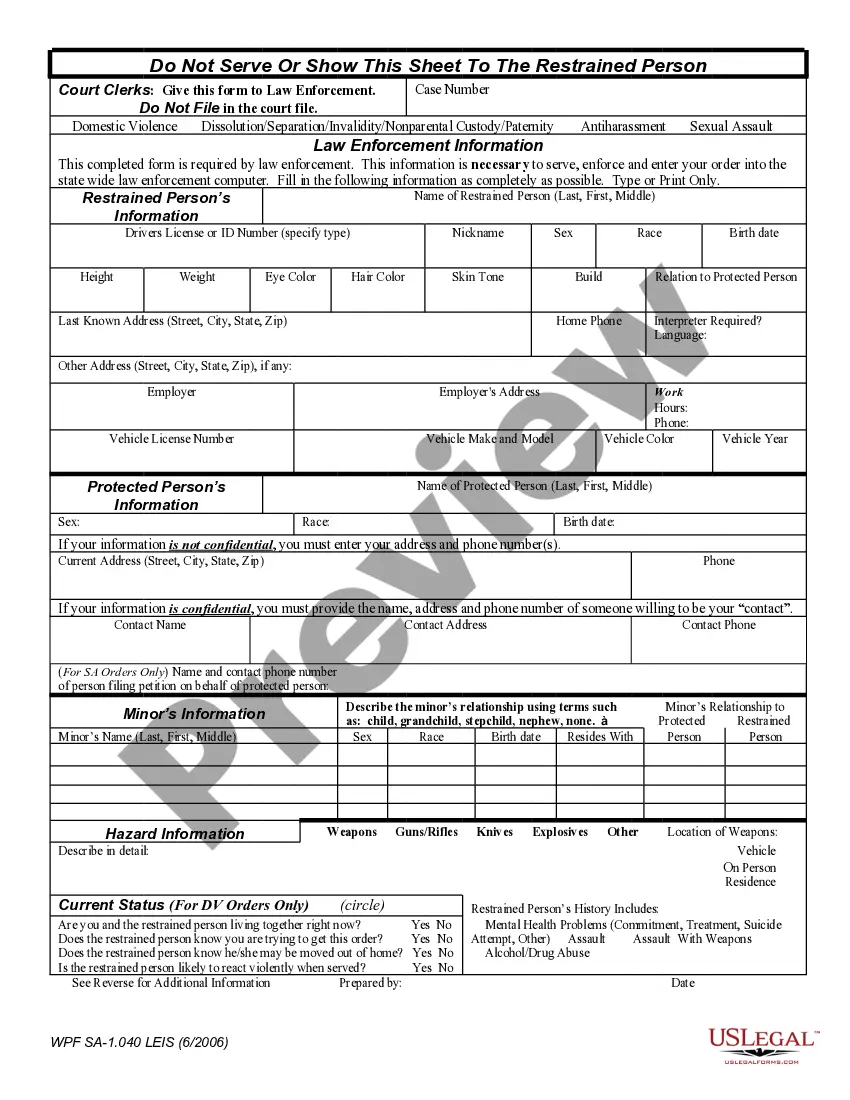

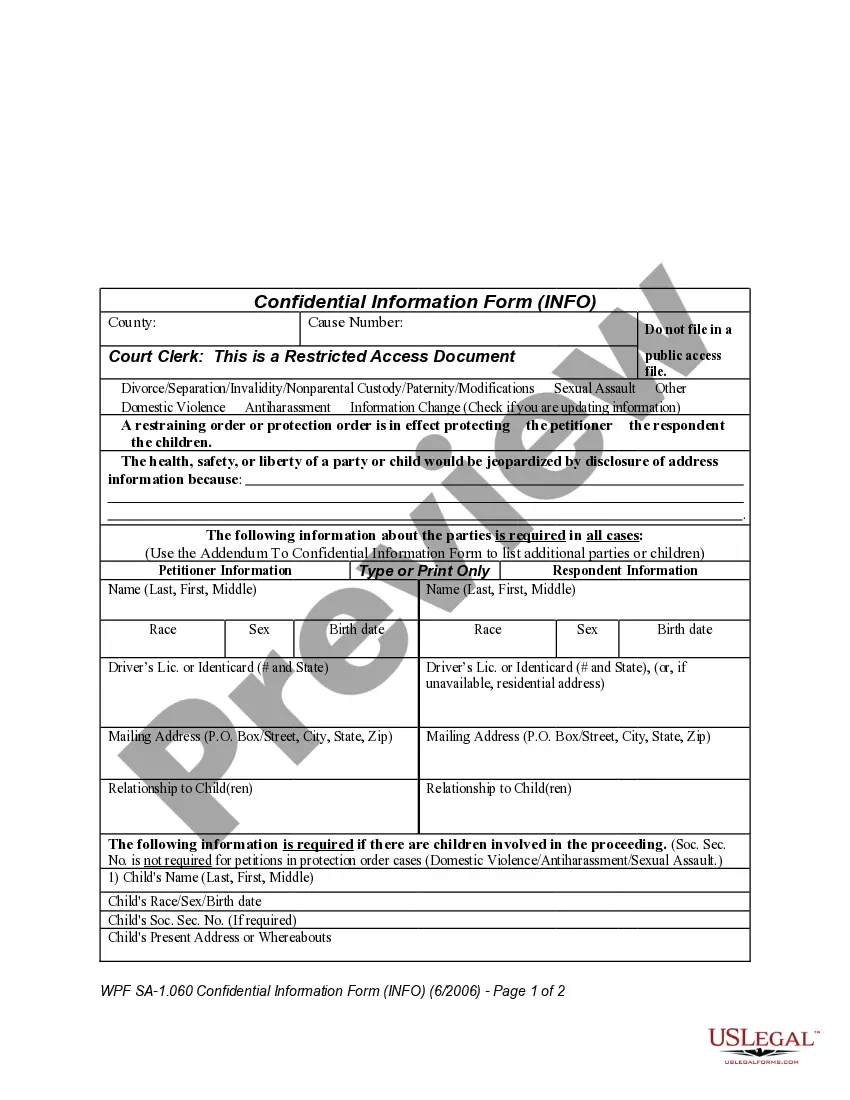

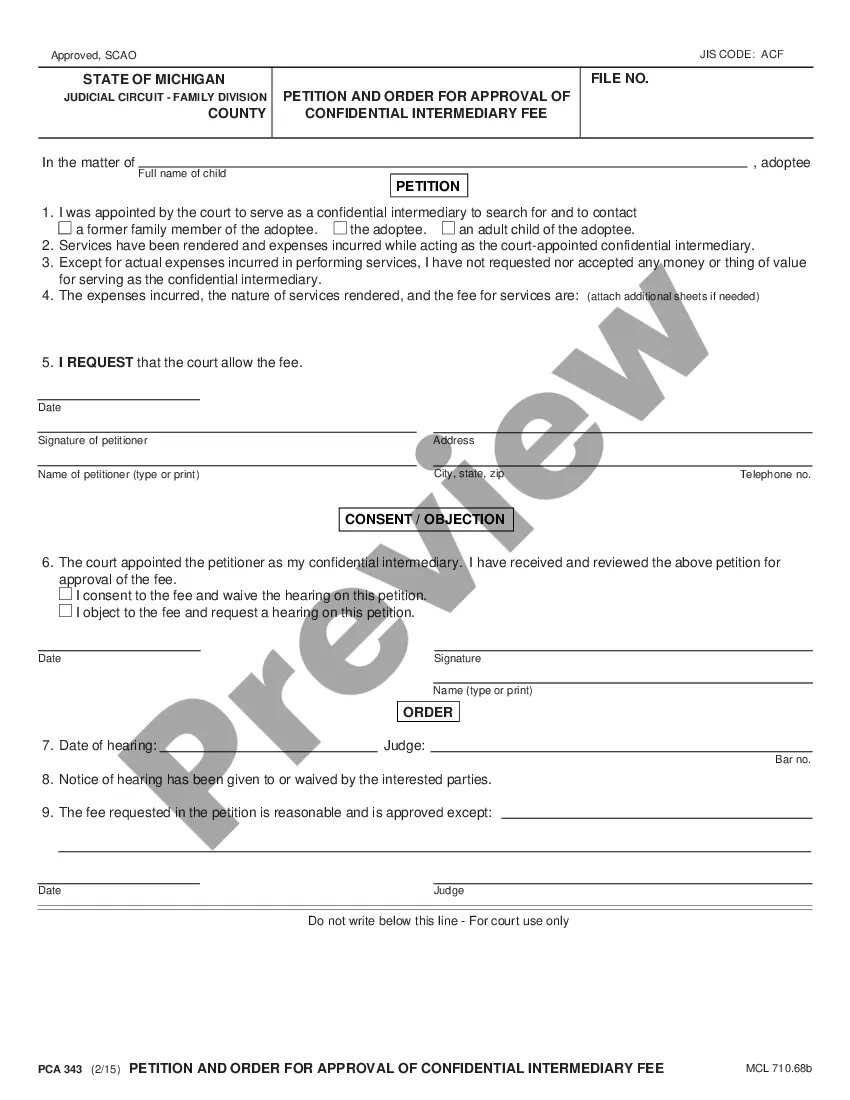

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

In California, mineral rights can be owned independently from the property. If an individual owns the mineral rights to a piece of land, he has a legal right to the minerals beneath the surface. The right's owner can access the minerals using any reasonable perimeters.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

1. n. Oil and Gas Business A percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

If you did happen to find a large gold deposit on your property and do not own the mineral rights, don't fear. You do still own the property at least from the ground up. The mineral rights owner cannot simply come and remove you and dig up your property.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

In general terms, the executive right holder is the party who has the right to take or authorize actions which affect the exploration and development of the mineral estate, including the right to execute oil and gas leases. Non-executive mineral interest owners do not have the power to lease the minerals.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

In California, the law allows the owner of real property to recover lost mineral rights provided that the mineral right is dormant for at least 20 years.

A mineral deed with special warranty in Texas conveys all or part of the oil, gas, and other minerals of a grantor in real property to a grantee, subject to certain warranties covering the grantor's period of ownership.