A San Diego, California Mineral Deed with Granter Reserving Nonparticipating Royalty Interest is a legal document used to transfer mineral rights from a granter (seller) to a grantee (buyer), while reserving a nonparticipating royalty interest for the granter. This type of mineral deed allows the granter to retain the right to receive a portion of the proceeds from the production of minerals on the property, without being responsible for any of the associated costs or risks. Keywords: San Diego, California, mineral deed, granter, nonparticipating royalty interest, transfer, mineral rights, property, production, costs, risks. There could be variations of the San Diego, California Mineral Deed with Granter Reserving Nonparticipating Royalty Interest, such as: 1. San Diego, California Mineral Deed with Granter Reserving Nonparticipating Royalty Interest and Surface Rights: This type of mineral deed would not only transfer mineral rights but also include the granter's reservation of nonparticipating royalty interest in the production of minerals, as well as surface rights to the property. 2. San Diego, California Mineral Deed with Granter Reserving Nonparticipating Royalty Interest and Override: This variant would involve the granter reserving a nonparticipating royalty interest as well as an override interest, which entitles them to a percentage of the revenue exceeding a certain threshold. 3. San Diego, California Mineral Deed with Granter Reserving Nonparticipating Royalty Interest and Working Interest: In this case, the granter would retain both a nonparticipating royalty interest and a working interest, which grants them the right to actively participate in the exploration, development, and operation of the mineral property. These variations offer different arrangements and levels of involvement for granters in the mineral rights and production processes, catering to specific needs and preferences.

San Diego California Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

How to fill out San Diego California Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

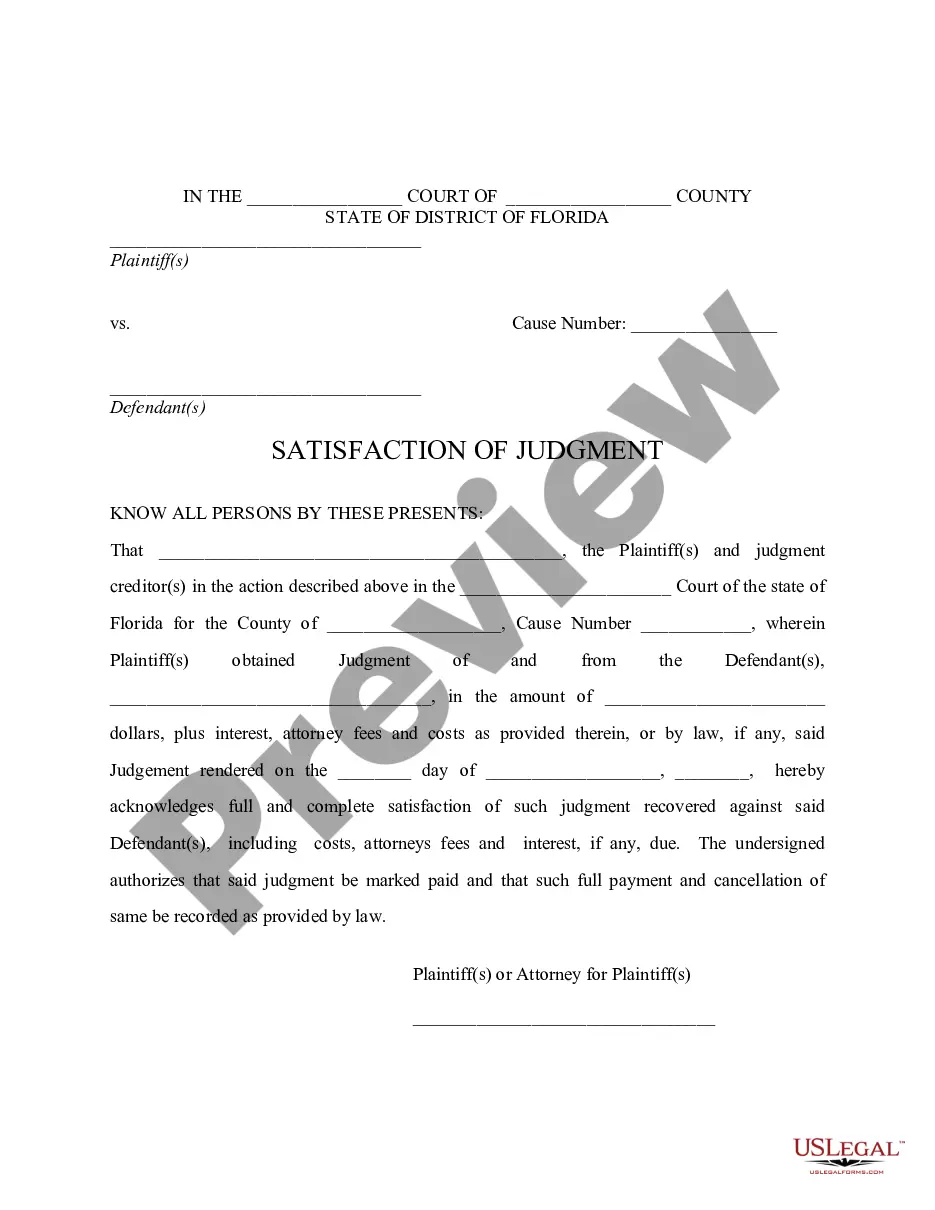

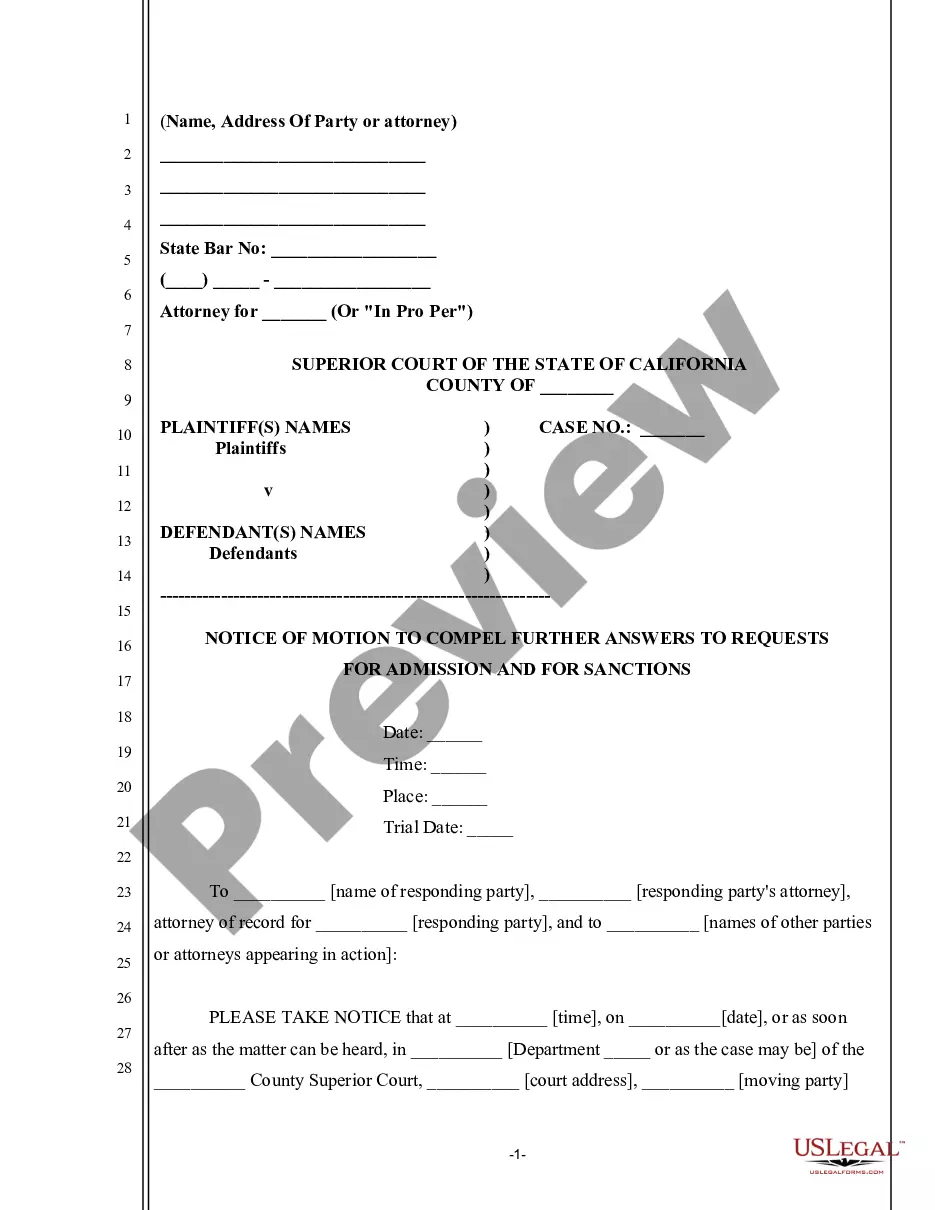

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a San Diego Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the San Diego Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your San Diego Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Diego Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

A royalty interest is a mineral owner's share of production as reserved in an oil and gas lease, usually 1/8 of the total oil and gas production.

More info

The following two properties are of interest: — San Pedro Springs, San Luis Obispo County, California, a nonparticipating royalty interest in mineral rights that produce crude oil in the San Luis Obispo Basin. — La Jolla, California, a nonparticipating royalty interest in mineral rights that produce crude oil in the San Diego Basin. 5. —Texas March 7, 2007, no pet. 7. This information is not provided. 8. (a) The estimated tax rate is estimated, based on the gross income of oil and gas producers when the tax is paid to the state. (b) The amount of the gross income is estimated for the tax year. © Net profits are estimated on a yearly or biennial basis if the income from the property is subject to corporate taxes or other taxes. (d) In determining this taxable income, you should not include any portion of property taxes paid in a county other than the county in which the property is located.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.