A Tarrant Texas Mineral Deed with Limited Warranty is a legal document that transfers the rights or ownership of mineral rights from one party to another within Tarrant County, Texas. This type of deed provides a limited warranty, which means that the seller guarantees the mineral rights only to the extent that they have not already been transferred or encumbered. The Tarrant Texas Mineral Deed with Limited Warranty is commonly used in real estate transactions involving land where valuable mineral resources such as oil, gas, or minerals are present. This deed ensures that the buyer receives a clear and marketable title to the mineral rights, with the seller warranting that they have not previously sold or encumbered the rights. One key feature of the Tarrant Texas Mineral Deed with Limited Warranty is that the warranty provided by the seller is limited specifically to the duration of their ownership of the property. The limited warranty means that the seller does not provide guarantees beyond their own period of ownership. It is important to note that there can be different variations of the Tarrant Texas Mineral Deed with Limited Warranty, depending on additional clauses or specific terms included in the document. These variations may include: 1. Specific Mineral Rights: This type of deed may specify the exact mineral rights being transferred, whether it is oil, gas, or specific minerals. 2. Royalty Interests: In some cases, the mineral deed may also include provisions for royalty interests, allowing the seller to retain a percentage of the revenues generated from the mineral resources extracted. 3. Limitations on Liability: The deed may include provisions that limit the seller's liability, such as excluding liability for any future environmental damages caused by the extraction of mineral resources. 4. Quitclaim Option: Some versions of the Tarrant Texas Mineral Deed with Limited Warranty may offer a quitclaim option, allowing the seller to transfer their mineral rights without providing any warranties or guarantees. In conclusion, the Tarrant Texas Mineral Deed with Limited Warranty is a legally binding document used to transfer mineral rights in Tarrant County, Texas. It assures the buyer that the seller has ownership of the mineral rights and warrants against any previous transfers or encumbrances. Different variations of this deed may exist, incorporating specific terms or additional clauses, depending on the nature of the transaction.

Tarrant Texas Mineral Deed with Limited Warranty

Description

How to fill out Tarrant Texas Mineral Deed With Limited Warranty?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Tarrant Mineral Deed with Limited Warranty, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information resources and tutorials on the website to make any activities associated with document completion simple.

Here's how you can purchase and download Tarrant Mineral Deed with Limited Warranty.

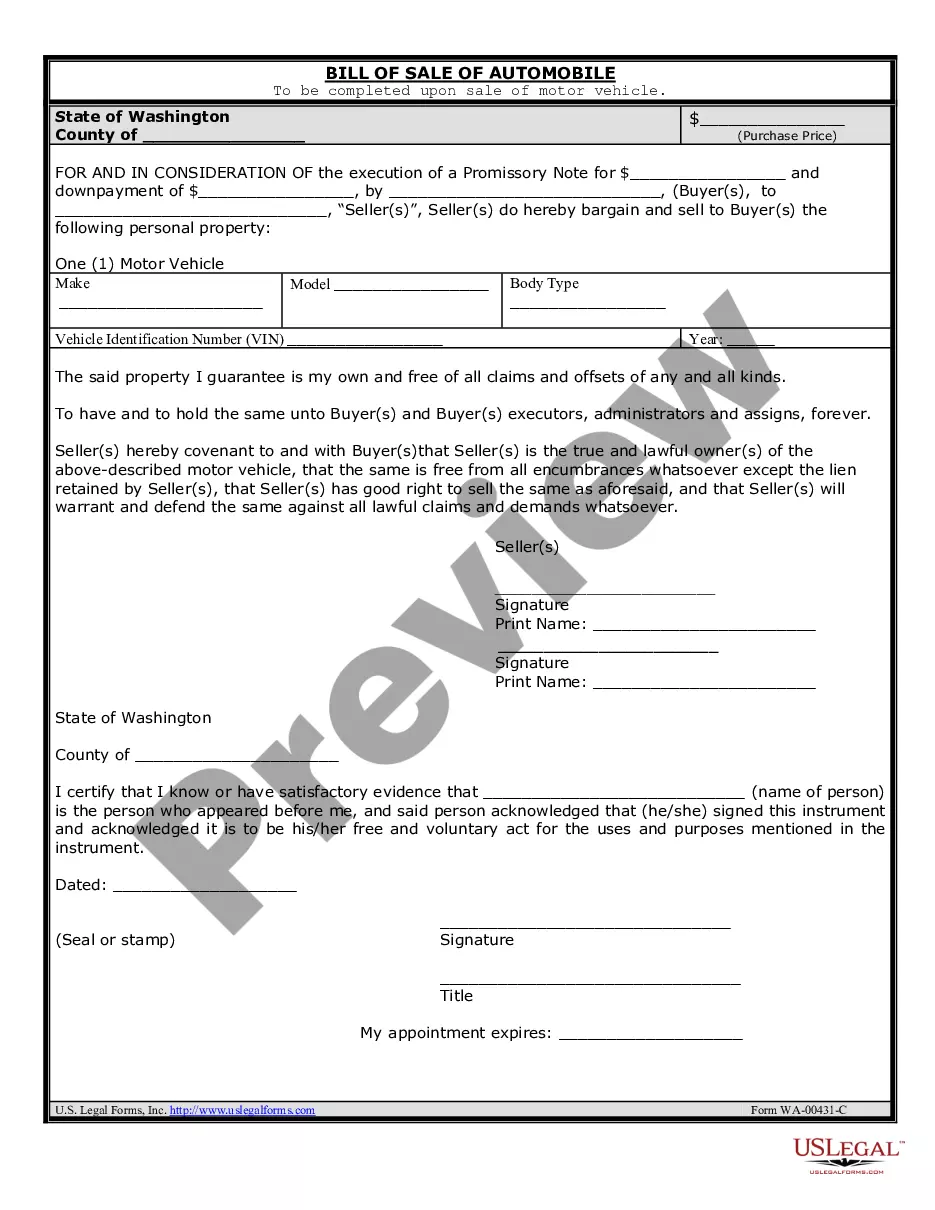

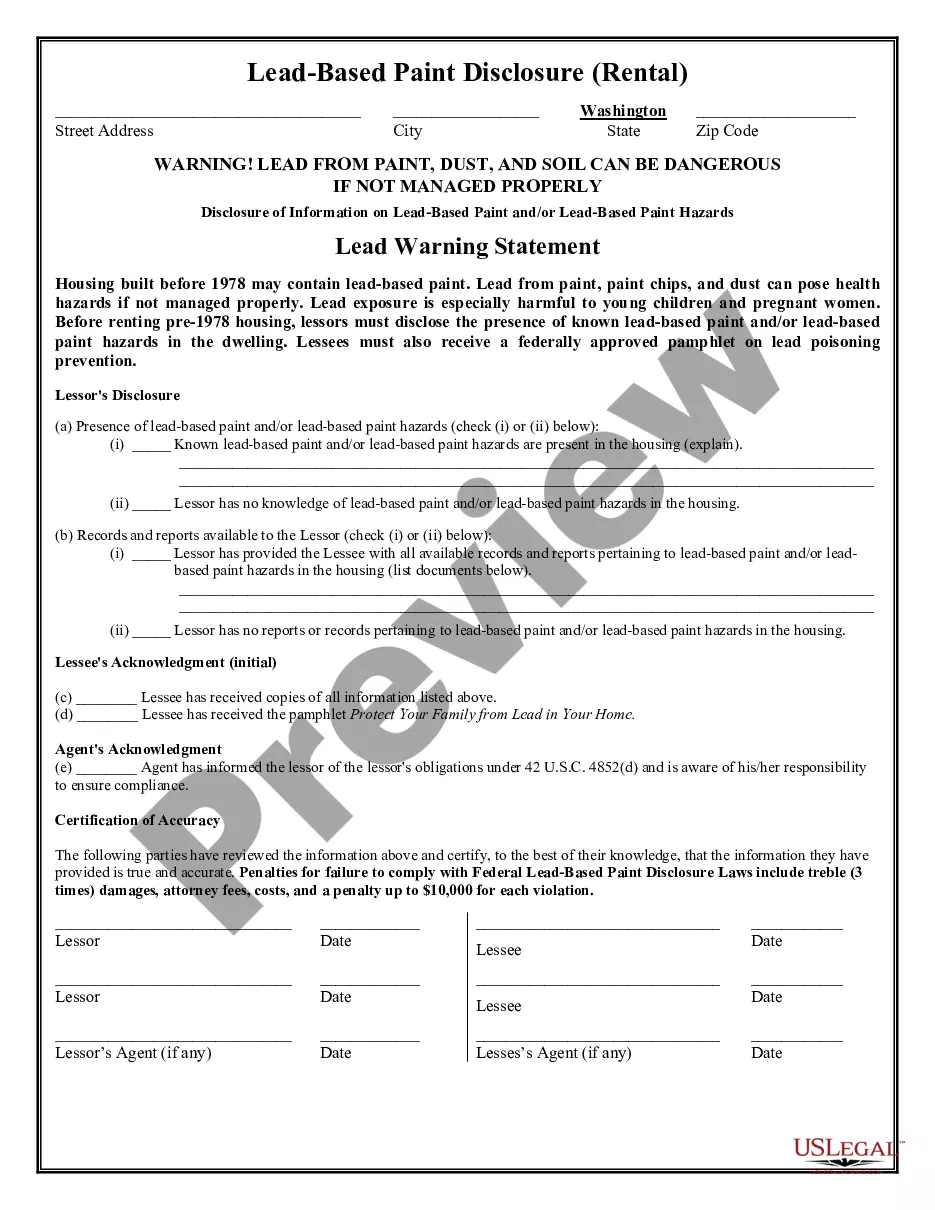

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the related document templates or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and buy Tarrant Mineral Deed with Limited Warranty.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Tarrant Mineral Deed with Limited Warranty, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you need to cope with an exceptionally challenging situation, we recommend using the services of a lawyer to check your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and purchase your state-compliant paperwork with ease!

Form popularity

FAQ

(a) All mineral proceeds that are held or owing by the holder and that have remained unclaimed by the owner for longer than three years after they became payable or distributable and the owner's underlying right to receive those mineral proceeds are presumed abandoned.

If you have a property that does not currently produce royalty income and you do not have an active lease, the value is nearly always under $1,000/acre. The average price per acre for mineral rights that are not leased is between $0 and $250/acre.

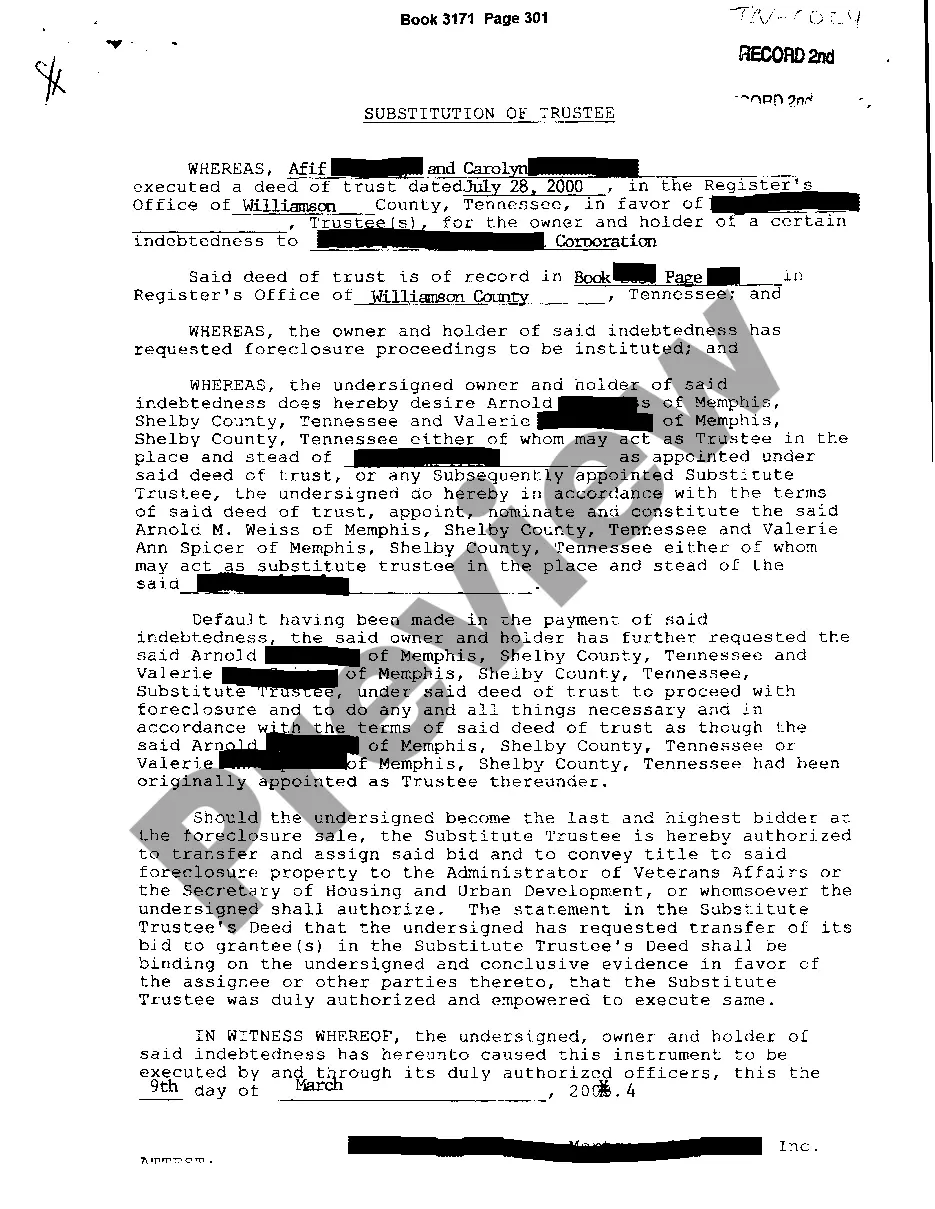

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

As a general rule of thumb, the value for non-producing mineral rights will nearly always be less than $1,000/acre. In most cases, the mineral rights value in Texas for non-producing minerals will be $0 to $250, but producing minerals $25,000+ per acre is not unusual.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Producing Mineral Rights Value in Texas As a general rule of thumb, you can expect to sell mineral rights in Texas for 4 years to 6 years times the average monthly income.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Even if mineral rights have been previously sold on your property, they could be expired. There is no one answer to how long mineral rights may last. Each mineral rights agreement will have different terms. A mineral rights agreement may range from a few to 20 years.